This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. bitcoin.com does not endorse nor support this product/service. bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

Remittancetoken.io is a tokenized money transfer platform with unparalleled speed.

The off chain version of Remco token is on a run rate of $20,000,000 by the end of 2018, and the solution is Jurisdiction and Money Transmission Flow Agnostic. Any money transmitter can use it.

Initial traffic will come from Remco’s corporate parent VTNGLOBAL and VTN which holds state money transmitter licenses in the USA and central Bank mobile payment operator and IMTO licenses in a country of 180 million

Remco solution is cost-effective, faster has the operational benefits of increased transparency, increased record security, and improved accuracy. COO Joel Patenaude said, “We will flip the switch and move existing transaction traffic to RemittanceTokens soon.”

Remco added three new advisors to their team a few months ago including:

Brent Segal Ph.D. Harvard (200 + patents)

Ty McCoy The Assistant Secretary of the Airforce (Retired) Investor

Moses Asom, Ph.D. (MBA Wharton, ) (Sold his Sychip company for $140m / several patents)

Led by CEO Peter Ojo who made it possible for subscribers to receive Western Union transfers into mobile wallet since 2013 and designed API for fund termination to 22 banks and billions of transactions monthly.

Remco ICO main sale begins December 1st

You can participate in Remco token sale at:

Contact Email Address

peter@remittancetoken.io

Supporting Link

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

The post appeared first on .

Key Highlights:

price may go south for a while;

XLM price may bounce from the demand level of $0.23;

traders can look for an opportunity to place a long trade.

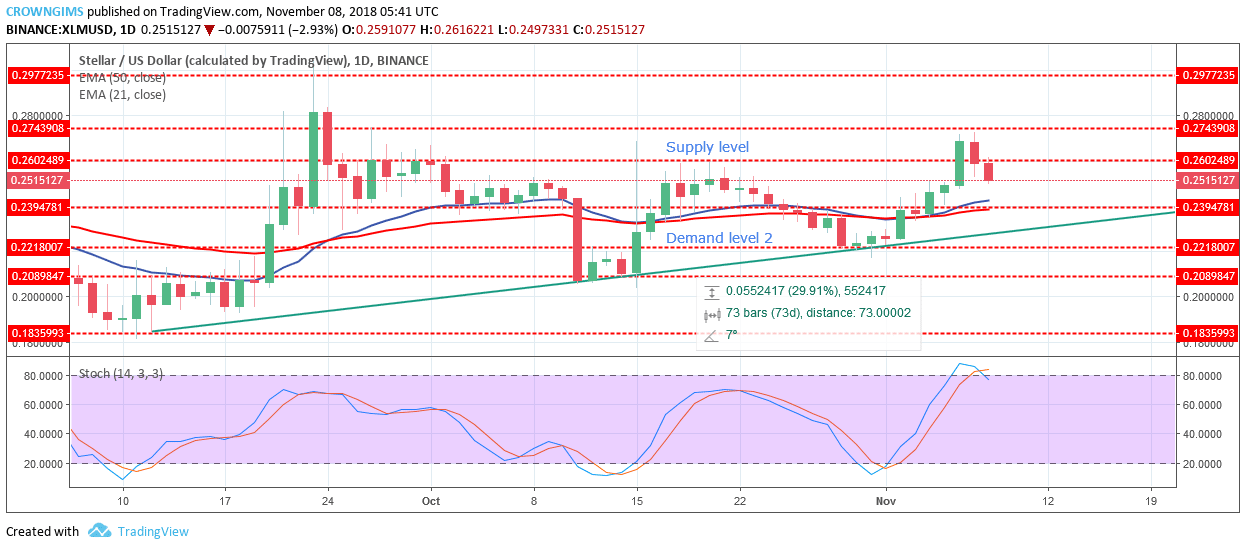

XLM/USD Price Long-term Trend: Bullish

Supply levels: $0.26, $0.27, $0.29

Demand levels: $0.23, $0.22, $0.20

XLM price is currently trading below the supply level of $0.26 heading toward the demand level of $0.23. XLM price is above 21-day EMA and the 50-day EMA which indicates the bullish trend is ongoing. Meanwhile, the Stochastic Oscillator period 14 is above 80 levels (oversold region) with its signal lines pointing to the south which indicates a selling signal.

Should the bears continue with their increased momentum the price would break the demand level of $0.23 and expose to the demand level of $0.22. On the other hand, in case the demand zone of $0.23 hold and the XLM price bounce to the north, the trader can look for an opportunity to place buy limit order at this level so as to take long trading and place the stop loss below the demand zone of $0.23.

