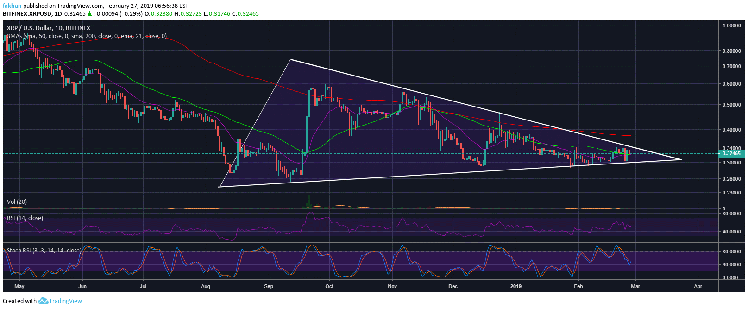

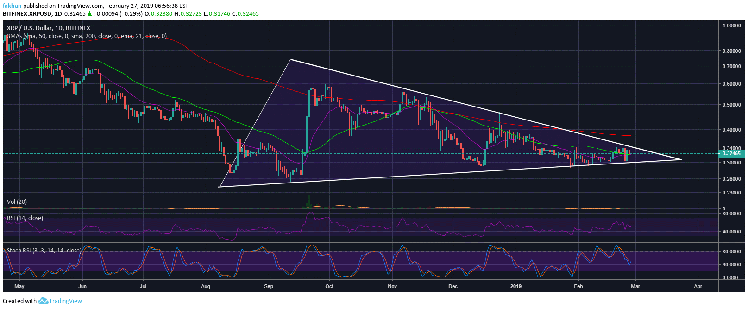

(XRP) has been constantly in the for the past few weeks and mostly for all the wrong reasons. The numbers of partnerships that it has signed with new banks as well as the use of its xRapid service have been on the rise but yet the sentiment is leaning bearish in the past few weeks. If we look at the daily chart for , we can see that it has declined below the 50 day moving average now and the bulls might finally have some hope to stage a short term reversal. We expect that XRPUSDShorts will have to test the previous support before it can continue higher from current levels. This means that if the sell pressure declines in the days and weeks ahead as we expect, we might see a strong rally in XRP/USD.

If (XRP) succeeds in pulling this off, we might see XRP/USD take the market by storm as no other looks as bullish as (XRP) at the moment. We have already seen some events setting the stage for this kind of a rally. Recently, (XRP) was added to Pro. The fact that listed (XRP) on its platform by bending one of its core rules for listing new assets explains the intent behind this move. requires that the ownership stake retained by a team is a minority stake whereas (XRP) owns around 60% of XRP coins held in escrow. This means that (XRP) might indeed see a strong move to the upside as the charts show us and the mainstream media will chalk it up to some listing or other events around that time.

If (XRP) breaks out of the wedge to the upside, there is a strong probability that it will form a golden cross and the price could rise all the way till $0.50 before it eventually comes down to complete its final wave of correction in order to bottom. Now, the RSI and Stochastic RSI both point to the same conclusion which is a break above this wedge to the upside. Considering the resistance that has faced around the 50 day moving average, we expect that the price may not rise significantly above the 200 day moving average, but the possibility is there.

It is pertinent to note that the price has risen and fallen below the 50 day moving average many a time and as it consolidated the past few days. This means that the price can continue to do that and it may just break sideways out of the wedge and continue to consolidate. If it reaches overbought conditions as a result of that consolidation, we might see a break to the downside before any golden cross or a strong move to the upside. While (XRP) still have a lot of potential to make an independent move based on all the bullish developments and indicators, it is important to realize that (XRP) is still paired to () on most exchanges and therefore any negative developments on that front could seriously hinder the chances of a breakout in XRP/USD.

Published at Wed, 27 Feb 2019 16:44:16 +0000