Sometimes things don’t go according to plan but those who are flexible know how to take advantage of any situation.

The US Government shutdown has affected many things, and the latest casualty seems to be the VanECK BTC ETF, which was up for review by the SEC. The deadline for a decision was February 27th but VanECK has now .

Diligent readers of our daily market updates will not be dismayed by this latest update but delighted. As we have noted several times, this proposal had a very slim chance of success. SEC Chairman Jay Clayton has been stressing that the BTC market is not yet mature enough for an ETF.

Recent price action seems to confirm this, as we’ve seen a number of price spikes due to the low liquidity lately.

The government shutdown seems to have put further strain on this process. If there was a hope of convincing the SEC before the deadline, it has now disappeared. So, rather than letting the application be rejected, VanECK has simply withdrawn it — thus denying the SEC any opportunity to deny it. This is what we call .

The price of BTC did decline slightly at the time of the news (purple circle) but is still holding well at the $3,500 support level.

The markets lackadaisical response to this news is a clear sign that investors are starting to understand…

The crypto market is not dependent on any government or financial institution and no single product or service has the power to make or break BTC. We call this maturity.

eToro, Senior Market Analyst

Today’s Highlights

Shutdown: Day 34 | Days to Brexit 64

Euro Data Smackdown

BTC TPS still growing

Please note: All data, figures & graphs are valid as of January 24th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Markets are trudging forward today. Looks like there’s a whiff of risk appetite but clearly, the current geopolitical tensions are holding them back from any substantial moves at the moment and so markets are range bound.

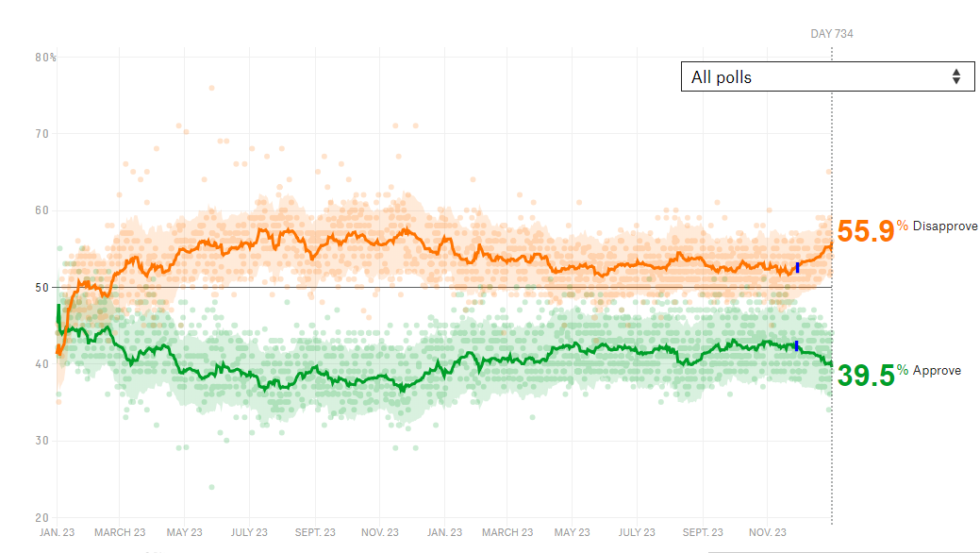

The US government shutdown has now dragged the President’s approval below 40%. This graph from shows Trump’s rating since the inauguration. The blue dots show when the shutdown began.

The shutdown to be coming any closer to resolution either. The squabbling between the two American political parties is only deteriorating.

Euro Data Smackdown

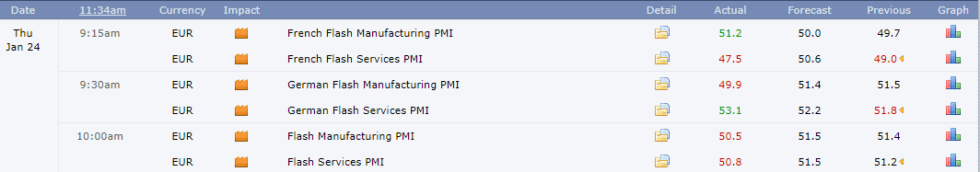

A string of data has hit the Euro today. The PMI is an index that measures how companies are feeling about the economy by surveying purchasing managers in the services and manufacturing sectors.

A measure above 50 indicates economic expansion and vice versa. As , the overall numbers for Europe (bottom two lines) do show expansion but were well below what analysts were forecasting.

We can see the reaction in the pretty clearly when zooming in on the short term chart.

Crypto Calm

Fortunately, not much to report in crypto land today, other than what we mentioned in the cover letter.

The transaction rate on the BTC blockchain is now at its highest level in a year, which is kind of cool. This is a good indicator that shows usage of BTC is growing despite the bear market.

There’s also about crypto adoption in Iran.

Unfortunately, however, there isn’t any real way to confirm this, other than the testimonials given in the article. The to track this hasn’t updated in the last few weeks. they’re working on it though, so hopefully, we’ll get a good report soon. If anybody else has some other way to gauge, hook a brother up!

Let’s have an amazing day ahead!

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared to utilize publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.

Published at Fri, 25 Jan 2019 03:00:18 +0000