Compound Finance

I’ve examined the smart contracts and the data produced by about 15 projects while working at , and Compound has been my favourite thus far.

At The Graph, we’ve built indexes (aka Subgraphs) of all the relevant data emitted and stored by these smart contracts. The Subgraphs we’ve built , and you can explore the mountains of data we make .

While exploring all these contracts and data, I came to a few realizations on what appears to work well on , and what doesn’t. Compounds smart contracts and their strategy make the most sense out of all the projects, and I can actually envision how they can make profit in the future.

There is no protocol token

In the last year a fair amount of projects decided to have no at all, and Compound is one of them. A can just complicate the protocol, or bring in a bunch of speculative traders. Legal problems are also hidden under the surface of some of these protocol , as some of them will end up being identified as securities.

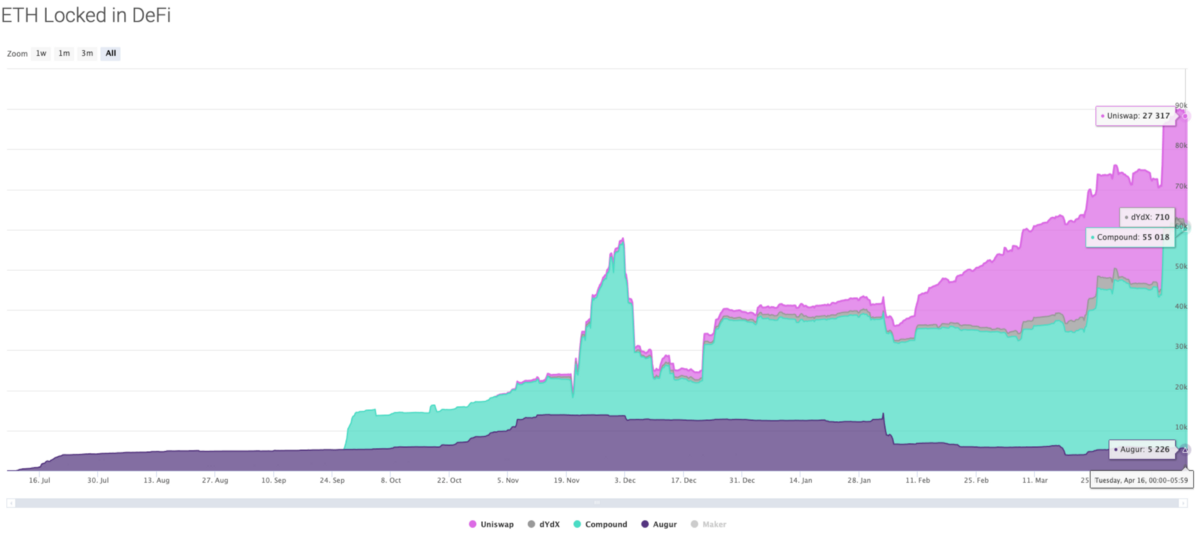

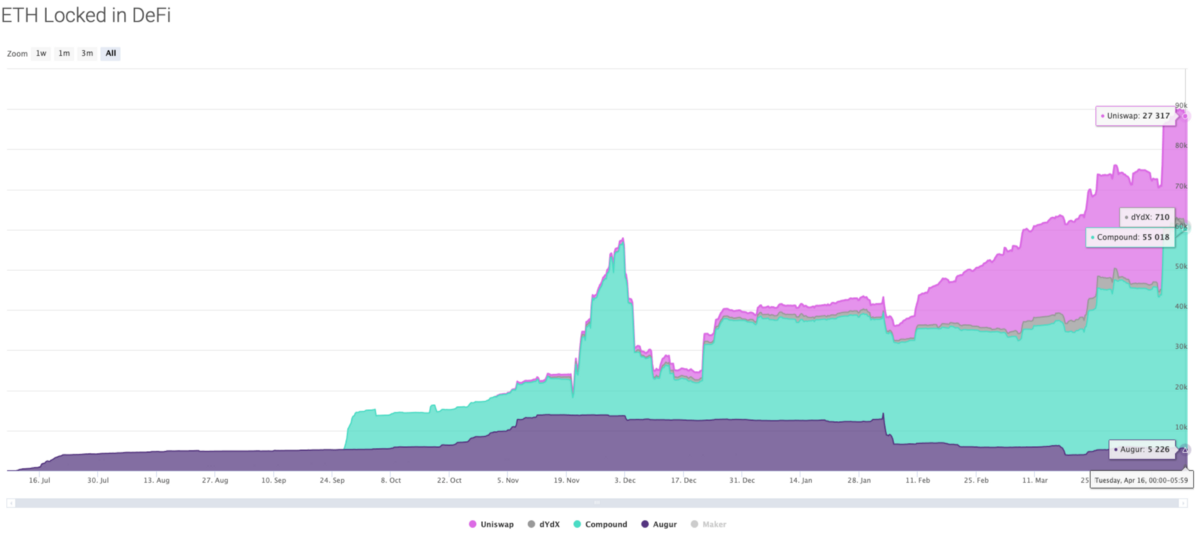

Protocols like Dharma, Compound, Uniswap and dY/dX do not have . And they each have real value stored in their smart contracts, as seen in the image above. They are starting to prove that a is not needed to build something useful in .

are only really needed when the network is large enough. ETH is used for ICOs, for locking up as collateral in DeFi, and as general purpose gas. These are good use cases that support the .

Right now there isn’t a good reason for Compound to have a network . Instead, they are focused on building a product that works, and getting a strong user base. But how does Compound actually plan to make money?

