Long-Term Investment: PowerLedger

CoinOverview:

Power Ledger aims to facilitate the peer-to-peer trading of power, using micro-grid setups which support major grids, but can work independently as well.

Imagine a neighborhood, all equipped with solar panels. These houses could produce, store, and trade electricity based on their needs. Some houses would need extra, and some would have a surplus.

A world-first public trial for 80 homes, involving the trading of water and electricity without support from a major grid, is about to commence in Fremantle, Western Australia. Private trials are also being conducted all over the world and are being driven by Origin Energy and Tech Mahindra in India.

Power Ledger could, ultimately, result in much cheaper energy for everyone; and given how 79% of the third-world does not have access to electricity, the Power Ledger project could really make a difference.

This is not an overnight success by any means, and the price support being witnessed now is due to a few reasons.

The project ran their ICO in October last year, and raised $34 million AUD. Once it hit the market, the token exploded, going from $0.056 on November 1, 2017 to above $0.91 later that month — a rise of over 1,525%.

The Power Ledger project is backed by a very impressive team, chaired by co-founder Dr. Gemma Green (PhD), who is also the acting Lord Mayor of Perth.

Managing Director David Martin also has over 20 years of experience within the electricity industry and has held executive positions in two state-owned electricity utility companies. They are also advised by legendary Silicon Valley venture capitalist Bill Tai.

This is a significant separator for Power Ledger, and the expected trial results will, if positive, set further developments in motion, leading the project to new heights.

A Deeper Dive into PowerLedger:

Powerledger (POWR) is an energy trading platform that allows people and businesses to sell their surplus solar power to their neighbors without an intermediary. PowerLedger was founded by a mixture of Energy veterans, tech professionals, and bankers located in Australia. They held their ICO during the third quarter of 2017 where coins sold at a rate of 0.09 USD. Over 15,000 buyers took part in Australia’s first Initial Coin Offering, with the Main Sale following a successful Pre-Sale at the start of September that saw the company raise A$17million in just 72 hours. The final amount raised in the Main Sale was made up of roughly A$6million in bitcoin, A$10.7million in Ethereum and A$0.4million in Litecoin, which sums to A$17million.

Of the 1 billion POWR tokens that were generated before the ICO, 350 million were made available for sale. Power Ledger co-founder and Managing Director David Martin commented: “These funds will enable us to build the business, broaden the applications and really make some solid inroads in peer-to-peer trading. We made it clear in our whitepaper how the money would be used and the recent new trials we’ve announced go to show how this business is growing.”

This whitepaper, which had been translated into 10 languages by eager contributors, outlined a series of milestones on the development roadmap. In 2018, these include the transition to a modified fee-less consortium Ethereum network and the first asset germination event, where POWR token holders will be able to become co-owners and beneficiaries of renewable assets.

As of right now they have a first market mover advantage along with support of the Australian Government. This is clearly seen through an $8 million Award the Australian Government funded for a Project In The City Of Fremantle Using The Power Ledger Platform. They will encounter some competition over the next few months as WePower, HydroCoin, and EnergiToken are all following suit and holding ICO’s.

Tangible Results:

PowerLedger’s price should continue to increase, they have experienced an average monthly ROI of 587.91%, as they continue to set themselves up for success. Power Ledger has received another nod of approval — and free publicity — by making the finals of Extreme Tech Challenge 2018 where they will compete with two other companies (not within the same industry). The start-up’s founders will now head back to Richard Branson’s Necker Island to pitch their business to the British venture capitalist and a panel of judges.

Additionally, one of Australia’s largest utility providers is working with Power Ledger. Origin Energy works in a number of energy fields, including power plant operation, natural gas processing and both commercial and domestic power delivery. Earlier this month the token price doubled on news that Origin Energy would soon release the results of an independent trial of Power Ledger’s technology. The technology is also being trialed as part of a government-backed pilot project in Fremantle.

The company now plans to acquire renewable energy assets including batteries and photovoltaic generators. POWR token holders will then be able to buy fractional ownership in these assets and earn income from power generated and sold. The tokens which listed at $0.09 have traded as high as $2 recently.

While hundreds of projects have raised capital via token sales in recent months, very few have managed to demonstrate tangible results to the extent Power Ledger has.

Tokens & Use Cases:

Power Ledger’s POWR tokens were designed to create a platform of interoperable applications rather than one business model, targeting one market. With that being said, the 10 applications and use cases POWR plans to implement are as follows:

“1) P2P Trading

– This class of Platform Application gives retailers the ability to empower consumers (or in an unregulated environment, the consumers themselves) to simply trade electricity with one another and receive payment in real-time from an automated and trustless reconciliation and settlement system.

