was introduced in 2009 by an anonymous individual known as Satoshi Nakamoto. Since its inception, have become a hot topic of discussion in industry. As of now there are more than 2000 different floating on the crypto market and they are gaining popularity like never. Undoubtedly, they are expected to disrupt the global industry. The craze of crypto currencies has become so evident that one out of three citizens of Kenya these days holds a known as M-PESA . The advantages of are many, just to name a few, decentralization of assets, transparency, lower costs, fast transactions, an easy access to everyone and many more.

But, just as every has its darker side, over the time have been increasingly on the risk of misutilization for money laundering, terrorism funding, corruption, and fraud. The availability of to everyone and their increase in scale now possesses several risks for government and regulatory authorities. In recent times, several cases have surfaced where bitcoins were used for forgery and malpractices. Because of these factors, several countries have tagged the usage of illegal. Nevertheless, banning cryptos is unimaginable and adapting them is the need of the hour.

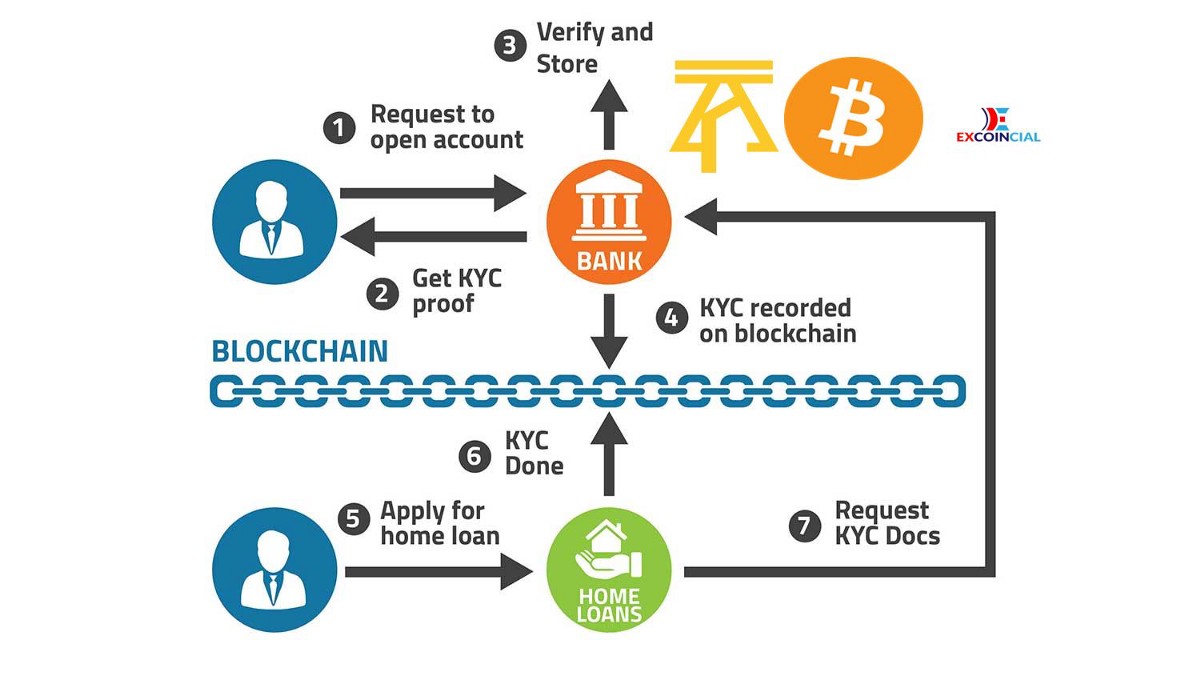

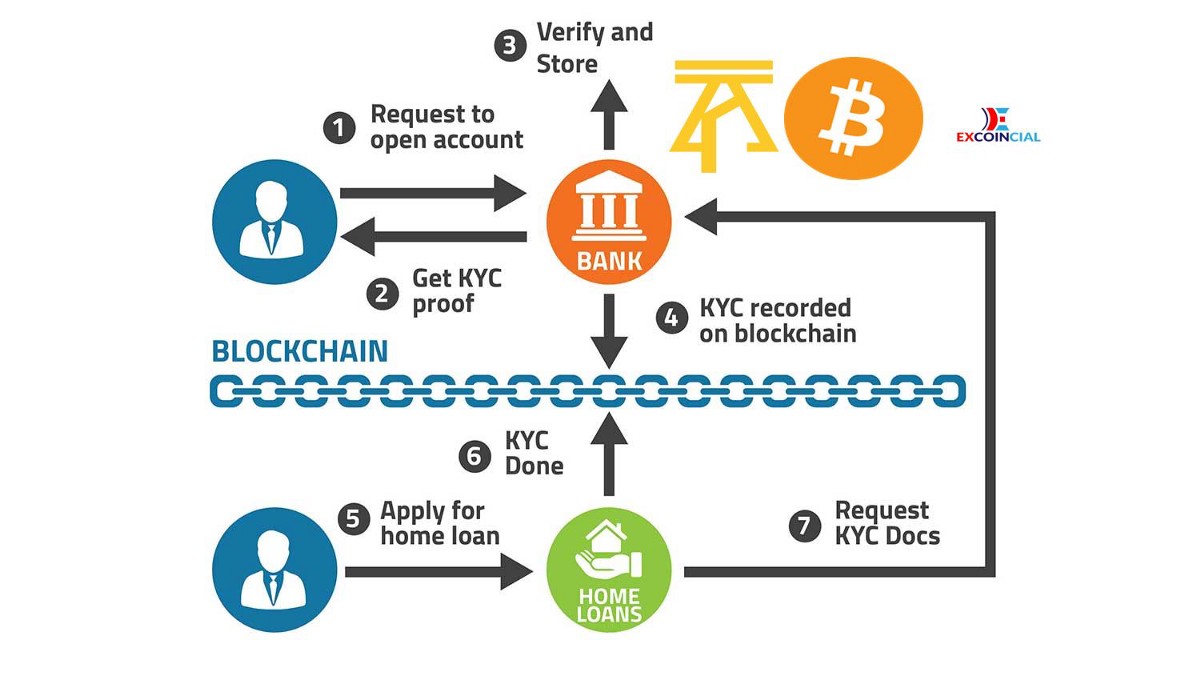

Because of the severe risks posed by frauds in , government authorities around the world have become increasingly vigilant and they are reframing their policy structures to enable risk-free transactions in . The implementation of KYC in and cryptos has now become somewhat mandatory in order to perform the transactions. The KYC plays the same role for an investor as a passport plays for a citizen. It is true that implementation of KYC stops an investor from being anonymous, but it is also capable of thwarting or minimizing several potential threats. Even with stringent market regulations, it is remarkable that market capitalization has reached to a whopping 134 billion dollars with 55% share going to the alone. And in 2019, volume of crypto trades will grow by more than 50 %.

