Zebpay, one of India’s largest bitcoin and cryptocurrency exchanges, is stopping customers’ fiat deposits and withdrawals as a result of the central bank’s banking curbs.

With an on Wednesday, cryptocurrency wallet and exchange platform Zebpay is moving to disable all Indian rupee (INR) deposits and withdrawals for customers as a direct consequence of the central bank’s mandated ban of prohibiting banks from offering services to cryptocurrency firms.

Smartphone-app platform Zebpay, which hit late last year, said in its statement:

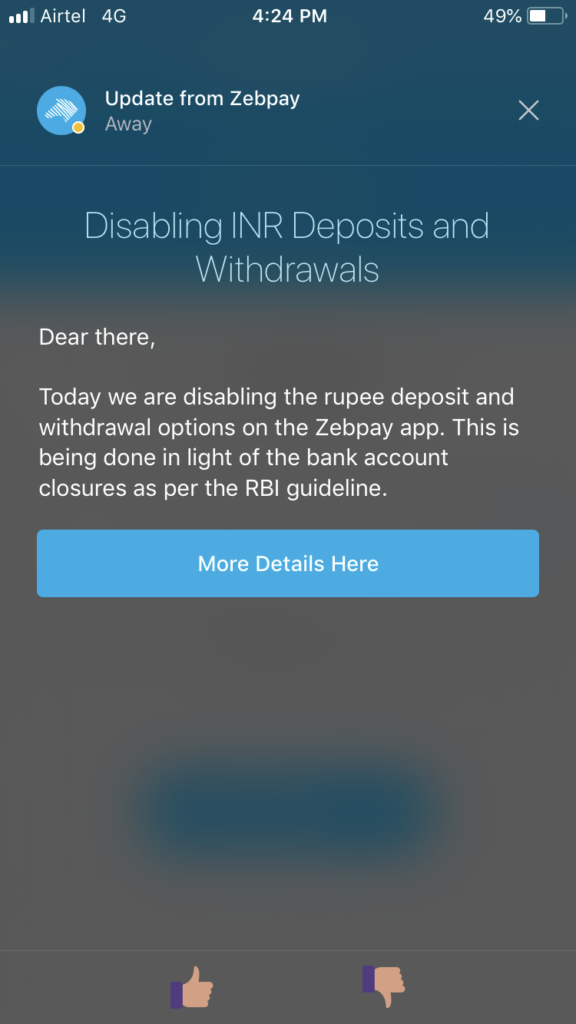

Today we are disabling the rupee deposit and withdrawal options on the Zebpay app. This is being done in light of the bank account closures as per the RBI guideline.

As previously by CCN, the Reserve Bank of India (RBI)– the country’s central bank – issued a circular on April 5 to all regulated financial institutions including banks, prohibiting them from providing services to companies in the cryptocurrency sector. The RBI pointedly enforced a three-month deadline for banks to follow the mandate. That deadline comes into effect on Thursday, despite to challenge the RBI-led banking blockade from cryptocurrency exchanges.

In a notice to its users last month, Zebpay had that fiat deposit withdrawals could become ‘impossible’, urging users to proactively file withdrawal requests. At press time, a Zebpay user confirmed the exchange was still accepting requests through the mobile application. It is, however, unlikely that the exchange continues to accept requests tomorrow after the ban comes into effect.

Existing users and new users looking to register with the KYC-enabled exchange are greeted with the following message upon opening the application:

In a substantial win for India’s central bank against the cryptocurrency sector, the country’s Supreme Court with a ruling yesterday. The Supreme Court will hear the industry’s case against the ban again on July 20.

Meanwhile, domestic crypto adopters, investors and the wider industry remain hopeful of promised regulations that would recognize – in essence, legalize – the sector.

“We are fairly close to developing a template [for crypto regulations] that we think is in the best interests of the country,” Department of Economic Affairs secretary Subash Chandra Garg in a televised interview last week.

He added:

We have prepared a draft which we intend to discuss with the committee members in the first week of July.

Featured image from Shutterstock.

Follow us on or subscribe to our newsletter .

•

•

•

Published at Wed, 04 Jul 2018 11:26:34 +0000

Exchanges

![Earn unlimited bitcoin without investment - get free bitcoins [0. 5 - 2 btc /month] Earn unlimited bitcoin without investment - get free bitcoins [0. 5 - 2 btc /month]](https://ohiobitcoin.com/storage/2017/02/5a920K.jpg)