Over the next month, we will be making a number of significant improvements to our product experience. We started with overhauling our buy and sell flows, and will soon begin rolling out Portfolio Balance and changes to our limits structure. As always, we would love your feedback along the way.

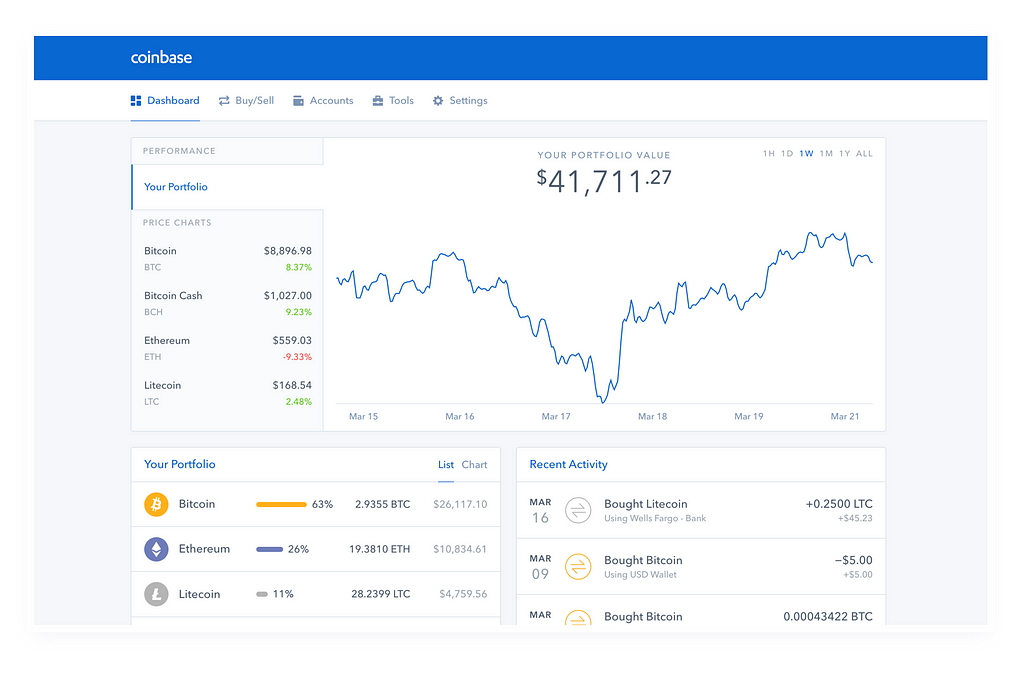

Portfolio Balance

Tracking your portfolio and its performance over time has been one of our most requested features. We’re thrilled to begin rolling Portfolio Balance over the next few weeks. We will initially add this functionality to web and will follow shortly with Android and iOS.

Our aim is to give all customers the tools they need to most effectively monitor their digital asset portfolio and manage their investments. Showing historical balances is the first of many improvements we’ll be making to enhance this experience.

Here’s how it works: your portfolio value represents the fiat equivalent of all crypto and fiat holdings on Coinbase at any given moment in time. So your balance will go up as you invest more on Coinbase or as your assets increase in value. Portfolio Balance does not show gains and losses. Since Coinbase enables customers to send and receive digital assets, we do not currently have an accurate cost basis for all holdings. (As we noted in our tax blog post, this same issue also makes it difficult for Coinbase to generate automated tax reports.)

Over the coming months, we aim to add more tools and information, like showing gains and losses on specific Coinbase investments and viewing historical balances for individual assets, which we hope will make managing your investments that much easier.

Multisig Vaults

As we noted in our , over the next 30 days, we will be winding down our support for existing multisig vaults on Coinbase. Multisig vaults were originally introduced as a way for customers to manage their private keys and control their own security while still using the Coinbase interface. However, as forks become more commonplace, the complexity of multisig vaults makes it infeasible to support multisig withdrawals for each additional forked asset. The last day of support will be on April 19, 2018.

Because this product is user-controlled, customers can move funds with the two keys they already control. This change will only result in customers not being able to access the third key that Coinbase controls. Customers should ensure they have access to their two keys over the next 30 days. Otherwise, we recommend customers withdraw all funds from a multisig vault prior to April 19, 2018.

For more information on multisig vaults and the withdrawal process, please read our .

***

We really appreciate all of your feedback over the last few weeks; and we’re looking forward to hearing your feedback on Portfolio Balance, buy / sell improvements and all of the other changes we have shipped or will soon be rolling out.

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

This week the U.S. Treasury Department issued guidelines on how the Office of Foreign Assets Control (OFAC) could add cryptocurrency addresses to the country’s sanction list.

Also read:

Cryptocurrency Addresses to be Added to the U.S. Sanctions List

The Treasury calls a cryptocurrency wallet “a software application (or other mechanisms) that provides a means for holding, storing, and transferring digital currency.” The report also describes a virtual currency and an address:

A [Digital Currency Address] is an alphanumeric identifier that represents a potential destination for a digital currency transfer.

OFAC May “Alert the Public” About Suspect Digital Currency Identifiers

Additionally, the agency issued guidance to those who have identified SDN owned wallets and addresses and ask them to report the news to OFAC immediately. Further, the Treasury says that the market itself, businesses, and cryptocurrency exchanges should work together to keep an eye on suspect addresses that might be on the SDN list.

“The digital currency address field on the SDN List provides the unique alphanumeric identifiers (up to 256 characters) for digital currency addresses and identifies the digital currency to which the address corresponds,” explains the OFAC report.

OFAC will use sanctions in the fight against criminal and other malicious actors abusing digital currencies and emerging payment systems as a complement to existing tools, including diplomatic outreach and law enforcement authorities — To strengthen our efforts to combat the illicit use of digital currency transactions under our existing authorities, OFAC may include as identifiers on the SDN List specific digital currency addresses associated with blocked persons.

The Treasury’s OFAC guidance does not go into great detail on how they will block these wallets and addresses or enforce the sanctions. According to the report, OFAC may “alert the public” about suspect digital currency identifiers.

What do you think about the Treasury adding cryptocurrency wallets to the SDN list? Let us know in the comments below.

Images via Shutterstock, OFAC, Pixabay

At .com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post appeared first on .