We’ve received feedback from customers that they want more assets on Coinbase. Building on our previous , we want to share additional information about how we manage the process of adding new assets to our platform. By sharing this information, we hope to provide transparency into our process and increase customer trust.

Our current process for adding new assets to Coinbase:

An internal asset selection committee uses our to make an initial recommendation of which new asset to add to GDAX. As part of this process, the committee will conduct a legal and risk assessment of the proposed asset.If the asset passes by the legal and risk review, the recommended asset is presented to the Coinbase executive team for approval.If approved by the executive team, the asset selection committee promptly announces which new asset will be added to our platform. This decision is announced both internally and to the public via our and .The engineering team begins the technical integration needed to support the new asset. Customers can expect to see public-facing APIs and other signs that the asset is being added.An announcement is made via our and when we begin final testing of the technical integration.An announcement is made via our and when the integration is complete and we are ready to allow deposits of the asset. We will always allow at least 24 hours of deposits before opening an order book for a new asset.After evaluating factors such as liquidity, price stability, and other market health metrics, the internal asset selection committee may choose to add the asset to the Coinbase platform.

We’ve assembled some frequently asked questions by customers:

Have you made any decisions for adding new assets?

No. As of March 16, 2018, we have not made any decisions for adding new assets. The internal asset selection committee has been assessing assets using our Digital Asset Framework, but no assets have been recommended to the Coinbase executive team.

What criteria does Coinbase use when considering new assets to add?

The GDAX highlights our criteria for supporting new assets.

Will Coinbase list all the top assets by market capitalization?

No. We will only consider assets that pass our .

Will all assets listed on GDAX also be listed on Coinbase?

Not necessarily. We currently believe that over the next few years, GDAX will likely have more assets listed on the platform than the Coinbase platform. However, all assets listed on GDAX will be part of the Coinbase Index and Coinbase Index Fund.

Are there trading and confidentiality restrictions for members of the asset selection committee?

Yes. These individuals are subject to additional confidentiality and trading restrictions beyond the standard employee confidentiality and trading policy, including heightened disclosure and pre-clearance obligations. Committee members, like all other employees, are prohibited from trading on the basis of material non-public information.

Does this process apply to forked or airdropped assets?

Yes, but with the variation that we may offer a forked or airdropped asset in withdrawal-only mode, e.g. (ETC).

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

Responding to media reports that South Korean internet giant Kakao plans to raise funds using an initial coin offering (ICO) abroad, the country’s financial regulator reportedly warned that the ICO could violate current cryptocurrency regulations.

Also read:

ICOs Abroad Could Still Violate Korean Laws

Kakao Corp, which operates the country’s most popular chat app, Kakao Talk, to raise funds through an ICO overseas as well as issue its own Kakao coin, according to local media reports.

At a press conference held at the government building in Seoul this week, the chairman of the Korean Financial Service Commission (FSC), Choi Jong-ku, described his department’s assessment of Kakao’s situation. “Although there were media reports that Kakao and Kakao Pay are planning to raise funds through ICOs abroad, financial authorities have not confirmed this fact,” the Korean Financial Daily reported. Choi emphasized, “No funding has been confirmed.”

He reiterated that “current laws [in Korea] do not prohibit ICOs from abroad,” but pointed out that “it is highly likely to violate current legislation,” the news outlet conveyed. Citing that Kakao is a major shareholder of Kakao Bank, he explained that the company’s ICO overseas “will lead to the problem of credibility of Kakao Bank.” The chairman was further quoted by No Cut News saying:

Even if there is no prohibition on virtual currency, there is a possibility that it may be regarded as…[similar to] fraud or multi-level sales according to the issuance method…Since the risk is very high in terms of investor protection, the government has a negative stance on the ICO.

Kakao Says No Official Plans for ICO Yet

The Korean Economic Daily quote a Kakao official saying on Friday:

We have not yet officially released plans for the ICO…As far as the ICO of Kakao is concerned, there is nothing to be determined.

An official of the company explained that the internet giant has been preparing for a blockchain platform business, emphasizing that “Virtual currency is inevitably required to activate the platform, but the development schedule is not yet known.”

While South Korea has already ICOs in the country, “there is no clear regulatory basis because the relevant legislation does not pass the National Assembly,” Sedaily detailed. “ICOs are likely to be fraudulent, multi-level…depending on the method of issuance,” Chairman Choi was quoted asserting, adding that:

In the case of ICOs in Korea, there is a problem in domestic law and there is a high risk from the perspective of protecting investors.

What do you think the Korean regulators will do if Kakao goes through with an ICO overseas? Let us know in the comments section below.

Images courtesy of Shutterstock, Korean Financial Daily, and Kakao.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

E-commerce just recently posted another winning year. According to a report by the US Department of Commerce, the sector closed 2017 with a strong Q4 and showed its in six years. E-commerce accounted for 8.9 percent of total sales with consumers spending $453.5 billion online last year.

