By : The other shoe could be about to drop in the economy. JPMorgan economists in a report predict the will witness slowed economic growth. They’re expecting U.S. GDP to expand by a measly 1%, lower than their original predictions of 2.25%. During Q1, the economy expanded at a rate of 3.2%.

The economists also analyze the Federal Reserve, marking an equal chance for interest rate hikes as there is for cuts. Originally, JPMorgan economists believed a rate hike would be the next move. has been pushing for an interest rate cut. He recently tweeted:

is adding great stimulus to its economy while at the same time keeping interest rates low. Our Federal Reserve has incessantly lifted interest rates, even though inflation is very low, and instituted a very big dose of quantitative tightening. We have the potential to go…

— Donald J. (@realDonaldTrump)

….up like a rocket if we did some lowering of rates, like one point, and some quantitative easing. Yes, we are doing very well at 3.2% GDP, but with our wonderfully low inflation, we could be setting major records &, at the same time, make our National Debt start to look small!

— Donald J. (@realDonaldTrump)

Should the Fed decide to slash interests, it will be a sign of a weakening economy, according to Morgan Creek Capital Management CEO Mark Yusko in a .

3 Biggest Risks Plaguing the U.S. Economy as per JPMorgan

So what was behind JPMorgan’s weak economic growth forecast? Their reasoning was three-pronged, including:

- Uncertainty stemming from the trade tensions between the U.S. and China

- “Business sentiment”

- “Global economic” slowdown

It seems the president’s tariffs has got everybody down. Most retailers and industries – specifically – export major items from , with footwear companies receiving more than 70% of their supplies from the country. The tariffs are shutting the doors to many of these companies’ “old ways” and forcing them to think about American-made products – something that probably hasn’t been on their minds for a while.

Anecdotally, Chris Rupkey, an MUFG Union Bank chief financial economist, suggests to CNBC that CFOs believe the chances of a recession are increasing, which ultimately inspired them to cancel several orders in both March and April. In all, total orders among manufacturers decreased by 2.1% in April.

