This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. bitcoin.com does not endorse nor support this product/service. bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

SINGAPORE – Viola.AI, the world’s first blockchain-powered Relationship Registry and Love AI that is created by the team behind dating giant Lunch Actually Group, has introduced REL-Registy — a global and transparent relationships and marital registry. REL-Registry protects users through decentralized ID verification with visual recognition and social media accounts and hashes their relationship status on to the blockchain which is immutable and accessible globally.

Viola.AI’s goal is to restore trust and transparency to the love industry in the current landscape that are plagued with problems from lack of verification, unsuccessful matches and wrong mindset to date for singles, to increasing relationships challenges that leads to more divorces, lack of transparency in relationship status, and diverse sources for advice for couples.

Why Relationships Registry?

In today’s day and age, online love scammers are making billions of dollars a year preying on unsuspecting singles. And there is no easy way for singles to find out someone’s actual relationship status. A key issue is that in area of relationship status, marital registries are centralized and unconnected between countries or states, leading to lack of transparency and accessibility for any useful verification purposes.

According to The New York Post, the popular hook-up website for cheating spouses, Ashley Madison attracts 5.7 million new users this year — and most of them are women. And GlobalWebIndex (GWI) released the figure that shows 30% of Tinder users surveyed are married, while another 12% are in a relationship.

Introducing, Viola.AI REL-Registry.

On top of verifying the users’ identity by checking their photo against the real-time video scan and their social media accounts, REL-Registry will also ascertain their relationship status and hash them on the blockchain.

With the nature of blockchain that is immutable, relationships that are hashed on the blockchain are decentralized and global – giving singles and couples a peace of mind that their relationship status are transparent, regardless of their geographical location.

REL-Registry gives the assurance for singles that they are really talking to other users who are single and ready to commit. Already-married couples can now renew their vows via a marriage on the blockchain. Couples who are about to get married can opt for a dual registration, one with their country of domicile and/or origin, and one on the blockchain, where they are openly declaring their commitment to each other.

“There needs to be a way for singles to know that the profile they are interested is indeed single and is not another (unhappily) married profiles looking for some companionship. And for couples, using blockchain is in fact the most efficient and cost-effective way to announce one’s engagement and marriage,” says Violet Lim, CEO & Co-Founder of Viola.AI.

A wide variety of smart contracts can also be added too give structures and complement different types of relationships, for example: fun conditions to one’s engagement, such as having a date night once every week, and wedding preparation’s tasks and deadline and a more serious note such as putting down intentions for assets and arrangements of digital assets if one party is no longer there, etc.

Blockchain marriages are not something entirely new. In 2014, the first couple in the world registered their marriage on a blockchain through a wedding ceremony held on Skype. More couples have followed suit since. In fact, smart contracts are much safer and more reliable than the conventional methods of storing information – marriage certificates being no exception. REL-Registry makes the process simpler and accessible to all.

REL-Registry works hand in hand with the other core features of Viola.AI: the AI-engine which can perform deep learning about each user’s personality, background, and behaviour. Viola.AI is a lifelong love advisor that evolves her role based on the user’s relationship journey which will give personalized advice, timely concierge service and quality matches to help singles to be effective in finding love and to help couples improve their relationships.

Experts and merchants would be able to offer their relevant services to highly targeted users. Using Ethereum smart contracts, all parties will be assured that any community and partner’s effort to improve Viola.AI will get their agreed-rewards or revenue share.

Viola.AI’s Open Integration also allows its technology to not just be used at solving problems in the Love industry. It is the core of a new registration, verification, and recommendation engine to provide innovative and secure solutions for all other industries, with VIOLET token at the heart of this ecosystem.

Viola.AI will be launching its Public Sale between 29 May to 17 June to coincide with the launch of the product’s MVP. The Pre-Sale of the project was sold out 5 days early back in January, and the company recently launched its Alpha Club for contributors of the project which entitles them for various rewards and privileges.

