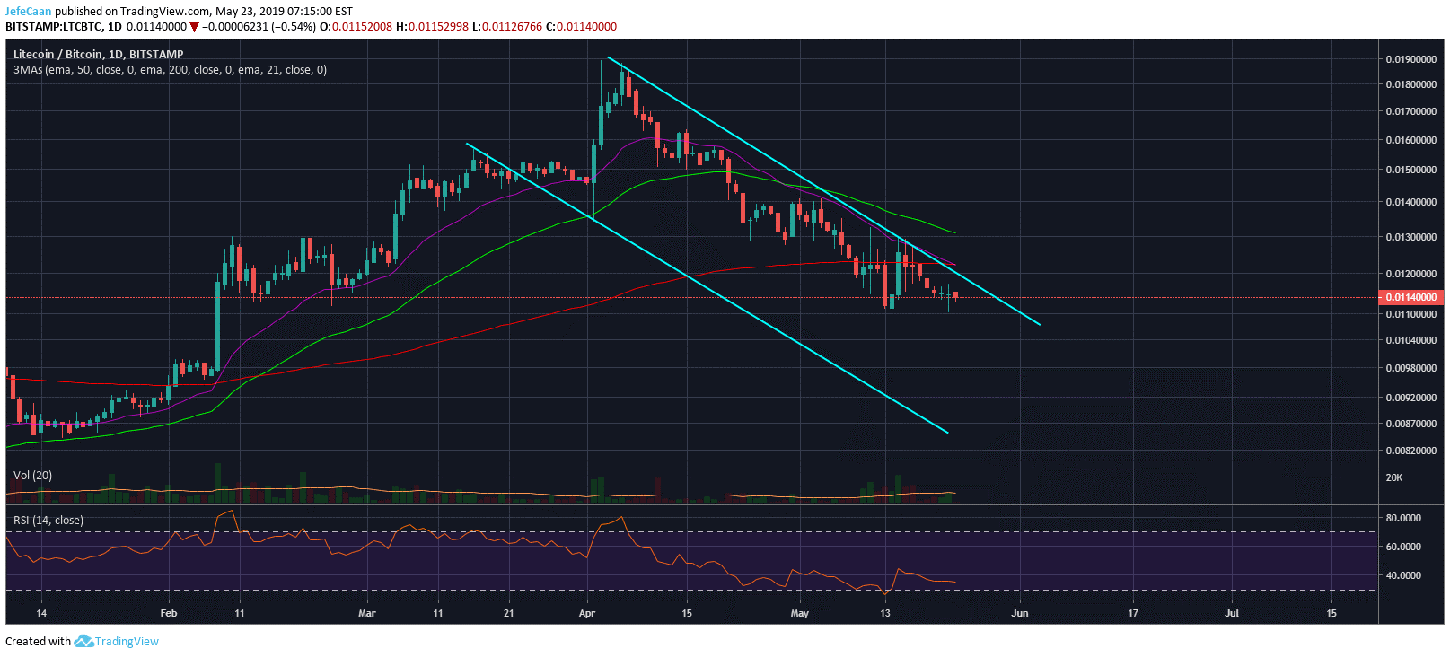

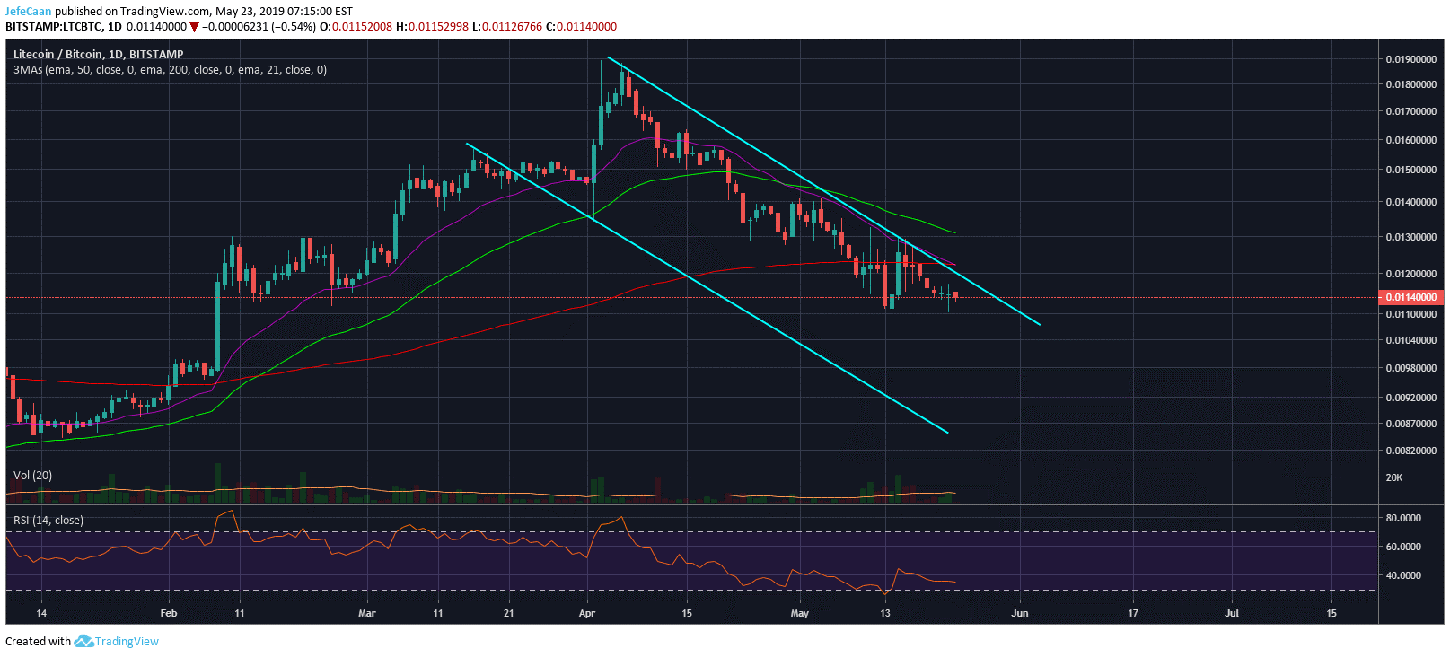

(LTC) has just tested a key support level again and is now likely to trade further within the descending triangle it has been in for the past two weeks. still has some room to trade sideways but it will have to break out of this triangle in the days ahead. If the price breaks below this triangle, it is likely to fall to the next support at $77. That support coincides with the 1.272 Fib extension level. If it fails to stop there, it will have to decline to $68.81. Either way, a fall below $80 is very probable in the days and weeks ahead. This decline might be followed by a temporary move to the upside but the big picture points to significant further downside for (LTC) in the months to come.

A bear market tests an asset for its true worth. We have seen the market inflict a lot of on many but maximum is yet to come. We still see a lot of useless forks of () as well as some useless ICO ‘projects’ that have to be wiped off the market before the next market cycle can begin. Before that wipeout, the next bullish cycle is very unlikely. The learning curve is very steep in this market and people have to learn a lot of things in a short time frame. Investors seem to be still learning what projects to invest and what to avoid but towards the end of this market cycle it will become a lot clearer. This is very for the long term growth of this market. Even like (LTC) that have been around for very long will have to prove that they have a use case other than being a short term alternative to ().

Chart for (1D)

enthusiasts often forget that the purpose of () was not to create a faster and cheaper digital currency but to solve the double spending problem with existing fiat currencies. So, if we keep forking other coins out of () and call them (LTC) or Cash (BCH) or SV (BSV) or any of the other useless forks, that undermines the entire purpose of existence of (). This does not mean that there is no place for other in the market but only that they cannot pose as () or its alternative.

(LTC) has been very popular since its inception and has remained in the top ten. The continues to have a very loyal support base even though its founder sold most of his coins at the peak of the last bullish cycle. () derives its intrinsic value from its use case. (LTC) derives its intrinsic value from its use case as being a () alternative. In other words, investing in (LTC) means hoping () will fail for if () becomes faster and cheaper with upgrades like Lightning Network, (LTC) will have no intrinsic value as it won’t have a use case.

Published at Thu, 23 May 2019 22:01:36 +0000