Malta. The Blockchain Island. A postage-stamp-sized nation nestled in the Mediterranean famous for its rocky coastline, Baroque cathedrals, Megalithic temples, and centuries of culture. It’s a veritable mishmash of graying British expats, luxurious hotels, exotic women, cars that drive on the left, and a host of other legacies left by the various civilizations that invaded the rock over the years.

In more recent times, however, Malta has become famous for more than its rich heritage. It’s made a welcoming home for the iGaming sector (a booming industry worth around — 12 percent of Malta’s GDP).

In the face of a long and drawn-out European crisis and deficits year after year, Malta was finally able to register a surplus of €182 million for 2017 — its second year in a row.

And the country is being talked about in blockchain regulatory circles for its on cryptocurrency, even rebranding as “The Blockchain Island.”

Its government is open-minded, and its Prime Minister Joseph Muscat gave a to the United Nations about how countries should work together to solve the world’s problems.

However, Malta has a few problems of its own — and a less-than-impeccable past when it comes to some very sticky issues, among them.

Malta the Blockchain Island

On the surface, Malta looks to be a pioneer in the cryptocurrency regulation space. On July 4, 2018, it became the first and only country to officially three new crypto bills into law.

This established a for cryptocurrencies, blockchain, and DLT in general. 2018 was also the first year that the country held its long-anticipated Malta Blockchain Summit.

When asked about the significance of this for Malta and the crypto community in general, Steve Tendon, blockchain strategist and member of Malta’s National Blockchain Task Force said:

“It will be the first event ever where Malta’s intention to recognize “Legal Personality” to the innovative technology arrangements (like DAOs) will be presented to a broad international audience. This is an innovation in lawmaking that will support innovation like no other law has ever done.”

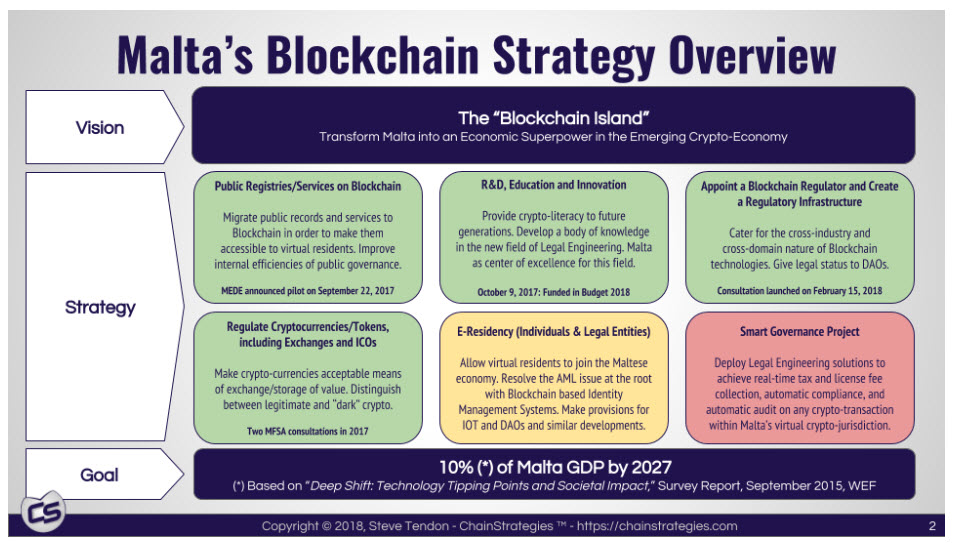

Malta didn’t just pass three laws as the headlines tend to focus on, they have a whole penned by Tendon, with six pillars that show a deep understanding of the technology and where it’s going. It covers initiatives like moving public registries to the blockchain, e-residency and digital identity, and smart governance.

Said Tendon:

“This will undoubtedly attract all the developers and entrepreneurs who are working on decentralized technologies of all kinds, such as new generation of blockchains, decentralized exchanges, decentralized ICO platforms, decentralized banking services, and so on.”

