The price of tokens (XEM) jumped to a peak 25 percent after Japanese exchange Coincheck announced that it would once again allow trading of the token, which was suspended after a led to a more than half-billion dollars in tokens being stolen and systematically laundered through other exchanges. During the last 24 hours, NEM price has making it the best performing cryptocurrency in the top 20 by market cap.

NEM said on Twitter:

resumed activities today! 🇯🇵

— NEM (@NEMofficial)

Coincheck announced on their official website:

“Coin Check Co., Ltd. resumed new account opening and payment / purchase of some virtual currencies on October 30, 2018, With regard to ETH, XEM and LSK, technical safety confirmation has been completed with the cooperation of external experts and we have resumed payment / purchase of the virtual currency from November 12, 2018 I will inform you that.”

Just for reminder, the hack took place in January this year, when all the cryptocurrencies were still on the bright side of the market. Almost 6% of the circulating tokens were compromised to the hack. This became known as the biggest hack to take place in the cryptocurrency market after Mt. Gox. According to reports, the tokens were converted on the darknet and were either encashed or converted to other cryptocurrencies.

When the unfamous hack happened, the NEM team helped the exchange as they had the mechanism to track the wallets which had the stolen funds. However, this came to an end as the hackers started to send some of the stolen funds to ‘innocent wallets’, resulting in the team tracking their wallets as well.

The exchange also didn’t have a license by the Financial Services Authority to conduct operations related to cryptocurrencies at the time of the hack. Nevertheless, Coincheck had agreed to distibute $440 million to over 260,000 users, who were affected by the hack.

In April, Japanese online brokerage firm Monex Group announced its decision to acquire 100% shares of Coincheck for more than 3.6 billion yen (around $34 million). The company then that they believe that blockchain technology is likely to change the future.

“We recognize blockchain technology and cryptocurrencies as next-generation technologies and platforms which are likely to drastically change the way people approach money. Therefore, since we announced “MONEX’s new beginning” last October, we have considered entering the cryptocurrency exchange business and set up the Monex Cryptocurrency Lab to grow our business based on these new technologies.”

After that, in August, the Ukrainian Central Election Commission said that they are seriously examining the possibilities of , which, they believe, could potentially facilitate and improve the procedure of local and national elections.

The head of the state register of voters Oleksandr Stelmakh then said that the experiment had been organized with the usage of NEM blockchain modules. However, the trials and testing procedures are still in progress.

NEM is 17th on the current list of tokens by market capitalization. It hit a high of $0.114 overnight, but currently sits about .007 less than that, being worth $0.107375, marking a 16 percent gain. Considering how NEM is incredibly popular in Japan, this news alone seems more than sufficient to get people excited about this altcoin once again. It is also an important step toward ensuring Coincheck users can trade in a safe and secure manner.

The New Economy Movement (NEM, for short) is a smart contract-ready platform for dApp development, similar to Ethereum. Founded in 2015, the platform uses its own consensus algorithm known as Proof-of-Importance, which weights a node’s influence based on network activity, as well as their wallet balance. This means active nodes can sometimes have more network authority than their richer, passive counterparts.

Market reactions like these usually occur whenever announces a new listing. The same thing happened for other fiat-crypto exchanges. (TRX) market cap went up by more than a billion dollars after it was listed on Bithumb in early April.

Coincheck’s new owners, the Japanese financial services conglomerate, Monex Group, will be probably wanting to put the exchange’s past firmly behind them. By relisting NEM, Coincheck shows its will to finally close the chapter on what must have been a trying ten months.

Key Highlights:

Consolidation is ongoing;

price break out is imminent;

there is a probability of the bears taking over the ETH market.

