A from research firm Delphi Digital takes an in-depth look at . One observation is the ether coin’s potential to outperform if the next bull run happens soon.

Better Beta

This is based on ether’s higher volatility compared to and the tendency for all to move in unison. The beta measurement of a is related to volatility, and over the past six months, ether’s has been greater. Notes the report:

ETH has also been significantly more volatile than over the last six months. It’s 90-day beta relative to is currently 1.5, substantially higher than its historical average.

Chart courtesy of Delphi Digital.

Crypto Correlation

In general, like tend to follow ’s price movements — and this tendency of late.

Historically, there have been instances of coins which have bucked this trend but these are exceptions rather than the rule. If anything, tend to fall further in bear markets but can rise faster in bull markets.

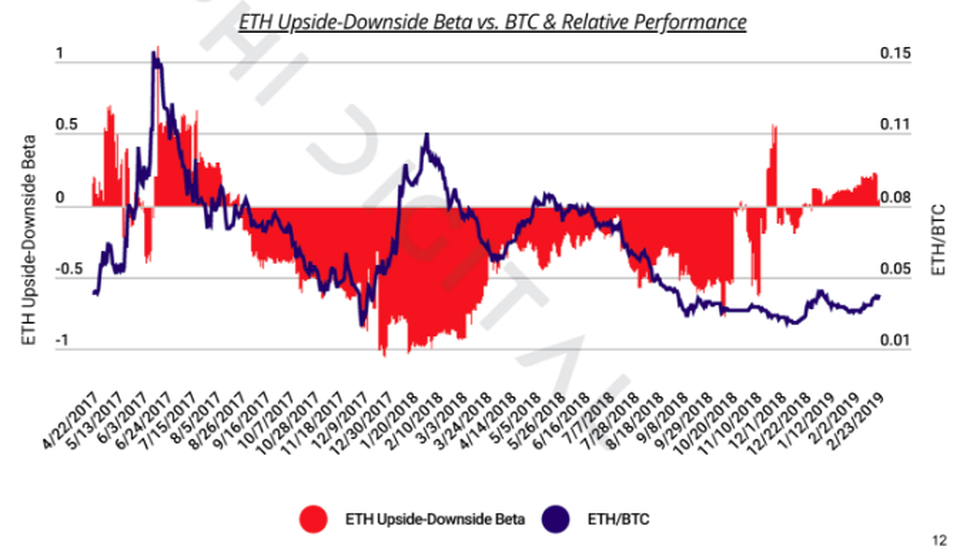

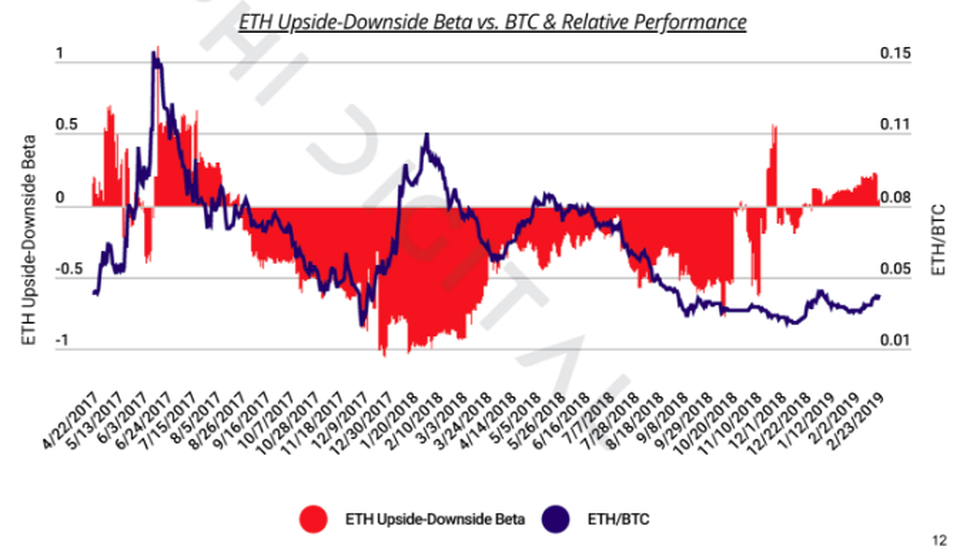

For the past eighteen months, has experienced downside volatility compared to . However, the report suggests that this could be changing.

We are… beginning to see upside volatility pick up for ETH. Given the extremely high intra-market correlations we previously discussed, this is a trend we are monitoring closely as ETH may be poised to outperform if rallies.

When Bull?

Whether we see outperform in the short term is anybody’s guess. Now that the Constantinople hard fork is complete, we may actually start to see its volatility decrease a little.

We have certainly seen ether mirroring the rest of the market over the past few days with , although not nearly as impressive as s. Whether that turns into a full-blown bull market remains to be seen.

Like all predictions, we just won’t know until it happens. Fortunately, this one already comes with its own ‘may’ — so it can’t ever turn out to be wrong.

What do you think? Let us know your thoughts in the comments below!

Images courtesy of Coinmetrics.io, Delphi Digital, Shutterstock.

Published at Sat, 09 Mar 2019 01:07:03 +0000

![Cryptopia hacker transfers over $4 million worth of stolen ethereum [eth] to unknown wallet Cryptopia hacker transfers over $4 million worth of stolen ethereum [eth] to unknown wallet](https://ohiobitcoin.com/wp-content/uploads/2019/03/Screen-Shot-2019-03-30-at-3.27.12-PM.png)