You can see clearly that this is just the beginning. Malta is not just aiming to lead the way in regulating ICOs but showing governments the need to understand rather than fear the technology. At the same time, the country is positioning itself as open for business among a sea of tightly-shut doors.

Attracting Major Crypto Businesses

This forward-thinking regulatory stance has already inspired an influx of blockchain companies to its shores, and a litany of other crypto exchanges.

It’s not that Malta is easy on crypto companies — according to Tendon, its KYC requirements are among the toughest out there — but at least it provides companies with a stable environment in which to operate, one in which their business isn’t at risk of being shut down from one day to the next, their token declared a security, or their government known for its hostility to crypto.

Malta’s progress is undeniable. I was recently at the Summit that attracted some 8,500 delegates. The place was packed at the seams and momentum sky-high.

Muscat gave a speech. Sophia the robot was there, even delivered a keynote commending Malta’s stance…and then pretty much concluding that governments had no place regulating crypto at all.

But it’s one thing laying the foundations for a new future. It’s another if you’re still scrambling to cover up your past.

The Money Laundering Issue and Lack of Crypto Banks

There is certainly positive rhetoric, a buzzing atmosphere, real legislation, and the promise that Malta will see crypto-friendly banks in 2019. But legacy banks are still not coming around. Their standards are higher, along with the fear of being slapped with a massive fine for being too lax on their AML policies. Just ask if you want confirmation of that.

While Binance is working on the in the world, crypto businesses may have to wait a bit longer. And if they think that Malta is their meal ticket to a safe haven, they may also need to dig a little deeper.

Malta has a history of working with less-than-desirable individuals. It seems that beyond gaming, innovation, and technology, the country’s name is also somewhat synonymous with money laundering.

Malta has been including that of Matthias Krull, a German banker working for the Swiss private bank Julius Baer, who admitted to laundering money for “Los Chamos,” thought to be connected with Venezuela’s President Nicolas Maduro.

There’s also the tragic assassination of Maltese journalist Daphne Caruana Galizia who, before she died, had accused the Pilatus Bank of Malta of laundering money. This thrust Malta into the global spotlight over freedom and safety of the press and the Pilatus Bank under the microscope of the European Central Bank (ECB).

Caruana Galizia had also accused the bank of making suspicious payments to senior Maltese and Azerbaijani figures. The bank had its accounts frozen in March and was eventually shut down by the Maltese FSA later in the year.

Then there’s the issue that the EU is over Muscat’s latest public blunder. According to Bloomberg:

“The union’s least-populous member nation has become a cryptocurrency and online gambling hub plagued by allegations of corruption and money laundering. And it’s selling passports.”

While the country was on a high after announcing its second year turning in a profit, Muscat announced that the government would donate €5 million to a cancer charity. This turned out to be a move welcomed by no one after it emerged that the donation would come from a fund that sells Maltese passports to foreigners for €650,000 apiece.

Once again, the whole touchy subject of Malta’s tenuous relations with undesirable individuals reared its ugly head, calling Maltese AML practices into question and rekindling the flame on the aforementioned issues.

So is Malta, the Blockchain Island, More than Just Hype?

Clearly, Malta’s presence on the global money laundering stage is a fairly large and potentially concerning one.

Some governments, according to Bloomberg, even argue that Malta could pose:

“a serious threat to global efforts to track money laundering, enforce economic sanctions, and maintain fair transnational standards.”

There’s also the fact that many banks will not work with crypto companies yet and some businesses may not want to associate themselves with Malta and its sketchy past (or should we say present?).

But then again, there’s no denying the progress being made. Malta’s new regulator, the Malta Digital Innovation Authority, is about more than just blockchain or . It’s about innovation itself and other emerging technologies, positioning the country as advanced and open to a world of possibilities.

Blockchain takes a beating from all sides for failure to attract the masses, for not being simple enough to use, and for being unregulated and unsafe. So, it’s encouraging to see countries diving into the depths, displaying a deep understanding, and welcoming crypto to its shores — even if it is a little lenient on who it does business with.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.

Featured Image from Shutterstock

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free.

Published at Sun, 25 Nov 2018 21:50:50 +0000