While eth’s price fell for much of last year, forced closure of Collateralized Debt Positions (CDPs) counter-balanced dai sell-pressure. Now that eth’s price is rising, questions have been raised on whether it can keep the peg.

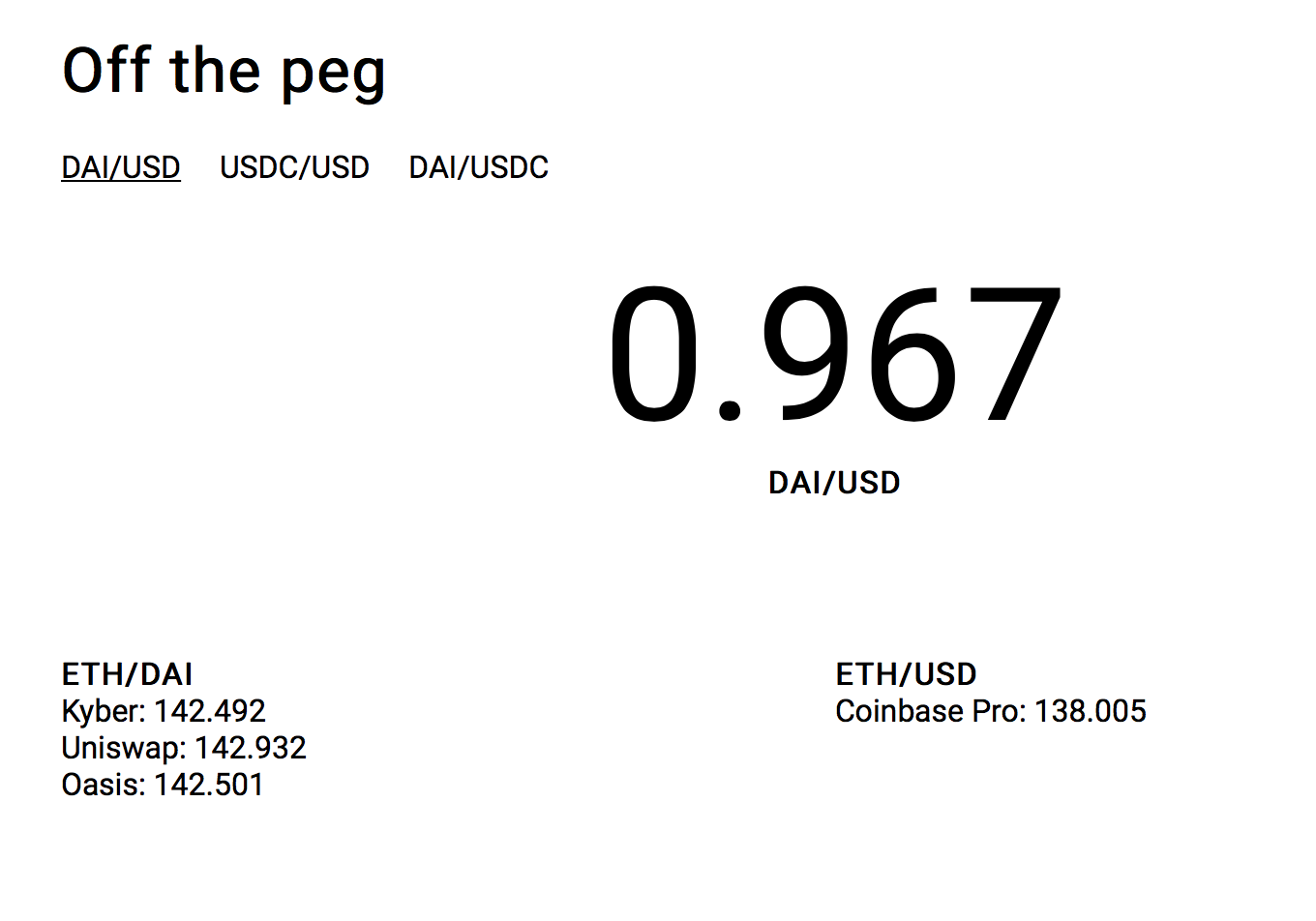

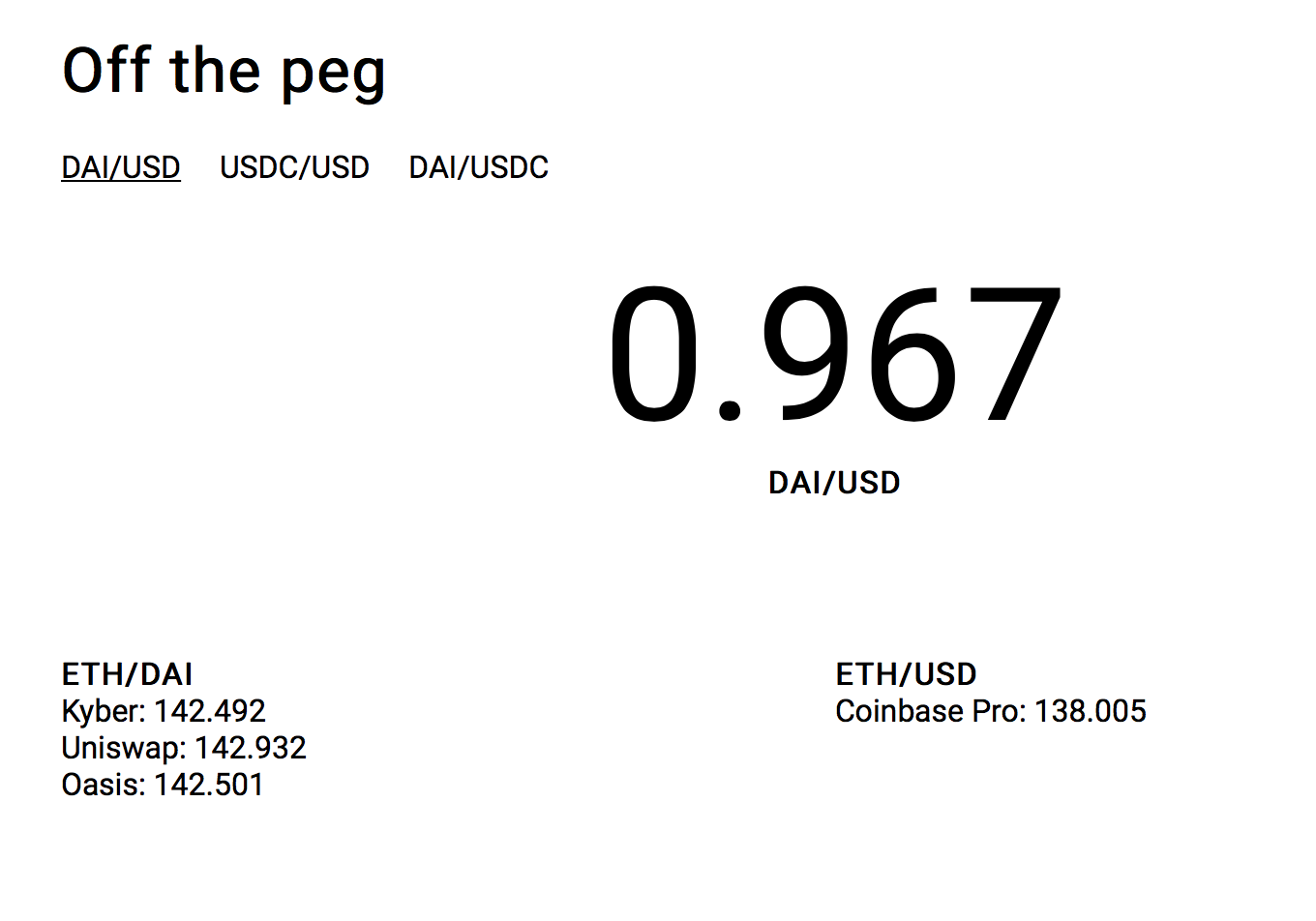

It hasn’t quite been able to do so for some time, at points falling to as low as $0.96 on Coinmarketcap which somewhat distorts the average by the inclusion of exchanges with fake volumes. So a new is out by MakerDAO devs (pictured above).

Last 50 days of vs from several DEXs from Lev at Spikes tend to correlate to CDP liquidations as keepers rush to get and cover debt. The big story is is consistently trading lower than 1 .

Seems like a stability fee hike is needed.

— Kenny Rowe (@kennyrowe)

There were two interest rate increases of 0.5% last month. That combined additional 1%, however, wasn’t having much of an effect.

That’s because the main use-case for dai has turned out to be decentralized and open margin trading. That is you lock say 10 eth, get 1,000 dai, then you buy with it 5 eth. Now you lock the 5 eth, get 500 dai, and repeat.

Obviously you risk getting called and losing it all, which is the primary concern for traders. A 1% yearly interest rate, by comparison, is kind of not at all a consideration.

So last week they hiked the interest rate by 2%, making it now a yearly 3.5%. Still, dai remains very much off the peg at the time of writing:

A proposal page for this 2% rate increase it is needed to force the closure of CDPs:

“An examination of the available data strongly suggests a Stability Fee increase is warranted. The exchange price of Dai across several major exchanges, such as Pro and Bitfinex, has been consistently hovering in the $0.975 to $0.985 range for 1-2 months. Decentralized exchanges with sufficient volume/liquidity, such as Eth2Dai, also confirm the same discrepancy.

Informal discussions with several large Dai market makers have suggested that inventory levels have run high, and balance sheet capacity has diminished. Informal polling through various community channels has also shown strong support for an increase.

Incentivizing CDP closures through a Stability Fee increase (thereby reducing outstanding Dai) is strongly viewed as the appropriate action.”

