With the latest “fall” in the crypto market, skeptics have been speculating on whether and its compatriots could mount a quick comeback and shake off this bearish run. However, in the midst of all this skepticism, some certain individuals continue to bet on crypto to be the future of money and the financial system. As one of such individuals, Ver touched various aspects of the , including his outlook on cryptocurrencies, the threat of regulation, mainstream adoption and bitcoin Cash (BCH).

Ver was asked if a “floor has been reached” and exclaimed in an interview that “nobody knows.” He then joked that this unpredictability regarding “up, down, or sideways” movements are just a part of cryptocurrencies’ inherent “fun.”

The bitcoin Cash proponent, who lauds BCH as the true digital cash, doing his best to specify a prediction said:

“I’m a fundamentals investor, so I’m investing [due to] fundamental [factors]. [In the] long-term, the future is brighter than ever [for cryptocurrencies]. There’s more awareness, there’s more adoption, and there’s more stuff happening all over the world. So, of course, I’m incredibly bullish on the entire crypto-coin ecosystem.”

Speaking out against regulatory measures imposed by bureaucrats, Ver noted:

To think that a politician in some government office somewhere knows more about how cryptocurrencies work and how to keep them safe from hackers, I think is just naive. So of course its the industry participants, that know the most and have the most skin in the game.”

Ver was also asked how the stigma surrounding cryptocurrencies can be shed. To which, he stated that influential people as well as businesses in the space “need to build an economy based on actually using cryptocurrencies as currencies rather than just a bunch of speculators speculating.”

It is to be noted that just last month, bitcoin Cash had a hard fork which got split into two coins: bitcoin ABC and bitcoin SV. bitcoin ABC was led by Roger Ver and other supporters, while bitcoin SV was led by Craig Wright and its supporters.

In a recent hosted by Roger Ver, three pioneers of bitcoin Cash- Roger Ver, Corbin Fraser, and showed high regards for Dash when a viewer asked their opinion about the virtual asset.

When the viewer asked the question, Roger Ver and others answered in the affirmative. Ver mentioned how the slogan ‘Digital Cash’ talks for the cryptocurreny and also talks about the overall objective of the cryptocurrency to be used in everyday transactions.

Ver said:

“I think you could argue that Dash is basically trying to do what bitcoin was trying to do from day one, but they actually want it to be cash.”

He compared the network with BTC (bitcoin Core) network on how hostile the BTC network is when using it as cash.

While Mate Tokay mentioned Venezuela being a major hub for the cryptocurrency where there is a huge community supporting the virtual asset, Roger Ver agrees to Tokay and he says that he “loves Dash as well.”

Ver also mentioned that as the second best cryptocurrency after [BCH].

Just for reminder, The CEO of bitcoin.com was in the news when he announced that he had a fallout with Craig Wright, the proponent of bitcoin Cash Satoshi Vision (SV). Soon after that, BCH underwent a .

We already about how Jim Breyer, the bitcoin billionaire, believes that the future of cryptocurrencies is bright specifically because of the young generations that are interested in the blockchain technologies.

Now, Mike Kayamori, Quoine CEO, in the Bloomberg interview said that by the end of next year he thinks that bitcoin will surpass the all-time high.

Many people thought that $4000 was the technical bottom, but we broke through that so it’s hard to say. Some of the issues that seem to be working against bitcoin and cryptocurrencies are actually helping build antifragility within the space. Getting rid of the tourists in the market and building proper protections for people and investors.

Pundits like to demonize cryptocurrency for its usage in cyber crimes, for being a Ponzi scheme, or how cryptocurrency exchanges have suffered security breaches resulting in millions of dollars stolen from investors. Ver, on the other hand, claims that these things are nothing more than “bullish signals that cryptocurrency is here to stay and here for the long-term.”

In the decade since the introduction of , it has been a rollercoaster of a ride for cryptocurrency investors – especially after the start of the bull run late in 2017. There have been thrills and spills, and more ups than downs across the 10 years. Certainly, those who were clever – or lucky – enough to invest in the early days will be very pleased with their yield.

Much like a rollercoaster, following a steep ascent comes an exhilarating – sometimes scary – drop, and that has been the case for bitcoin and the other major cryptos in 2018.

