The

rise of the distributed exchange has long been predicted by a wide

range of leading industry figures. Changpeng Zhao, CEO of

has been quoted as saying:

“I

believe that decentralized exchanges are the future. I don’t know

when that future will come. But we’ve got to be ready for it.”

However,

not all exchanges nor DEX’s are created equal.

When using platforms users can face many

issues from complicated interfaces and slow

transaction speeds to a lack of privacy, security, and

freedom.

Currently,

the vast majority of occurs on centralized exchanges such as

and . Users must rely on trusted third parties,

escrow services and derivatives which makes it almost impossible to

trade privately. The centralized nature of these platforms exposes

users to serious security risks too. It only takes a single breach to

jeopardize the assets of all users on these exchanges.

Decentralized

exchanges are now challenging the hegemony of the centralized

behemoths by allowing users to retain their own private keys

and, in turn, ownership of any

crypto assets held on the exchange. However,

the first-generation of DEX’s have been plagued by issues. They are

often slow, indirect, only moderately secure, and offer very little

support for users concerned about privacy.

Introducing

Resistance

Winner of best ICO at

the 2019 World Economic Forum in Davos, Resistance is a decentralized

exchange, ResDEX, driven and supported by its privacy-oriented

which uses the Resistance privacy coin, RES, as an

intermediary to facilitate private .

ResDEX

is a distributed exchange unlike any other. It is the first DEX

designed with a privacy-orientated powered by a democratic

and easily accessible operation which utilizes multiple reward

mechanisms.

Created

by a team of experienced developers with a background in

cybersecurity, the

Resistance core team includes the founder and core developer behind

the Linux operating system Whonix, as well as the founder of

Openwall, who is also responsible for creating the hashing algorithm

yescrypt, and the newly released yespower CPU-optimized hashing

algorithm, which is used by Resistance. Ivan Liljeqvist (AKA Ivan on

Tech), is onboard as an

advisor. Also on board is David Kravitz, a cryptographic mastermind

with 35 years of experience in the sector, Vice President of Crypto

Systems Research at DarkMatter, former IBM researcher, key

contributor to the Linux Foundation Hyperledger Project, and inventor

of the Digital Signature Algorithm (DSA).

A Wide Appeal

Resistance appeals to a

wide community because it incorporates the best aspects of many

different technologies. The simplicity of the Resistance

Desktop Application ensures Resistance is not limited only to

advanced users and can be easily adopted by the masses without

sacrificing usability.

Their focus on privacy

and anonymity attracts individuals that are passionate about the

ongoing : development of technology. Anyone, anywhere in

the world, regardless of skill level, can use ResDEX and it’s not

even necessary to have a bank account.

ResDEX

makes use of atomic swaps which enable fast, direct and private

trades without the need for a trusted

third party. ResDex and its

accompanying facilitates privacy through the use of its

native RES coin which acts as an intermediary and validates

transactions using zero-knowledge proofs.

Utilizing Resistance

InstantSwap enables you to perform trades on ResDEX in under a

minute. Normally a ResDEX trade requires both sides to wait for

confirmations on the underlying blockchains that the trades occur on.

The amount of time can vary significantly with a transaction

taking on average 10 minutes to confirm.

ResDEX InstantSwap

negates the need to wait. This is achieved by allowing users to

deposit RES coins into a time-locked contract for a certain period,

this decentralized collateral is locked in Resistance masternodes.

The funds remain inaccessible until the time-lock is released. Whilst

the RES coins are locked in the user is able to trade amounts less

than the equivalent market value of the deposits immediately. This

dramatically increases the speed at which trades can be completed on

ResDEX without compromising security, because there is no need to

wait for block confirmations.

The

Resistance team has already been granted developer access to the

Ledger Nano S, the world’s most popular hardware , by the

company’s founders and a limited edition Resistance version of the

is now available. This integration will give users the option

to transfer funds from ResDEX into one of the most secure and easy to

use multi-currency hardware wallets available today.