Protocol fees

Charging a small fee to engage with the Compound Protocol is a completely reasonable way to make money. The whole entire financial industry makes money by charging fees between 0–4%, on trillions of dollars worldwide. People don’t care about a small 0.25% fee, as long as the product is reliable and works.

If Compound incorporates a small fee which helps them build a public, transparent, upgradeable, globally available money market, the product they create will be well worth the fess accumulated over time.

Building a brand around the company will bring trust to platform, which will help bring more users. The brand and the experience thinking deeply about smart contract money markets will build a moat around the company, and protect against the risk of someone forking the code with a 0% fee. It is also unlikely that further development will happen on a 0% forked protocol. As cool as it would be, no one builds great products while working for free.

Let’s do some math

Over the last few months Compound has hovered around $30 million dollars locked up in value. The fee that the protocol uses in V1 is an origination fee on borrowing at 0.25%. This amounted to the as of April 26th 2018:

$34,943.34 in DAI

$4019.59 in WETH

$83.70 in ZRX

$350.22 in REP

$522.42 BAT

TOTAL = $ 44,469.27

This is since the day it was created, September 26th 2018. This is not a lot of money. But let’s consider the size of traditional money markets today.

The market size has been This is 10,000x larger than what Compound has been hovering around the last few months.

A well designed smart contract can be more efficient than the traditional money markets of today, making the cost of operating money markets cheaper, and thus reducing fees and friction for the end user.

When you combine that with the fact that even the smallest fee on $3 trillion dollars adds up to a HUGE sum of money, you start to understand why smart contract money markets are lucrative.

Other ways to profit

I am not sure what Compounds long term strategy is to make profit with their protocol. They might not plan to charge fees, and there are likely other avenues to explore that I haven’t thought about or expressed here.

Implemented with simplicity

There is something to be said about simplicity. It is often with complex financial instruments (i.e. 2008 backed securities), that risks are hidden in the facts and figures.

What is great about Compound is if you read the , it is easy to understand exactly what the protocol is aiming to accomplish. There are only a few smart contracts one needs to understand, and there are only 5 main functions users interact with the protocol through:

- Supply

- Withdraw

- Borrow

- Repay

- Liquidate

This simplicity, combined with the protocol being based on traditional money markets, which have been around for decades, make it extremely easy for even beginner users to grasp.

The ease at which the code can be read is important in open source development. It makes it much easier to attract open source developers to build on top of your protocol, since they can actually understand what it does.

This isn’t to say complexity is bad, it is just refreshing to see such a simple protocol work so well. Maker/Dai is extremely complex, and hard for outside developers to read with And even with this complexity, Maker/Dai is the most successful protocol on .

Both complexity and simplicity are needed in smart contracts, but it is likely that the simple protocols will appeal to more users.

Strategically decentralized

The code release strategy of Compound has become clear to me as I have followed the project. They work on their code in secret, and then release the smart contracts all at once in order to provide their product to the world. They did this with the Compound Money Market back in 2018, and now with that was recently announced.

The strategy here is keeping the code proprietary up until the last moment, and building a proprietary interface in parallel. Then you release the whole platform, and start attracting users and building the brand and trust of the company. This strategy protects against someone forking the code and launching right beside you. It would likely take at least a few weeks for a competitor to fork the code, understand it all, and build a safe and secure interface around it.

The next part of the strategy is to go right back to the drawing board when you release a new version of the protocol. Once Compound officially releases V2 on mainnet, you can bet they will start building out V3 with newer features. Thus allowing them to always stay a few steps ahead of anyone trying to fork their protocol.

This release strategy for DeFi products provides teams a distinct way to capture users, and it isn’t too different from traditional financial products strategies. Any bank can create an to invest in a single industry. But the first of its kind can corner the market, and can end up with billions under management. Copycat ETFs will end up being a shadow of the original.

Building DeFi products instead of building entire blockchains

Building a is hard. There are so many and competitors that tweak the protocol a bit, and claim to be better. But the reality is many of these blockchains will fail. There is only so much need for unique blockchains, and the network effects make it very hard to steal the momentum away from the current leaders.

But the beautiful thing about building a DeFi product is it can be created on any smart contract platform. Compound is working towards designing the best smart contract money markets in the world. Dharma is working to be the best in the world at peer-to-peer loan smart contracts. Because they are thinking about it deeper than anyone else, and they are building a reliable brand, they can build a moat around their product.

As long as they can learn to adapt quickly, there is no reason their protocols can’t be implemented on other platforms. It is likely in the next year we will start seeing smart contracts on Cosmos, Polkadot, Tezos, or other networks that allow for smart contracts.

With a DeFi product, you can keep your brand, and your web interface, and change the it runs on top of, and many of your users might not even notice!

Conclusion

Let’s sum up the most important points:

- Compound is a money market protocol built on Ethereum, which gives Ethereum users functionality such as shorting, and earning interest on otherwise idle assets.

- If a DeFi protocol can get enough assets under management, it can compete with the traditional banks at 0.1%–4% fees, and turn a profit.

- There is an estimated $3 trillion dollars in traditional Money Markets. That is a huge opportunity. , and all of these are opportunities in DeFi.

- They work on the protocol in secret, and then release it to the public when it is ready to be used. This gives them a distinct first mover advantage, that will allow them to build a brand and attract money to be stored within the protocol. This appears to be a realistic strategy for many DeFi applications, showing that useless protocol tokens are not needed.

- DeFi products can migrate to other smart contract platforms if Ethereum starts to lose ground.

The innovation happening in the DeFi space right now is incredible, and the opportunities are limitless. Over the next two decades we may see trillions of dollars change shift into DeFi, along with trillions of dollars in new digital assets that weren’t even possible without the invention of blockchains.

Published at Fri, 26 Apr 2019 14:58:33 +0000