However, while this growth should be welcome news for stakeholders, this increased adoption is also putting pressure on merchants, e-commerce platforms, and payment services to further improve the experiences they provide to their users. The payments sector, in particular, has become a highly competitive market as traditional institutions and new fintech ventures vie for dominance.

The explosion of crypto activities also complicates matters. Cryptocurrencies have gained much significant value over the past year. This has prompted merchants to seriously consider them as mediums of payment. It is now also hard to ignore the emerging “crypto rich” – investors and users who have found wealth in cryptocurrencies – as a demographic with plenty of spending power.

What’s interesting is that blockchain and crypto services are also aggressively figuring into the payments space. Platforms like and aim to improve upon the groundwork laid down by bitcoin to become the new backbones for financial transactions. Other crypto services like and have more focused goals as they seek to address the evolving needs of consumers and merchants in today’s commercial environment.

Here are four ways cryptocurrency services are poised to be the future of payments:

1. Trust

New entrants in e-commerce may find it challenging to build relationships and establish trust with customers. Users are now becoming savvier and discerning in choosing with whom they entrust their businesses. However, user-generated reviews are sometimes unreliable and testimonials could also be suspect.

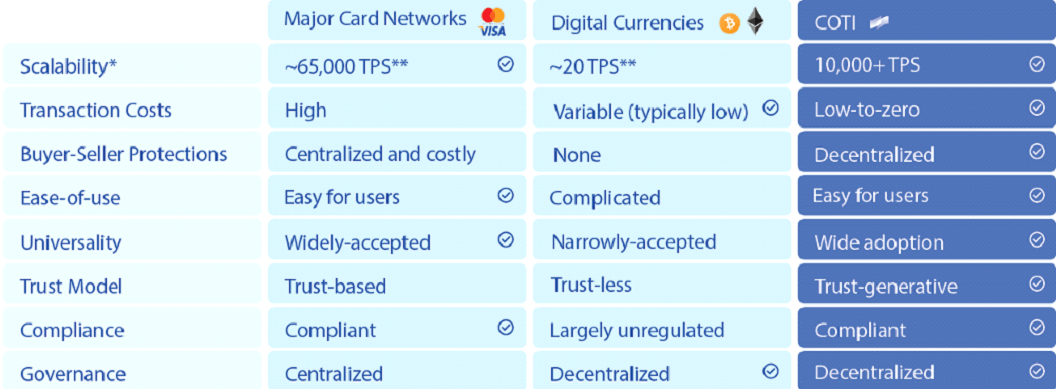

This is why it’s important to have a reliable mechanism to establish a merchant or consumer’s trustworthiness. This is a particular use case where blockchain’s transparent and immutable record-keeping shines. Crypto payment network COTI offers a speedy, convenient, and affordable means for consumers and merchants to transact with each other.

But beyond these, it leverages blockchain’s transparency to offer a reliable trust scoring mechanism for its users. Dubbed Trustchain, COTI’s protocol incentivizes good behavior by lowering transaction fees for users with high trust scores and penalizes those with unfavorable ratings.

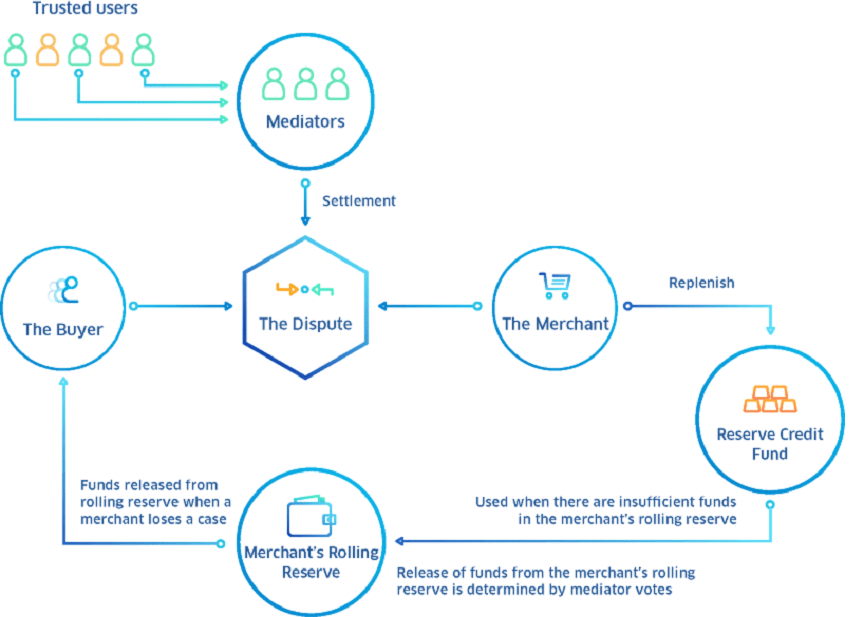

COTI also offers a decentralized dispute settlement mechanism. COTI crowdsources the mediation of disputes between parties where decisions are reached via consensus. Many users bemoan the lack of transparency of dispute resolution of established payment services.

