It is not a secret that cryptocurrency investment can reap fabulous benefits for people all around the world. For example; bitcoin, Litecoin, and Ethereum saw their value triple last year, while other altcoins also grew enough to make people earn their fair share of dividends without much effort.

The digital currency industry is enormous, lucrative and very enticing in a general view of things. However, people tend to get enamored with the advantages and potential benefits, often investing large chunks of money without analyzing or even knowing some of the attached risks that come with the activity.

Reality indicates that cryptocurrencies can be very volatile. The same high appreciation can quickly turn into substantial losses as most investors discovered this year when bitcoin and other cryptocurrencies dropped to half the value at one point, causing more than a few people to take their hands to their heads. Experienced traders can analyze the markets and minimize their losses, but the fact remains that the majority of conventional traders cannot prevent these unexpected events.

The ODUWA team noticed the problem and developed a solution; ODUWACOIN, which is a Nextgen cryptocurrency that offers indemnity and covers against the volatility of the cryptocurrencies listed on the platform. The system achieves that by combining blockchain technology and insurance to give investors a way to insure themselves from losses in the always active cryptocurrency market.

Imagine being able to invest in cryptocurrency and sleeping peacefully at night, or watching bitcoin or altcoin crash in the news and not losing your mind. You can give your family peace of mind, focus on things you love to do, going on vacations and starting up other projects if you know that the crypto investments you have done so far are protected under the rules of the ODUWA decentralized exchange platform.

The attractiveness of trading cryptocurrencies and the associated risks

The interest of investors in cryptocurrencies is at an all-time high right now. As more people start to consider coin investments as a lucrative opportunity to make money, there are also many who are put-off by the pitfalls involved.

Issues like high uncertainty and cryptocurrency volatility are preventing investors from taking the leap and entering the market. However, things are starting to change with the rise of ODUWA, which is a revolutionary platform where investments on approved coins inside their Exchange will be 100% Insured against depreciation, protecting investors against some of the risks.

Another reason why people can be afraid of trading digital assets is that there are lots of worthless coins are out on the market, so they don’t know which one to trust. That is why ODUWA will approve only four reliable cryptocurrencies against volatility at the beginning and continue to add more as the platform expands.

The financial experts behind ODUWA understand investors’ concerns that investing in cryptocurrency is an enterprise with high risk considering its digital nature that is always prone to hackers, the volatility and high uncertainty within the coin market. Users don’t want to risk their resources, so they often look for a secure alternative that provides a stable floor and a high ceiling when it comes to potential profit.

ODUWA aims to counter those problems through an intelligent solution, which involves selecting coins to insure, keeping a proportional reserve to the invested amount, and automated smart contracts to provide reliability and trustworthiness.

It is not difficult to see the appeal of cryptocurrency investment. Amazingly, in 2017, the market with bitcoin went from $830 to $19,300 and now lingers around $8,000, so apparently, there is money to be made. The pull of achieving financial freedom when an ICO portfolio skyrockets have investors worldwide salivating, but there are real risks involved, which are big enough to hold investors back. But fear no more: ODUWA is in the house.

ODUWA: a risk-palliative network

ODUWA is nothing more than a decentralized exchange platform in a similar mold of Coinbase, Bittrex, and HitBtc, just to name a few; with an option for asset protection within the exchange for investors on a contractual term using smarts contracts.

ODUWA protects cryptocurrency Investors with Insurance volatility and asset safety solutions, making it the perfect setting for both beginners and advanced users of digital currencies who are afraid of some of the risk pertaining crypto trading.

With a revolutionary solution like ODUWA’s, users will experience little to no risk of losing money with absolute protection in the face value of their principal investment. The ODUWA solution will play a significant role in stabilizing the market and creating a new trust economy.

The ODUWACOIN platform includes the ODUWA encrypt feature, one that provides Nextgen security for digital assets and an inbuilt exchange where trading ODUWACOINS is free. The ODUWATEAM achieves that by providing smart contract indemnity once users insure coins on the platform.

