(LTC) has gained a lot of media attention the past few weeks because it seems to be showing () the way. Usually it is () that shows the market the way but this time it is (LTC). A few weeks back, it was (ETH) that assumed such a role but it was short lived. The reason we believe is more reliable in predicting market direction than () is because the is due for halvening in August which would making one (LTC) twice as expensive. Besides, most of (LTC) buying and selling occurs on the exchanges whereas () has seen large volume on over the counter markets. If an asset has such a high volume on OTC markets, its price on exchanges becomes unreliable and misleading.

The daily chart for LTC/USD shows that (LTC) has already rallied towards the top of its ascending channel and faced a strong rejection there. Most of the time it would be () that would reach a certain point and then if it faced rejection, we would see the rest of the market follow. However, this time LTC/USD seems to have the lead. Seeing as how (LTC) has already faced a rejection at the top of the ascending channel, we can expect that the market is ready for a strong move to the downside as LTC/USD falls towards the bottom of the ascending channel. The price of (LTC) is currently above its 200 day moving average which would easily cross below the 50 day moving average if the price starts to fall. So, (LTC) does not have a lot of room for growth at current levels but it has plenty of room for a strong decline.

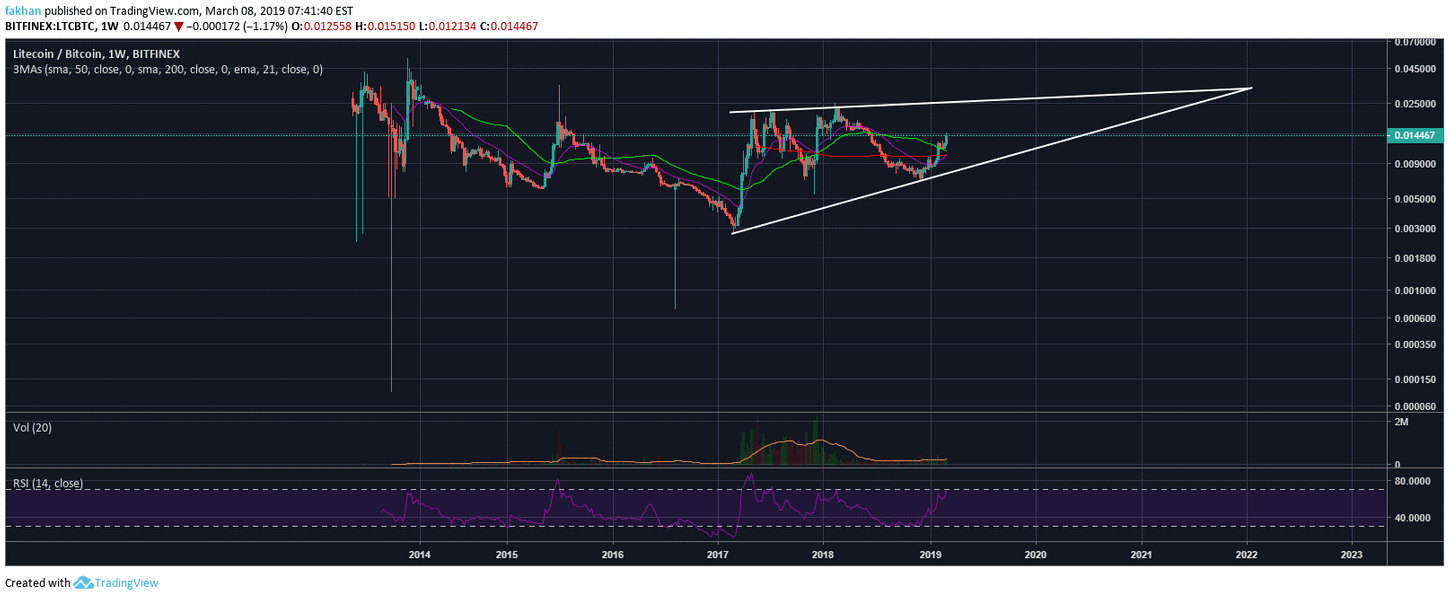

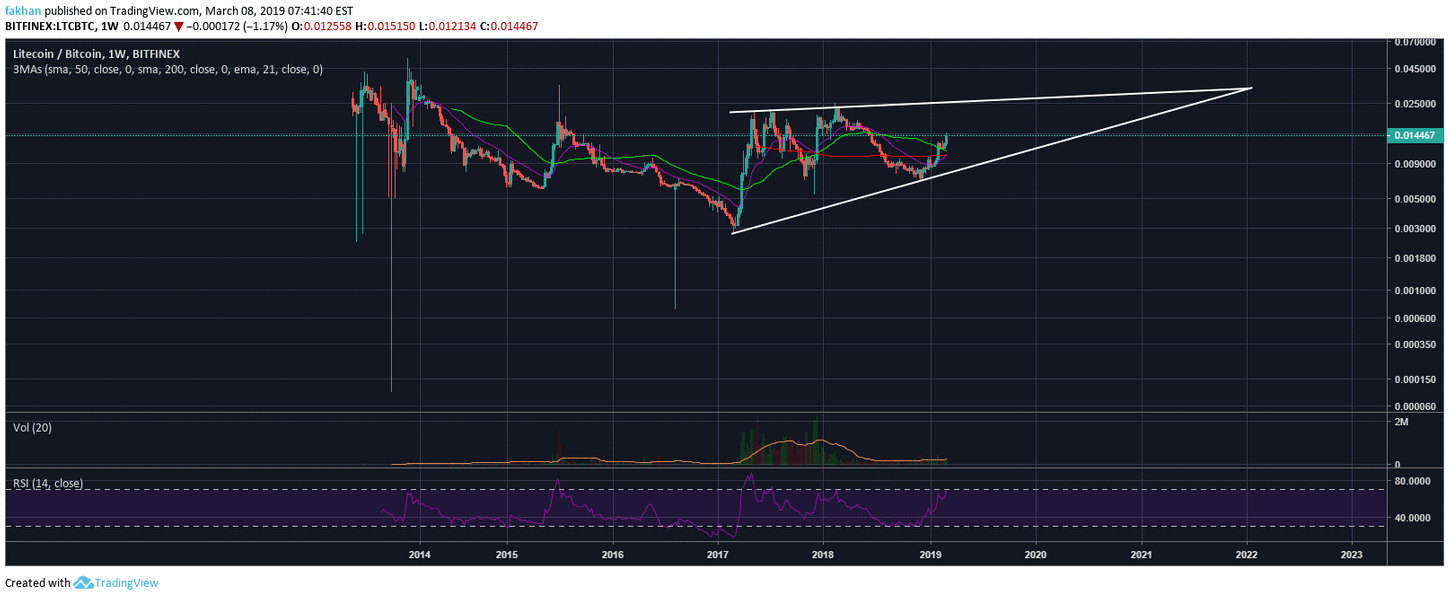

The weekly chart for shows that the price is above the 50 week moving average but if the price declines below it, we might see a retest of the 200 week moving average. If it fails to hold that level, (LTC) could drop sharply below the rising wedge. We expect this to be the case as (LTC) has already had its run and the price has outperformed most in the near future. That being said, we might see a short term rally towards the top of the rising wedge for a strong rejection.

If (LTC) continues to decline in the weeks ahead, we might see it reach a price target of $25 or lower before it finds a true bottom. This means that the worst is not over for (LTC) yet despite the fact that it has a halvening event in the months ahead. We expect the market to recover before (LTC)’s halvening but there is still a lot of time between August and now. A lot could happen between (LTC)’s next halvening and now and it most likely will in the weeks ahead.

Published at Fri, 08 Mar 2019 23:05:41 +0000