Unlike most public

blockchains, including and , that publicly

visible personal data on an immutable and distributed ,

Resistance gives users the option to shield their Personally

Identifiable Information (PII) by using private transactions. The

EU’s General Data Protection () and the California

Consumer Privacy Acts are now in effect and exchanges

and blockchains are under pressure to uphold each individual’s

right to alter or delete their own personal information. Resistance

was built with a fundamental principle of the in mind: the

user’s ability to control their PII. Users are therefore free to

decide if any PII is to be used on the .

Democratic Mining

The

Resistance CPU-optimized miner

makes it easy for anyone with a standard laptop

or desktop computer running MacOS,

Windows or Linux, to mine on the

Resistance . Block rewards and

transaction fees are split between masternodes, supporting further

project developments, Proof of Work

, and Proof of Research on whitelisted

BOINC projects that advance scientific research for the benefit of

humanity.

As

with and , the Resistance is built

upon a fast cryptographic hash for performance. The Resistance

also utilizes yespower as a separate Proof of Work hash,

similar to how uses scrypt. Yespower is based on scrypt and

the newer yescrypt. The is specifically designed for CPU

and favors the standard CPUs you’ll find in regular laptop

and desktop computers and offers no benefit to FPGAs or ASICs. This

means that anyone can mine on the Resistance without the

need for the high-spec rigs required to mine on other

blockchains such as , , and many other

.

If someone did decide

to build an ASIC for Resistance, the gains in efficiency would be

orders of magnitude smaller than an ASIC built for coins that are not

CPU-optimized. This makes fairer.

ResDEX

has low fees and the typical 0.15% exchange fee is paid for by the

taker. A proportion of these fees are used to support and develop the

platform further.

Currently,

ResDEX has a functional , testnet and a one-way Simplex fiat

gateway confirmed allowing users to buy on ResDEX using VISA

or Mastercard in USD, GBP, and EUR.

In addition, ResDEX has dedicated market makers who help ensure

liquidity stays high on the exchange and lets users perform trades

quickly at competitive prices. Anyone can become a market maker on

ResDEX and provide liquidity to the market. Resistance has dedicated

a lot of time and resources to developing the REST API that makes

this possible. As an added bonus, makers don’t pay fees on ResDEX.

Masternodes

Unlike regular nodes,

masternodes do not participate in . Instead, they perform vital

services and, as a result, receive a significant percentage of the

block reward. On the Resistance platform, masternodes will play a

pivotal role in ensuring the security and fluidity of the

decentralized

exchange. Masternodes will speed up the Resistance

network. Each masternode will host a full copy of the Resistance

and help achieve consensus quickly and efficiently.

Furthermore, masternodes enhance security on the by

helping to deter individuals who set out to falsify transactions.

Masternodes stabilize the Resistance network, and the more of them

there are, the more stable it becomes. That’s why they receive such

a large portion of the block reward as an incentive – 30% of every

block reward.

Right now, Resistance

masternodes fulfill a number of key roles including:

1 . Incentivizing

people to run full nodes on the Resistance network

2 .

Incentivizing users to hold on to their RES thus stabilizing the

currency

3. Holding the

collateral used in InstantSwaps

4. Voting on

governance issues after ownership of the Resistance platform has been

decentralized

It is crucial that many

Resistance users run full nodes that contain the entire current

Resistance . As Resistance grows and becomes more

competitive, many users will choose to join pools rather than

mine Resistance directly. When users start in pools rather

than on their own full nodes, the number of full nodes on the network

decreases. This pushes the network towards centralization, which is a

threat to blockchains that solely rely on Proof

of Work.

It is also

essential that the Resistance maintains a stable and

accurate value, and that it isn’t used by wealthy individuals to

“pump and dump” the Resistance coin supply. “Pumping and

dumping” is the process by which perpetrators acquire a large

number of coins at a low price, then

artificially increase the

value of that coin to create hype and, in turn, drive up prices.

