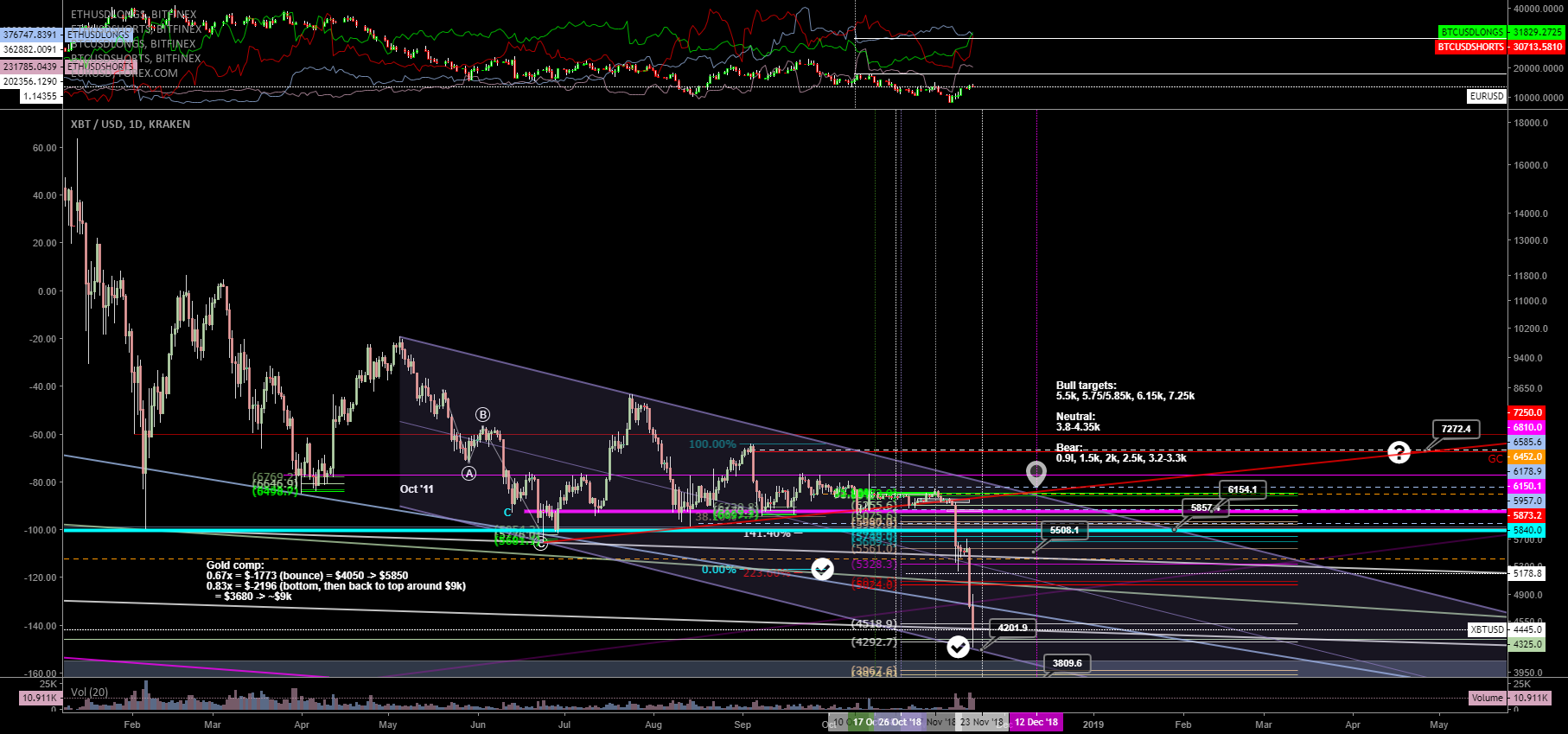

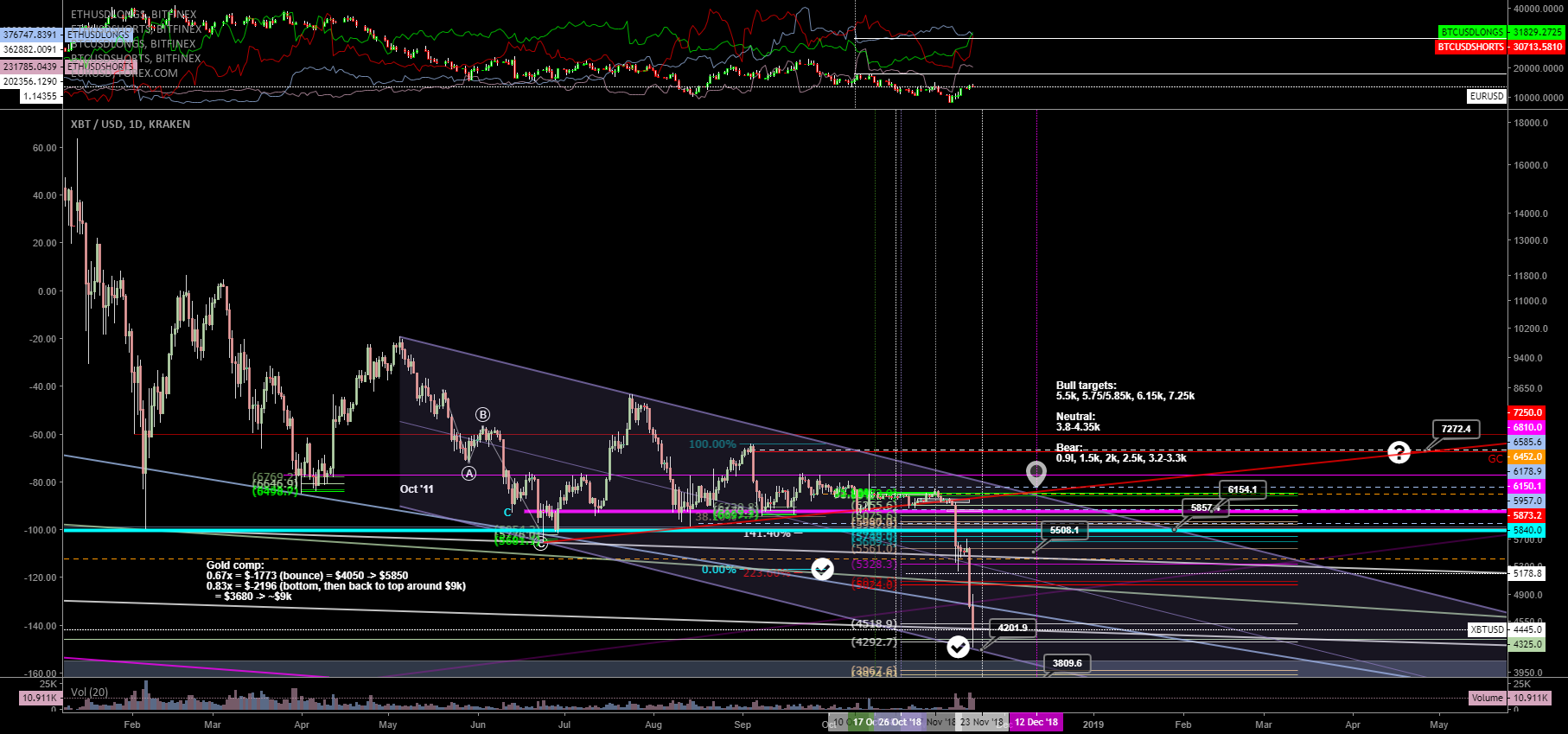

Well, don’t have to say so much, we are due for a decent % bounce and previous idea long term targets are met at 4.24k with PA wicked to 4.2k. Still think it can go to 3.8k, but doesn’t have to, so can scaling in if you wanna trade this, but RR is more interesting to the long side. Be my guest to join the scared chickens to sell here, then this idea is not for you.

If 3.8k breaks, then I look for 3.2-3.3k, if that breaks 2k/2.5k, then 1.5k, then 900.

Do NOT think this is the bottom, but that doesn’t mean you can trade it. This is what I’ve waited for, for like a quarter of the year and the shorts paid off nicely. When 99.99% of crypto twitter and wannabe traders are wrong and got liquidated and stopped near a potential bottom and TA points to a stronger support, it’s not time to sell, but to look for buy setups.

My last bigger buy calls where at 6k and 6.45k bottom. I missed the 5.75k one where i had my first scale in orders at 5.65k, that turned out exactly what I’ve said it would be, namely a market maker exit scam pump, started from an insignificant SFP, although this one has a bit more room to the downside, so scale in and if you’re smart, you don’t use (high) leverage at times of crises when exchanges can go poof (premeditated to prevent you to buy the bottom or sell the top).

My predictions are fullfilled faster than what I’ve expected, one of the last ones are that lucky whales who pretend to know they know something and trying to be a god by manipulating small cap shitcoins by being early in the ponzi will give all their profits away and even their own capital to smart money and manipulators, so one is left outstanding for Q3 ’19.

The bottom is in when 1) those guys are fully rekt, like so many are on Okex and partially on bitmex and bitfinex right now, which is good, 2) majority becomes fully up to a point they wanna suicide (they’re just starting to get ), manipulators calling dead and make propaganda on television all the time, 3) crypto exchanges gonna slam their doors, etc. etc. (use common sense for this). You had your chance to sell 8 months+, but you thought you could manipulate upwards with your small bags, but I always said, you will lose vs the house who can do what they want in this space, voilá. 3 months of scalping gains you gave away in 1 impulsive trade to the downside.

Since TV doesn’t send out any notifications of updates (and yes, I’ve checked with dozens of people), you have to check out manually.

My condolences to the permabulls who got liquidated.

EDIT:

You got to zoom in to see the targets on the chart, tv messed up the scaling of text label

Published at Tue, 20 Nov 2018 10:44:06 +0000