Investors should know that the implementation of KYC is good for the security of their assets. KYC may look like a stringent condition initially, but there is a need to make them more simplified. Working on this line, EXCOINCIAL is one of the major crypto-exchanges operating in globally, which has made the KYC procedure very simple and hassle-free.

EXCOINCIAL is a trusted and secure exchange for which can be used for buying, selling and exchange of . In order to make an investment, an investor just need to sign-up on and go through the KYC procedure. Unlike several other exchanges where investors may have to wait for days or even weeks, EXCOINICAL KYC procedure is very simplistic and within minutes investors can start without compromising their security. The investor just needs to upload an ID document and a utility bill as a proof of identity. This is to make sure that the investor should not go through the of sharing unnecessary and critical information. Such an approach makes investors at ease and it develops a better trust in the services.

The platform promises to provide a flexibility to transact in more than eighty fiat currencies and pairs which include in AFRICUNIA BANK (AFCASH) (), Ether (ETH), (XRP) and many more. I believe needs no introduction but AFCASH is a new currency created by AFRICUNIA BANK in 2017 and it is poised to become one of the hot in the world. The total supply of which is 10 Billion crypto-coins with one AFCASH equalling one dollar. AFRICUNIA bank also has its own digital known as AFCASH WALLET which can be used to exchange and buy AFCASH and other currencies. The can also be used on mobile phones through their android application which can be downloaded on the following link.

AFRICUNIA BANK is the first African financial institution which is 100% digitally crowdfunded. It is based on digital technology and it provides a bridge between traditional and present-day driven financial setting. The bank will allow participation of almost anyone through a distribution structure which can be found on:

Published at Sat, 09 Mar 2019 10:05:18 +0000