Described by his sentencing judge as a “one man cybercrime wave”, British hacker Grant West caused hundreds of thousands of dollars worth of damages through his activities stealing and selling personal and financial information on the dark web.

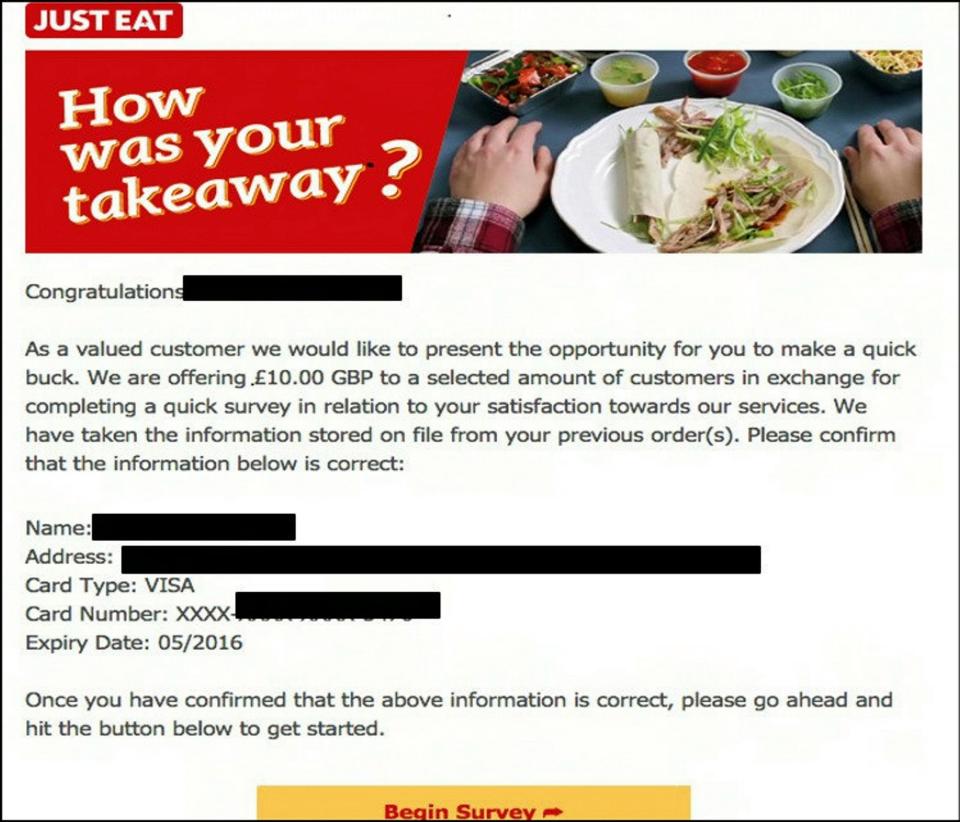

West sent emails under the guise of surveys from popular takeaway food delivery service Just Eat, offering food vouchers in exchange for completing a survey. The survey was a fake, and respondents were actually sending their personal details back to Grant so that he could sell them to the dark black market – the phishing scam alone netted West £180,000 or $240,000 which he then converted into bitcoin. BBC reports that the scam cost the Just Eat company £200,000 or $265,000.

West also directly targeted over 100 other companies including major firms like Barclay’s, Asda, Ladbrokes, Uber, and British Airways, hacking them for more customer data to sell. His Barclay’s attacks resulted in West’s clients fraudulently removing £84,000 or $110,000 from customer accounts and costing the bank £300,000 or $400,000 to remedy through new security measures. Similarly, West cost British Airways £400,000 or $530,000 after he hacked Avios accounts.

He used the money to pay for a new Audi worth £40,000 or $53,000 and several trips to Las Vegas among other luxuries.

West was arrested in 2017 on a first-class train to London in September 2017. Detectives from the Scotland Yard cybercrime unit chose the moment to end their two-year investigation carefully, making sure Grant was logged into his computer so and grabbing his arms before he could log out of his heavily encrypted cryptocurrency wallets and dark web accounts, which otherwise would be very difficult to link to him legally.

On the laptop, which belonged to West’s girlfriend, police found the financial information of 100,000 people. A subsequent raid on his home revealed an SD card with the details of 63,000 credit and debit cards as well as 7 million email addresses and passwords, along with £25,000 or $33,000 in cash and half a kilogram of cannabis, which West was also selling on the dark web.

West went by the username Courvoisier, after the top-shelf brandy, selling stolen information and drugs on the now-defunct site Alpha Bay. He pled guilty to conspiracy to commit fraud, computer misuse, and drug offenses on 2 May and on Friday May 25 Judge Michael Gledhill sentenced West to 10 years and eight months in prison.

Police accessed and seized over £500,000 or $667,000 worth of ill-gotten bitcoin from West’s girlfriend’s device, and she was sentenced to community service for unauthorised access of computer material – however, according to Judge Gledhill, over £1.6 million or $2.13 million worth of West’s cryptocurrency is still unaccounted for.

Featured image from Shutterstock.

Follow us on .

Advertisement

Published at Mon, 28 May 2018 17:30:42 +0000

bitcoin Crime