Litecoin price gained bullish momentum towards $140 against the US Dollar. LTC/USD is currently performing better and is trading above $135.

Key Talking Points

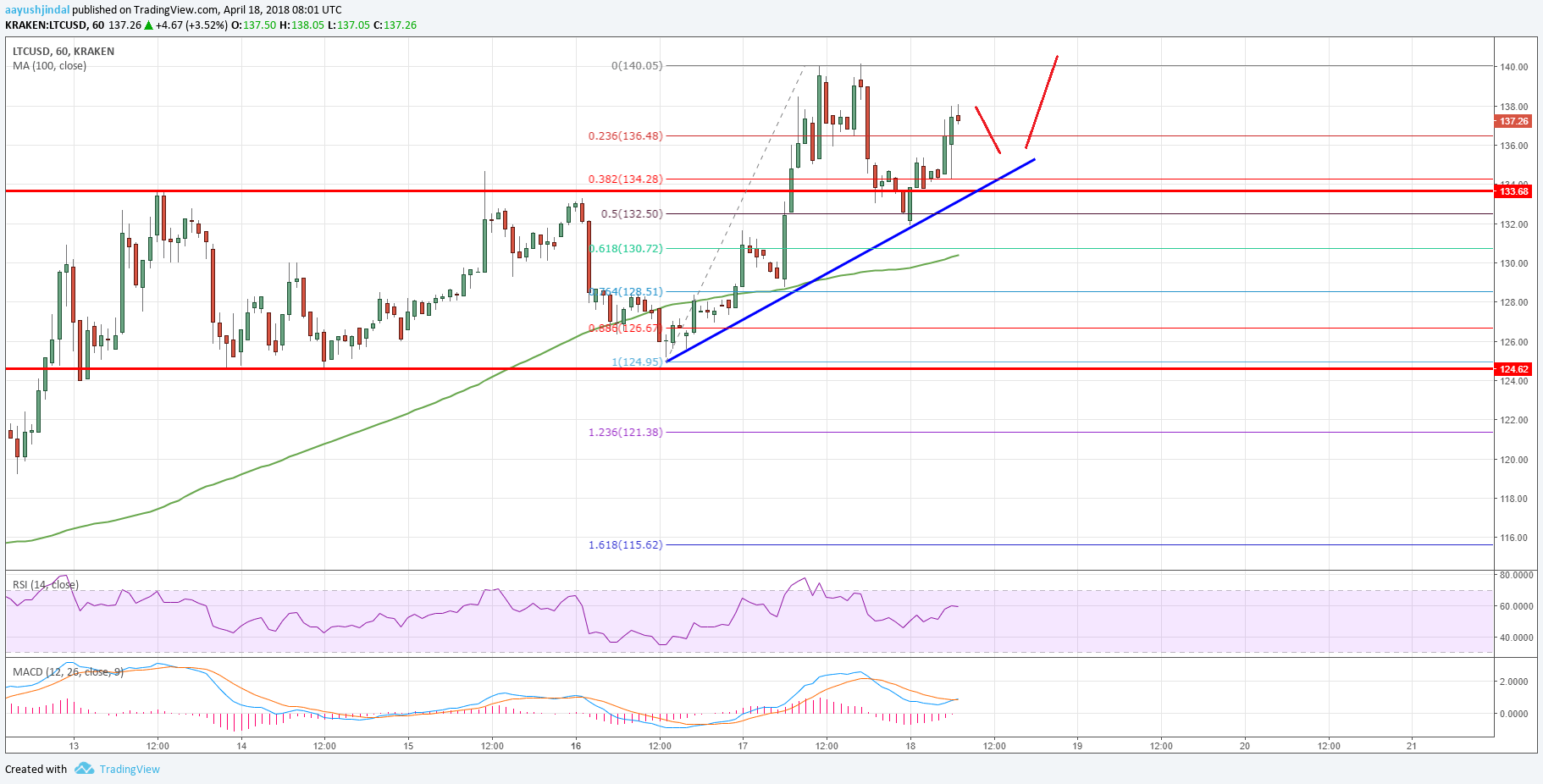

Litecoin price extended gains recently and tested the $140 resistance level (Data feed of Kraken) against the US Dollar.

