INTRA-DAY BREAKDOWN – 04/04/19. (REDACTED BREAK DOWN FROM PRIORITY – OUR PREMIUM SERVICE)

WHAT HAS OCCURRED SINCE OUR LAST (BITFINEX) INTRA-DAY BREAKDOWN ?

Our previous analysis of ON THE 20TH OF MARCH ENDED WITH THE FOLLOWING CONCLUSIONS:

‘’TO CONCLUDE:

1. PRICE ACTION ON BITFINEX IS CAPPED TO 4720$ AND 5111$ RESPECTIVELY – both of these targets and resistance points are extreme case scenarios and will first be indicated by a break of 4121$ resistance and also finally 4223$ resistance on BITFINEX. We expect bitmex price to also make highs between 4380-4500$ and 4900$ in these two respective scenarios – our confirmation prices for FINEX are at 4125$ and 4225$ respectively, one being conservative (the latter).

2. NONE THE LESS, UNLESS WE BREAK 4121$, PRICE ACTION STILL IS HOLDING PRECEDENCE. This will first be indicated by the break of higher low formation and a break below 4080$. Thereafter, a break below support on the hourly at 4050$ and on the 4 hourly at 3960$. This would place XBT testing 3870-50$ support.

3. A break of 3960$ will indicate a break of all structure and therefore, we would be heading for 3480$ and 3650$ respectively – therefore this is our confirmation price for fines. ‘’

REVIEW :

1. price cap of 5111$ was achieved as a resistance. Moreover, conservative first target to the upside of 4720$ was achieved and is now a price floor incase of price action from this level. Also, a confirmation price as clearly stated for you guys with final resistance stated at 4223$ on Bitfinex.

2. Both downside supports of 3840$ and 3960$ finally held in the end with the latter being broken through but 3840$ acting as final support for .

3. All in all, another call made to the T days before the move actually took place.

We will do the top down style analysis that you should have become accustomed to by now to look at possible price direction.

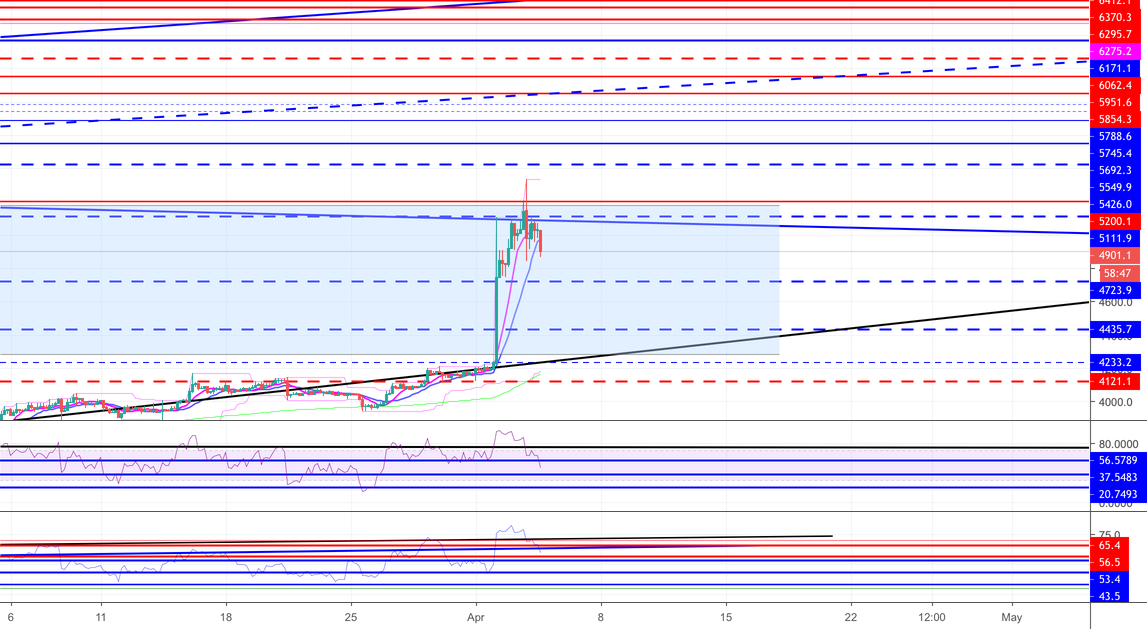

WHAT CAN BE SEEN ON THE FOR ?

– Looking at our chart on the daily on a more zoomed in scale, we can see that we are currently at a resistance as estimated before to be 5111$ on Bitfinex. To even further this more, we can see that from a formed at 3400$, with a neckline at 4120$, we expected an increase to previous supporting as can be seen on our zoomed our version of the and this has been used as support since as early as march 2018$ and it was broken through in November and now we are retesting it, and it is so far holding as a resistance, which is what we expect as price floors often become price ceilings as the chart moves. To the upside, maximum capacity is until 5745-5788$ – this is our conservative upside target and this can only come with a confirmational break of 5350$, which was the previous spike in price. In reality, we do even have upward potential to highs of 5850-5950$ and this can be regarded as an extreme maximum.