As can be seen, the supply of dai (market cap) has been rising and rising, doubling since December. Much of that newly created dai has probably been sold for eth. Thus, there’s too much inventory, or rather too much dai for . A research report , and we’ll quote at some length:

“When the Dai price is below the peg, CDP users with outstanding Dai may be able to profit through repaying their Dai debts cheaply. Anyone who issued Dai when it was at the peg (and then sold their Dai for ≈$1 in other assets) will be able to buy Dai at the market price and repay their debts for less than they received by selling the loaned Dai in the first place. Since the market price is below the pegged price, they get a discount and thus profit, as long as the discount is larger than the transaction fees and accumulated interest on their Dai debt.

Concretely: Alice opens a CDP and issues 1 Dai to herself, then sells it for $1. Dai later is at $0.90, so Alice buys 1 Dai for $0.90, repays her debt, retrieves her collateral, and pockets $0.10 in free profit. (This ignores transaction fees and interest, but you get the idea.)

When users repurchase Dai to repay their debts, they drive up market prices…

Note that this trade does not exactly depend on the Dai market price being below the peg. It depends on the market price being below the Dai price from when you originally issued your Dai. So you can make this trade and profit whenever Dai drops.

This means that this mechanism doesn’t just incentivize CDP users to buy back Dai when the Dai is below the peg; it incentivizes buying back Dai whenever the Dai price is below the price it was when you issued Dai.

Instead of creating demand for Dai at the peg, which would help it stabilize towards the peg, this mechanism creates demand at a cloud of different values around the peg, at the values at which users opened their CDPs and issued Dai.

Should Dai face volatility and its price start fluctuating, while people keep using CDPs to issue Dai, this mechanism will not only not help much, but, in the worst case scenario, could actually cause increased volatility.”

The volatility we have seen so far is pretty close to $1, but according to this research that might be because of what they call off-chain stability mechanisms. They say:

“Early on, the Maker team might stabilize Dai through off-chain funds. As the MKR currently has a much larger market cap than Dai, they can sell off MKR to generate off-chain reserves larger than Dai’s entire market cap. The team can then use the reserves to stabilize Dai in various ways.

They could put large buy orders right below the peg (buy walls) and large sell orders right above it (sell walls) on exchanges. Alternatively, they could give large amounts of capital to bots that defend the peg in a more dynamic way. They could also use the funds for dynamic market making, to ensure that Dai markets have sufficient liquidity at whatever price they are at…

It may be that Dai is currently being stabilized off-chain. Dai’s founder Rune has that a short crash in January was caused by a failure in one of their market making bots. It’s unclear exactly what funding source this bot is using.”

Rune says “a third party market making bot malfunctioned on bibox,” with Trustnodes unable to reach him for further comments in time for publishing. A representative from MakerDAO said:

“The foundation has a proprietary desk that contributes with data to the governance process, together with other desks such as Wyre,” as previously . Regarding the peg, he says:

“Dai has a soft peg to 1 USD, right now it is deviating more than what we would expect it to in the long run, so the community is very focused on engaging the governance process to adjust the stability fee to get the price closer around 1 USD. We’ve already seen a positive impact of the last stability fee increase, so it has been great validation that the governance process works as intended.”

The research further says dai can’t quite scale in part because MKR bots need to stabilize it, however they are working on a Dai Savings Rate (DSR). MakerDAO :

“A person who holds Dai can lock and unlock Dai into a DSR contract at any time. Once locked into the DSR contract, Dai continuously accrues, based on a global system variable called the DSR. There are no restrictions or fees for using DSR other than the gas required for locking and unlocking.

For example: If the DSR is 2%, a user who locks 100 Dai into DSR mode, and keeps it locked for a full year, would earn two additional Dai which will automatically be added to their when the Dai is unlocked. Anyone can ‘lock’ their Dai into DSR mode using a simple UI.

This creates a whole new dimension of incentives for balancing the supply and demand for Dai.”

Such return on investment would presumably increase demand for dai, thus counterbalancing any selling pressure from leveregers or individuals who use it as a plain loan, but to do so convert dai into USD.

If that increases demand for dai too much, they can then lower the savings rate, and vice versa. With this effectively being a decentralized central bank managing supply through the stability fee and demand through a savings rate. The Maker representative said:

“The Dai Savings Rate needs to be enabled via Governance Vote after we transitioned from Single Collateral Dai (SCD) to Multi Collateral Dai (MCD). It won’t be enabled immediately at launch because it needs to be at 0 to facilitate the large scale SCD to MCD upgrade process.”

He couldn’t provide an estimate of when MCD will launch, but even without such savings rate, the peg has held fairly well, but of course if that is due to MKR’s bots, then it is sort of cheating, which is perhaps to be expected at this very early stage.

Such bot peg would also limit capacity because there’s only so much MKR funds that can be utilized for that purpose.

With a savings rate, however, this might perhaps be able to scale, but naturally the system will have to go slowly with a supply limit of 100 million dai now close to being reached.

They’ll have to decide whether to increase it, just as they’ll have to decide whether to increase the stability fee further.

Copyrights Trustnodes.com

Published at Sun, 17 Mar 2019 15:12:12 +0000