Ripple has been trending below a descending trend line and looks prime for another correction. Applying the Fibonacci retracement tool shows that the 61.8% level lines up with the falling resistance and could be the line in the sand for a pullback.

This also lines up with the 200 SMA dynamic inflection point, which adds to its strength as a ceiling around the 0.6500 level. The 100 SMA is closer to the 50% Fib and is below the 200 SMA to signal that the path of least resistance is to the downside. In other words, the downtrend is more likely to resume than to reverse.

RSI is pointing up to show that buyers still have some energy left for more gains, so a higher correction is possible. Stochastic is also heading higher but dipping into overbought territory to signal that buyers could be exhausted soon and ready to let sellers take over. If so, another move to the swing low could be seen.

Much like its other cryptocurrency buddies, Ripple hasn’t seen a lot of developments recently and has been vulnerable to overall market sentiment. It has also been sensitive to dollar action, enjoying a bit of a bounce after this week’s release of the FOMC meeting minutes for May.

However, there are rumors that Amazon will adopt Ripple due to the swift and cheap nature of its transactions. In addition, the relatively large supply of Ripple means lower volatility for this particular altcoin compared to its peers like bitcoin.

Lastly, the lower price compared to other cryptocurrencies has also made it more friendly to mainstream users versus bitcoin whose price can be daunting for most.

But without any confirmation or any other developments, Ripple could maintain its steady drop, especially since geopolitical tensions are keeping risk appetite in check these days.

The post appeared first on .

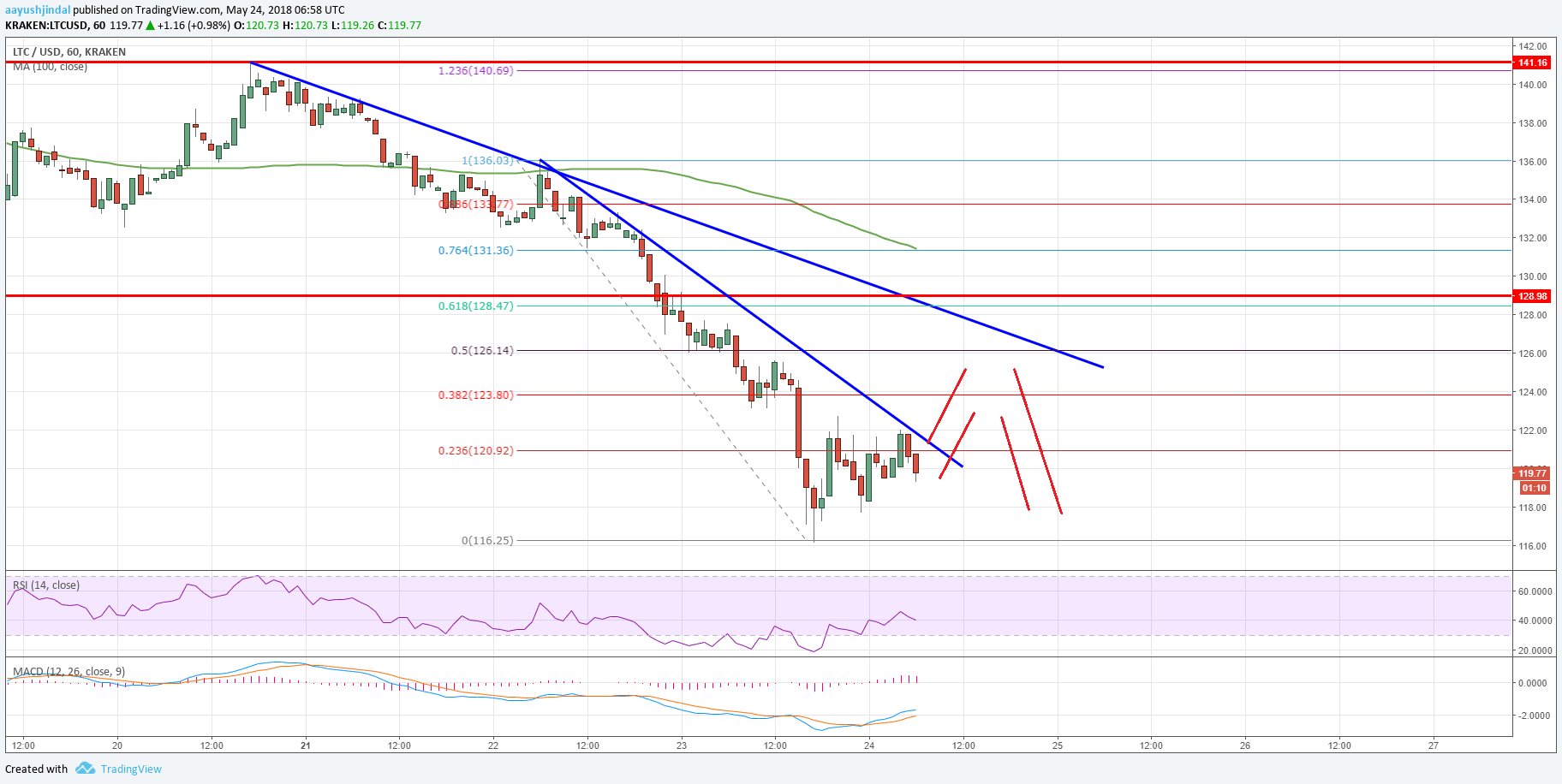

Litecoin price declined further and traded below $120 against the US Dollar. LTC/USD remains in a bearish trend and it could soon break $110.

Key Talking Points

· Litecoin price was not able to recover and declined further below $120 (Data feed of Kraken) against the US Dollar.

· There are two key bearish trend lines formed with hurdles near $122 and $126 on the hourly chart of the LTC/USD pair.

· The pair is struggling to move higher and upsides may be capped by $124-126 in the near term.

Litecoin Price Forecast

The past three days were mostly bearish on litecoin price as it tumbled below the $130 pivot level against the US dollar. The LTC/USD pair extended declines and it even broke the $120 support level.

Looking at the , the price traded towards the $115 level and a low was formed at $116.25. Later, an upside correction was initiated and the price moved above $120. However, the upside move was capped by the 23.6% Fib retracement level of the last drop from the $136.03 high to $116.25 low.

It seems like a major recovery in LTC won’t be easy since there are many hurdles on the upside on the way to $130. There are also two key bearish trend lines formed with hurdles near $122 and $126 on the hourly chart of the LTC/USD pair.

The second trend line is close to the 50% Fib retracement level of the last drop from the $136.03 high to $116.25 low. Therefore, a break above the $126 level could open the gates for a push above the $130 pivot level.

On the flip side, if litecoin price fails to move above the $126 resistance level, it could move down once again. The recent low of $116.25 is a short-term support, followed by the $110.00 level.

If sellers remain in action, there is even a chance that the price may break $110 for a in the near term.

The market data is provided by TradingView.

The post appeared first on .

The project aims to create a decentralized cloud storage platform where users can earn rewards by sharing the physical memory of their devices.

Since the turn of the 21st century, the Philippines has actively played a part in the global labor market. Seeing the promise of a bigger…