People do not have to pay anything when their cryptocurrency assets are depreciating. However, the system will ask them to pay a small fee when their cryptocurrency securities and assets are doing well, as a small token of appreciation!

The company is working on a beta version of their core software, and it is actively being tested. The ODUWA encrypt application will be a multiplatform solution that enables users to connect and make VoIP calls using any device (desktop or Android SIP, Zoiper, 3CXPhone, X-Lite and more), and gain access to their PBX via Telegram, Facebook Messenger, and other apps.

Without a doubt, ODUWACOIN is revolutionary in numerous aspects of the decentralized exchange. You can join the ODUWA community by investing in their ICO or by entering their referral or bounty programs.

The ODUWA token (OWC)

To interact with the same ecosystem, people will be able to acquire their ODUWA tokens (OWC,) and they will become immediately available upon purchase and will be deployed through Ethereum. The ODUWA company has announced that they will not create any additional token during or after the crowd sale.

ODUWA tokens will be tradable on various notable exchanges around the world, and since ODUWA is the exchange, you can trade the associated coin on the existing platform with no extra fees.

ODUWA coin holders can gain several benefits, including added protection for their network portfolio against volatility, easy liquidation with ODUWAPAY debit card, and no Inflation, among others.

Token sale

After the platform was successfully funded, the development began, and it is now expected to be live and go on the exchange in May 2018. ODUWA tokens are currently available only for 21 cents a token and will be tradeable in the secondary market known as the exchanges, for those who can buy now for 50,000.00 dollars and above, their tokens will be delivered at 15 cents each until April 5th.

ODUWA final stage Initial Coin Offering (ICO) will scale to .90 cents starting April 5th, 2018 until May 5th, 2018 with supporting bonuses and discounts for the growing ODUWA community because there is no inflation.

During the ICO, a total of 21,000 000.00 OWC tokens will be offered to the purchasers. The crowdsale will continue until the end of the time frame, or the project receives 3,150 000.00 USD

Start: Feb 8, 2018 (9:00AM GMT)

Number of tokens for sale: 16,930,081 (9%)

End: April 05, 2018 (11:00AM GMT)

Tokens exchange rate: 1 token = 0.21 USD 10% Discount

Acceptable currencies: ETH, BTC

Minimal transaction amount: 0.10 ETH

Distribution of tokens:

57%: Core phase of the token sale

12%: Project team

10%: Bonus fund

8%: Tokens presale (Round 2)

6%: Partners and advisors

5%: Tokens presale (Round 1)

2%: Bounties

Use of proceeds:

53%: Branding and marketing

29%: Gift code inventory

12%: IT infrastructure

4%: Legal and financial overhead

2%: Bounty and overhead

In conclusion, ODUWA is a decentralized blockchain organic wealth building community, an exchange platform with asset protection options designed with full security, complete decentralization, with a focus on protecting investors’ money.

If you are a beginner in the cryptocurrency trading world and want to get your feet wet, using a decentralized exchange platform like the is a recommended first step. It can guarantee that most of your investment is protected against unexpected falls in value, and all you have to do is show your appreciation when things are going smoothly with a small contribution to the system.

<iframe width=”560" height=”315" src=”" frameborder=”0" allow=”autoplay; encrypted-media” allowfullscreen></iframe>

■ Miners Economics

Becoming Miners (Nodes)

Miners are a supportive and incentivized community that processes bitcoin’s transactions and keep everything running smoothly 54A node is a powerful computer that runs the bitcoin software and helps to keep bitcoin running by participating in the relay of information. Some nodes are mining nodes (usually referred to as “miners”). 55Anyone can run a node and mining nodes. 56The service miners provide is not only transaction validation. Every full node can validate transactions.Miners’ role is critical in that they preserve the distribution of power: the power to decide which transactions to include in each block, the power to mint coins, and the power to vote on the truth. 57There’s no official statistics on the number of active bitcoin miners, but it was estimated there are about 100,000 or more miners globally as of 2015. 58 The number can be higher today.As of 2017, it is estimated that about 100,000 Venezuelans are “mining,” although it is impossible to have an exact figure because many are protecting themselves by using servers in foreign countries. 59