Sell in May, Go Away

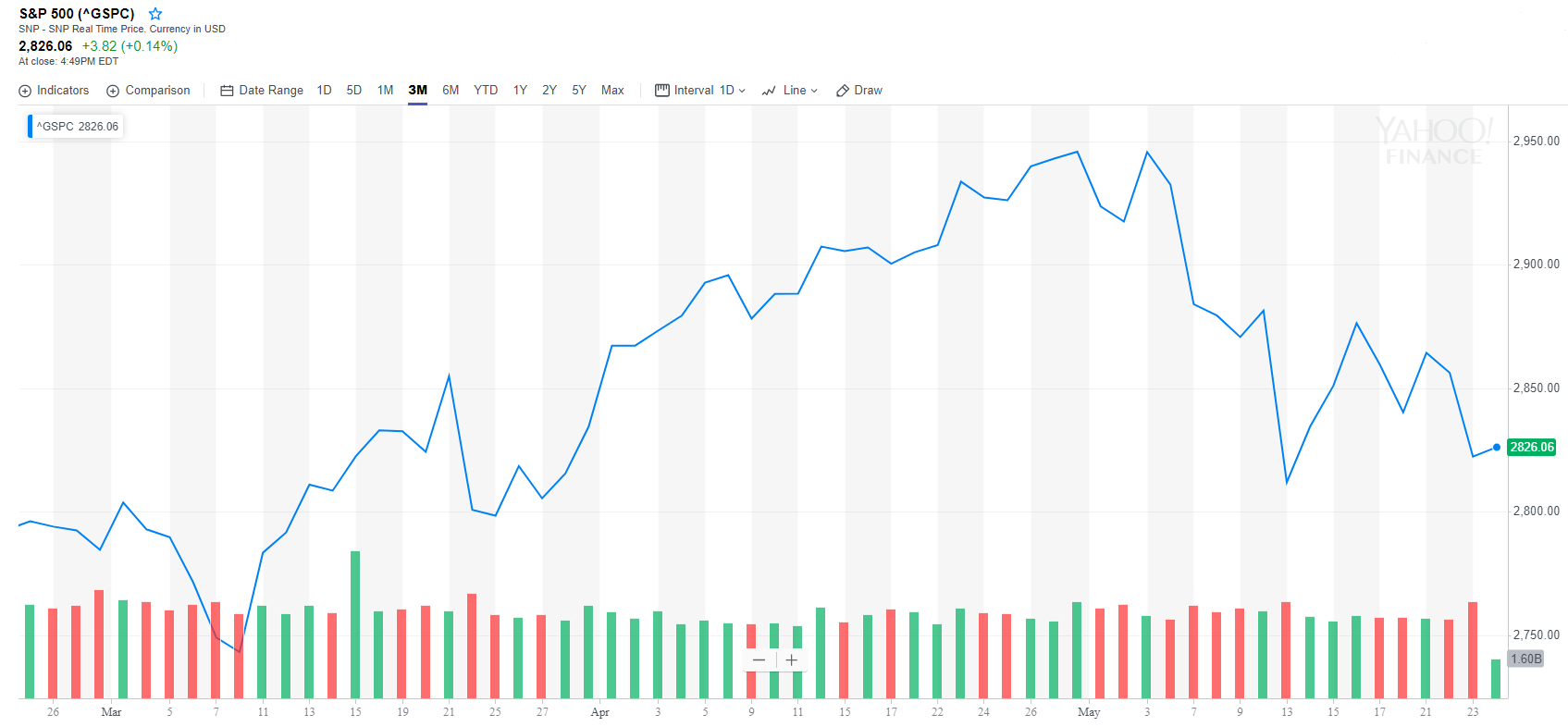

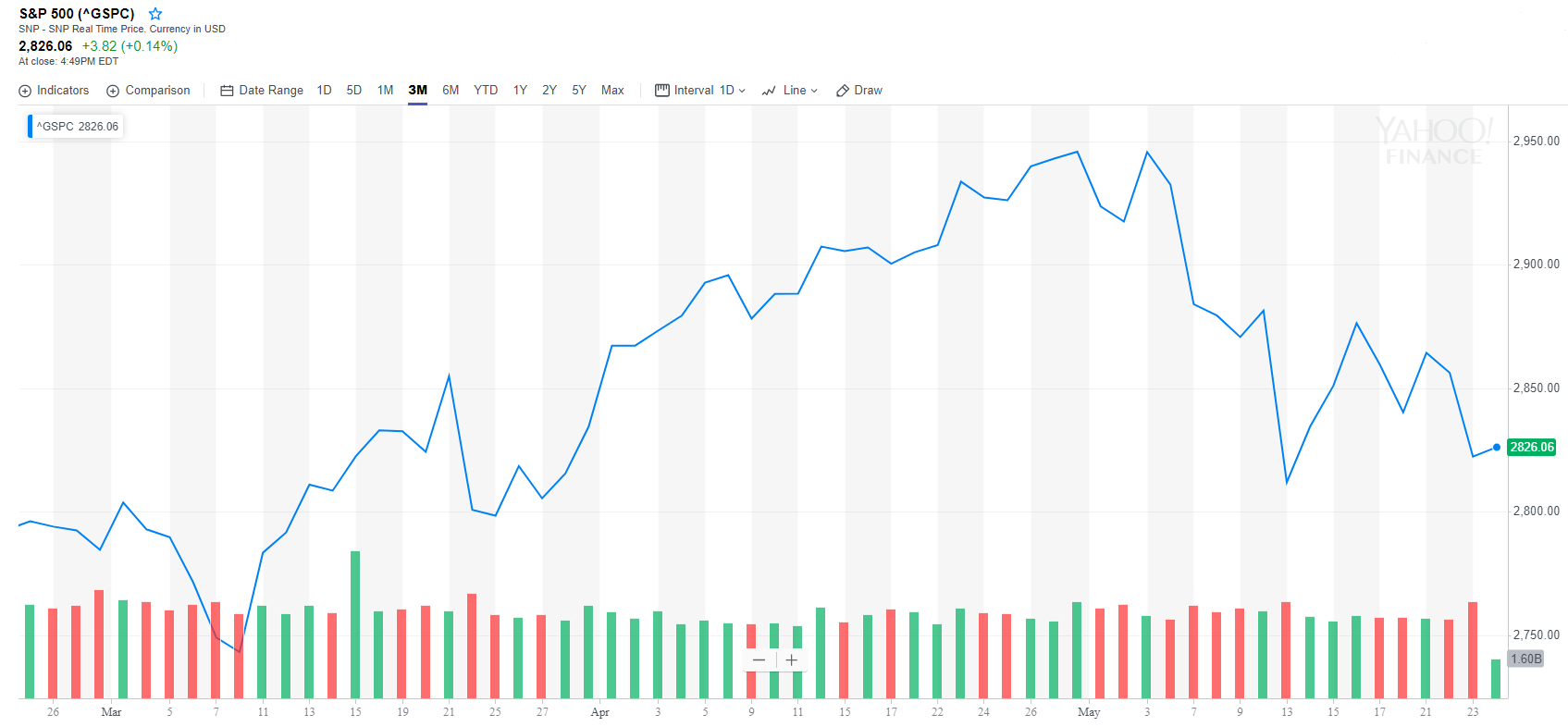

Meanwhile, the economic slowdown that JPMorgan explains is spilling over into the stock market. May is shaping up to be the worst month of the year so far for stocks. The S&P 500 is hovering at approximately 2,800, having revisited January 2018 levels. It is in jeopardy of slipping to the 2,700 level or worse, giving stock market bulls the opportunity to buy the dip if they choose to.

The S&P 500 is on track for its most dismal month of the year. | Source: Yahoo Finance

Patrick Palfrey, a senior U.S. equities strategist at Credit Suisse, is is “looking to make sure his constituents get the best deal possible… He wants to make sure he can deliver it.”

Palfrey also says that while swings may occur as negotiations continue, any drops will probably be viewed as “buying opportunities” rather than pushes to sell. Additional stock purchases can only move the markets higher. stocks stand to drop as much as U.S. stocks, and Chinese officials will be more eager to make a deal, speeding up the process. This will allow the markets to not only settle quickly but come back bigger, thanks to allegedly higher investor interest.

All three major indexes – the Dow, NASDAQ and S&P 500 – finished the day modestly higher but remain lower for the sixth-straight week.

This makes me more bullish . Stephen Moore, Herman Cain, and Mike Pence all make me bullish hard money. To be fair, MMT and some of the far left’s policies also makes me bullish crypto.

— Michael Novogratz (@novogratz)

Regardless of JPMorgan’s diagnosis of gloom and doom, Fundstrat Co-Founder Thomas Lee believes that many S&P 500 companies are insulated from the U.S.- trade war. As a result, the S&P 500 will finish the year higher by a double-digit percentage.

Published at Fri, 24 May 2019 22:31:57 +0000