Produits Artistiques Métaux Précieux (artistic, precious metals products), better known as PAMP, is the world’s leading independent refiner of precious metals, and unquestionably the most prestigious.

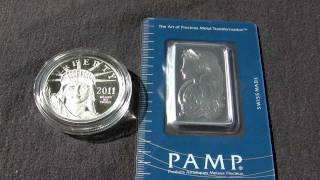

The woman on the bar is Lady Fortuna, the goddess of fortune.

The comparison coin in the clip is a 2011-W 1 oz Proof Platinum American Eagle

Invest in Platinum. Diversify your portfolio with precious metals.