Capital Intensive Investment

Miners consist anonymous individuals including hard-core online gamers, mining pools, and mining companies.The costs of being a mining node are considerable, not only because of the powerful hardware needed (if you have a faster processor than your competitors, you have a better chance of finding the correct number before they do), but also because of the large amounts of electricity that running these processors consumes. 60Mining pools are groups of miners who work together to mine, under the agreement that they will share block rewards when they are unlocked. The rewards are allocated in proportion to the contributed mining hash power of each member of the pool. 61This capital intensive nature may keep ordinary want-to-be miners from joining, creating a concentration of wealth creation to a capable few in such a way only those who can afford intensive capital can take opportunities. This is against the bitcoin’s promise of the equitable(egalitarian), distributed and inclusive system. √

Concentration Tendency (Mining Process, Capital and Geography)

Mining is now predominantly executed in large, specialized warehouses with huge amounts of mining hardware, so hashing power is typically directed towards mining pools in these venues. 62 √The process of mining for bitcoin has become so complex that the amount of computer power, and as such electricity, required in mining has become sizeable. Therefore, mining tends to gravitate towards countries with cheaper electricity. 63 √In each country, the top handful of mining companies have harnessed a large amount of network hash power in their mining efforts, creating a more centralized structure of the mining process. 64 √There are only a few countries that can boast of a concentrated mining effort, able to sizeably export bitcoins. They are Georgia, China and US. 65As of Jan 2018, it is reported bitcoin miners are shifting outside China amid State clampdown. 66While the moves are unlikely to have a noticeable effect on bitcoin transaction speeds, they could reshape the cryptocurrency mining industry. Miners have until recently flocked to China because of the country’s inexpensive electricity, local chip-making factories and cheap labor. They now have little choice but to look elsewhere. 67As miners function as a true distributed power, any concentration issue can cause a problem for the bitcoin network to function as distributed technology. √

Decreasing Rewards and Profits

The mining cycle depends on the price of bitcoin.As of today, 80% of bitcoins have been already mined. The number of bitcoins awarded as a reward will decrease from current 12.5 because it halves every four years or so. The next one is expected in 2020–21. 68The reduced future rewards can cause miners’ operation unprofitable to cover their investment cost for mining equipment. √The market value of bitcoin relative to cost of electricity and hardware could go up over the next few years to partially compensate this reduction, but it’s not certain. 69

bitcoin Value versus Miners versus Security

When the bitcoin price drops, some bitcoin miners park their supply, but they continue to play the lottery until the price increases. Others who can’t afford to park and play may join mining pools, pooling their computing power with nodes with the hope of increasing their odds and at least getting some fraction of the winnings rather than nothing at all. 70If miners decide to desert the network due to reduced incentives either by zero bitcoin reward after 2140, or by low bitcoin price, then the network can be exposed to concentration issue that can lead to potential 51 percent attack. √A huge mining pool or a cartel of large mining pools can control 51 percent of the hash rate. The result is that, with that much firepower, they would constitute a majority vote of miners and could hijack block generation and force their version of the truth on the bitcoin network. 71

Implications on Other Consensus Models

While 51 percent attacks on PoW models stem from concentrated mining power, attacks on PoS models come from concentrated coin control, and coin exchanges are typically the biggest stakeholders. 72 √Permissioned blockchains don’t have miners and mining. They rather opt for a small number of specific known validators(nodes) in the private space rather than relying on random, anonymous miners in the public space. Therefore, they are faster.However, its easiness to change rules and small scale of the network raise security issue. The easier it is to change the rules, the more likely a member is to flout them. 73 √

