The cryptocurrency market has seen better times, some might say. With a bunch of once valuable digital assets losing their shine every day, while investors are wavering out by the trading in uncertainty, save is Ripple’s native tokens, namely.

An explanation has been sought for what makes XPR so indifferent to the major market trends. It includes the Ripple’s suspicious openness towards the government direct supervision as well as the numerous claims made of token false decentralization. Yet as shows, the company’s income does not much suffer from these allegations.

Astonishing Success of XRP tokens

According to data presented by the , the revenue collected from the sales of XRP token in the last four months almost two times exceeds the amount Ripple has gained for the previous quarter.

The company reveals that it sold $163.33 million worth of XRP in the Q3, which is more than double the $73.53 million it sold in the previous quarter. The sales were distributed between Ripple and its subsidiary XRP II, LLC, which saw $65.27 million and $98.06 million sales revenues respectively.

These two Ripple offsprings are catering for institutional investors only, making the scope of revenue very interesting in a part of institutional sales. The report unveils that the largest part of an overall sales upsurge accounts for the institutional direct sales that bounced up to $98.06 million, in comparison to Q2’s $16.87 million.

The remainder of $65.27 million goes to a much smaller increase in programmatic sales that accelerates from a $56.66 million benchmark. Notably that all of this was achieved by the company regardless of the high volatility the market exhibited in Q3.

This includes a price upswing of more than 100% in September 2018, which led to the XRP token taking over Ethereum’s second position in the market. Today, the price of a coin is rather stable with trading for $0,4589.

However, Ripple has some aces under the sleeve, moving on to escrow activity. At the end of last year, Ripple locked up 55 billion XRP in a cryptographically-secured escrow account that was said to create certainty of XRP supply at any given time. Due to that lockup, Ripple has access to only 13 percent of the total XRP in circulation while Ripple’s sales were a tiny fraction of that amount.

An excerpt of the report reads:

“In Q3 2018, 3 billion XRP was again released out of escrow (1 billion each month). 2.6 billion XRP was subsequently put into new escrow contracts.”

Therefore it remains to be seen whether this new lockup would be such a great influencer of investors’ behaviour as the previous turned out to be.

Maltese Exchanges Ready to Seize All of XPR Volume

Another interesting fact could be absorbed from the Ripple’s report. The company confirmed that Malta is leading the world in terms of currently trading XPR’s volumes.

It also has been said that Maltese authorities devised the most flattering rules and regulatory frameworks for crypto-trading, thus Malta became a favorable destinations for those interested in cryptos.

Additionally, Malta lets international companies pay as little as 5 percent in corporate taxes. Prime Minister Dr. Joseph Muscat has called cryptocurrencies ‘the inevitable future of money.’ This has led to a number of large crypto firms, including Binance and OKEX Technology, moving their operations to the Mediterranean island nation.

Earlier this year, the Royal Mint, the institution responsible for producing the UK’s coins and holding gold, has attracted the attention of the crypto community when it was announced that the organization was launching its own digital currency.

As CoinSpeaker has already, this blockchain-based coin is known as Royal Mint Gold (RMG) and it is backed by gold. So, one RMG coin’s value is equal to the value of one gram of gold.

Royal Mint’s Plans

The Royal Mint firstly revealed its plans to issue digital gold tokens worth $1 billion in equivalent in 2016. These RMG tokens were to be traded on a blockchain-based trading platform managed by U.S. exchange CME. The Royal Mint even chose the company to develop RMG’s multi-signature crypto wallet (it was tech firm BitGo that specializes in blockchain technology).

The launch of these gold-backed coins had several purposes. First of all, it was aimed at providing investors with a simplified way to purchase and trade the physical gold that is held in the Royal Mint’s vaults. Secondly, selling tokens could be an additional revenue flow for the 1,100 year-old institution.

Originally, it was planned that the RMG projects would be launched a year ago but as the Royal Mint lost its trading partner, it was impossible to start the project realization.

