Liechtenstein cryptocurrency exchange LCX has been granted a license to provide crypto trading services for utility and payment tokens. The exchange will be offering four main crypto services including a custody service and a fiat-to-crypto exchange in partnership with Binance.

Also read:

A Regulated Exchange

An LCX representative told news.bitcoin.com:

With this license, we got the permission from the regulator to provide crypto exchange trading services for utility and payment tokens. So, we can offer an exchange to investors, to safely trade utility and payment coins (stable coins for example), that is approved by the regulator.

The Liechtenstein Blockchain Act defines three different types of tokens: utility, payment, and security.

“We also want to offer security token trading to our clients,” he emphasized, noting that LCX has increased its nominal capital from 100,000 CHF (~$100,400) to 1,000,000 CHF in order to apply for additional licenses, such as the Financial Market Authority (Fma) license, to be able to trade security tokens and offer other regulated services.

Upcoming Services

The company plans to offer four key products. One is a trading platform for security tokens and other cryptoassets. The second is a crypto custody service called LCX Vault.

The fourth is a fiat-to-crypto exchange unveiled in August in partnership with Binance. This exchange will offer the trading of Swiss francs and euros against major cryptocurrencies.

The LCX representative explained to news.bitcoin.com:

The moment we decide we’re ready to integrate our exchange into the terminal we can go public with this product … All other products are in development and will be announced and made public in the near future.

Furthermore, he noted that LCX’s exchange services “can be offered in a global manner,” adding that “we will be setting new standards in terms of KYC and AML, which every client of LCX should pass.”

What do you think of LCX’s plans to provide crypto-related services? Let us know in the comments section below.

Images courtesy of Shutterstock and LCX.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

Recent research on the tone and frequency of cryptocurrency coverage in the mainstream media over the past five years suggests that some news outlets appear to be much more biased against bitcoin than the norm. The results also indicate that overall sentiment has become more negative with time.

Also Read:

Price Declines Sparked a Press Frenzy

Blockchain-focused research company surveyed 7,527 cryptocurrency-related articles from 48 media outlets from January 1, 2013, to July 31, 2018. It used an algorithm to assess the broad sentiment expressed in each article.

The researchers found that the mainstream media didn’t really pay much attention to cryptocurrencies until they started climbing in value. But what these news outlets really liked was to report about price crashes. Even during the great bull run of 2017, coverage spiked during sudden declines in market value. And the downturn from the peak at the end of the year created a “press frenzy” as the number of articles shot up.

“In the wake of bitcoin’s market cap plunge in the final days of 2017, negative articles multiplied — with cryptocurrencies falling 34 percent in the first month of 2018, cautionary tales of vanished wealth were common,” the researchers note.

Old vs. Young, Left vs. Right

Long-established mainstream brands were particularly harsh with their cryptocurrency coverage, including The Wall Street Journal, The New York Times, The Economist and The Financial Times. In contrast, the researchers found that business and financial news outlets that skew toward a younger audience, such as Forbes and Business Insider, had coverage that was consistently above the overall median for positive sentiment.

Comparing American publications by their political leanings, the researchers found that those that skew conservative were considerably more negative in their crypto coverage than those that skew liberal. This was exemplified by Breitbart News, which was found to have published only negative articles — a surprising finding, considering that its former executive chairman, .

The report indicates that some publishers became less hostile over time. However, the more common trajectory was for coverage to become increasingly negative, the researchers noted. The average sentiment of Reuters, USA Today and Gizmodo articles became substantially more negative over time, for example. And overall, financial news outlets seemed to be more positive than technology news sites.

What are the most interesting findings from this research? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our , the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at , another original and free service from bitcoin.com.

The post appeared first on .

Over the last few weeks, the bitcoin Cash (BCH) community has been discussing how miners and nodes will handle bigger blocks in the future to encourage mass adoption. A company called Bloxroute has been coming up a lot lately, as it aims to resolve the block propagation bottleneck.

Also read:

Bloxroute Claims It Offers Greater Efficiency

“In particular, Bloxroute propagates blocks without knowledge of the transactions they contain, their number, and the ‘wallets’ or addresses involved. Miners are free to include arbitrary transactions in a block,” the Bloxroute . “Furthermore, Bloxroute cannot infer the above characteristics even when colluding with other nodes, or by analyzing blocks’ timing and size — Bloxroute cannot favor specific nodes by providing them blocks ahead of others, and cannot prevent any node from joining the system and utilizing it.”