There is talk of another bull run on the horizon, though whether it will happen is anyone’s guess. So what strategies do crypto investors employ in a bear market? Basically, you have four options – as listed below. Choose wisely.

Short Sell

“Shorting” is when a trader backs a certain market to decline. If their hunch is correct, then they will benefit. Arguably the most famous example of short selling happened in September 1992, when Hungarian-American investor George Soros netted approximately $1 billion after correctly predicting the British pound would drop when it was forced out of the European Exchange Rate Mechanism.

Shorting is made possible through Contracts For Difference (CFDs), or derivatives, as they allow the trader to sell assets he or she doesn’t actually own. Simply put, a short trade is executed when a borrowed asset, or instrument, is sold at the current market price. If the market moves the trader’s way thereafter, and the price of the asset declines, the value of their position increases. From there the trader can choose to buy back the now-cheaper asset and make a tidy profit.

The 1,200 instruments offered by leading global social trading and investing platform to its 10 million+ members have the option to short, including within the cryptocurrency and stock markets. Never has the adage “one man’s loss is another man’s gain” been so apt.

HODL

The first time you see “HODL” when someone is discussing cryptocurrencies the word causes you to stop reading. You think: “Is it a misspelling?” Well, yes it is – at least it was mistyped originally. Now, rather amusingly, HODL has spawned a life of its own. It has evolved to represent a long-term trading strategy and philosophy for crypto investors.

HODL has become an acronym (or even backronym) for “hold on for dear life”, meaning that even when investors are in the deep red with their cryptos they should not buckle under pressure and sell, driven by the belief that they will, ultimately, reap great rewards, once mass adoption has been achieved.

Quartz heralded as one of the most important terms in crypto culture in 2017, describing it as a determination to “stay invested in bitcoin and not to capitulate in the face of plunging prices”.

There is certainly great potential of HODLing as an investment strategy, and not selling while under pressure, as history shows us – and not just in the cryptocurrency world.

One of the most notorious examples of failing to HODL happened in the mid 1970s when Ronald Wayne, Apple’s third co-founder – alongside Steve Jobs and Steve Wozniak – sold his 10 percent stake in the then-start-up back to the other two co-founders for $800.

In August 2018, Apple achieved the historic milestone of reaching a market capitalization of $1 trillion. Had Wayne adopted a HODL mentality his Apple stake would be worth around $100 billion today.

It is impossible to predict the future, but Jay Smith, one of’s most recognizable Popular Investors (whose trades can be copied by others – as can anyone’s on the platform), believes staying strong will reap the biggest rewards. Full-time trader Smith – a.k.a. – describes his trading style as “fundamentals, future, and HODLing”.

“I firmly believe that cryptos will change the world, replacing stock markets, most currencies and powering everything from machine-to-machine payments and the Internet of Things through to streaming media, prediction markets, governance systems, voting systems, even potentially the internet,” he continues. “That being said, there is a long way to go, we are in the very early stages for most of these areas.”

Keep Investing

When the value of cryptos falls, many investors double down – effectively strengthening their commitment to a course of action that is potentially risky – because the prices are so low. As with HODLers, those who keep investing see the long-term benefits of cryptos.