There is a key bullish trend line forming with support near the $134 level on the hourly chart of the LTC/USD pair.

The pair may continue to move higher but it won’t be easy for it to break the $140 resistance.

Litecoin Price Forecast

Yesterday, we discussed about litecoin price against the US dollar. The LTC/USD pair traded further higher and tested the $140 level recently.

The upside move was decent and it seems like LTC performed better than bitcoin during the past few sessions. The price traded as high as $140.05 before it started a downside correction.

It declined and traded below the 23.6% Fib retracement level of the last wave from the $124.95 low to $140.05 high. However, the downside move was protected by the $132.00 level. Moreover, a key bullish trend line with support near the $134 level on the hourly chart of the LTC/USD pair also acted as support.

The pair held the 50% Fib retracement level of the last wave from the $124.95 low to $140.05 high, which is a positive sign. It bounced back and is currently above the $135 level and the 100 hourly simple moving average.

As long as the price is above the $134-135 levels, it remains in a bullish trend. Should there be a downside break below $134, the price may correct lower towards the $130 level.

On the upside, the price is facing an initial resistance near the $140 level. Once LTC buyers succeed in pushing the price above the $140.05 level, there could be further gains. The next resistance is around the $150 level, which is a crucial barrier.

Overall, litecoin price is in a bullish trend and is eyeing more gains above the $140 level.

Trade safe traders and do not overtrade!

The post appeared first on .

Blockchain is basically a distributed database that keeps shared records. These records are blocks, and every block of encrypted code has a record of the block history before it. Each block includes time-stamped information on the transactions made down to the second. The effect is a chain of those blocks to get them together; hence, its name.

A blockchain has two major components: an immutable ledger that the network keeps, and a decentralized network verifying and facilitating transactions. Everyone with access to the network could see this shared transaction data, but there is no possibility that the records can be corrupted or hacked. This decentralized trust means there is no one organization that controls the data, be it a tech giant or a big financial institution.

No third parties serve as gatekeepers of the World Wide Web. The power of the blockchain’s technology has uses across every bit of digital transaction and record. In fact, major industries are already leaning into this big shift.

The automobile industry

Blockchain can be another piece in the automobile industry’s complex machinery within a short time, both from the business and technical point-of-view. Its fundamental characteristics — immutability, transparency, and decentralization — is going to have a profound effect on the automotive industry’s internal processes. However, it will also impact the new mobility currently arising, where shared vehicles are becoming increasingly important and vehicle ownership less so.

The banking industry

Blockchain can also be used across the many business lines in the banking industry. Several banks, in fact, have already began using this technology in partnership with the other firms, and for their own requirements. Financial institutions are not far behind, as well, including Visa, Citibank, Bank of America, JPMorgan Chase, ING, NASDAQ, Barclays, BBVA, Commonwealth Bank, DBS and other financial institutions. These institutions are experimenting on the technology on their own or in partnership with firms.

The technology, which is based on distributed ledger concept, is available to everyone engaged in transactions. It helps keep transaction details, such as transaction history in block format. It benefits all the financial systems, from providing security, transparency, robustness, reliability, and immutability to fraud prevention.

Blockchain as middleman

The rise of smart contracts based on blockchain will turn the technology into a middleman that executes complex business transactions, automated data exchanges, and legal agreements. Companies, such as IBM and Microsoft, use cloud infrastructure to create custom blockchains for their clients and conduct experiments. The researchers, meanwhile, are exploring the use of blockchain, from digital identity to insurance and medical records.

Vast potential

Plenty of startups are now using blockchain for everything, from music sharing to global payments, from monitoring diamond sales to the legalized marijuana industry. This is why the technology has a vast potential. When it comes to digital transactions and assets, you can place anything on the blockchain.