Disclaimer: Coinbase is not authorized to give tax advice. For specific questions we strongly recommend speaking with a tax professional.

As a reminder, gains on digital currency sales and exchanges are taxable in the US. For reference, are the IRS guidelines for reporting digital asset gains. We understand taxes for digital currency can be complicated, so we updated our tax tools to make reporting easier. You and your tax professional can reference the steps below to prepare your tax filings.

Step 1. Establish a complete view of your trading activity to determine your cost basis

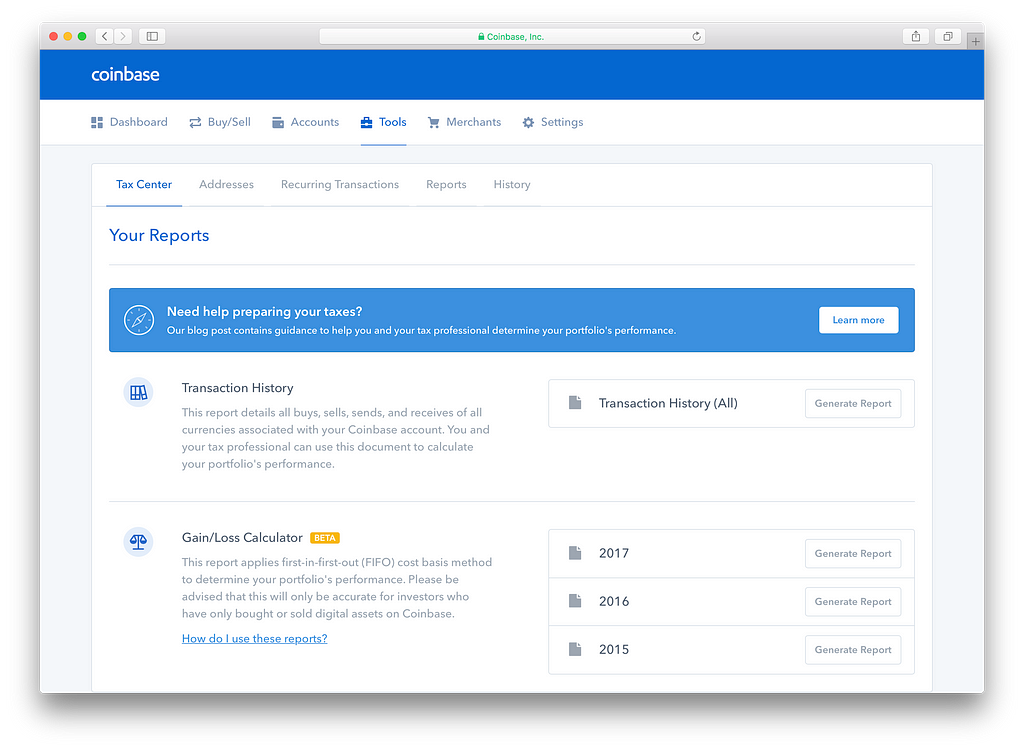

First, customers must create a complete view of all digital asset transactions. Coinbase customers can click to generate a single report with all buys, sells, sends, and receives of all currencies associated with their Coinbase account.

This report provides your cost basis for all purchases and proceeds for all sales, inclusive of Coinbase fees. This information is necessary to determine your gains/losses. Please be advised that transactions with payment reversals and refunds may not be reflected in this report.

Remember, this report only details transactions associated with your Coinbase account. In order to create a complete view of your digital asset investments, you will need to download similar reports from all other exchanges you have used.

Step 2. Calculate your gains/losses

After determining your cost basis, you and your tax professional can calculate your investment gains or losses. Simply put, your gains or losses are calculated by subtracting your cost basis from the proceeds for each individual sale or exchange.