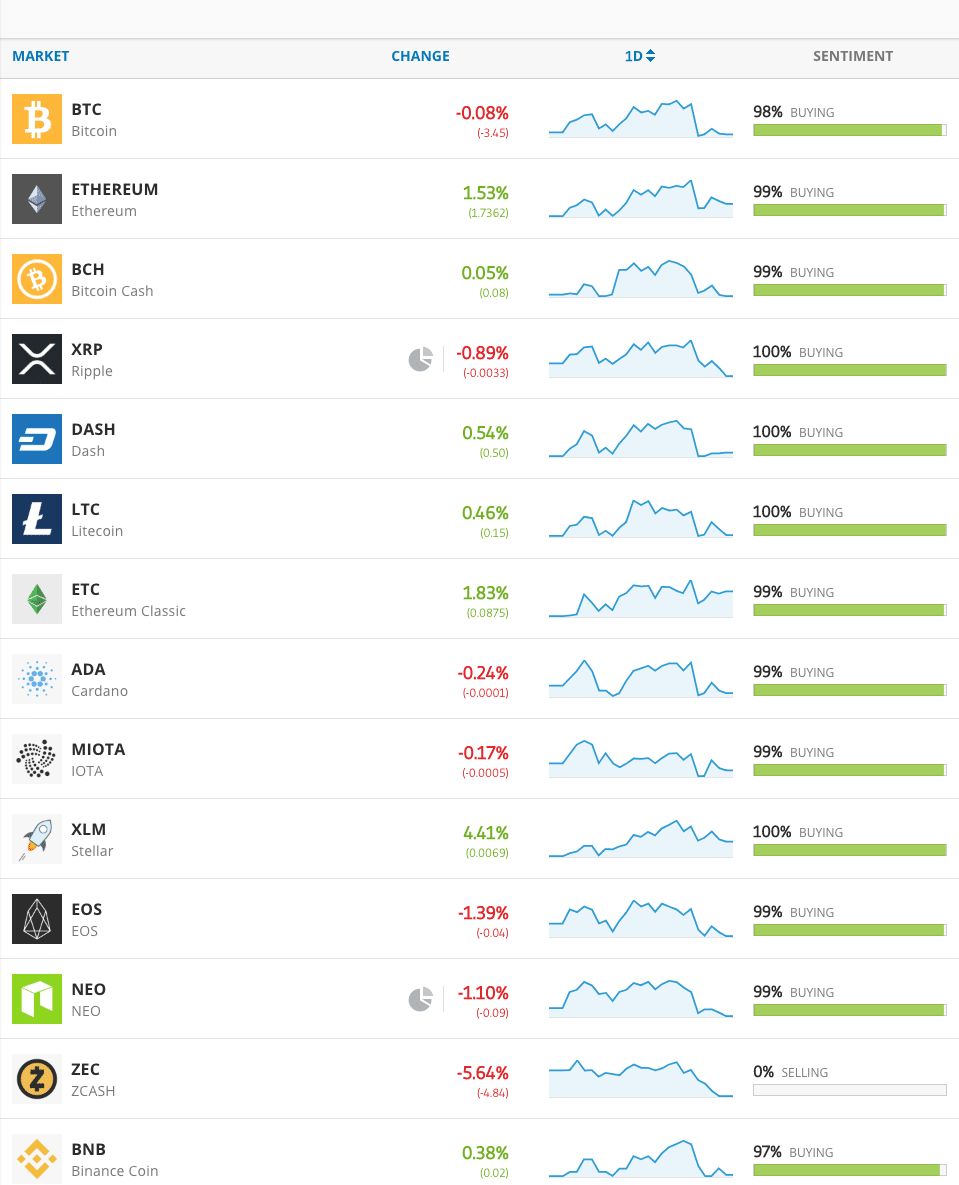

Despite the bear market of 2018, many eToro users have invested more in bitcoin, , and a range of other cryptos available on the platform – just see the market sentiment (image taken on November 30, 2018).

This is not investment advice or an investment recommendation.

Diversify

If you have gone all in on cryptos and are waiting for the arrows to turn green, rather than red, it might be a good idea, during a bear market, to consider investing in other asset classes. By diversifying your portfolio this approach will spread your overall risk.

On eToro there are over 1,200 financial instruments, across six asset classes, on offer: ; (ETFs); ; ; ; and . There are other ways for users to invest with eToro, in addition to manual trading. The innovative tool allows clients to copy the trades of top investors automatically. Users can view and copy anyone with a profile in a straightforward way, and expand their portfolio using CopyTrader while still using an individual strategy.

Another option is ™: eToro offer various portfolios including in cryptos, technology, and the best-performing traders. These allow users to invest in multiple markets or traders based on predetermined investment strategies.

The award-winning platform truly is a one-stop shop for all your trading needs in a crypto bear market.

The Monetary Authority of Singapore (MAS) has published new guidelines pertaining to digital token offerings. The document provides additional clarity on the regulatory requirements for intermediaries that facilitate them, while highlighting the reporting obligations of entities offering capital markets products that are not classified as securities.