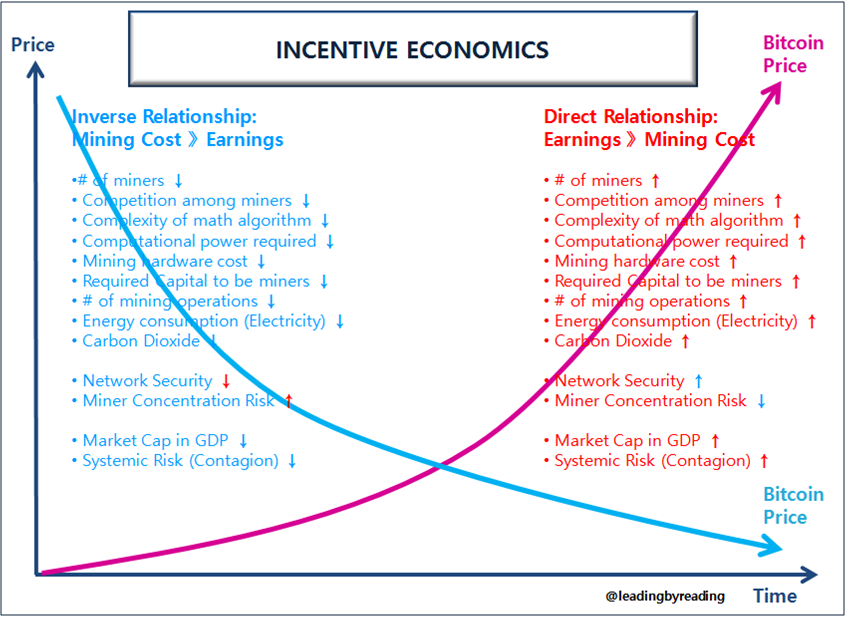

■ Incentives (Rewards) Economics

Fixed Supply of bitcoin as Incentives

The deflationary monetary policy with the fixed supply of coin increasing the value over time, provides incentives for a miner to commit to a long term project with future reward. 74Rewards comprise two elements: rising value of coin and transaction fees miners get.The economic incentives miners have to continue their proof-of-work keep the public blockchain honest without any oversight, indiscriminately and free of censorship. 75They also ensure ledger accuracy and prevent tampering. In the same context, a blockchain lacking such built-in safeguards becomes easier to hack. 76The bitcoin-mining process is neither cheap nor simple: Proof-of-work requires the use of application-specific integrated circuits(ASIC), computer peripherals that can cost several thousand dollars. 77

__________

It means if the cost to create bitcoin exceeds the reward, miners theoretically lose incentive, which ultimately leads the network security issue prone to attack in case miners leave. √

Once All the Bitcoins Have Been Minted

Once all bitcoins have been minted by around 2140, transaction fees will become the sole reward for miners. 78Because each block has a fixed maximum size, there is a limit to how many transactions a miner can include. Therefore, miners will add transactions with the highest fees first, leaving those with low or zero fees to fight for whatever space might be left over. 79 √If your transaction fee is higher enough, you can expect a miner to include it in the next block; but if the network is busy and your fee is too low, it might take two, three, or more blocks before a miner eventually records in the blockchain. 80Without fees to incentivize miners, the hash rate would likely drop. If the hash rate drops, network security declines. 81 √

Reliance on Anonymous Incentivized Miners

A distributed technology is maintained by ‘distributed powers’ such as anonymous miners, which itself contains both strength and weakness.

__________

While bitcoin claims to be “trustless,” it’s just created a precarious house of cards whereby everyone has some incentive not to let it topple. However, miners can still shut off their computers and freeze the network if they wanted to. 82Unlike centralized system or permissioned blockchains, for public blockchains such as the bitcoin network, without this incentive structure designed in the system, there’s no way to control or direct anonymous miners. 83 √Incentives are the sole driver in keeping the system maintained. √

Reaching Break-Even Cost amid bitcoin Price Instability

As of March 15th, 2018, it was reported that bitcoin traded at the break-even cost of mining a bitcoin, at $8,038. 84If the cost to create bitcoin exceeds the reward, miners theoretically lose incentive. In some cases the miners may simply turn off the machines until the price comes back. 85 √