It is believed that CME left the project as its management had changed; nevertheless, this information was revealed by some unofficial sources. The Royal Mint’s attempts to find a new trading partner were unsuccessful.

UK Government’s Veto

Nevertheless, the situation with its partnership with the CME Group is not the only failure that the Royal Mint has met. As it has been recently , the U.K. government “vetoed a plan to have the tokens trade on a cryptocurrency exchange.”

A spokesperson of the institution confirmed the information that RMG plan would not be carried out in the nearest future. Nevertheless, it was explained that they are still open for new proposals and it is possible that the project will be restarted.

The spokesperson commented the situation the following way:

“Over the last few years, The Royal Mint has been working on the development of a digital gold product, RMG, which was due to launch this spring. Sadly, due to market conditions this did not prove possible at this time, but we will revisit this if and when market conditions are right.”

Though the hope to realize this project is still alive, due to such a delay, the U.K. will lose the position of a pioneer that it should have had if the Royal Mint had managed to fulfill its first plan to issue its gold-backed coins in time.

Now its counterparts from Australia and Canada have already presented their variants of the RMG token. Nevertheless, it is unclear whether their tokens can boast great attention from the side of investors.

Ellipal is one of the lesser-known names in the hardware wallet game. The Hong Kong-based company is on the rise, however, propelled by the success of its flagship device, “The Cold Wallet 2.0.” The smartphone-like device promises all the functionality of a Ledger or Trezor wallet, but without the need to ever connect to the web.

Also read:

Hot Property

For those who are paranoid about security, however, there’s an extra step that can be taken: separating the wallet from the web altogether. That’s the step that have taken with their plainly named “The Cold Wallet 2.0.” The device claims to be “the most secure crypto hardware wallet.” Coming from a company that can’t even SSL its homepage, that’s a claim that should not be taken at face value. An investigation of the facts mercifully support 2.0’s boast to be highly secure, but it is impossible to rank it categorically alongside the likes of Ledger or Trezor.

Unboxing the Ellipal

The Ellipal, as we’ll refer to the device for the remainder of this review, arrives in packaging similar to that of a Ledger Nano S, complete with the obligatory tamper-proof seal. Inside, however, the device looks nothing like the sort of glorified USB sticks that normally pass as hardware wallets. Instead, it looks like this:

That’s right, a cheap smartphone. The Ellipal cold wallet feels as cheap and plasticky as it looks. In fact, it resembles a child’s toy smartphone — the sort you might pick up in the bargain bucket of a Walmart for a couple of dollars. Appearances can be deceptive, however. Inside the device is all the circuitry you need for a cold storage hardware wallet, controlled via a color touchscreen and a single side-button. For all intents and purposes, this is a smartphone without the dumb internet connection. And the cheap feel of the device is actually perfect for what it’s designed to do.

If you were to pull the Ellipal from your pocket in bars, boardrooms and coffee shops, there would be cause to take issue with the prominent bezel, thick profile and light weight. As it is, the HW will ideally never leave the sanctum where you’ve decided to stash it. And if it were to come fitted with a Gorilla Glass screen, all it would do is add a couple of hundred dollars to the $149 price tag, without any sort of improvement in security or UX. The cold wallet feels cheap then, but what’s inside is extremely expensive — the means to access your precious cryptocurrency.