***END***

Learn more about how Viola.AI is going to change the world, one relationship at at time at www.viola.ai

Join the discussion on Viola.AI Telegram:

About Viola.AI

Viola.AI is the world’s first blockchain-powered Relationship Registry and Love AI to restore trust and transparency to the Love industry. Viola.AI evolves with you depending on the stage of relationship you are in – from single, to courtship, to engagement, to marriage and give users personalized advice and recommendations. Viola.AI also verifies the identity and relationship/marital status for all users and couples through its decentralized Relationships Registry.

Contact Email Address

christina@viola.ai

Supporting Link

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

The post appeared first on .

A U.S. District Court has ruled against Chinese conglomerate Alibaba Group in favor of a Dubai-based cryptocurrency foundation, Alibabacoin. The judge says Alibaba Group did not show any jurisdiction in the U.S. and China’s ban on initial coin offerings eliminates any potential confusion.

Also read:

No Jurisdiction for Alibaba

U.S. District Judge J. Paul Oetken ruled in favor of a cryptocurrency and its foundation on Monday against the Chinese giant Alibaba Group Holdings. He “rejected Alibaba Group Holdings Ltd’s bid for a preliminary injunction to block the Dubai cryptocurrency firm Alibabacoin Foundation from using the Alibaba name,” Reuters elaborated, adding that he explained:

Alibaba did not show he had jurisdiction, having failed to establish a ‘reasonable probability’ that Alibabacoin’s interactive websites were used to transact business with customers in New York.

Alibaba Group accuses the defendants of using an “unlawful scheme to misappropriate” Alibaba’s brand name “in order to deceive investors in the U.S. and around the world.” The defendants used the Alibaba trademark to raise over $3.5 million from investors through initial coin offerings (ICOs) of Alibabacoins or Abbc Coins which “are neither registered nor approved by U.S. Regulators,” the Chinese company alleged.

The Alibabacoin Foundation argued that it was not trying to piggyback off the Alibaba name. Judge Oetken then dissolved a temporary restraining order against the foundation issued on April 2 by another judge.

This Is Not China

“The judge said it did not matter that Alibabacoin might eventually list its cryptocurrency on U.S. exchanges or that a New York company hosted one of its websites,” Reuters detailed, noting that:

Any injury Alibaba might have suffered to its business, goodwill and reputation from alleged trademark infringement likely occurred in China, where the e-commerce retailer is based.

Furthermore, the judge explained that “China’s ban on initial coin offerings in September eliminated a key source of potential confusion among consumers about its lack of ties to Alibaba,” the news outlet conveyed.

Do you think Alibaba should be able to stop Alibabacoin? Let us know in the comments section below.

Images courtesy of Shutterstock and Alibaba Group Holdings.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

Information as of May 1, 2018

This report was created by:

Professor , Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox;

, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox

This report presents data on the ICO market changes during 2017-2018. Special emphasis has been placed on an analysis of the changes that have taken place in April 2018, including over the period from April 23-30, 2018.

1. General analysis of the ICO market (by week, month)

1.1. Brief overview of ICO market trends

Table 1.1. Brief ICO market overview, key events, news for the period from April 23-30, 2018

| № | Factors and events

(link to source) |

Date of news | Description | Type of impact |

| 1. | EOS Main Net Launch on June 2 – The Transition will Trigger Increased Speed & Reduced Costs [source: ] | April 24, 2015 | Can EOS take Ethereum’s place? EOS is preparing for the launch of its main network on June 2. The unveiling of EOS.io will trigger the transition of EOS from the Ethereum blockchain to its own main network, and this will lead to many positive effects.The transition will facilitate an increase in speed, a reduction in costs, and enhanced security and performance. | Favorable

ICO ⇑

|

| 2. | Binance Leads $30 Million Funding Round in Signal Founder’s Crypto MobileCoin [source: ] | April 25, 2018 | A team of developers including Moxie Marlinspike, the creator of the Signal end-to-end encryption protocol and exchange service, intends to make the protection of users’ personal data and integration in mobile messengers a central focus. | Favorable

ICO ⇑

|

| 3. | Following Acquisition of Coincheck, Monex Group Plans to Develop Its Own Blockchain and Hold ICO [source: ] | April 26, 2018 | It has been learned that the Japanese-based online brokerage firm Monex Group, which purchased Coincheck, is considering the prospects of creating its own block platform and collecting funds through an initial coin offering.