– If we pay attention to our momentum indicators such as , we can see that we are at resistance levels of 80 plus and looking at our RSI/ROC indicator we can see that again we are at resistance on this indicator as well as normal of 65 on RSI/ROC. I expect drops to the 56 level on RSI/ROC following a rejection from the 65 level on the daily.

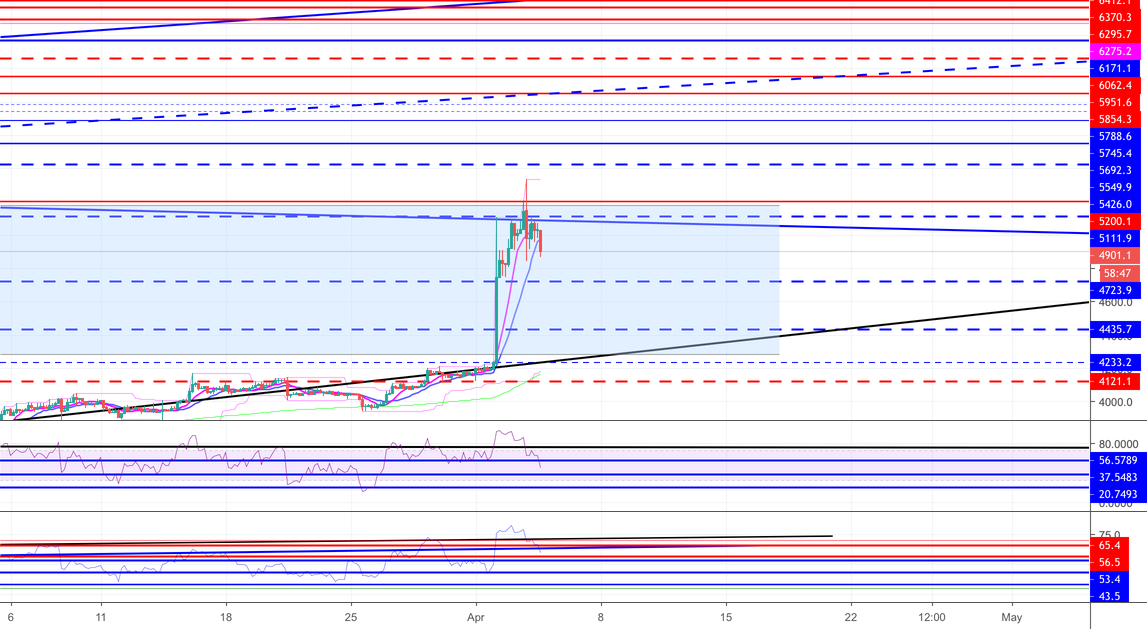

WHAT CAN BE SEEN ON THE 4 HOURLY CHART FOR ?

– We can see that of 5111$ is currently being respected and we currently lie under the resistance which was previously a supporting . In addition to this, we can see resistance levels across our momentum indicators. On our indicator we can see a rejection from 80 level with hops of seeing support at 37 or 20 level on this indicator. On the RSI/ROC , we can see that currently nearest support lays at 53 level. Moreover, on the price chart, we can see that nearest support for is at 4723$, where I believe the bulls will come back in again. If this level is broken, we can see that we are aiming for supporting at 4450-4500$.

WHAT CAN BE SEEN ON THE 4 HOURLY CHART FOR ?

– On the 1 hourly chart, we can see that 4836$ seems to be the last low we had a wick to and thus we can use this as a point of referral for confirmation of price action. Also, we can see that our momentum indicators are all currently at resistance but with 20 and 33 levels on both and RSI/ROC to eye up, we need to remember that a little bit of upward activity can be expected up and until 5018$ and this is where you should place you stop loss.

TO CONCLUDE :

1. To the upside, given a break of 5111$ as first sign of confirmation and then after at 5335$ (you can trade between these two gaps), our maximum upside potential is capped to 5745-5788$ on a conservative basis with previous resistance being at this level. However, upsides of 5850-5950$ are still possible but when I say this is the most upside we can have with those clearly stated confirmation prices for price action, then I mean it.

2. I do not feel these levels will be achieved straight away though as I feel what is more likely is a to the stated downside targets of 4723$ on a conservative basis and 4450-4500$ on a more irrational move but regardless supports to the downside lay at this price with confirmation prices for this downside coming in at 4840$.

3. After, supports are found at these levels, there is a small chance that we may break through previous supporting and now a resistance at 5111$ but this is unlikely as this will be followed up by a retest of previous supporting and now they should be resistances.

4. In the medium term, we are still and this bull move will be short lived and guarantee to REKT many as they HODL up on holdings since they hear from ‘experts’ its bull run time per usual. Regardless, even given an inch into 6k and we are at previous Clear price floor and now should be as a clear of a resistance.

PLEASE SEE RELATED IDEAS DOWN BELOW 😉 & don’t forget to stay up to date with our calls by following our Instagram and telegram channels down below AND ON OUR TRADINGVIEW PAGE – CALL AFTER CALL CORRECT!

Published at Thu, 04 Apr 2019 19:01:15 +0000