Credit card companies, for instance, typically favor customers which leave merchant shouldering losses in cases of chargebacks from fraudulent transactions. Many agents from these services don’t even offer any explanation to their decisions.

2. Scalability

One of the key reasons why cryptocurrencies like bitcoin has not gained wider use for day-to-day transactions is its scalability. bitcoin’s blockchain has a block time of 10 minutes which means transactions, on the average, take this long to go through. This translates to about (tps). It’s highly impractical for a customer to wait 10 minutes at a checkout lane for a bitcoin payment to be processed.

The popularly used blockchain networks like bitcoin or Ethereum can also experience bottlenecks when there are sudden bursts in transaction volume. This leads to longer waits for transactions to be confirmed. In comparison, Visa’s network averages around 2,000 tps and can handle as much as 50,000 tps at peak capacity. Credit card transactions only takes a few seconds to complete.

Fortunately, new blockchain platforms have been working on addressing these scalability concerns. Stellar, an open platform for financial applications, is currently able to handle . Ripple is also able to handle a similar load at . Both platforms can be scaled up as needed.

These developments mean that more applications and services can now rely on blockchain platforms for financial transactions. This speed and reliability would enable the use of crypto assets for real-world transactions.

3. Fees

Traditional payment methods are plagued by high fees. Merchants often have to factor in processing fees to prices leading to higher costs for consumers. These can even get higher for cross-border and cross-currency transactions. Card companies, remittance services, and even digital payments services like PayPal often have unfavorable currency conversion rates and additional service fees aside from the basic fees.

Cryptocurrencies are supposed to be cheaper to use compared to these traditional methods. To start, cryptocurrencies don’t rely on the participation of various entities like banks, clearing houses, card companies, and digital wallet providers to work. Tokens are transferred directly from one wallet to the other.

However, some may point out the worrying rise in transactions costs for cryptocurrencies. In this regard, bitcoin appears to be the exception and not the rule for crypto. bitcoin’s transaction fees are only deemed high due to the token’s massive growth in value. But even with these transaction fees, bitcoin can still be cheaper for cross-border remittances compared to the likes of Western Union or PayPal especially when dealing with large amounts.

Other platforms and networks are significantly cheaper by comparison. Stellar and Ripple transactions, given their current market prices, would only cost a few cents to initiate. COTI’s trust-based computation of fees even creates an interesting dynamic for transaction costs.

4. Convenience

Consumers demand quick and uncomplicated checkouts and any point of friction in the customer experience needs to be addressed. As it stands now, friction in the payment experience can be caused by a variety of factors.

It could be the time it takes to complete the checkout process. Card companies and digital wallets attempt to address this by introducing contactless payments systems for brick-and-mortar transactions. Amazon even takes this a step further with by creating a physical store with no checkout lines.

For crypto payments, friction could be from their lack of ready acceptance, interoperability with other systems, and seamless conversions between fiat and cryptocurrencies. Blockchain venture Centra aims to make the use of crypto assets easier via a multicurrency wallet. The company even offers prepaid cards that can be used with traditional checkout systems. COTI, likewise, acknowledges this need and has partnered with to create a more comprehensive ecosystem that would add a debit card option aside from crypto coin and wallet.

Without easy-to-use wallets, many cryptocurrencies require running nodes and using command line interface wallets that are complicated even for tech-versed users. These new crypto payment services are now making the use of cryptocurrencies familiar and simple which would make the customer experience similar existing methods. What makes them perhaps even better is that crypto services allow users the flexibility of spending either their fiat or crypto assets all through a single interface.

Conclusion

The commercial landscape is changing at a rapid pace due to the emergence of various disruptive forces including e-commerce, financial technology, and blockchain. It would be inevitable for consumer expectations to also shift as adoption of these technologies grow.

Payments services, for instance, have to cope with the growth of cross-border commerce and the explosion of crypto assets. This has triggered intense competition in the sector. These, however, seems to put crypto payments at a unique advantage as they can readily draw from the strengths of both traditional payments methods and blockchain-driven mechanisms to address the new needs of the space. Crypto payments may just be the future of payments.

The post appeared first on .

![Btc weekly chart: dow jones industrial buy signals for bitcoin [btc]! Btc weekly chart: dow jones industrial buy signals for bitcoin [btc]!](https://ohiobitcoin.com/storage/2019/01/SV1joG.png)