2) Neo-Retailer

– This class of Platform Application provides Neo-retailers’ with smart demand and supply management, along with almost instantaneous remuneration and payment settlements while managing consumer exposure to the risk of non-supply.

3) Microgrid/Embedded Network Operator/Strata

– This type of Platform Application enables electricity metering, big data acquisition, rapid micro transactions and grid management at an unprecedented granular scale. Trading in embedded networks breaks the nexus between generation ownership and energy consumption meaning value can be derived from an investment in DER even if the investor is absent or doesn’t consume all the energy they generate.

4) Wholesale Market Settlement

– This Platform Application class offers rapid low-cost and transparent dispatch optimization and management, data aggregation, reconciliation and settlement for wholesale energy marketplaces.

5) Autonomous Asset (AA) Management

– This current Platform Application allows for (1) shared ownership of renewable energy assets and (2) trading renewable asset ownership. The AA is able to buy and sell its own electricity and distribute its income to assigned wallet addresses.

6) Distributed Market Management

– This Platform Application provides optimized metering data, the collection of big data, right to access and dispatch of assets, rapid transaction settlement, network load balancing, frequency management, demand side response and demand side and load management. The optimization of network assets is made viable by the near real-time remuneration of asset owners.

7) Electric Vehicles

– This class of Platform Application facilitates real time metering data (interfacing with the Open Charge Point Protocol (OCPP)), collection of data, user identification and rapid transaction settlement.

8) Power Port

– A class of Platform Application whereby virtual pipeline and roadside assistance type assets may be automated via the platform, such as EVs, and can provide a mobile storage discharge facility maintaining energy supplies to predominantly self-sufficient energy consumers.

9) Carbon Trading

– This Platform Application class offers smart contracts for carbon traders to assure digital transactions across organizations; credibility of asset using immutable distributed ledger technology; and transparency and auditability. It supports reporting and surrendering of carbon credits or certificates to regulatory authorities.

10) Transmission Exchange

– In the management of transmission networks, the Platform can provide real time metering data, collection of big data, right to access and dispatch assets, rapid transaction settlement, network load balancing, responding to non-stationary energy.”.

If Power Ledger had decided to use blockchain technology merely for a secure, fast and transparent database to settle energy transactions, many limitations would be presented when trying to expand globally. Prior to integrating ERC20 token — POWR — to their Ecosystem, they only used Sparkz, a token that is pegged to the lowest denomination of the local currency. A brilliant model for ensuring the volatile nature of cryptocurrencies doesn’t impede on revenues earned from selling surplus energy. But Sparkz didn’t cut it for their Ecosystem of global energy Applications. How would we convert Sparkz from one country to the next? Would we need a different token per country? These are a few questions that remain.

Competition & Market Share

As mentioned earlier POWR is the first to market in this space giving them an inherent advantage over newcomers. There were a few ICO’s over the December and January that brought some competition to the market. The main competition is likely to come from WePower & Restart Energy. We will dive into those two Coins over the next week. Stay tuned!

AirSwap Logo (Source: )

AirSwap Logo (Source: )

AST is an ERC20 token that gives liquidity providers the right to make orders on the AirSwap peer-to-peer decentralized exchange. Read the published guide .

What is AST?

AST, or the AirSwap Token, is the membership token of the AirSwap . The folks at AirSwap call the present iteration of their decentralized exchange (or DEX) the AirSwap . Eventually, you will be able to trade your favorite tokens for free on the AirSwap DEX. The AirSwap Token provides the right to signal your intention to trade one cryptocurrency (or asset) for another. If there is someone out there that agrees to your terms, the transaction may safely proceed without you having to take the risk of giving custody of your asset to a third-party. Transactions are executed in a peer-to-peer fashion using either MetaMask or Ledger .

Token Summary

Website:

Symbol: AST

Specification: ERC20

Network:

Circulating Supply: 150,000,000 AST

Total Supply: 500,000,000 AST

Introduction

Transaction-fee free trading is possible thanks to the . The protocol settles orders on the blockchain (or on-chain) through an Ethereum smart contract. Everything else is handled independently of the blockchain (or off-chain). Connecting traders off-chain should make the AirSwap decentralized exchange faster than other decentralized exchanges, like and even the -based , that depend on the blockchain for information propagation and order fulfillment.

Connecting traders on-chain is not ideal because the nodes in the network, like the Ethereum network, must reach consensus on the transactions in each block. On the Ethereum network, the time to reach consensus is 15s. In comparison to tradition exchanges that transmit order information in microseconds, this is simply too slow.

Apart from the latency introduced by propagating order information on-chain, the ability for unethical parties to manipulate that public information is also possible. This phenomenon is called front running. is not unique to cryptocurrency exchanges, however, it is a particular problem for decentralized exchanges that publish order information on the blockchain.