|

Favorable

ICO ⇑

|

| 4. | Sales of Petro Have Reached More Than $5 Billion1 [source: ] | April 27, 2018 | Information from the official website of the ICO: “Sales of Petro during the presale reached more than $5 billion, which is equivalent to more than 4 billion euros or more than 31 billion yuan.” | Favorable

ICO ⇑

|

1 However, the data on the amount collected by El Petro in various sources differ (for example, according to criptomoedasfacil.com, the amount of funds collected cannot exceed billion with due account of discounts, in the project’s the figure shown is million, and certain other sources indicate a figure of more than billion, which is what was announced by President Nicolas Maduro)

Table 1.2 shows the development trends on the ICO market since the beginning of 2018. Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered.

Table 1.2. Aggregated trends and performance indicators of past (completed) ICOs1,2

| Indicator | January

2018 |

February

2018 |

March

2018 |

April

2018 |

| Total amount of funds collected, USD million | 1 666 | 2 702 | 7 214 | 1106 |

| Number of companies that completed an ICO1 | 95 | 95 | 89 | 113 |

| Maximum collected, USD million (ICO name) | 100 (Envion) | 850 (Pre-ICO-1 TON) | 5,000 (ICO Petro)3 | 133 (Basis (previously Basecoin)) |

| Average collected funds, USD million | 17.5 | 28.4 | 81.1 | 9.8 |

Note:

1 Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com. For some ICOs information may currently be incomplete (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

2 Including the TON Pre-ICO-1,2 and the Petro ICO.

3 According to the data from the official website of the Petro ICO, sales during the Petro presale reached more than $5 billion, which is equivalent to more than 4 billion euros or more than 31 billion yuan ().