To date there is no standard guidance from the IRS on how to apply your cost basis to individual sales or exchanges of digital assets. We’ve seen two common approaches:

First in first out (FIFO) — This method assumes that the first assets you purchased are also the first assets you sold or exchanged. Your gain/loss is calculated based on the price you paid for the oldest assets in your portfolio, and the asset price at the time of sale or exchange. This is the most common approach for traditional investments.Specific Identification (SpecID) — This method relies on investors to specifically identify to their tax professional the assets they sold or exchanged. This is also a common approach for traditional investments, but requires significant effort from the investor.Note that other approaches to calculate your cost basis may exist. We suggest you contact your tax professional before pursuing alternative approaches.

Adding the gains/losses from all of your sales and exchanges will give you your gain/loss for the year.

See below an example gain/loss calculation. This example illustrates how an investor might account for gains on selling two of five ETH purchased using FIFO and SpecID methodology. This table is illustrative.

Step 3. File your taxes

Once you have calculated your gains or losses on your digital assets investments, you are ready to file your taxes. Consult your tax professional on how to best report this information in your tax filing.

Coinbase-only gain/loss calculator

For our customers who have only bought or sold digital assets on Coinbase, we offer a tool that automatically calculates your gains or losses based on a first-in-first-out (FIFO) accounting method. Note that FIFO is only one of several methods you can use to calculate your investment performance. You can generate this report .

This tool provides a preliminary gain/loss calculation to assist our customers, but should not be used as official tax documentation without validating the results with your tax professional. Please be advised that this report will only be accurate for customers who have not transacted outside of Coinbase. Do not use this report if you have:

1. Bought or sold digital assets on another exchange

2. Sent or received digital assets from a non-Coinbase wallet

3. Sent or received digital assets from another exchange (including GDAX)

4. Stored digital assets on an external storage device (i.e., Trezor, Ledger, etc.)

5. Participated in an ICO

6. Previously used a method other than FIFO to determine your gains/losses on digital asset investments

Disclaimer: This post does not constitute legal or tax advice. Tax laws and regulations change frequently, and their application can vary widely based on the specific facts and circumstances involved. You are responsible for consulting with your own professional tax advisors concerning specific tax circumstances. Coinbase disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. These tools are intended for Coinbase customers filing as individuals, not businesses.

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

The Chairman of the Thai Fintech Association (TFA) and Thailand’s Former Finance Minister, Korn Chatikavanij, has offered his support for recent proposals that Thailand’s Securities and Exchange Commission (SEC) should be tasked with developing and enforcing cryptocurrency regulations.

Also Read:

Thai Fintech Association Chairman Supports SEC Regulation of Crypto Assets

“I agree with the Finance Ministry’s [view] of letting the SEC be the only organization governing digital assets, because it already oversees securities and has a profound understanding of digital assets,” Mr. Korn said.

The TFA chairman also stated that Thailand’s Fintech Association has consulted with the SEC, Finance Ministry, and the Bank of Thailand, advocating for the development of clear legislation designed to reduce the risks associated with cryptocurrency investment.

Former Finance Industry Speaks in Favor of ICOs

Mr. Korn also emphasized the benefits that initial coin offerings (ICOs) can offer smaller businesses seeking to raise funds, advocating that regulators seek to avoid stifling the burgeoning ICO industry.

SEC Authority Over Crypto Industry Expected to Be Formalized Soon

On Wednesday, the Thai deputy prime minister Wissanu Krea-Ngam, the Finance Minister Apisak Tantivorawong, and representatives from a number of pertinent agencies agreed that the SEC should be empowered via royal decree to regulate the virtual currency sector. The SEC’s board of directors are expected to hold a meeting in which all details relating to the SEC’s new regulatory jurisdiction be discussed soon after the enactment of the decree.

Veerathai Santiprabhob, the governor of the Bank of Thailand, stated that the meeting concluded with agreement regarding the need to enact a comprehensive regulatory apparatus governing the Thai digital currency sector.

Do you think that the SEC is the appropriate institution to be tasked with the regulation of Thailand’s cryptocurrency industry? Share your thoughts in the comments section below!

Images courtesy of Shutterstock and www.sec.or.th

At bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post appeared first on .