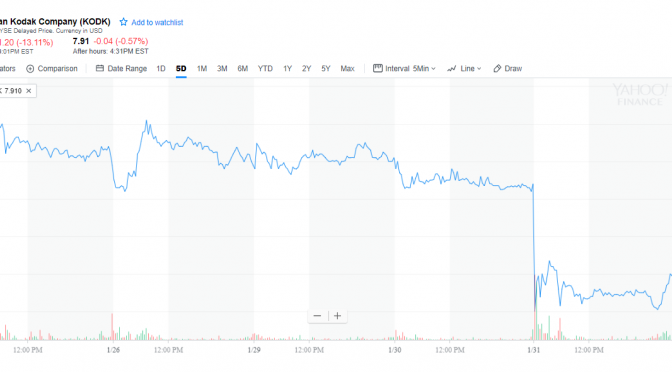

The much-hyped $20 million KodakCoin ICO was supposed to debut on Jan. 31. Instead, the iconic brand announced the night before launch they needed at least several more weeks to get to know their customers better, as they enter the “accredited investor verification phase,” leaving the 40,000-plus potential buyers who want dibs on Kodak’s “photo-centric cryptocurrency” waiting. Skittish investors fled KODK, as the stock tumbled 13% after gaining 200%-plus when the KodakCoin ICO was announced.

The delay comes on the heels of a couple of critical reports, most notably from questioning the vetting practices of the nostalgic brand. The Times suggests that Kodak’s push into cryptocurrencies, for which it is betting its comeback, is one fraught with questionable decisions, most notably its business partners, including “a paparazzi photo agency, a penny-stock promoter and a company offering what has been called a “magic money-making machine.’”

Bull’s Eye

Publicly traded Kodak, which only a few years ago filed for bankruptcy protection, must have known it would have a target on its back even though it registered its token as a security given the hard-line regulators have taken on cryptocurrencies and ICOs of late. SEC chairman Jay Clayton a Jan. 22 speech called out public companies that “shifted their business models to capitalize on the perceived promise of distributed ledger technology,” and might as well just have mentioned Kodak by name.

Meanwhile, for all its controversy, KodakCoin is a much-anticipated project among photographers as it solves an industrywide problem for them. By using distributed ledger technology, photogs can register their prints and then proceed to license them out, paving the way for them to be paid for their work and catch anyone who violates the copyright.

Kodak chief Jeff Clarke told the Times it was this disconnect in the photography industry that led him to blockchain technology in the first place.

“This is not a dog food company that’s creating a currency. This is a real solution around digital rights that Kodak has been involved in for many years,” he told the Times.

The KodakCoin ICO is targeting accredited investors across the United States, Canada and the UK, as per early reports. Meanwhile, the lead advisor that Kodak engaged for the blockchain project is sure to raise some more red flags among regulators. Cameron Chell was banned from the Alberta Stock Exchange for half a decade in the late nineties and fined $25,000 for rules violations. Prior to that, one of Mr. Chell’s companies closed its doors amid fraud allegations tied to its chairman.

Not the first impression Kodak wants to give to regulators, or investors for that matter.

Featured image from Shutterstock.

Follow us on .

Advertisement

Published at Wed, 31 Jan 2018 23:32:55 +0000

ICO[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]