4 The data for 2018 have been updated (date updated: April 30, 2018).

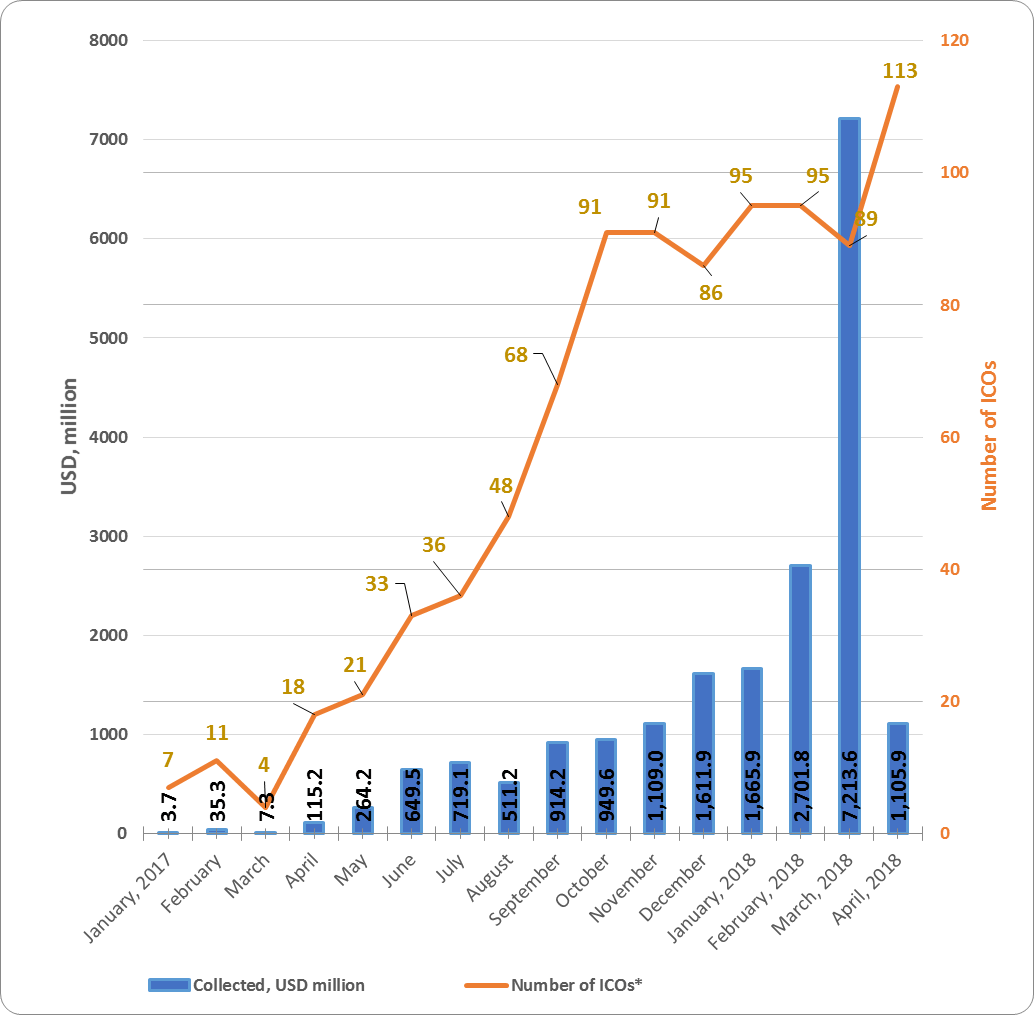

During April 2018 the amount of funds collected via ICOs equaled more than $1.1 billion. This amount consists of the results of 113 successfully completed ICOs, with the largest amount of funds collected equaling $133 million (Basis (previously Basecoin)). The average collected funds per ICO project equaled 9.8 million (see Tables 1.2, 1.3).

Table 1.3. Amount of funds collected and number of ICOs

| Month | Collected,

$ million |

Number of ICOs* | Average collected,

$ million |

| January 2017 | 3.7 | 7 | 0.53 |

| February | 35.3 | 11 | 3.21 |

| March | 7.3 | 4 | 1.82 |

| April | 115.2 | 18 | 6.4 |

| May | 264.2 | 21 | 12.58 |

| June | 649.5 | 33 | 19.68 |

| July | 719.1 | 36 | 19.97 |

| August | 511.2 | 48 | 10.65 |

| September | 914.2 | 68 | 13.44 |

| October | 949.6 | 91 | 10.44 |

| November | 1 109 | 91 | 12.19 |

| December | 1 611.9 | 86 | 18.74 |

| Total, 2017 | 6 890.1 | 514 | 13.4 |

| January 2018 | 1666 | 95 | 18 |

| February 2018 | 2702 | 95 | 28.4 |

| March 2018 | 7214 | 89 | 81.1 |

| April 2018 | 1106 | 113 | 9.8 |

| Total for 2018*** | 12 687.1 | 392 | 32.4 |

* Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com.

Information on funds collected is not available for all ICOs (information for last week is tentative and may be adjusted). ICOs that collected less than $100,000 were not considered.

** More than 1,000 ICOs were performed in 2017. However, the data for the 514 largest and most popular ICOs, the data of which can be processed, were considered when calculating the total amount of funds collected during 2017.

*** Including TON Pre-ICO-1,2 ($1.7 billion) and the Petro ICO ($5 billion). The data for 2018 have been updated (date updated: April 30, 2018).

Table 1.3 shows that the largest amount of funds was collected via ICOs in March 2018, mainly due to the appearance of major ICOs. The highest amount of average collected funds per ICO was also seen in March 2018.