Getting Started

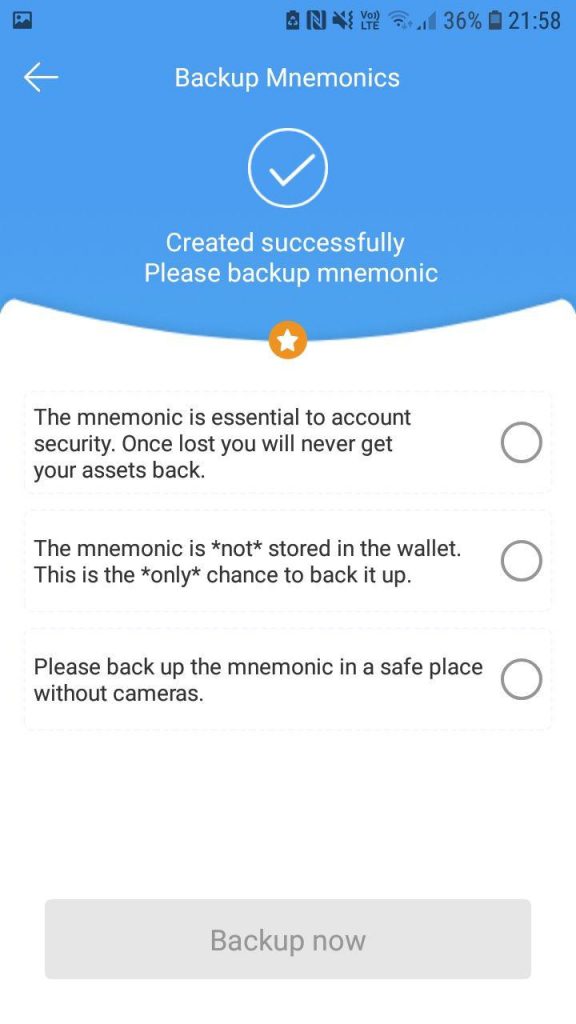

Getting the device up and running involves a process that lies somewhere between setting up a new smartphone and a new hardware wallet. After popping the battery into the device and powering it up by pressing the side button, you’re prompted to run through a series of onscreen options, starting with language selection, followed by account creation. You can create a new BCH, BTC, ETH, or ERC20 wallet from scratch, or alternatively import an existing one. If you’ve gone for the former option, you’ll be asked to create an account name and password. The password length is capped at 12 characters which, while not a major security concern, seems an odd decision.

Next, it’s mnemonic time. The Ellipal displays a 12-word seed and instructs the user to write it down and store it safely. After doing so, you’re forced to input the seed by placing the words displayed on screen in the correct order. I took this opportunity to try and memorize the seed, using the technique. My daughter and I competed to see who could learn the seed off by heart, and within a few minutes, we had it committed to memory, with the aid of a picture-rich story in which each word was laid down in a particular place along the trail. I also made sure to write down the mnemonic as a fail-safe against the fallibility of human memory. You should, too.

It’s wise to obfuscate some element of this, perhaps by changing a letter in one of the words, or by reversing the order of the last two words. Alter the seed just enough so that any attacker who finds it and tries to input it will be stumped, but not so much that you’ll struggle to recall the correct order yourself when the time comes. Speaking of security, the decorative Ellipal sticker that comes with your HW shouldn’t be applied to your laptop or anywhere else that might alert others to your ownership of cryptocurrency, as with stickers produced by other HW manufacturers.

