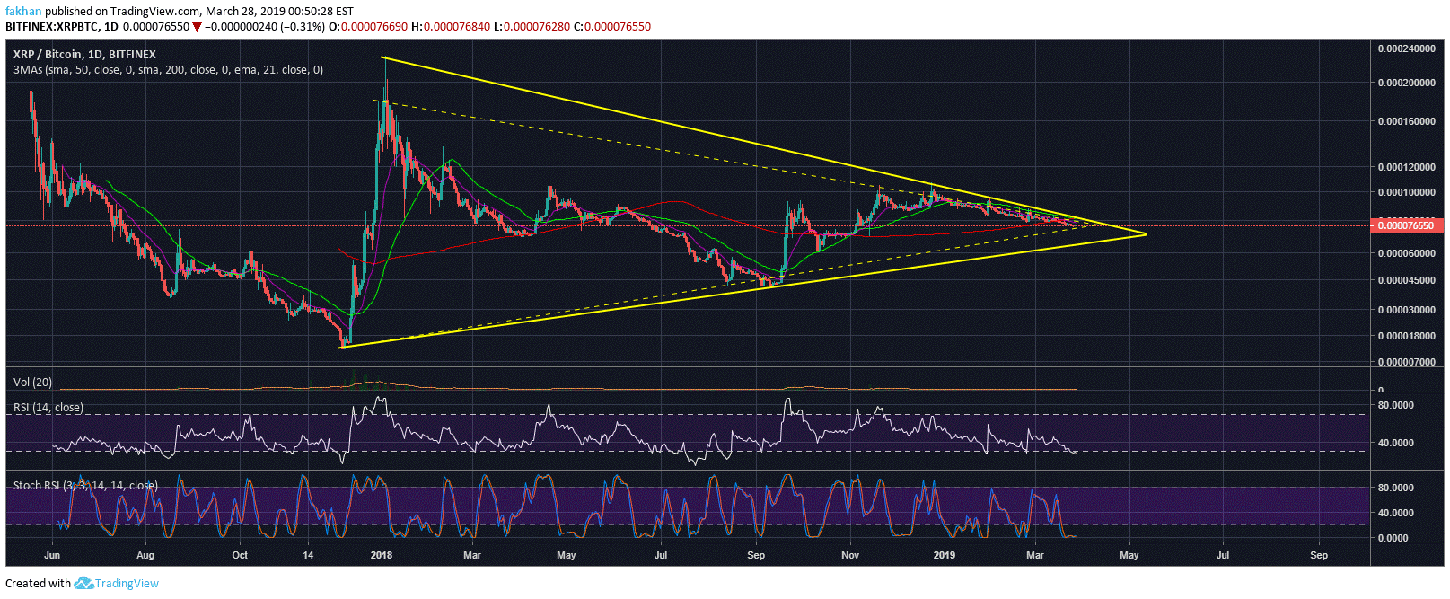

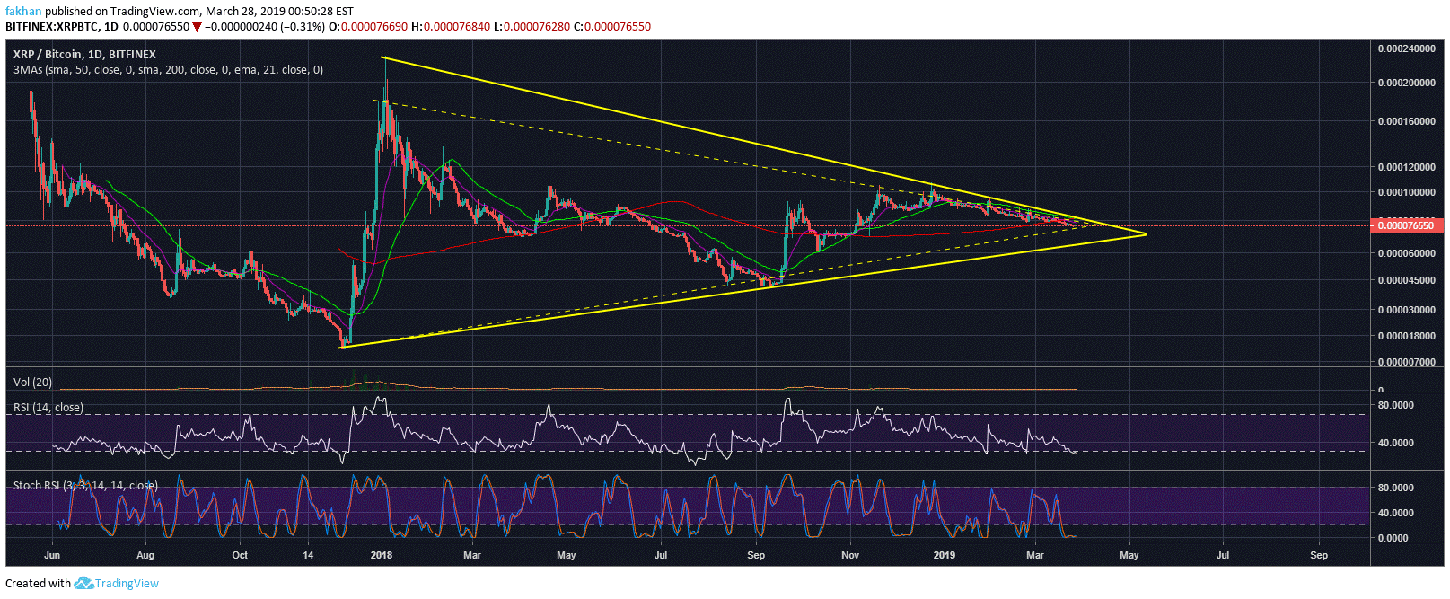

(XRP) is going through a tough time as the price closed the day below the 50 day moving average yesterday and is currently showing no signs of a bullish reversal. If it continues to trade below the 50 day moving average, we could see it fall below a critical trend line support. On the other hand, if the price succeeds in breaking above this level, we could see it rise towards the 200 day moving average before it faces a strong rejection. The daily chart for shows that the price is recovering from oversold conditions on the daily time frame. However, most of the recovery has been sideways movement as the bulls are reluctant to step up.

The has lost most of its bullish charm since the beginning of the year but long term hodlers are still hopeful that (XRP) might reach a price of more than $5 during its next bullish cycle. This seems very reasonable considering (XRP) has made a lot of progress even during the bear market. (XRP) has been busy signing partnerships with banks and financial institutions the whole time. This is what led to (XRP) taking (ETH)’s place as the second largest coin by market cap many a time during the past few months. We expect (XRP) to reclaim the second spot once again as the market recovers. This is because (ETH) has lost most of its dominance to aggressive competitors like (ADA) and (TRX) whereas (XRP) remains pretty much unchallenged. (XLM) could be considered a (XRP) competitor but it is more focused on peer to peer banking.

(XRP) still remains the best bet for banks and financial institutions to preserve their status quo against the attacks of proponents of a decentralized banking system. We have seen a lot of industries change in the past few decades but the banking industry remains unchanged for the most part. Transactions still take long to go through and they continue to be expensive. (XRP) has just shown the world how fast and cheap banking can be. Any financial institutions that do not use (XRP) or its own (XRP) like service will lag behind in this race. This is why (XRP) is considered such a good investment despite concerns over its legal status as being a potential security.

(XRP) is massively oversold against () on both the daily and weekly time frames. The daily chart for shows that every time the Stochastic RSI has dropped this low, we have seen a strong bullish reversal to the upside. This time a reversal could mean a break above the symmetrical triangle which would give (XRP) the green light to surge higher in the weeks ahead. So far, the bulls seem reluctant to step but as we have seen with (XRP) in the past, every time the price begins to rally after a prolonged correction, the uptrend is very sustainable and the results are long lasting.

Published at Thu, 28 Mar 2019 17:06:48 +0000