A Canadian businessman agreed to sell four gold castings of South African leader Nelson Mandela’s hands. For $10 million in bitcoin, a cryptocurrency firm launching an initial coin offering (ICO) has agreed to the purchase, promising a world tour of the art pieces in an effort to educate more people about Madiba’s legacy.

Also read:

Mandela Art Sells for $10 Million in bitcoin

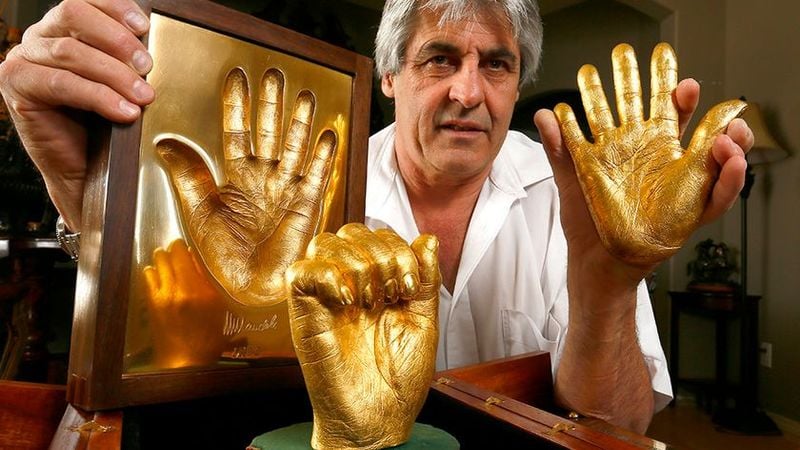

South African-turned-Canadian businessman Malcolm Duncan has sold the four piece Nelson Mandela Golden Hands Collection, castings in gold of the South African leader’s hands. Canadian cryptocurrency company and aspiring exchange, , is delivering a total of 10 million USD in bitcoin for the prize. The marketing strategy is an interesting juxtaposition of history and the future, radical politics and radical free marketism, and Arbitrade’s curious business plan. The firm plans an upcoming ICO, mining operations, and a token supposedly backed by gold — thus the grandiose purchase.

Mr. Mandela was the first black president of South Africa, after a period of mandatory racial apartheid. He was charged in 1962 with violent insurrection against the government, and served nearly three decades in prison. President F.W. de Klerk released him in 1990, and the country has been on the long process of reconciliation and power sharing ever since. His advocacy of socialism might pose a philosophical problem for followers, considering go-go capitalism appears to have a piece of his legacy. He died in 2013 at the age of 95.