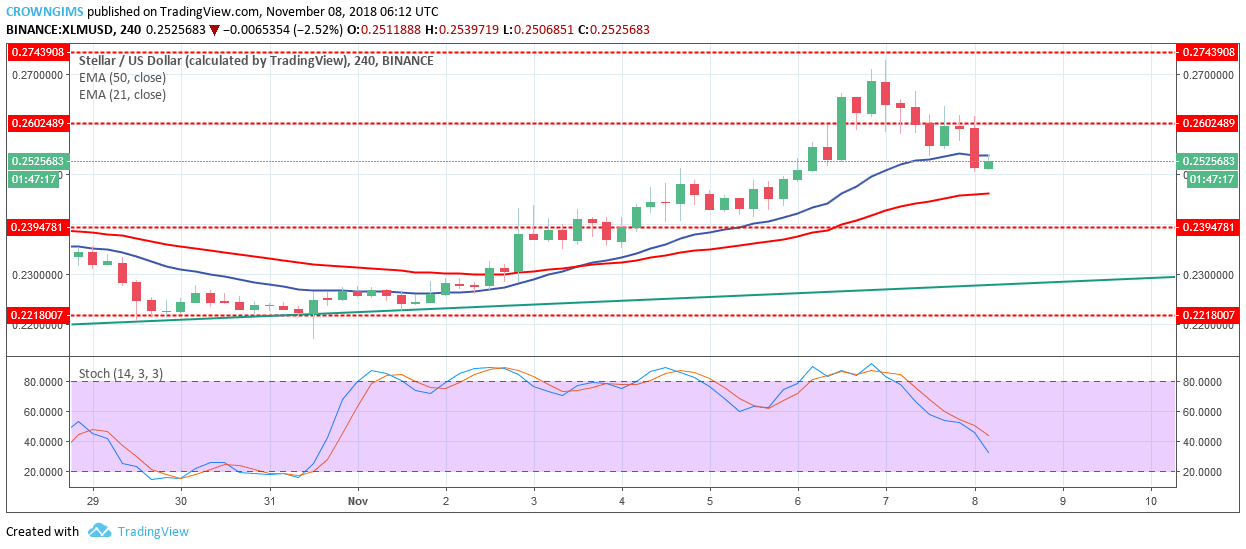

XLM/USD Price Medium-term Trend: Bullish

Currently, XLM price has broken downside the supply level of $0.26 exposed to demand level of $0.23. Stellar is between 21-day EMA and 50-day EMA as the sign of bearish market and the Stochastic Oscillator period 14 is at 40 levels with its signal lines point down indicates sell signal.

, one of the largest crypto mining companies, announced it had closed an $80 million round of private financing with global investment firms. Among the investors were such companies as Macquarie Capital, Asian financier Dentsu, European companies Armat Group and Jabre & Lian Group, and the merchant bank founded by billionaire and ex- Group Inc. partner Mike Novogratz.

Bitfury has closed an $80 million private placement – led by and joined by many others including Armat Group, Macquarie Capital, Lian Group, Jabre, Dentsu Inc., Foyer, MACSF, Argenthal Capital Partners, and more.

— The Bitfury Group (@BitfuryGroup)

According to Bitfury, the round was led by a Paris-based venture capital firm Korelya Capital. After the funding round is finished, the company is valued $1 billion. It is notable that BitFury is among the top five manufacturers in the crypto mining hardware market, along with AMD, Bitmain, Canaan, and Baikal Miner. This sector, which is continuously increasing, could grow by 44.6% between 2018 and 2022.

BitFury executive vice president George Kikvadze said:

“This private placement will take our corporate governance to the next level, expand our strategic financial options and ideally position us for our next phase of growth as the market matures.”

Valery Vavilov, CEO and co-founder of Bitfury, commented:

“2018 has been a year of incredible expansion for Bitfury. This private placement reflects our achievements, and it recognizes our ability to address adjacent market segments in high-performance computing, including in emerging technologies like artificial intelligence (AI). The institutionalization of blockchain and cryptocurrencies, partnered with the opportunity of these emerging technologies, is a natural expansion opportunity that Bitfury will build on — in 2019 and beyond.”

As Vavilov states, the demand for the blockchain from companies and institutions had increased significantly over the past 11 months.

“We see a lot of demand from companies and public institutions to put their services or products in the blockchain — especially in emerging markets, where administrative systems can be very inefficient.”

BitFury to Facilitate Crypto Mining

BitFury is the largest full-service blockchain technology company in the world which develops and delivers cutting-edge software and hardware solutions necessary for businesses, governments, organizations and individuals to securely move assets across the blockchain. BitFury derives sustainable advantage through its custom-made application-specific integrated circuits (ASICs), optimized to achieve the lowest power consumption coupled with the highest processing metrics – the parameters that drive mining margins.

The firm has 700 employees in 15 countries and five data centers active in mining in Iceland, Canada, Georgia, and Norway.

In September of this year, BitFury the cooling system at its 40-megawatt mining plant located in Tbilisi, Georgia. With Bitfury’s immersion cooling technology, cooling costs can be reduced by 95%. BitFury also the market with a new highly efficient ASIC mining chip. Fully customized for SHA256 bitcoin mining, the chip boasts of 55 millijoules per gigahash (mJ/GH) power efficiency rate and up to 120 gigahashes per second (GH/s) hashrate.

Is BitFury Preparing for an IPO?

There are rumors that BitFury would already be preparing its Initial Public Offering (IPO) and is considering doing so in Amsterdam, Hong Kong, or London. If the rumours are true and the company’s plans are executed in the next two years, it will seek a valuation of up to $5 billion.