[Draft in progress, following up from legal hackathon…]

One of the biggest headaches I can recall as a junior associate at a corporate law firm was managing records for bankruptcy claims.

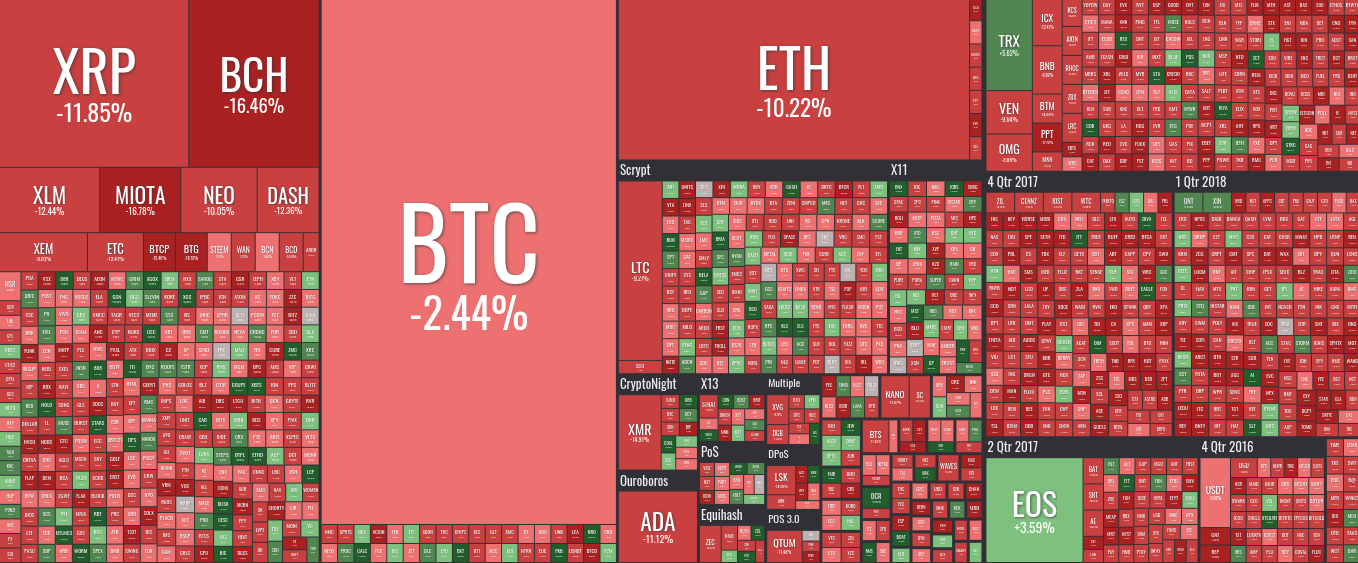

Complex cases can drag on for years, and creditors often sell pieces of their rights to a Debtor’s estate (the ✨🥧✨) for quick satisfaction.

To the issue… for high $value claims that can influence the direction of a given proceeding, various stakeholders (who might have conflicting records from drafting mistakes) need to securely track and reconcile claim transfers among various sub-creditors with little room for error.

For example, you might see a $9 billion claim held by a major creditor get whittled into many minor claims over time, spread across parties, geographies, and law firm records. End result: diligence review and other duplicative processes whenever these splinters change hands in “assignments of claims.”

This has likely been a necessary transaction friction to make this secondary market actually work: without careful records of the downstream transfers and assignments between an initial creditor and their subs, a court might not allow full repayment on the claim and/or hear disputes that consume even more resources — hardly ideal when trying to claim large sums against a dwindling estate.

Thankfully, more legaltech tools are coming online to help program the behavior of claim assets and their recordkeeping 👉

Tools at hand: 👉

* PROOF OF CLAIM FORM (TOKEN CLAIM — HOSTED)

* ASSIGNMENT OF CLAIM (TOKEN CLAIM — TRANSFER HOSTED)

- Token Factory Smart Contract: 0x6BE2f9087A6d1e7D4C6c1079BbCA5b24719224D2

As a simple record of transfers, smart contracts seem to add a nifty backend solution here to smooth the and reconciliation process:

(1) proofs that register claims over a debtor’s estate might be tokenized through a platform like OpenLaw.io by calling a Factory Smart Contract after a creditor files their “proof of claim” with an call embedded into the underlying form itself….

(2) These form proof-generated “claim ” can then be traded very efficiently transparently using () claim transfer agreements….

- End result: downstream transfers between creditors and their subs are timestamped and recorded in an orderly fashion by the token smart contract, offering value to the claims trading market.

OK Then….. let’s see what this actually looks like hashed out:

Generate proof of claim form // ERC20 Digital with *Case Number* and *Creditor Name* via:

Then, in the event of assignment:

Take newly-generated Contract address….

and select desired claim transfer time (among transaction other details)…..

….in the ‘’ assignment of claim form,

Zounds!

Published at Sun, 31 Mar 2019 17:10:15 +0000