Well-known hedge fund manager Michael Novogratz has launched a cryptocurrency benchmark index in partnership with Bloomberg. The index, designed to track the performance of the largest, most liquid coins, consists of 10 cryptocurrencies at its inception.

Also read:

New Crypto Index

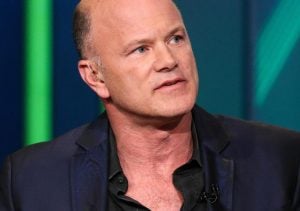

Galaxy Digital Capital Management and Bloomberg announced on Wednesday the launch of a cryptocurrency benchmark index called Bloomberg Galaxy Crypto Index (BGCI). Galaxy Digital Capital Management LP is an asset management firm dedicated to the digital currency and blockchain sectors founded by Michael Novogratz, a former Principal and Chief Investment Officer of the Fortress Macro Funds and a former Partner at Goldman Sachs.

Citing that “the BGCI offers the first institutional grade benchmark for the cryptocurrency market,” the announcement details:

The index is designed to track the performance of the largest, most liquid portion of the cryptocurrency market. The BGCI is market capitalization-weighted and measures the performance of ten USD-traded cryptocurrencies, including bitcoin, ethereum, monero, ripple, and zcash.

“The index constituents are diversified across different categories of digital assets, including stores of value, mediums of exchange, smart contract protocols, and privacy assets,” the companies explained. “The index is owned and administered by Bloomberg Index Services Limited and is co-branded with Galaxy Digital Capital Management.”

About the Index

At its inception, the BGCI contains 30% bitcoin and ether, 14.13% ripple, 10.63% bitcoin cash, 6.11% EOS, 3.77% litecoin, 1.67% dash, 1.66% monero, and 1% ethereum classic and zcash.

Novogratz set out to launch a crypto hedge fund originally but he halted this plan in December and unveiled Galaxy Digital instead.

He said on Markets Now that “we are hoping that this index becomes the bellwether and benchmark for the whole crypto space that hedge funds are compared to it… and that is seen as a watershed moment where crypto starts to become an indigestible asset class from an institutional perspective.” He also asserted:

The Bloomberg Galaxy Crypto Index brings unprecedented transparency to the crypto markets.

“It’s almost essential for every investor to have at least 1% to 2% of their portfolio” in crypto, he emphasized.

In November last year, Novogratz said on CNBC’s Fast Money that “bitcoin could be at $40,000 at the end of 2018. It easily could,” adding that “Ethereum, which I think just touched $500 or is getting close, could be triple where it is as well.”

What do you think of Novogratz’s crypto index? Let us know in the comments section below.

Images courtesy of Shutterstock, Galaxy Digital Capital Management, and CNBC.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

By Gabriele Giancola, Co-founder and CEO of blockchain-powered loyalty ecosystem,

1. Build a good team

Surround yourself with an awesome team!

Think technology experts, marketers and investors. Having experienced and relevant industry professionals working behind the scenes will add credibility to your ICO and product.

A lot of startups make the mistake of not hiring the right people in the first place. It’s so important to have a team who understands your goals and knows how to leverage your varying skill sets to build and offer a value-added product to your target market.

2. Have a clear vision and product roadmap

Developing a clear vision and product roadmap to sustain and achieve that vision is one of the most important things you should do before starting an ICO or investing in one. Ask yourself, what am I trying to achieve here? How am I developing a blueprint for the future?

To answer those questions properly, there are two things you should do:

A. Create a watertight whitepaper introducing your product, and explaining your approach, the problems it’s going to solve, how it’s going to do it and your business development plan in as concise a manner as possible. Go beyond the typical whitepaper and be able to show something more to people. That in itself brings a lot of value to startups.

B. Develop a product roadmap with clearly defined and realistic goals and timeframes.

3. Adopt the right technology

Once you know what your vision is, the next step is to think which technology are you going to use to actually fulfil the problems that you are making with your product. Ask yourself, which blockchain should you use? Should you use more than one blockchain? Or should you build your own?

Next, decide on the token design and economics you want to use. This is important because it is part of your product. You have to think, what does my product do? Who is the user of my product? This is one of the core parts of the product so it’s important to really think about the token economics and design.

4. Decide on your distribution strategy

A good distribution strategy cannot be underestimated, so begin with the end in mind. Ask yourself, how will you acquire new customers and keep existing ones? On the blockchain, distribution has taken on a new dynamism and become extremely competitive, so how will you market your products or services effectively?

5. Conduct due diligence

Dot the i’s, cross the t’s and develop a due diligence process. Like any business venture, before starting an ICO you must meet certain requirements. Find out what taxes you have to pay, when you must pay them and what regulations exist in the country you are based in. Plan your ICO along with the local tax authorities to provide legal certainty and enable more reliable planning.

Deciding on your ICO’s terms and conditions is also worth doing early on.

6. Look at your investors

Be selective with who your investors are. Every single person who is investing in your company should genuinely believe in what it is that you do and have values that align with yours. Leverage the community that are investing in you and learn as much as possible from them. Remember, it’s important that your ICOs obtain smart as well as connected capital and not just any capital.

![Prominent crypto investor expects “choppy waters” for bitcoin [btc] over 2019 Prominent crypto investor expects “choppy waters” for bitcoin [btc] over 2019](https://ohiobitcoin.com/wp-content/uploads/2019/01/paRFft.jpg)