Also Read:

MAS Publishes New ICO Guidelines

Capital markets products are described as “any securities, units in a collective investment scheme, derivatives contracts and spot foreign exchange contracts for purposes of leveraged foreign exchange trading.” Any entity that offers capital markets products will be required to submit a prospectus in accordance with SFA requirements.

Exemptions From Prospectus Requirements

Rules for Intermediaries Offering Tokens

The guidelines also state that any person who “provides financial advice in respect of any digital tokens” as an intermediary must secure a financial adviser’s license. The same expectations will apply to any person who “provides any financial advice in Singapore in respect of any digital token that is an investment product.” In addition, the regulator says that anyone based in a foreign jurisdiction who engages in activities designed to influence citizens of Singapore through financial advisory services will be “deemed to be acting as a financial adviser” in the city-state.

Do you think that other nations will adopt similar guidelines for digital token offerings to Singapore? Share your thoughts in the comments section below.

Images courtesy of Shutterstock

At bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post appeared first on .

Did you hear that China’s just banned bitcoin? Or that mining is killing the planet? Course you did. It’s hard to ignore the FUD when it’s all around you, like a thick fog that just won’t shift. Some bitcoin falsehoods are so pernicious and pervasive they they refuse to die, despite all efforts to set the record straight. Here are three of the worst.

Also read:

‘bitcoin Is Locked in a Death Spiral’

A death spiral sounds hella cool, like something out of a Star Wars movie, but the reality is more humdrum. The term, which is being bandied about a lot this week, describes falling BTC prices leading to falling hashrates as miners are disincentivized to secure the network.

Once 1 BTC drops below the break-even cost of mining, say the FUDsters, thousands of miners will power down their machines, leaving the network at risk of getting . Suffice to say, this is bullshit. For one thing, bitcoin has a lot further to fall to reach break-even point — around $2,000, — and as hashrate falls, some miners will be incentivized to rejoin the network. The death spiral may sound gnarly, but for all kinds of reasons, it’s not gonna happen.

The people that say is gonna die don't realize that it is almost certain that THEY will die first. It's just software, pure code, a technology. To kill bitcoin, you need to kill the internet and every physical copy of the Satoshi's white paper. It will outlive all of us.

— Miguel Cuneta (@MiguelCuneta)

‘bitcoin Is Going to Zero’

Why do people keep predicting that BTC will reach zero? Cos it makes for a way better headline than screaming that bitcoin will go to $872.53. Even bitcoin’s staunchest critics know that BTC will never reach zero, but so long as their bait keeps getting bites, they’ll continue to float this flawed theory. Postulating the lowest price point that bitcoin could conceivably reach is an interesting intellectual exercise. Wherever that floor may be found in a worst-case scenario, however, it’s not even close to zero. High hundreds or low thousands of dollars seems plausible, which would take BTC back to its 2016 days.

One fact that bitcoin critics seem to have missed in the midst of their hyperbolic predictions is that even at $100 a coin, BTC functions exactly as it did at $10K per coin, and will continue to be used by an army of advocates for a plethora of purposes. Price is temporary, but censorship-resistance is permanent.

10 Years from now it won't matter if you bought bitcoin at $4,000 or $3,000………because it will be at $0

— Trevon James (@BitcoinTre)

Hey Trevon, you spelled “Bitconnect” wrong.

‘bitcoin Has Been Superseded by Next-Gen Blockchains’

Anyone who thinks bitcoin’s value can be measured in TPS or the number of smart contracts, sidechains and shards it supports doesn’t understand bitcoin. Getting seduced by newer, sexier blockchains is all part of the learning process. Once it passes, you’ll return to bitcoin, your first love, more convinced than ever that it’s the one chain to rule them all.

From canards about energy consumption to FUD about death spirals, mainstream media loves a bitcoin hit piece. Life’s too short to refute all the misinformation out there. bitcoin lies won’t die any sooner than bitcoin will. Whether its hashrate be 60 exahash/s or 6, and whether its price be $2,000 or $20,000, falsehoods will continue to circulate. It’s all part of the cycle.

What other bitcoin lies are mainstream media guilty of spreading? Let us know in the comments section below.

Images courtesy of Shutterstock and Blockchain.com

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .