Galaxy Digital Holdings, the crypto merchant bank founded by former hedge fund manager Michael Novogratz, lost $97 million in the fourth quarter, according to financials disclosed Monday.

The net loss widened from $76.7 million in the third quarter and from about $100,000 a year earlier, according to the with Canadian securities regulators. (Last February, New York-based Galaxy a Canadian publicly traded company in a reverse takeover.)

For all of 2018, its first full year of operation, the company lost $272.7 million.

The majority of the red ink in 2018, $101.4 million, came from selling digital assets at a loss.

Galaxy also recorded $75.5 million in paper losses on crypto it held that declined in price, $8.5 million in unrealized losses on investments in companies and $88.4 million in operating expenses.

Which coins lost

At the end of 2018, Galaxy held 9,724 ($36.4 million), 92,545 ether ($12.3 million), 2.4 million ($6 million) and 60,227 of ($2.8 million). The firm increased its investment in and ether from the beginning of the year when it held 5,902 and 57,000 ETH.

Galaxy also used to hold large amounts of Wax ($50.2 million) and BlockV ($17.4 million), which disappeared from the top ranks of the firm’s investments at the end of the year.

According to the report, Galaxy lost money selling ($70.3 million) and ether ($64.4 million), which was partially offset by $54.3 million earned selling some short (it’s not specified which ones).

was the biggest source of losses at the beginning of 2018, while ether caused the most damage during the rest of the year.

Interestingly, Galaxy lost as much as $47 million on the depreciation of the Wax , an asset created to power a platform for virtual goods like items in video games.

Several other also lost in price before Galaxy could profitably sell them during 2018: Kin ($10.9 million in losses), BlockV ($17.2 million) and Aion ($8.6 million). Some $5 million was also lost on .

Protocols, mining and ICOs

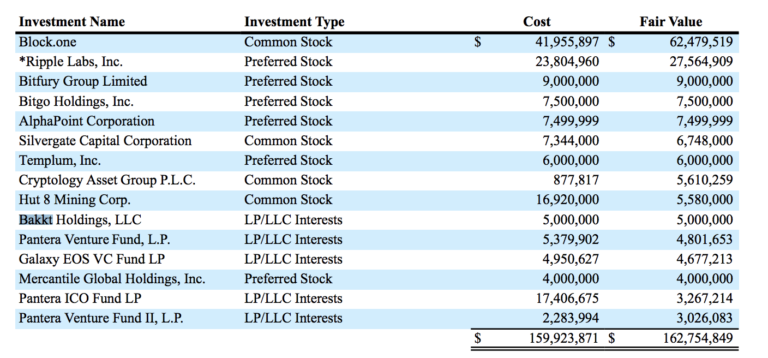

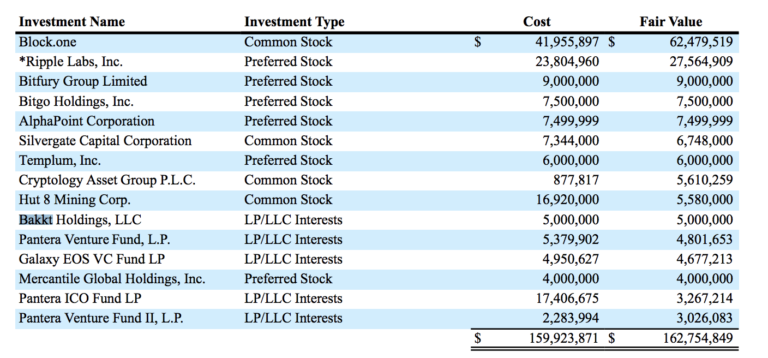

A number of companies and investment funds in Galaxy’s portfolio declined in value.

For example, the Pantera ICO Fund LP shares’ depreciation caused the loss of $14.1 million (Galaxy currently has $17.4 million invested in the fund). The firm also took a haircut of $11.3 million on its shares of Canada-based Hut 8 Corp, and $11.1 million on crypto firm Xapo.

As of the end of 2018, Galaxy held $41.9 million in the stock of Block.One’s, the creator of , plus some $5 million more in Galaxy VC Fund focused on developing the .IO ecosystem.

Meanwhile, payments startup Labs received $23.8 million, including “an indirect investment through a special purpose vehicle,” the report says.

Galaxy also invested $26 million in businesses, including Hut 8 and Bitfury; $7.5 million in custodian and multi-signature provider BitGo; and $5 million in Bakkt, the futures exchange yet-to-be-launched by New York Stock Exchange parent ICE.

Other investments include Silvergate Capital Corporation, parent of the crypto friendly Silvergate Bank; tokenization startups AlphaPoint and Templum; investment vehicles Cryptology Asset and Pantera Venture Fund; and Mercantile Global Holdings, a Puerto Rico-based entity operating the San Juan Mercantile Exchange. The firm also provided $3.8 millions of loans for the crypto lending platform .

Risk factors

Talking about the risks Galaxy may face in the future, the report pays special attention to the concentration of power in the hands of the CEO and major stakeholder Mike Novogratz, who owns of Galaxy.

Among the regulatory and market risks, Galaxy is “highly dependent on Michael Novogratz, exposing shareholders to material and unpredictable ‘key man’ risk,” the document says, adding that the CEO’s “interests may be different from those of shareholders,” and there is a danger he “could engage in activities outside of GDH LP or could quit GDH LP in favor of other pursuits.”

No less notable, the report adds: “Mr. Novogratz’s public profile makes it more likely that GDH LP will attract material regulatory scrutiny, which would be costly and distracting regardless of whether GDH LP has engaged in any unlawful conduct.”

Image of Mike Novogratz via CoinDesk archives

Published at Mon, 29 Apr 2019 19:42:46 +0000