Tether announced today that it’s issuing USDT on the . As Tether in its own blog post on the subject:

The TRC20-based USDT enables interoperability with -based protocols and Decentralised Applications (dApps) whilst allowing users to transact and exchange fiat pegged currencies across the Network.

is only the third on which Tether has issued its stablecoin. Late last year, various actions by Tether Limited got people thinking that maybe the company was exiting the market altogether. For one thing, their post-Bitfinex exclusivity. For another, they were seen and .

Today we take the next step in our journey towards stablecoin mass though the introduction of USDT on the .

Read more about how has become the latest to deploy Tether here:

— Tether (@Tether_to)

Tether On The Rebound?

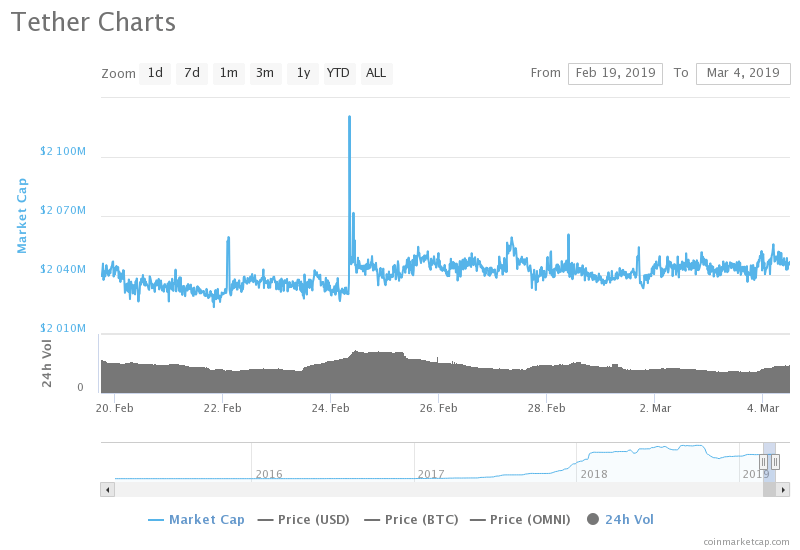

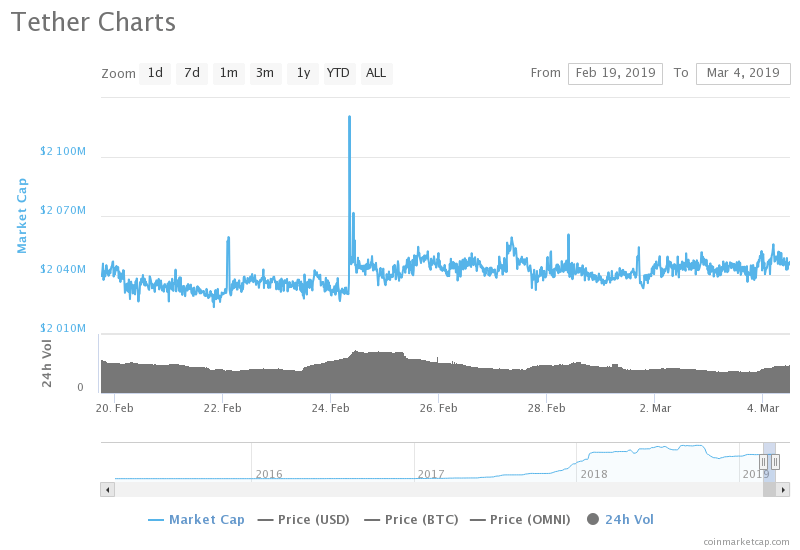

But the of a expansion dovetails with a rebounding market capitalization, which in the past 30 days spiked above 2.1 billion at one point. The market capitalization of Tether signifies both the trust in its stability and the current state of the market. Many traders stash funds in stablecoins when markets are uncertain, as they have been recently.

USDT spiked earlier in the 14-day period. Source: Coinmarketcap.com

The also happens at a time when Tether is posting a “positive peg,” wherein Tether at press time was for 1 cent over its $1 target. That means demand is outpacing supply on several exchanges. The exchanges doing the most volume on USDT today were BitMax, CoinBene, and EXX. Interestingly, the most active market today was Paxos Standard and USDT, with 10% of the total volume.

The top market in the 24-hour period was PAX/USDT. Source: Coinmarketcap.com

Are people exiting PAX and entering USDT? PAX has lost $5 million over the 7 day period, that much is for sure.

Paxos posts a $5 million market cap drop over the week. Source: Coinmarketcap.com

This may be looking at the issue too closely.

TRON Sales Up On News

For its part, gained 3% against in the 24-hour period. The base of the highly popular has been in the 2-cent range for quite some time. Its all-time high was over 25 cents not long after its launch in 2017. While it has consistently been a top-10 crypto asset by market capitalization, owes this fact to its large supply. The has suffered as badly as any other throughout the crypto winter. stands apart as a coin that seems to have gained during these times.

The decision to list Tether on raises the question: why not and NEO? As long as we’re making Tether available on blockchains besides the #1 and #2, there are plenty of communities that could use the stablecoin for a multitude of purposes. Further, Block.one founding partner Brock Pierce also co-founded Tether. Perhaps the decision speaks to ’s ejection of Pierce?

Stablecoins have introduced a new dynamic into crypto markets that requires a wait-and-see approach. Nearly 100 projects around the stablecoin idea have been started, but less than a dozen seem to have any hope of “success.” It’s a low-margin game for the stablecoin issuers. Introducing fiat liquidity into crypto markets instantly breaks down borders. In theory, a user in Iran can hold USD all day using the Omni version of USDT. The same goes for , with some degree of lessened privacy.

The tells us one thing: Tether is alive and well. Its position as the dominant stablecoin isn’t changing in the near-term, but the next big crypto bull run might shake things up as traders decide between the various options including TrueUSD, Paxos, USDC (notably the preference of ), and Tether.

Click for ’s real-time price chart.

Published at Tue, 05 Mar 2019 01:47:52 +0000