Our guest today is Spandan Sharma from MaidSafe. We go over the results of the second community testing of Crust, the automated peer-to-peer connection library being developed by MaidSafe for the SAFE Network, and available for open source use by other P2P projects as they find useful.

In looking at all that the upper network layer needs the Crust connection level to do, we get a peek at the Routing level, which is the heart of the SAFE Network structure.

Enjoy.

Music

Music for this episode: Safe Crossroads Beta, an original piece composed and performed by Nicholas Koteskey of Two Faced Heroes

Links

Key Highlights:

Bears took over the market;

there is a probability of a further decrease in BCH price;

price pullback is inevitable.

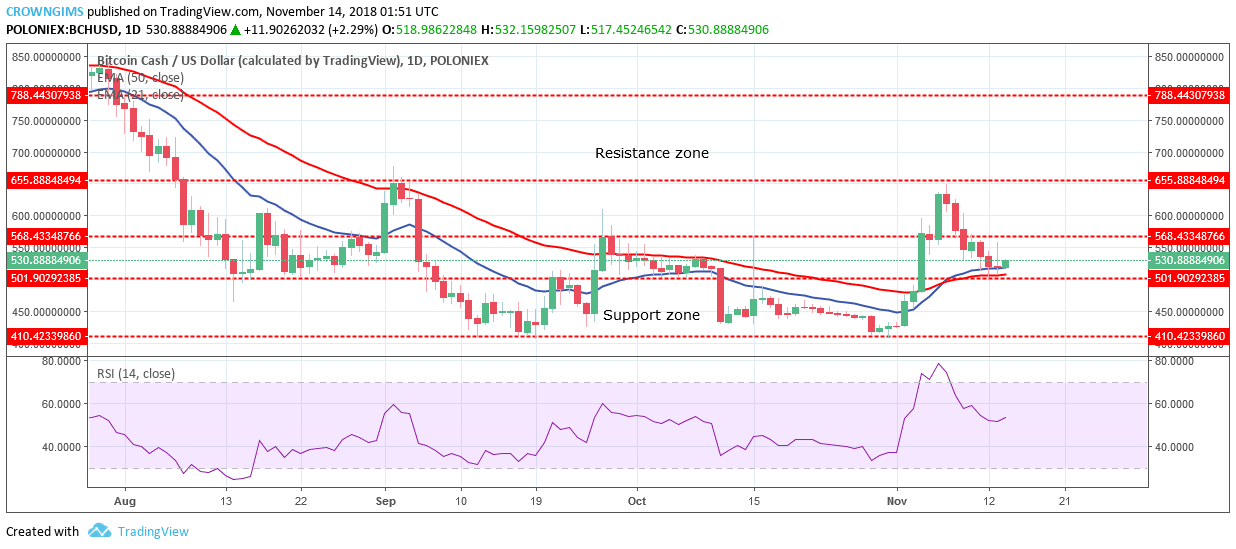

BCH/USD Price Long-term Trend: Bearish

Resistance zone: $568, $655, $788

Support zone: $501, $410, $310

The formation of bearish pin bar candle formed on the support level of $501 (directly rest on the dynamic support and resistance of 21-day EMA and 50-day EMA) is an evidence to the bears’ strong pressure. Should the bears maintain or increase their pressure, the support zone of $501 will be broken and expose the support zone of $410 for BCH price to find its low. In case the support zone of $501 holds the price will bounce up and the bulls may take over the market for the BCH price to rally to the north and may find its high at the resistance zone of $655.

BCH/USD is directly on the 21-day EMA and 50-day EMA. Meanwhile, RSI period 14 is at the 50 levels and its signal line about turning to the north indicates a buy signal, which may be a pullback.

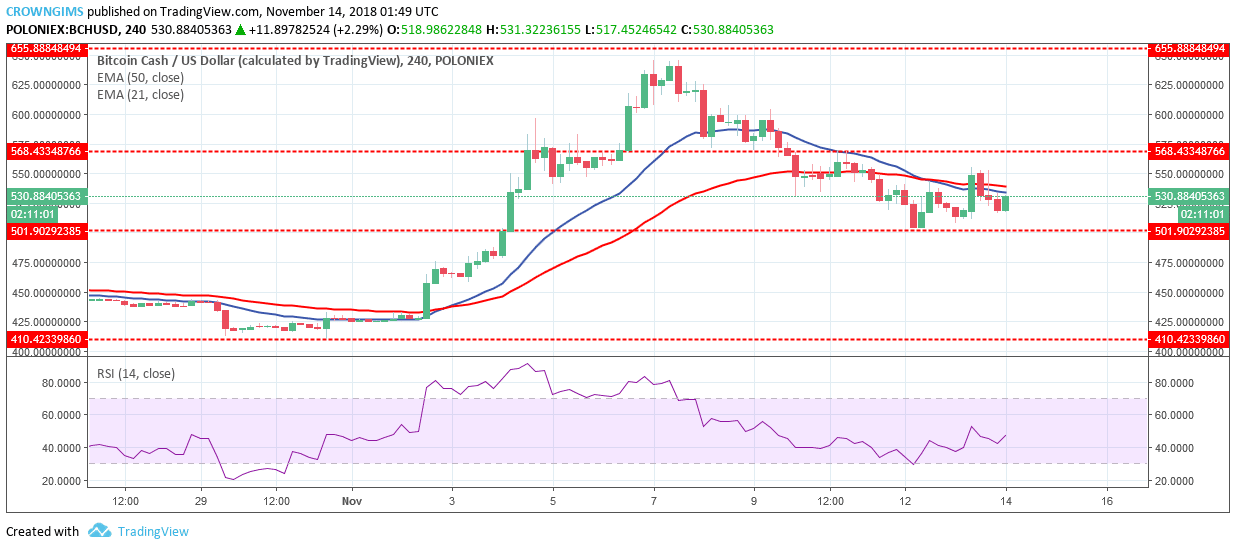

BCH/USD Price Medium-term Trend: Bearish

BCH price is below the 21-day EMA and 50-day EMA which is an indication of a bearish trend. The RSI period 14 is above 40 levels and its signal line points toward north connote buy signal which may be a pullback.