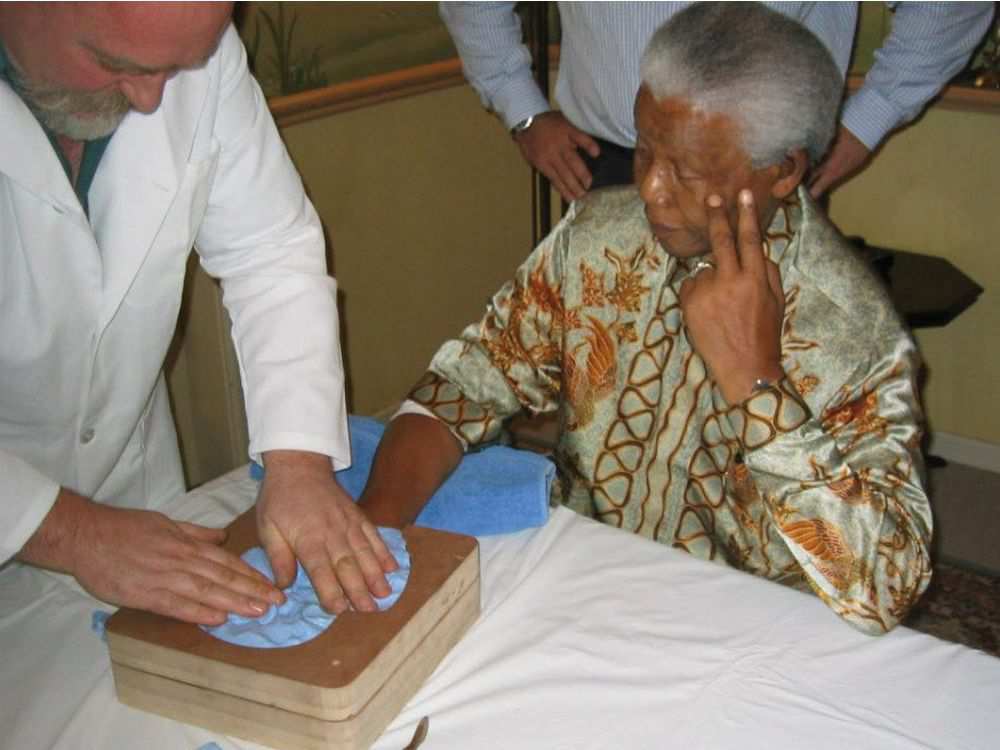

It has taken Mr. Duncan a decade to unload the hands (he reportedly purchased the sets for $31,000), two sets of two, casted in 99.999% gold, weighing a total of 20 pounds. For at ten years, it has been thought untoward to sell the pieces, which Mr. Mandela sat for in 2002 at the behest of a South African mining concern, Harmony Gold, to cast 27 sets, one for each year he spent a political prisoner. The sets are made up of a palm and a fist, but after two sets the project stalled, leaving commemoration of 1964 and 1990, years Mr. Mandela was jailed and freed from Pollsmoor, respectively.

Arbitrade insists it will world tour the collection, helping to educate more folks about Nelson Mandela, and, one would assume, cryptocurrency (at least their conception of it). An irony is the gold’s worth itself is rather little, but the symbolic art could be deemed by admirers as priceless, revealing another lesson: price discovery.

Art and bitcoin, an Increasing Intersection

Len Schutzman, the company’s chairman, the recent purchase and subsequent publicity “was the first time the collection had been on display to the general public anywhere in the world since the Letter of Authenticity had been received from Harmony Gold, […] The collection celebrates not only the remarkable contributions of Nelson Mandela to humanity each year, but also all that has been done by South Africa in supporting gold and the mining industry through the years. Moreover, our timing in buying the collection is especially significant since we are celebrating the 100th anniversary of Mandela’s birth in this unique way for the first time in North America.”

For South Africans, art concerning Mr. Mandela is something of a controversy, as his image and name had been overused to such an extent he reportedly ordered all such art destroyed. Art purchased with bitcoin, however, has been steadily getting more attention. Last year, a painting by Mark Flood, Select a Victim, was auctioned through The White Company for $100,000 in the decentralized currency. Cork Street, the famed London gallery, accepts all manner of crypto in an effort to broaden customer base (the owner also is a booster of digital assets).

Mr. Duncan will release his collection fist by fist at 2.5 million USD per pop, in bitcoin. So far, he’s been paid about $50,000, with the remainder due sometime in April, according to reports.

Is this a good marketing strategy for bitcoin? Let us know in the comments!

Images via Pixabay.

At we do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post appeared first on .

Ethereum News Update

As Ethereum prices continue to fall—alongside the rest of the market, I might add—investors are concentrating their funds in bitcoin, otherwise known as digital gold.

bitcoin has drawn these comparisons for much of its history, though the reasons have evolved with time.

At first, investors argued that bitcoin’s fixed supply mirrored the real-life limitations of gold deposits. Now, however, investors point to the use of gold as a safe-haven asset, arguing that bitcoin serves the same purpose in cryptocurrency markets.

There’s even a metric to reveal the market’s concentration in bitcoin. It’s known as BTC Dominance.

Like with anything.

The post appeared first on .