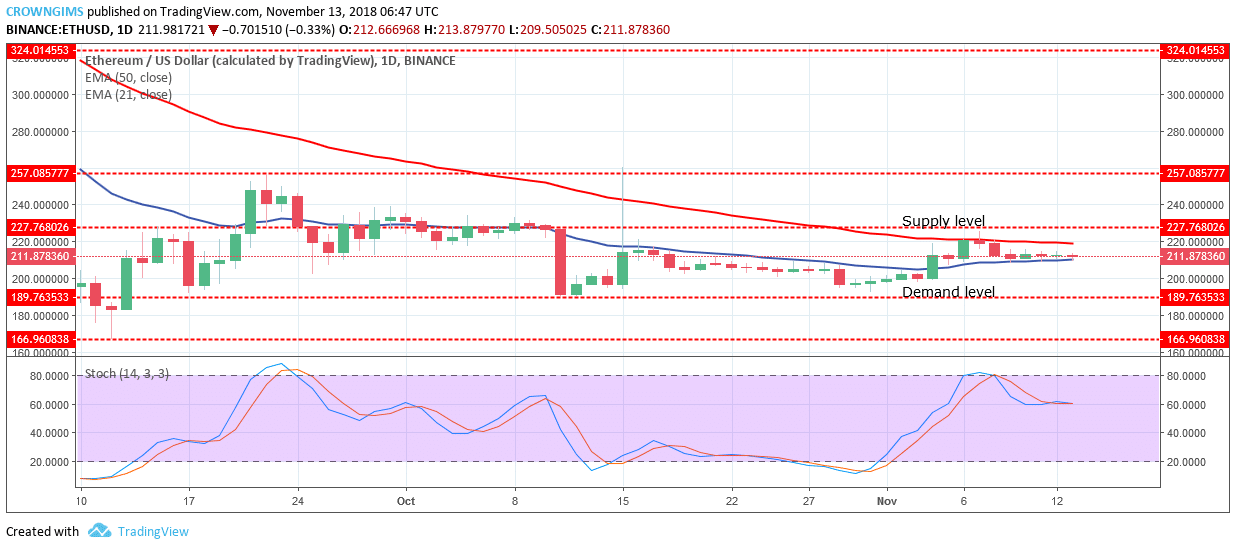

ETH/USD Long-term Trend: Ranging

Supply levels: $227, $257, $324

Demand levels: $189, $166, $147

Neither the bulls nor the bears were able to push the ETH price to rally neither to the North nor to the South respectively. ETH price is currently between the 21-day EMA and 50-day EMA with the two EMAs close to each other; which indicates that consolidation is ongoing.

Should the bulls gain enough momentum and break up the supply level of $227, ETH price will rally to the north and may have the supply level of $257 as its target. On the other hand, in case the bears gain enough pressure and break down the demand level of $189, the coin will find its low at $166 demand level.

Moreover, the Stochastic Oscillator period 14 is at 60 levels with the signal lines interlocked and parallel without direction confirm the ongoing consolidation. Breakout is imminent, It is not logical to take any position on Ethereum market for now until the breakout.

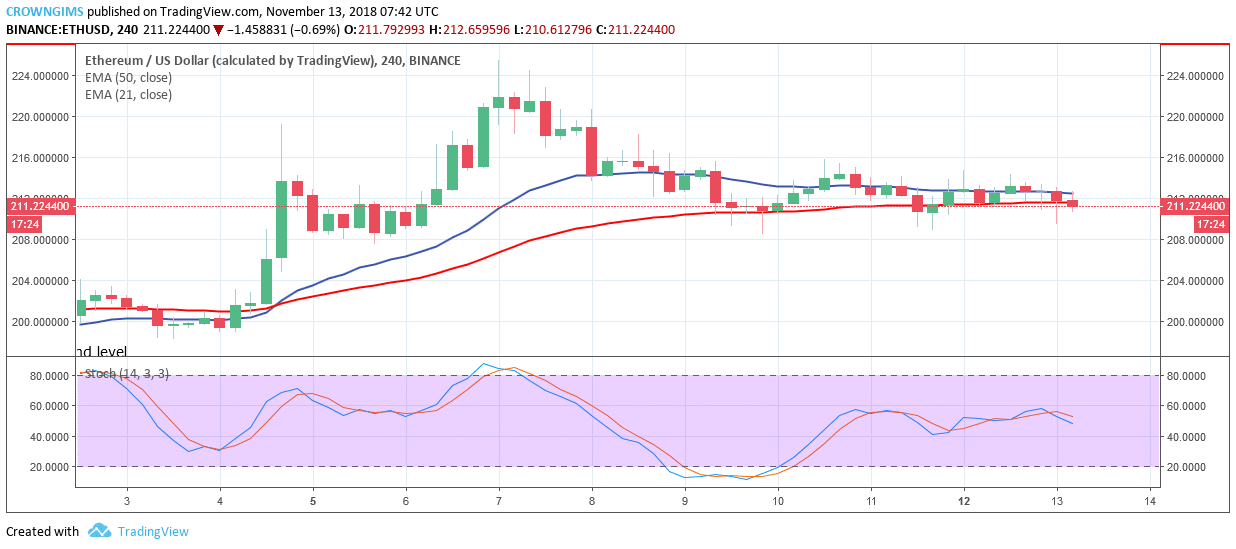

ETH/USD Medium-term Trend: Ranging

Meanwhile, the Stochastic Oscillator period 14 is at 50 levels with the signal lines point to the south which indicates a sell signal.