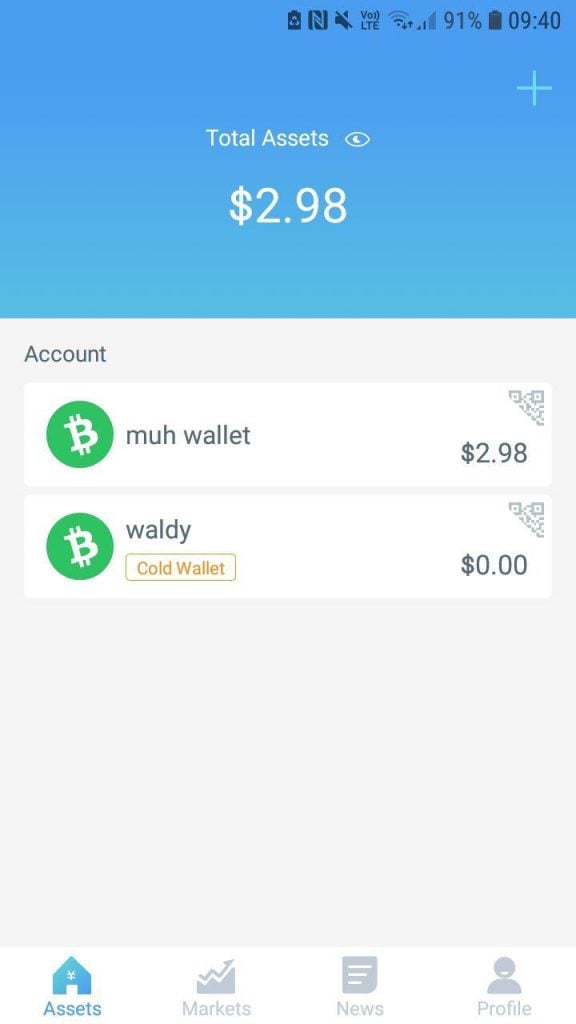

One Box, Two Wallets

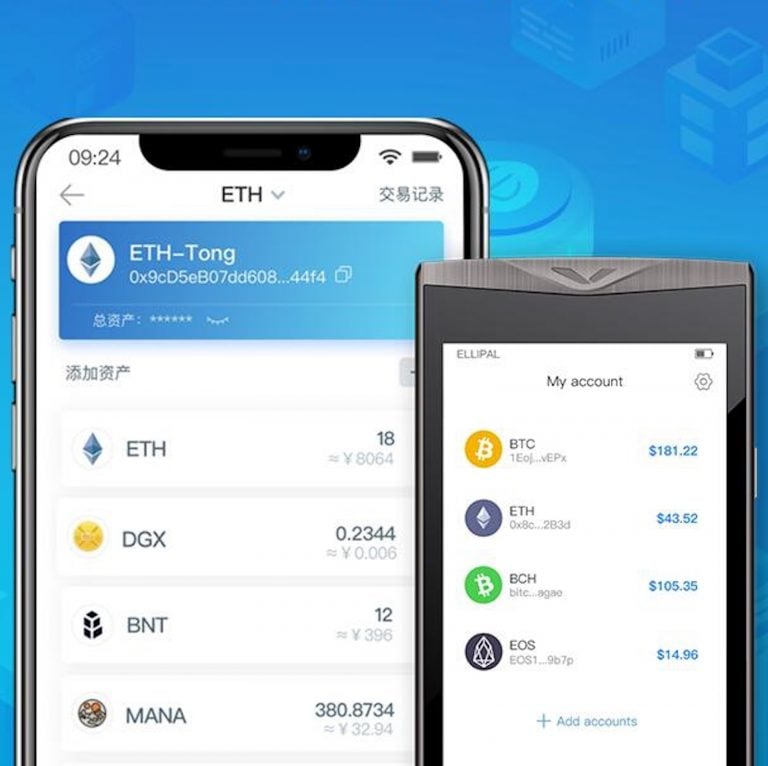

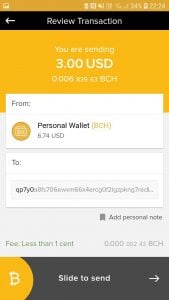

The Ellipal, up until the point of creating a wallet on the hardware device, functions just like any other HW, albeit with the bonus of a convenient touchscreen. The cool part comes when you go to sign a transaction sent from the cold wallet using your smartphone. How exactly do you bridge the gap between an internet-connected device (smartphone) and a cold storage device? The answer comes in the form of QR codes, which each device can generate and the other can scan.

For example, once you’ve installed the Ellipal app on your smartphone, you can by scanning a QR code generated by the HW device. This now grants the ability to view the balance of the cold storage wallet on your phone. However, to send a transaction from that wallet without connecting the HW to the web, you’ll need to cue up the transaction in the Ellipal smartphone app, whereupon it will generate an unsigned QR code. You then scan this code using the HW, which in turn generates a signed QR code that you then scan using your smartphone. The process sounds convoluted, but it’s less arduous than it seems.

Its UX isn’t as refined as that of the market leaders, but The Cold Wallet 2.0 is a fairly priced addition to a crowded market, and one which stands out on account of its original take on cold storage.

