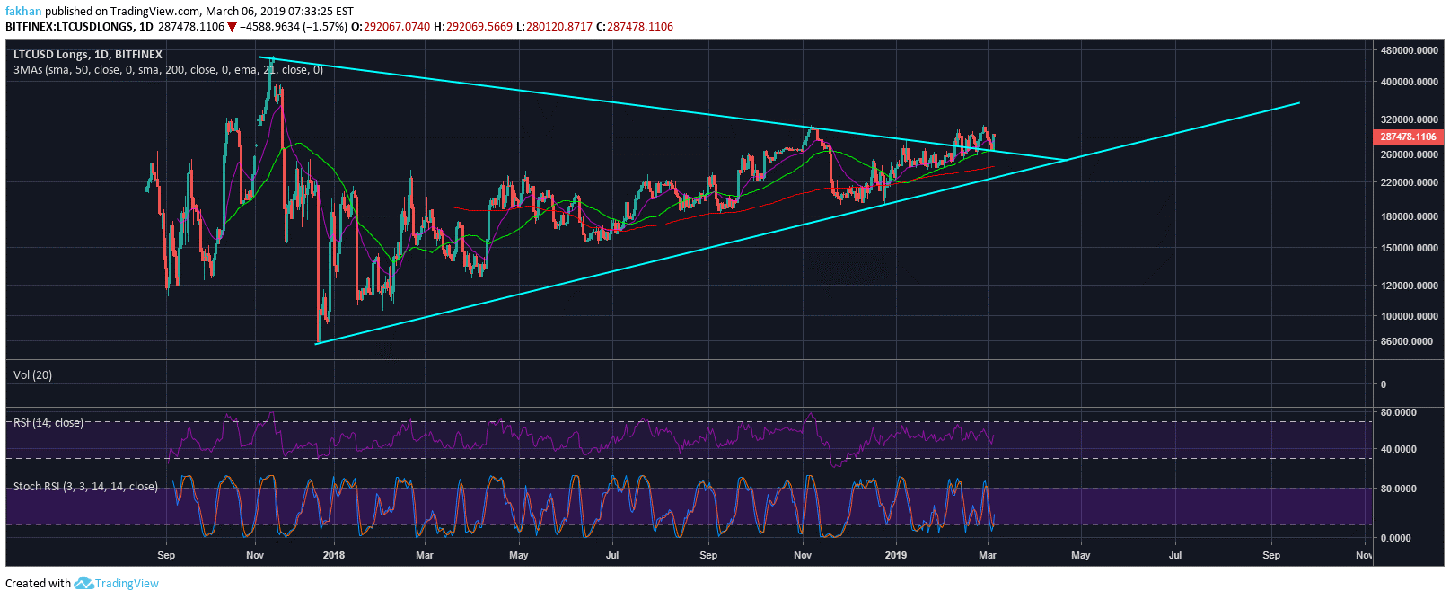

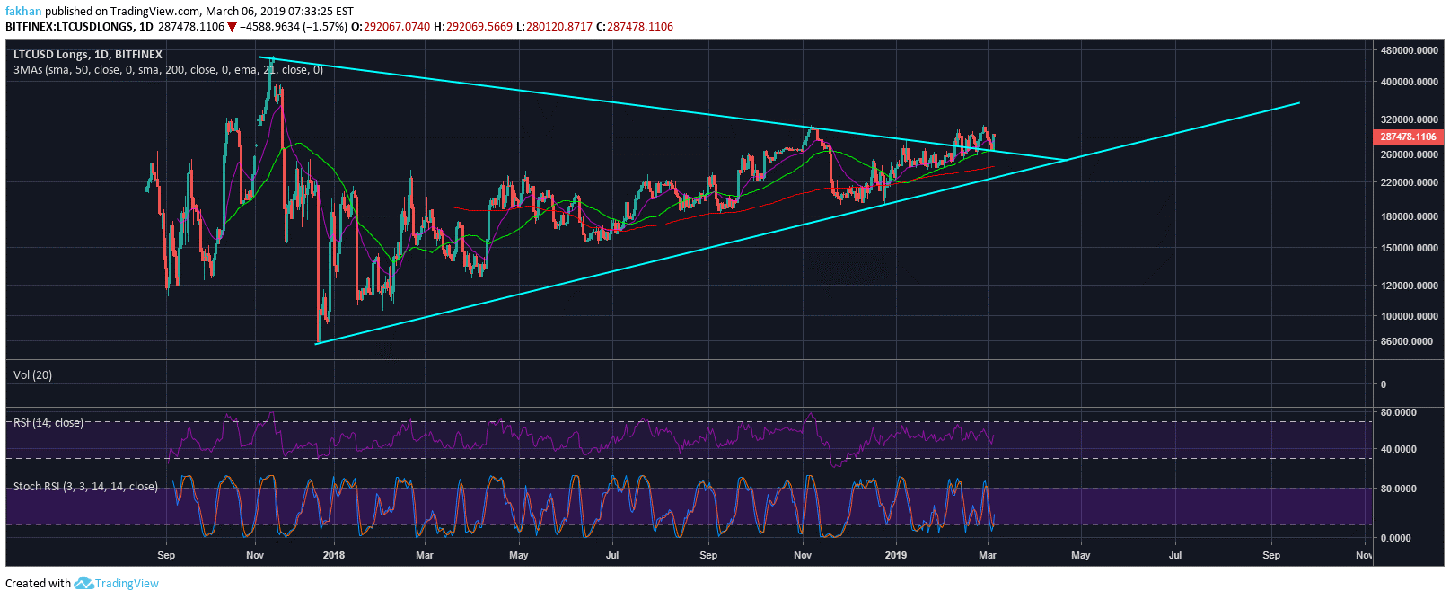

(LTC) saw a lot of bullish momentum over the past few days which resulted in a strong rally to the upside. The 4H chart for shows that the price is now around the top of the ascending channel after facing a strong rejection at the top. This means that if LTC/USD fails to break out of this channel soon, we will see a sharp decline below $50 in the days ahead. The price could decline all the way towards the bottom of this ascending channel during the next correction but we expect it to find short term support around the 50 MA and then the 200 MA if that level is breached. Stochastic RSI conditions on the 4H time frame shows that the price does not have ample room for a rally and is very likely to fall back.

Even the RSI on the 4H time frame does not show any promising signs for a rally that could lead to a break above the ascending channel. This would be a good bearish setup to short (LTC) all the way towards the bottom of the ascending channel. The volume has seen some big spikes over the past few days but this is hardly anything convincing. The interest in most at the moment still comes from large interest groups that are miners, professional traders or long term investors. Retail investors who bought near the top are still holding at big losses and have forgotten about the market. Some have taken their losses and left this market while others are looking for the price to crash hard before they get into the game again.

(LTC) is a with a lot of potential despite some of its risks. Well, one of the major risks facing (LTC) is that it is not a unique project, meaning it does not solve a unique problem. For now, (LTC) and Cash (BCH) claim to be better versions of () as they are faster and cheaper. However, that is not a very good use case especially when () implements Lightning Network. Will these have a good use case when () can process transactions as faster and as cheaper as (LTC) or Cash (BCH)? I don’t think so. In all fairness, it is not like they are solving a big problem now either. The number of transactions that uses Cash (BCH) or (LTC) for payments on online stores still remains quite low compared to ().

The daily chart for shows that the number of margined shorts on (LTC) also presents an entirely different picture compared to most other . (LTC) bulls appear to be more confident, or should we say more complacent. As we have seen in the past, this kind of blind madness does not end quite well especially for the bag holders. While (LTC) is a wonderful project that will most likely see more by investors as the market recovers, let us not forget what its use case it and whether or not it will have a future in five or ten years from now.

Published at Wed, 06 Mar 2019 16:55:51 +0000