Figure 1.1. Trends in funds collected and number of ICOs since the start of 2017

1.2. Top ICOs during April 2018

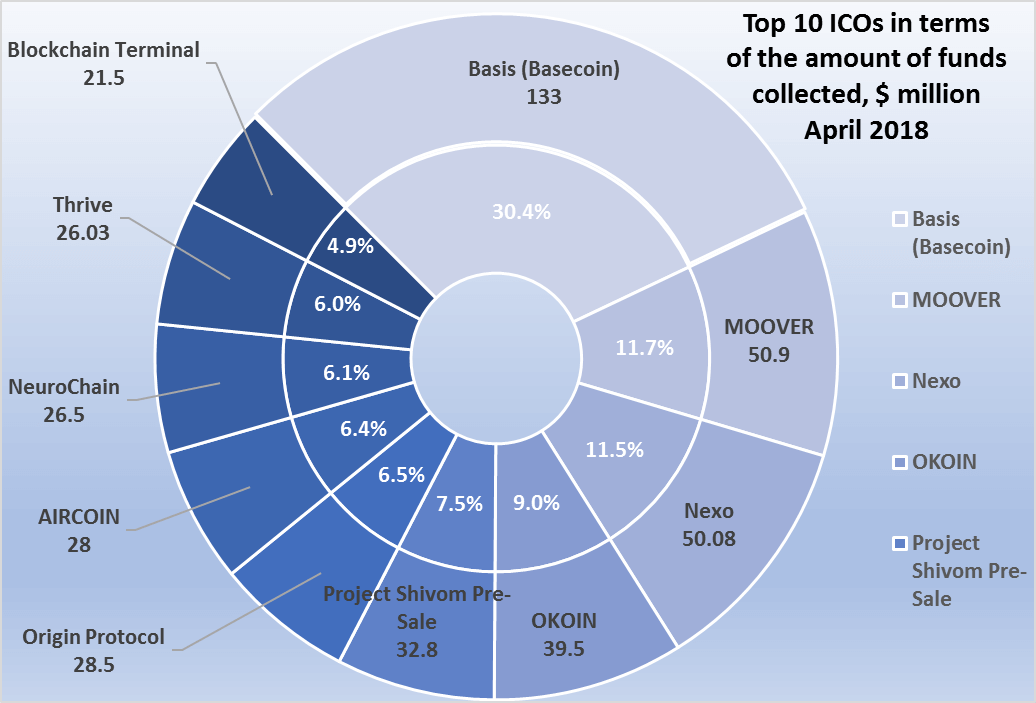

Table 1.4. Top 10 ICOs in terms of the amount of funds collected during April 2018**

| # | Name of ICO | Category* | Collected, $ million | % | Completed |

| 1 | Basis (Basecoin) | Finance | 133 | 30.4% | April 18, 2018 |

| 2 | MOOVER | Communication | 50.9 | 11.7% | April 15, 2018 |

| 3 | Nexo | Finance | 50.08 | 11.5% | April 20, 2018 |

| 4 | OKOIN | Gambling & Betting | 39.5 | 9.0% | April 1, 2018 |

| 5 | Project Shivom Pre-Sale | Drugs & Healthcare | 32.8 | 7.5% | April 25, 2018 |

| 6 | Origin Protocol | Infrastructure | 28.5 | 6.5% | April 27, 2018 |

| 7 | AIRCOIN | Infrastructure | 28 | 6.4% | April 17, 2018 |

| 8 | NeuroChain | Infrastructure | 26.5 | 6.1% | April 16, 2018 |

| 9 | Thrive | Commerce & Advertising | 26.03 | 6.0% | April 16, 2018 |

| 10 | Blockchain Terminal | Trading & Investing | 21.5 | 4.9% | April 5, 2018 |

| Total, top 10 | 436.9 | 100% |

* The project category is determined by experts (a total of 30 categories are used).

** When compiling the lists of top ICOs, information from the websites tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com, and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com.

Table 1.4 shows the top 10 largest ICOs in terms of the amount of funds collected, most of which belong to the Finance, Communication, and Infrastructure categories.

Figure 1.2. Top 10 ICOs in terms of the amount of funds collected during April 2018

During the analyzed period (April 2018) at least 113 ICO projects were successfully completed, each of which collected more than $100,000, with the total amount of funds collected exceeding $1.1 billion. Last month’s leader (not including Petro) was the Basis (previously Basecoin) project, which collected $133 million.

As mentioned , the Basis project indicated that the amount of funds collected equaled $133 million in its and channels. Pursuant to the .

The participants in this project included Andreessen Horowitz, Bain Capital, Lightspeed Ventures, Google Ventures, and other companies. The goal of this startup is to create a stable cryptocurrency, or stablecoin. Basis plans to use the same operations as those used by the central banks but will control them using software instead of human resources. The project’s White Paper also gives a description of other previously issued stablecoins: Seigniorage Shares, MakerDAO, Tether, and BitShares.