When other potential

buyers see these huge price spikes, they are encouraged to purchase

coins. At that point, the perpetrators “dump” their coins for a

huge profit and the price tumbles. To help mitigate this issue, and

to control the stability of the coin, Resistance masternodes are

required to hold a certain number of RES at all times to maintain

masternode status. This helps motivate users to hold on to their

coins instead of or selling them. By supporting masternodes,

Resistance is laying the foundation for future improvements to the

network. Further down the line, ownership of Resistance will be

decentralized and handed over to the Resistance community. The

community can use the masternode framework to add support for

additional functionality, such as governance (voting), real-time

double spend protection, and platform development. Prior to this, as

mentioned, masternodes will also play a crucial role in InstantSwaps,

by holding the collateral used to execute these lightning fast

peer-to-peer trades.

10,000 RES is the

expected minimum stake required to be rewarded for running a

masternode. Investors will have the opportunity to receive

proportionally greater rewards (approximately) for larger stakes by

running multiple nodes and/or, possibly, larger node types. When

active, nodes provide services to clients on the Resistance network

and, in return, are paid for their efforts.

As this rewards

program operates on a fixed percentage, and the number of masternodes

will fluctuate, expected rewards will vary according to the current

total number of masternodes in operation.

Proof of Research

Reward splitting is a

key feature of the Resistance consensus algorithm. In addition to

Proof of Work and masternodes, participants can allocate their

computing power to Proof of Research for block rewards. When enabled,

users contribute computer time to Resistance’s whitelisted BOINC

projects. This allows users to receive a percentage of the block

reward whilst making a positive contribution to humanity. The share

of block rewards allocated to Proof of Research are split between the

members of the Proof of Research Resistance Pool (respool). The more

computational power an individual contributes, the greater the share

of the block rewards they receive. As the block reward split is 30%

to miners and 30% to researchers there is an incentive to perform

both these actions. Users can also specify that they wish to partake

in the option that has the fewest participants. This should ensure an

even distribution of miners and researchers.

BOINC is the world’s

largest and most powerful distributed computer network. They host a

wide range of research projects helping solve problems in

astrophysics, , climate change, humanitarian causes and more.

Resistance’s whitelisted projects will focus on causes such as

and Alzheimer’s research, nanotechnology, clean water

technology, molecular biology, and solar power.

Tackling Liquidity

Resistance recently

confirmed a partnership deal with Huobi, the world’s leading

company with an accumulative turnover in excess of U.S.

$1 trillion.

The deal will ensure

liquidity on ResDEX and allow for fast and reliable . In turn,

the partnership opens new possibilities for Huobi by giving the

organization access to new markets.

The partnership will

eventually give the Resistance exchange access to over 150

and 350 pairs. Initially, the digital asset

pairs available will include , , and the USD-pegged

stablecoin Tether with more coins added as soon as they are included

on the Huobi platform.

Poor liquidity has been

the weak link for most of the DEX platforms currently operating. With

slow , many first-generation DEXs have struggled to achieve

the levels of liquidity required. Low liquidity can also lead to

issues like price slippage, where the value of a currency changes

over the period of time it takes to complete a trade; unfair or

uncompetitive pricing; instability; slow transaction speeds; and

more.

Resistance has already

secured a number of other important partnerships too. As well

liquidity on the exchange provided by Huobi and hardware

support from Ledger, market making is facilitated by GSR, and TLDR is

responsible for assisting and mentoring the core team.

Privacy Focus

When a user wants to

initiate a trade on ResDEX, they open the ResDEX interface in the

Resistance Desktop Application and enable the coins they are

interested in . The user can then deposit coins into a special

exchange address derived from their exchange secret seed phrase that

only they know. This address is specific to the coin they are

and each coin has its own unique derived address.