Noticing Block Propagation Difficulties

Big blocks have been a topic of intense discussion over the last few weeks, especially within the bitcoin Cash community. The week before the Nov. 15 hard fork, a few sizable blocks were processed on the BCH chain, including . After the blockchain split, BSV miners processed a 64MB block, marking the largest onchain block ever mined on a blockchain. However, huge blocks that have been mined in the past and blocks above a certain threshold usually have issues propagating across the network. This was noticed by many observers when BMG pool mined a Cash block that took well over an hour to propagate correctly.

“It took 85 minutes to find this block and the mempool was continuously growing at a rate that seems to be close to the limit nodes can accept transactions,” Jochen Hoenicke, the cryptocurrency developer otherwise known as “Johoe.”

Researchers noticed these issues when the concession of 32MB blocks was mined on the BCH chain. And the 64MB block found by BSV miners also had and took an extremely long time to propagate — some believe the BSV stress test pretty much DDoSed the nascent network. Another on r/BTC explains how the BSV chain is showing issues with stuck Child-Pays-for-Parent (CPFP) transactions.

Hash War Winners or ‘Bloody Socialists’?

Since these issues started appearing, Bloxroute has come up more and more in the block size debate among people like Cornell University professor Emin Gün Sirer and Nchain’s chief scientist, Craig Wright. For instance, Gün Sirer told his Twitter followers on Nov. 23 that the hash war had shown that Bloxroute is an interesting protocol.

“The big winner in the hash war was, oddly, Bloxroute Labs. Coingeek demonstrated the importance of block propagation by accidentally selfish mining themselves. Anyone building high-performance blockchains needs to pay attention to the kind of things Bloxroute focuses on,” he .

However, Wright and supporters of BSV don’t seem to see many benefits with Bloxroute’s technology. “[Bloxroute] will never see the light of day with SV. In bitcoin … miners vote and miners can choose to orphan blocks,” Wright recently to his Twitter followers. “Basically, this is the complete opposite of everything bitcoin is about. And it also does not work.”

In another tweet, Wright claimed that Bloxroute proponents are “bloody socialists” and if miners cannot vote they are “neutered.” He continued by :

It is not scaling, it is removing miners from having a say.

Whether or not people agree with Bloxroute’s business model, its success or failure will be decided by the free market. If blockchain developers find use cases with this kind of system, it could theoretically thrive or simply introduce more problems. But no one can stop Bloxroute, as it’s free to provide these types of services in a permissionless fashion.

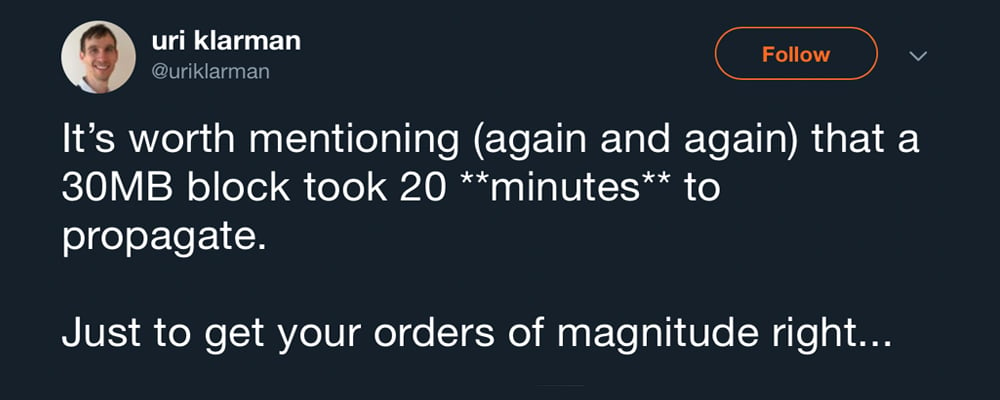

Uri Klarman, CEO of Bloxroute Labs, to Gün Sirer’s statements on Nov. 25, after the BSV chain had processed some larger blocks.

“Here’s why Bloxroute Labs is the big winner of the hash war: *Any* blockchain doing large blocks needs them to quickly reach other miners. Otherwise, they will mine empty blocks based on header and forks (orphans) — BSV just showed 30MB block take 20 minutes since they lack layer 0,” Klarman said.

What do you think about the Bloxroute protocol and business model? Let us know in the comments section below.

