In 2013, when first began asking investors to buy a then $80 , the line of conversation often ended with an abrupt no. “Nine times out of ten, they would just hang up the phone,” said Michael Moro, CEO of Genesis Trading and Genesis Trading. Now, as the pioneer cryptocurrency is crawling back from an imboninable crypto winter, venture capitalists, investors, and family offices are more eager than ever to get their hands on a slice of digital gold.

Decentralized Finance as an Institution

The second annual in New York opened on May 9, 2019, in the midst of a bustling . The investor-facing event brings together key players from the ecosystem all eager to capitalize on the myriad disruptive technologies that have emerged in recent times. More importantly, the collection of speakers and attendees are outlining a new trajectory for where the opportunities in the space are popping up.

“When we look at the space, we’re looking closely at how DeFi is panning out,” said of ConsenSys. One of the breakout projects on the side of things, that which ConsenSys has placed much of their focus, has been . The platform boasts a total of $300 million in collateral and is one of the first few examples of a successful crypto experiment. If batched with the rest of the crypto lending platforms, like the newly-launched , that figure moves closer to $400 million.

Experiment, however, is still the best word at this point. When speaking on the nascent features of crypto and blockchain projects, Cassatt underlined that:

“It’s still baby steps, of course, but the way decentralized finance is panning out, we see it blowing up traditional finance. This could even be to the extent that these technologies will replace the institutions we’re so interested in attracting.”

The toddler-like maturity of the space also comes with a host of unique challenges. If not for volatility, the often that surround the crypto space makes it even more difficult for startups to gather funding. For these reasons , formerly of the , placed the odds at a generous one successful investment in every ten. Others were slightly less optimistic.

, the founder of venture firm , expected to land a hit investment in the crypto space closer to one in every 50. Part of this, according to Jopanputra, has to do with the velocity of information which she explained as “one of the fastest ever experienced.”

Thus, a very high premium is placed on the entrepreneur and the team behind their project. Beyond that, the rise of more scientific approaches has brought special attention to “tokenonomics” and the power of compounding networks. Arriving at a positive result is, therefore, a mix of traditional evaluation as well as the added complexity of tokenized best-efforts.

It is for this last portion, as well as the uncertainty of how the sector will establish itself, that sends many investors running for the hills. of describes an aspect of this paradox as “.”

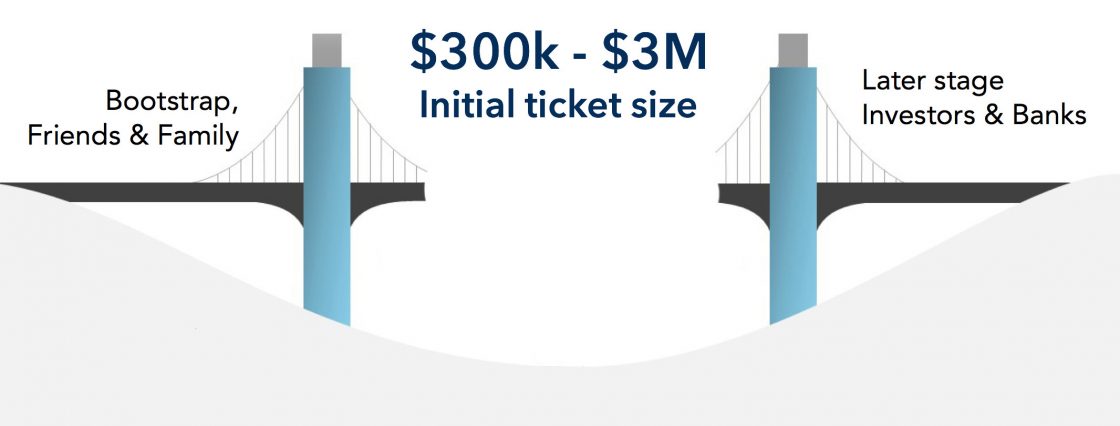

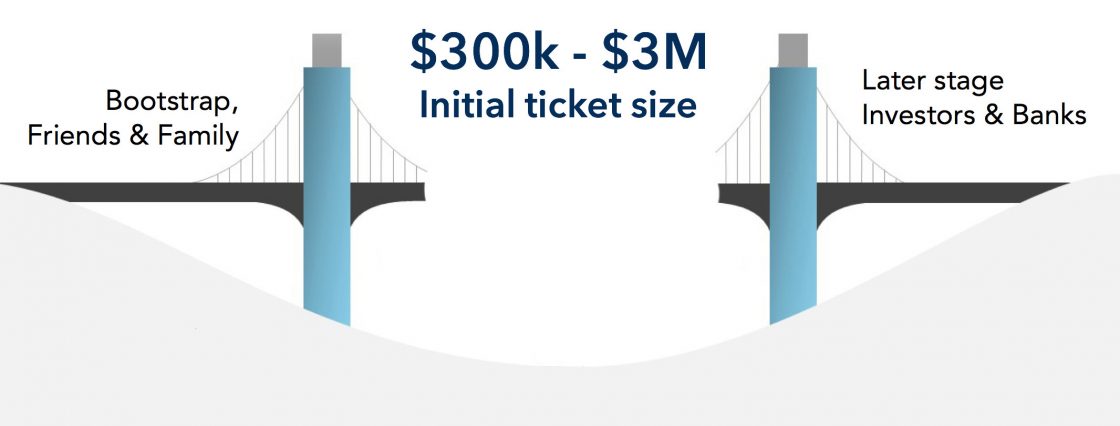

(Source: )

The thesis behind the Missing Middle position is that startups with solid fundamentals, a strong team, and a workable product rarely make it to the late-stage investor conversations. This is true for small and emerging businesses, but even more so for companies working in the crypto space. New and ambitious funds entering the space see this as a massive opportunity, however.

Filling a market need that brings these small companies to their next stage and hands them off to institutions is likely a good bet for some time to come. Eventually though, and in typical open finance sentiment, institutions could still be ousted entirely from the equation.

The future, if initially desperate to attract the Fidelity’s and CME’s of traditional finance, may later politely dismiss them in favor of a superior technology.

Published at Sun, 12 May 2019 03:03:08 +0000