__________

bitcoin mining today requires not only custom hardware that can cost several hundred to a few thousand dollars but also the need to regularly replace equipment accounts for more than half the cost of mining. 86Chinese miners have an incentive regardless, because miners can access very cheap electricity produced by hydropower and they can produce bitcoin regardless of cost because it allows them to send money overseas and evade the government’s capital controls. 87Four out of the five largest bitcoin “mining pools” in the world are Chinese. 88As of Jan 2018, bitcoin mining is considered so profitable in China that the cryptocurrency could fall by half and miners would still make money, according to Bloomberg New Energy Finance. Even at the country’s highest regulated electricity tariff, miners can profit from bitcoin as long as it’s worth more than $6,925. 89The price at which most miners would really start shutting down their operations is around $3,000 to $4,000 per bitcoin. 90

__________

It is reported that miners’ earnings have roughly halved in March 2018 from December due to a surge of interest in bitcoin mining. 91The median transaction fee, another source of revenue for miners, has also fallen below 50 cents from as high as $34 in late December, according to bitinfocharts. 92

Satoshi Nakamoto’s Identity

It is understood that Satoshi Nakamoto owns a “massive cache” of the currency, estimated at 1 million bitcoins, or 7 percent of the total supply, spread under various anonymous accounts. This person or group could wreak havoc on the currency if those bitcoins were suddenly sold into the market, potentially devaluing all bitcoin. 93 √Even if he sells only a few, others will notice, causing a crash as everyone panics and sells theirs before Satoshi can dump. 94In this regard, the importance of Satoshi’s identity goes well beyond bragging rights. At its heart is how widely bitcoin’s value can fluctuate — and how much influence s/he (or they) potentially has over that fluctuation. 95 √

Incentives versus Leadership (or Absence of It)

Under absent leadership, decision making is done by community’s consensus, which is slow and sometimes hard to reach. √We cannot rule out the possibility that the core principle — the fixed supply of 21 million bitcoins — can also be compromised if a majority of “miners” agree. This will be the most critical compromise affecting negatively for all the stakeholders’ incentives. 96 √Likewise, for other cryptocurrencies, miners are prone to the risk where/when leadership suddenly decides to sell their holdings devaluing the coin’s value, affecting miners’ incentives in a negative way. √

Compromise of Network Integrity Affecting Miners Incentives

As was shown from the case of bitcoin XT in 2015, any design change to the original bitcoin protocol, whether through an altcoin or an upgrade, must keep in mind appropriate economic incentives to sustain miner decentralization, so that the network gets good value from miners in exchange for the large sums of bitcoin.Smaller miners in geographically dispersed locations should be able to compete with larger miners that are geographically centralized large mining pools in Iceland or China. 97 √

(End of Part 6. To be continued in the next article)

Original article on leadingbyreading.org :

Tron is forming a double bottom pattern on its 1-hour time frame, which is considered a classic reversal signal. Price failed in its last two attempts to break below the 0.03 level, creating this formation with the neckline at 0.035.

A break above this neckline could lead to a rally of the same height as the chart pattern. However, price has yet to surge past the 100 SMA dynamic inflection point to lead to a test of this barrier.

Speaking of moving averages, the 100 SMA is below the longer-term 200 SMA to indicate that the path of least resistance is to the downside. In other words, the downtrend is more likely to resume than to reverse. Also, the gap between the moving averages is widening to signal strengthening bearish pressure. In that case, a move below the latest lows is still a possibility.

Stochastic is pointing up to show that buyers still have some energy left in them, though. However, the oscillator is also nearing overbought conditions to signal that selling pressure could return sooner or later.

Risk aversion has been popping back in and out of financial markets, driven by the uncertainty spurring from the trade spat between the US and China. The latter has initially published a list of products to slap higher tariffs on while the former is due to release a list of companies subject to higher duties.

This back and forth could keep dampening investors’ demand for riskier assets like cryptocurrencies, driving them to lower-yielding assets or safe-havens like gold and the dollar.

Still, Tron has its testnet launch coming up and this would remove its dependence on the ethereum network. Analysts have mixed views on this event, although it could provide some upside opportunity for this particular altcoin if all goes well.

The post appeared first on .