By : World’s third largest (XRP) has appreciated up to 31-percent against the US dollar in just two days.

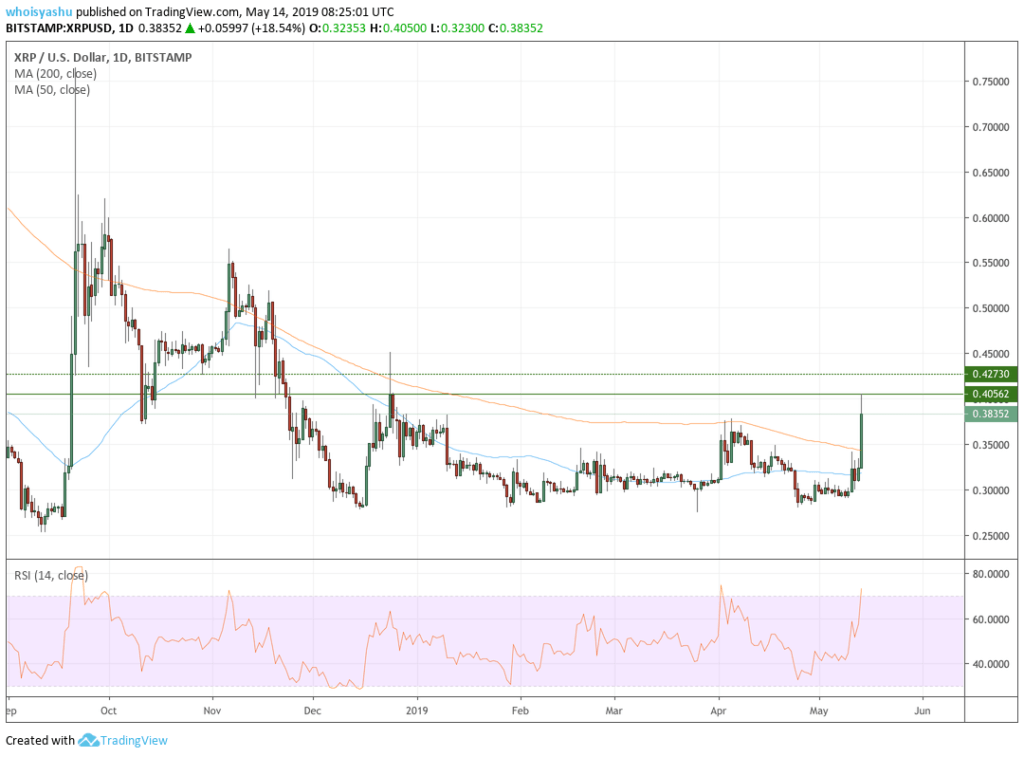

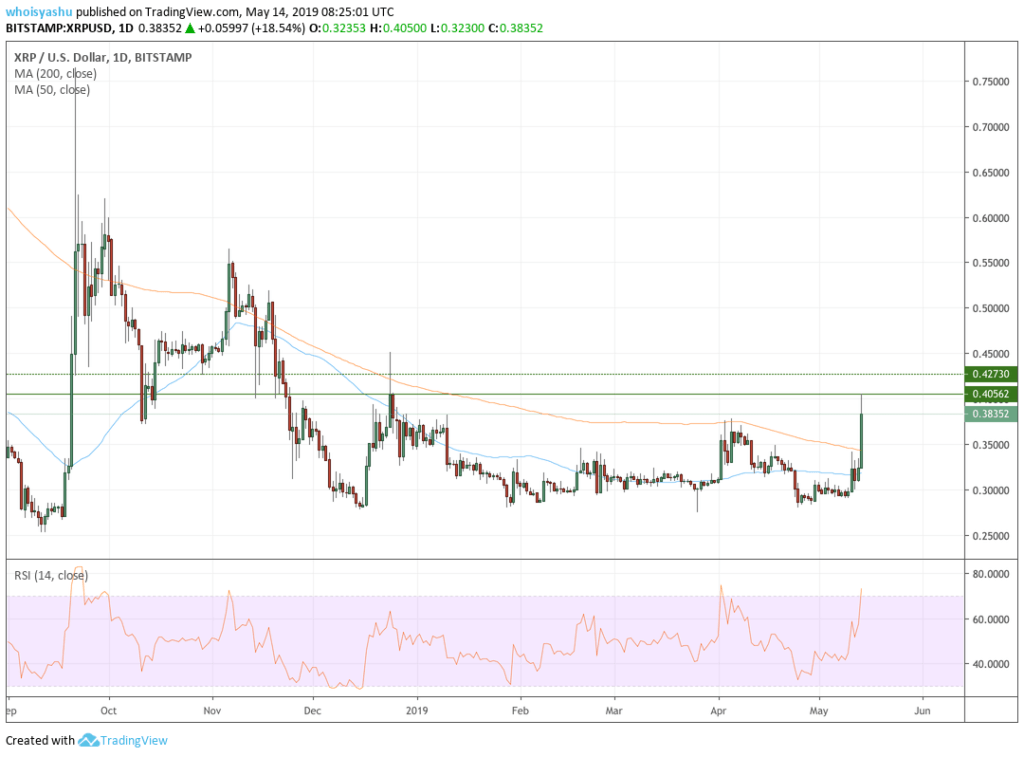

The Tuesday established an intraday high towards $0.405, up 25.05-percent since the market open on Luxembourg-based Bitstamp exchange. The pair dropped as much as 5.05-percent ahead of the European session to neutralize its overbought sentiments, finding interim support at $0.384-level.

(XRP) SURGES 25-PERCENT IN A DAY | SOURCE: TRADINGVIEW.COM, BITSTAMP

The sentiment was the same across the rest of the index, with almost all the leading posting surplus intraday gains. (), for instance, extended its rally action to establish a new 2019 peak towards $8,836.19. , , and Cash too recorded double-digit percentage gains on a 24-hour adjusted timeframe.

The ’ breakout action further came with a rise in volume, confirming a strong bullish bias across the market. Exchanges XRP-enabled pairs noted $3.69 billion worth of buying and selling activity. Meanwhile, data on Messari.io, which excludes manipulated volume statistics, showed $127 million value of trades in the last 24 hours.

At the time of this writing, XRP was hinting to extend its upside momentum, consolidating sideways while at $0.385.

Splash of Great Fundamentals

gains owed to a confluence of positive fundamentals in both inside and outside the market. The rise of trade tensions between the US and offered a soft launching pad to haven assets like . The sentiment, as it appears, rippled across the rest of the market, including the XRP.

The asset found additional fundamental support from Boerse Stuttgart. Germany’s second-largest stock exchange on Monday launched two exchange-traded notes for XRP and ’s LTC each. As if that was not enough, Boston-based asset management company, Fidelity Investments, expressed the possibility of offering XRP services to its institutional clients.

Fidelity is planning on listing and there will be heavy investing in it, along with the recent of allowing New York residents to buy , I feel it’s safe to start building a position in XRP now

— UZI (@LilUziVertcoin)

The reports improved buying sentiments in the XRP market, at least in the last two days. They also served as primary factors to drive the asset’s upside run further, making it attractive for investors to build their XRP positions.

Technically Overbought

The XRP’s daily Relative Strength Index was now above 70, indicating the asset’s overbought sentiment. While that didn’t impact XRP’s bullish bias in near-term, it indeed hinted that a downside correction wave was underway. As of now, XRP has located interim support near $0.384. A break below it could have the asset test its 200-period moving average.

The other way, extended upside momentum could push XRP towards $0.42 level, an interim upside target.

Click for a real-time (XRP) price chart.

Published at Tue, 14 May 2019 11:08:19 +0000