A useful additional

feature is that users can add privacy to almost any ,

including , even if that currency doesn’t support private

transactions natively. Through the use of the Resistance

privacy-oriented , users can enable the privacy feature at

the click of a button. ResDEX will then automatically trade the coin

of your choice to RES and send RES in place of the original currency,

thereby adding a layer of privacy to the trade.

cannot be

considered truly fungible as it does not provide users with

sufficient privacy and anonymity. The transaction history of every

is publicly available on the for anyone to

scrutinize. Older coins may be associated with illegal or unethical

transactions and effectively become devalued in comparison to a new

coin with a fresh . Centralized

exchanges like , for example, have been known to block funds

based on the coins’ previous transactions. With zk-SNARKs, a form

of zero-knowledge proof used to facilitate private transactions on

the Resistance , it’s possible for RES coins to have no

public record or history. If users choose to send a coin through a

private transaction, its history is completely obfuscated.

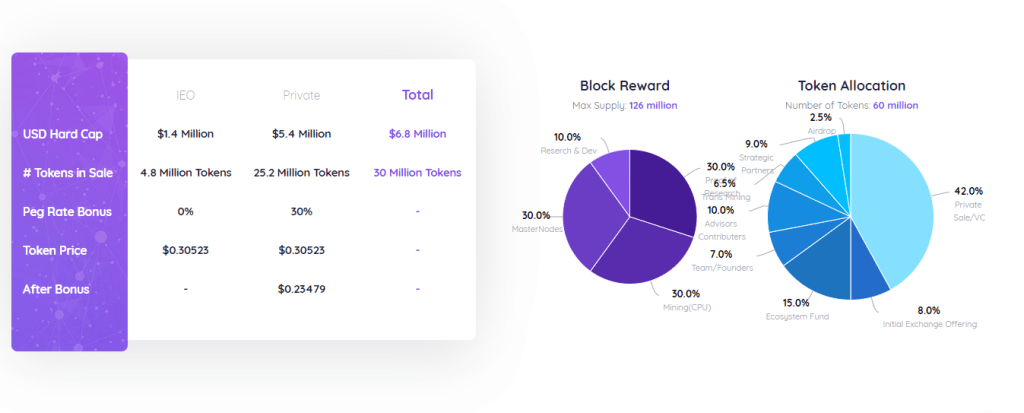

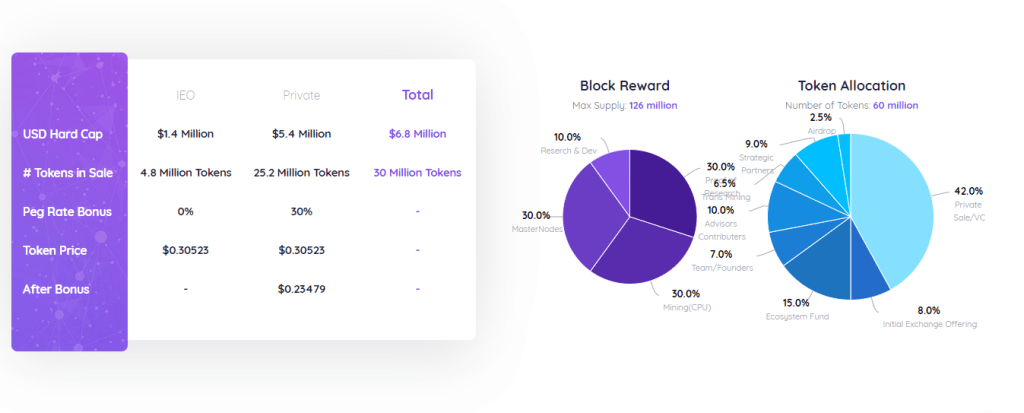

The Token Sale

Resistance is in the

closing stages of its Private Sale. The platform’s Initial Exchange

Offering (IEO), a process similar to an ICO but conducted through an

exchange, will begin as soon as the Private Sale has ended.

Related

Published at Mon, 08 Apr 2019 14:07:00 +0000