What are your thoughts on the Ellipal wallet? Let us know in the comments section below.

Images courtesy of Shutterstock.

Disclaimer: .com does not endorse nor support this product/service.

Readers should do their own due diligence before taking any actions related to the mentioned company or any of its affiliates or services..com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

The post appeared first on .

We built the Blockchain Wallet because we’re driven by a relentless passion for making crypto easy to use. We want everyone to be able to use it, not just invest in it.

We believe that owning and controlling your own private key is the single most important aspect of using crypto. Without a private key, you aren’t using crypto – you’re just speculating and you’re missing the defining part of crypto: user controlled, sovereign money.

It was enabling that exact need that underpinned the development of the Blockchain Wallet six years ago. The mission? Make it easy for every user to have their own private key, to get users away from storing funds at exchanges and “bitcoin banks”, and to enable everyone to be their own bank.

Fast forward six years and we’ve achieved a few things that we’re proud of:

Building the first cross-platform, non-custodial, and cross-chain wallet

Signing up 30 million wallets in 140 countries globally

Powering over $200 billion in consumer transaction volume and over 80 million consumer crypto transactions in the last two years alone

Championing the cause of financial sovereignty and user-control with regulators around the world. (We’ve spent thousands of hours and millions on education and outreach.)

Helping our users store millions of BTC, BCH & ETH coins and generate over a quarter of bitcoin network traffic alone

Most importantly, it’s been a honor and privilege to be the first place tens of millions of people turn in order to actually use crypto and hold their own keys.

But there’s a lot still to do.

At the end of the last bull run, we did a serious self-assessment and asked ourselves, what do users need that we aren’t delivering today? We identified four common requests and frustrations:

Better, faster ways for new users to get their first crypto and make their first transaction

More storage types, like hardware, as users’ balances increased

More assets as users want to store and use an increasingly diverse asset set

Better, more reliable sources of liquidity as trading and investing across assets continues to increase

Satisfying these demands meant building a huge extension of our platform, at scale. We’ve had our heads down much of this year doing exactly that and starting today we’re excited to begin delivering new solutions to you, beginning with two new capabilities.

First, we’re launching Swap by Blockchain: a next generation trading product with best-in-class liquidity and execution, powered by our new machine trading software platform that ensures best execution across assets. Blockchain Wallet users will now have access to exchange-like prices without giving up control of their keys or their crypto. And trade limits will increase from hundreds to thousands of dollars of crypto per trade.

While the system currently has deep liquidity drawn from a variety of sources, we plan to add more liquidity sources over time, including decentralized exchange protocols. We’ve rebuilt our risk and KYC systems, so that you can onboard with ease, in minutes. Swap ensures our users stay liquid and can trade at the best prices in the market, regardless of overall market volatility and challenges. We’ve started rolling Swap out today and everyone will have access over the next two weeks.

Secondly, we’re launching Lockbox: a hardware vault in your pocket, built in partnership with hardware leader Ledger. Lockbox is simple to use and is even more secure thanks to a locked endpoint that prevents phishing and spoofing attacks. It’s hardware made easy, with a setup that takes just a few moments thanks to our custom hardware-software integration.

With Lockbox you’re able to check your balance and receive transactions, on mobile and web, without the inconvenience of having to plug your device in every time. In an industry first, you’ll also be able to trade directly from your Lockbox while still maintaining your keys. In conjunction with Lockbox, we’re also excited to let current Ledger device owners seamlessly pair with the Blockchain Wallet and trade directly from the Ledger device they already own.

And we have more coming this year, including additional assets and new products within the Blockchain Wallet that will bring you new, faster, and better ways to get started in crypto.

We’re here to build a new financial system and the Blockchain Wallet is your passport to that new world. Store crypto, trade crypto, transact with crypto and most importantly truly own and control your crypto.

We’re dedicated to building the functionality you want, without compromising your control of your key. Your crypto is yours, and it should stay that way.