Thankfully, the Swap Protocol eliminates front running by miners and exchange operators. This happens because the protocol does not publish order information on the public blockchain. Miners are not privy to sensitive information that they could exploit for financial gain.

Furthermore, the protocol dispenses with the use of a centralized order book. It is able to do this thanks to implementing:

An IndexerAn Oracle (Optional)

The AirSwap Indexer is like a search engine. It disseminates counterparty information publicly. Traders may then communicate price information privately with the counterparties provided by the AirSwap Indexer. Should the trader not know what price to use in negotiations with the counterparty, the trader may consult with the AirSwap Oracle.

The AirSwap Oracle provides pricing suggestions. By using the AirSwap Oracle, the AirSwap decentralized exchange enables without requiring the levels of liquidity found in large, successful centralized exchanges.

How does AST work?

The AirSwap Token is essentially a token for professional market makers, or simply makers, on the AirSwap decentralized exchange. Makers have a cryptocurrency that they want to exchange for another cryptocurrency at a specific rate during a specified period. This is called providing liquidity. Consequently, makers are also referred to as liquidity providers.

The price the maker offers to pay for an asset is called the bid price. The price that the maker wants to sell that same asset for is called the ask price. Traditionally, liquidity providers hold large amounts of a specific asset and they make their money on the spread, or the difference between the ask and bid prices.

Anyone can be a liquidity provider on the AirSwap decentralized exchange. You simply need to signal your intention provide liquidity. In order to signal your intention to trade, you need to possess 100 AST. That amount of AST is then staked, or locked, for seven days.

This amount and the lock duration are determined by the governance mechanism built into the AirSwap Token. Holders of AST can collectively decide on the threshold and lock period at any time. For the time being, locking 100 AST entitles the maker to signal 10 trades.

Liquidity takers, or takers, accept a maker’s ask or bid price. They trade for free on the AirSwap decentralized exchange. Even if they don’t own AST, takers pay nothing to discover makers via the AirSwap Indexer, receive pricing information from the AirSwap Oracle, or settle the order via the Ethereum smart contract.

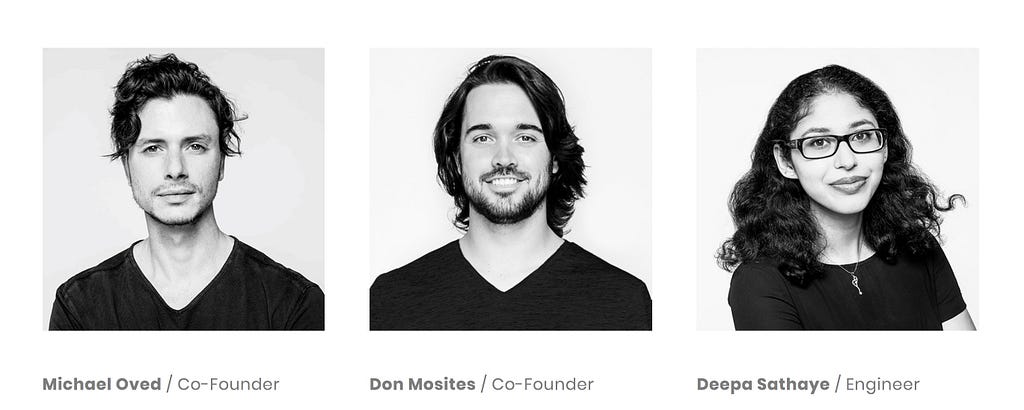

Who came up with AST?

Mike Oved and Don Mosites co-founded AirSwap in Hong Kong in 2017. The two first met at Carnegie Mellon University as students. They parted after graduating, however, cryptocurrencies brought them back together. Deepa Sathaye was the first engineer on the team.

AirSwap launched with several strategic partners. , , , and are some of the high profile individuals to through support behind the project.

Initially, a silent liquidity partner provided a market for AST-ETH trading. However, the number of liquidity providers has been steadily increasing. On March 1st, 2018, Michael Oved an additional three liquidity partners for the upcoming AirSwap Token Marketplace. Market makers interface with the AirSwap Token Marketplace via a private API. The Marketplace builds on AirSwap Token Trader to enable the trading of 24 new cryptocurrencies.