Those of a certain vintage will probably remember being given a piggy bank. For many of us, piggy banks were our first real introduction to money management. Research from the University of Cambridge suggests that by as early as seven years old we’ve already developed the habits – good and bad – that will inform the way we deal with finance in the future.

The world of money has changed significantly over the last decade. Chances are, children growing up in the Information Age won’t think about money in the same way that we do.

In an ever-shifting landscape of internet finance, cryptocurrencies, blockchain and contactless payment, the venerable piggy bank has become somewhat obsolete. Nonetheless, it’s vitally important that we provide children with the foundations of sensible money management at an early age.

Piggy Wallet

hand-held hardware wallet is the benchmark in educational finance. It’s designed to reinvent pocket money for a whole new generation, introducing children age 6+ to modern money management while teaching good financial habits in the process. It runs on Wollo (WLO), a novel, family-friendly cryptocurrency.

Pigzbe’s game-changing concept lead to a partnership with , the payment company that has already reset the industry by bridging the gap between crypto and everyday spending. This partnership will see Wirex offer a WLO wallet on their platform, and users will be able to spend the token seamlessly using the contactless Wirex Visa card.

In a world where the Organisation for Economic Co-operation and Development has shown that around one in five students struggle with even the most basic of fiscal responsibilities, increasing financial awareness and responsibility from a young age can only be a positive.

OECD Secretary-General Angel Gurria said:

“Young people today face more challenging financial choices and more uncertain economic and job prospects.

However, they often lack the education, training, and tools to make informed decisions on matters affecting their financial wellbeing.”

The concept of a piggy wallet will go a long way to tackling these issues in the future and provides a shining example of the positive impact technology can have on society.

To effectively conduct various transactions and attract more customers, companies purchase different software licenses for their staff to use and incorporate them in software for clients. Bit it’s not an easy thing to monitor licenses and make sure that an entire category of Software Asset Management (SAM) tools exist. Accenture, global management consultancy company, has come up with the solution.

Accenture has announced a blockchain-based application that delivers enhanced enterprise software asset management capabilities. According to the , the new app uses Digital Asset’s smart contract language, DAML, to model and enforce software license events throughout their lifecycle, from origination to purchase, which simplifies tracking, usage and audit functions.

The company has to manage a lot of software licenses for various customers — including businesses — all around the world, that’s why Accenture has been looking for a technological solution that would underpin its procedures and policies.

As Accenture states, the innovation is going to be one of its first DLT-based solutions. The company has chosen distributed ledger technology, not centralized database, as blockchain can make it easier to monitor licenses and improve the auditing process. Accenture will be able to see which customer got a license, which can help the company save plenty of money and avoid lots of paperwork annually.

Melanie Cutlan, senior principal and Accenture Operations blockchain lead, said:

“We manage a significant portfolio of software licenses across businesses, clients and geographies, which demands relevant policies and procedures supported with the right technology. While software asset tracking and management tools have evolved, it can still be a daunting task for any large organization to manage. The power of DLT will simplify the traceability of these licenses, and, therefore, the auditing function so all can see where each license is assigned. This has the potential to save organizations millions of dollars per year in the management of their software license portfolios.”

Chris Church, chief business development officer at Digital Asset, commented on the initiative:

“The delivery of this application also represents a tremendous milestone for us since this is the first application built for a non-financial use case to go into production on the Digital Asset Platform.”

According to Accenture, the app is patent-pending. The company believes that it will effectively allow organizations to reduce the risk of utilizing unlicensed software or failure to comply with license use terms. Moreover, it is expected to ensure transparency in distribution and utilization of licenses.

Accenture to Foster Blockchain Adoption

is the world’s leading professional services company. Accenture provides unmatched services in strategy, consulting, digital, technology and operations. Partnering with more than three-quarters of the Fortune Global 500, Accenture is driving innovation to improve the way the world works and lives. With expertise across more than 40 industries and all business functions, the company delivers transformational outcomes for digital world.

Recently, Accenture a two-way solution that empowers major blockchain platforms to work together without changes to the DLT platforms or ongoing messaging between the different platforms.

Accenture is going to continue testing its technology solutions to establish integration effectiveness between other leading DLT platforms and further foster blockchain adoption. The company has already filed three patent applications for major elements of the underlying technology used in the integration solution and is set to apply blockchain to upgrade its logistics network.