The total amount of funds collected by a number of ICOs failed to reach even $100,000 (the information for some projects is still being finalized).

Annex – Glossary

| Key terms | Definition |

| Initial coin offering, ICO | A form of collective support of innovative technological projects, a type of presale and attracting of new backers through initial coin offerings (token sales) to future holders in the form of blockchain-based cryptocurrencies and digital assets. |

| Token sale price

Current token price |

Token sale price during the ICO.

Current token price. |

| Token reward | Token performance (current token price ÷ token sale price during the ICO), i.e. the reward per $1 spent on buying tokens. |

| Token return | (see token reward) Performance of funds spent on buying tokens or the ratio of the current token price to the token sale price, i.e. performance of $1 spent on buying tokens during the token sale, if listed on an exchange for USD. |

| ETH reward – current dollar value of $1 spent on buying tokens during the token sale | Alternative performance indicator of funds spent on buying tokens during the ICO or the ratio of the current ETH price to its price at the start of the token sale, i.e. if instead of buying tokens $1 was spent on buying ETH at its rate at the start of the token sale and then it was sold at the current ETH price. |

| BTC reward– current dollar value of $1 spent on buying tokens during the token sale | Similar to the above: Alternative performance indicator of funds spent on buying tokens during the token sale, i.e. if instead of buying tokens $1 was spent on buying BTC at its price at the start of the token sale and then it was sold at the current BTC price. |

| Token/ETH reward | This ratio describes a market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying ETH. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on ETH. |

| Token/BTC reward | This ratio describes the market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying BTC. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on BTC. |

The post appeared first on .

The arrival of the Sharding Tech – Ethereum’s mcuh-awaited scalability solution is pretty much on the cards! On Monday, Ethereum founder made the announcement tweeting “Sharding is Coming” while simultaneously uploading a proof-of-concept for Sharding on the Github platform.

Sharding is coming.

— Vitalik "Not giving away ETH" Buterin (@VitalikButerin)

On the platform which is an online community comprising of Ethereum developers, investors, users and enthusiasts, Buterin explained in detail about the proof-of-concept which he released earlier this week. Butein here explains that the fundamental idea behind the implementation Sharding’s proof of concept requires first implementing proof-of-stake beacon chain or full Casper which is later merged into the original Ethereum blockchain network.

In the post, Buterin explains: “The basic idea is based on a concept of dependent fork choice rules. First, there is a proof of stake beacon chain (in phase 4, aka full casper, this will just be merged into the main chain), which is tied to the main chain; every beacon chain block must specify a recent main chain block, and that beacon chain block being part of the canonical chain is conditional on the referenced main chain block being part of the canonical main chain.”

Buterin also stated that Sharding-enabled proof-of-stake beacon chain will be able to issue new blocks every two-to-eight seconds which is significantly faster in comparison to its rivals like bitcoin which has an average block time of 10 minutes.

Sharding is basically aimed at improving the ability of the Ethereum blockchain to process a number of transactions within a given time. Sharding thus helps in optimizing the process of smart contracts and transaction verifications by splitting the Ethereum blockchain network into shards. This means that multiple network computers on the Ethereum blockchain will divide the workload between them. This would further allow to ease up the congestion on the network thereby allowing more number of transactions to take place at the same time while simultaneously lowering the costs.

Buterin said that it takes around ten seconds to process all the shared blocks that are split between the group of computers. In yet another , Buterin wrote: “I would not say the spec is finalized at this point, though the ‘bag of ideas’ is IMO pretty well-established. The latest research consists of combining together existing ideas about scaling and latency (ie. block time) reduction.”

This news comes at a time when the Ethereum network has been facing an increasing pressure to scale in order to meet its increasing demand. Last month at the Deconomy conference in Seoul, South Korea Buterin explicitly said that the Ethereum applications are “screwed” by the existing scaling challenges. The arrival of Sharding will be a much bigger breather for Buterin at this moment.

Story is developing……..

The post appeared first on .