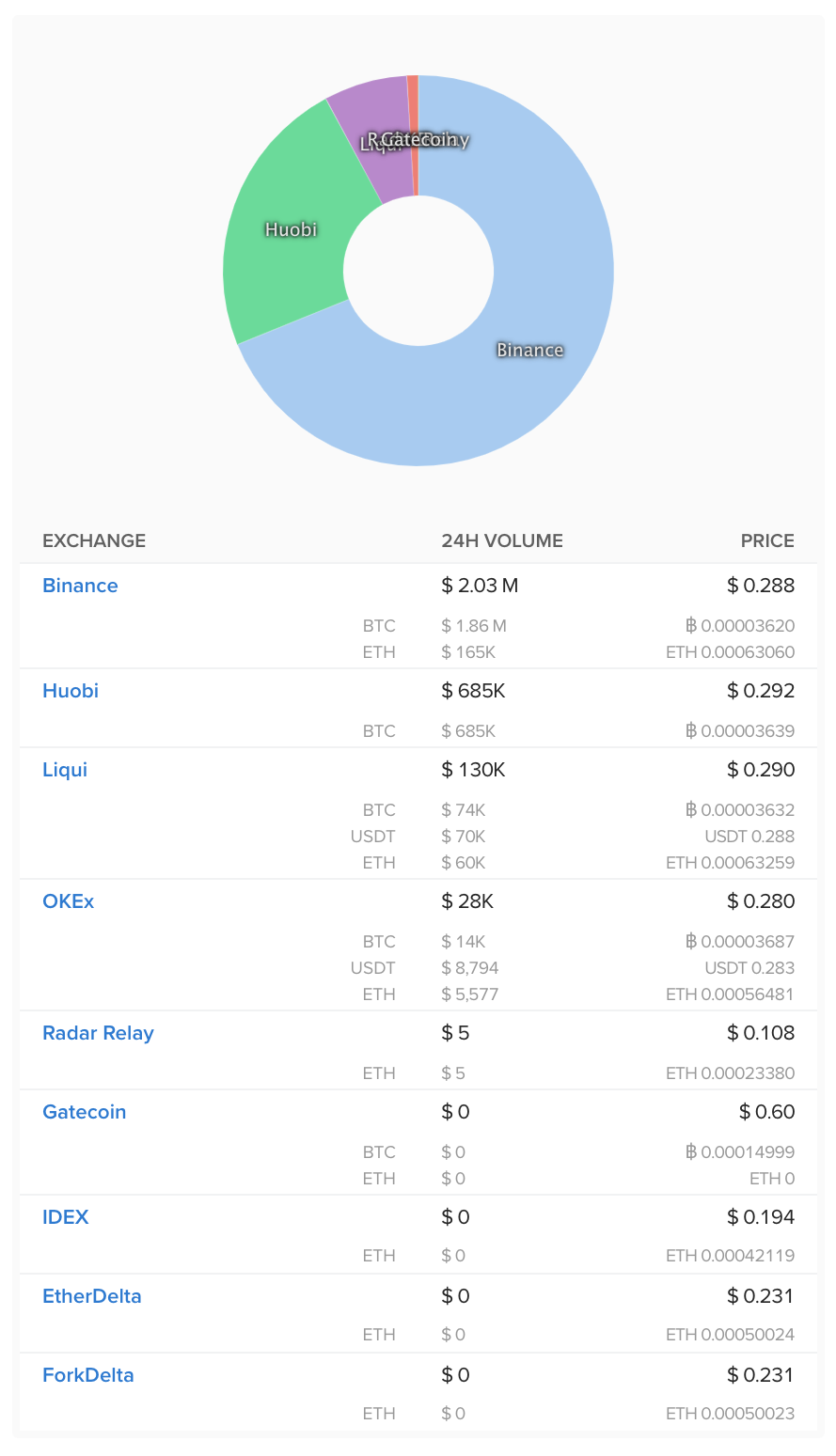

According to , AST is available on , , , , , , , , and . It is most certainly available at .

AST is supported by the browser extension and . It is certainly supported by , so you can also store it on the and hardware wallets.

Conclusion

The AirSwap Token is most valuable to market makers on the AirSwap decentralized exchange. If the platform grows, demand for AST will increase as liquidity providers become more active on the AirSwap decentralized exchange. Makers must lock more AST the more active they become. Since the supply of AST is fixed, the price of AST is certain to increase with the success of the exchange. The AirSwap team, holding 350 million AST, will be handsomely rewarded by this appreciation.

This potential to appreciate will also appeal to speculators. Thanks to the power of network effects, the forthcoming AirSwap Token Marketplace and Partner Network, and the fact that the AirSwap DEX competes with rivals unencumbered by transaction fees, AST is well positioned to make a big impact on how everyone buys and sells cryptocurrencies.

Useful Coin provides market research and business strategy services. In this Medium Publication, Useful Coin shares research into cryptocurrencies, cryptocurrency-based fundraising, and financial services delivered over peer-to-peer network technologies performed for clients in South Korea, the Cayman Islands, Jamaica, and the United States of America.

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

, , , , , , , , , , ,, , , , , , , , , , , ,