Images via Shutterstock, Bloxroute Labs, Twitter, and Pixabay.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

This post about better crypto UX was written by venture capitalist David Gold. He is the CEO of , which launched the and FIO Protocol.

***

Satoshi Nakamoto’s laid out an intoxicating vision for a “purely peer-to-peer version of electronic cash” — free of involvement and interference from third-party intermediaries.

Also read:

Ten years later — despite much growth, shrinkage, excitement and hype — bitcoin, and cryptocurrencies in general, have yet to be put to any significant use in commerce, which is a key reason why crypto markets continue to face such extreme volatility.

Crypto is currently too difficult and risky to use. This why it has not achieved mainstream adoption. Many other cryptocurrency and token-utility protocols have been launched to create variations that are faster, cheaper and more able to handle complex transactions. But very few have focused on how to make them easier, safer and more comfortable for people to actually use.

Bad Utility Equates to Bad UX

Imagine stopping people in the street to show them what it is like to use cryptocurrency with the incoherent crypto addresses, the lack of obvious route to learn the progress of payments, and the irreversible transactions — even in the event of payment errors.

It seems reasonable to assume few would be comfortable using cryptocurrency to conduct an exchange of value.

Praising third-party intermediaries is considered heretical in the blockchain world. But from the everyday users’ perspective, they at least can provide greater confidence that a transaction of value proceeds as intended. Checks can minimize errors, and errors often have the opportunity to be corrected.

For Satoshi’s vision of a “purely peer-to-peer version of electronic cash” to become a broad reality, the user experience of sending/receiving crypto must be greatly improved.

In fact, than that of sending/receiving value in the fiat world because transactions are irreversible. Users need near certainty on the accuracy of their transaction details — including where funds are being sent, the amount of funds, the type of funds, and the purpose for which they are being sent.

But all this needs to be achieved without a trusted third-party intermediary.

Poor Attempt

Efforts to address blockchain usability in a decentralized manner to date have almost exclusively focused on solving only one piece of the problem — the concept of human-readable “wallet names” to eliminate the need to deal with incoherent public addresses.

Those attempts have failed to make any meaningful impact on usability for a number of reasons. First, many of the attempts at wallet names are as complex as the usability problem they attempt to solve. Next, some attempts have been blockchain-specific, meaning that a user would be faced with a wallet name for one token but not for other tokens in their wallet.

Others have created “walled gardens” requiring all users to utilize specific browser plugins or wallets to obtain greater usability, but solving nothing for the multitude of users interacting with different wallets. Even if any of these efforts were successful, wallet names themselves are an insufficient piece of the usability solution, as they do nothing to provide confidence about the accuracy of transaction details, nor shared context for the purpose of the payment.

Here We Go

It’s time for wallets and exchanges to change the paradigm and enable dramatic improvements in usability across all blockchains. By uniting around a decentralized Paypal-like protocol, we can finally break through the barriers on blockchain usability.

This protocol should be open sourced and available to all. In other words, every wallet and exchange should be able to participate. We need a protocol that works with existing blockchains rather than competes with them. We need a protocol that doesn’t require them to change in any way, and won’t sit in the middle of transactions. Rather, it should augment blockchains by enabling all wallets and exchanges to provide a decentralized suite of information and workflow not previously possible.

A protocol like this would enable the first wallet names that work across every token and coin. Crypto users would be able to send a request for payment from within one wallet to another wallet — . Cross-chain metadata could work identically for every token or coin so that transfers of value, regardless of token or coin utilized, could include secure details on the purpose.

And these capabilities would only be the beginning. A raft of other usability solutions could be built if everyone gets involved.

Calm After the Storm

The volatility experienced by cryptocurrencies over the past year would greatly diminish if crypto just became more consumer-friendly. As long as blockchain tokens and coins are limited to being primarily an alternative investment asset class, market adoption will be constrained.

The vision of a decentralized, peer-to-peer system for exchange of value is not only about accuracy in the ledger of transactions, it’s about the comfort and confidence of the user in the process of moving the value represented.

I’m optimistic that the whole industry is about to come together to solve these usability issues. , but will finally find it superior to fiat currency for a variety of transactions.

Do you think a single protocol for interoperability between blockchains is the way to go? Will the industry unite to solve these pressing issues?

Images courtesy of Shutterstock

OP-ed disclaimer: This is an Op-ed article. The opinions expressed in this article are the author’s own. bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post. bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

The post appeared first on .