by

I’ve always believed that life strongly rewards curiosity: humans are optimized for constant learning and growth in order to socialize and solve problems. One of the reasons blockchain technology is so fascinating to me is that it’s so hard and has so many evolving unknowns. When I joined , I did so in part because decentralized identity promises to be connective tissue across many blockchain use cases and there is still so much to learn. As Chief Blockchain Evangelist, I wear three main hats:

finding ecosystem partners who will build on our open-source identity platform,listening to what’s happening in the industry to inform our team’s future design and product decisions, andeducating the market about our philosophy on identity on the blockchain and what it means to own and manage your digital self-sovereign identity

That means I get to learn, as I go, about the world of decentralized identifiers, decentralized public key infrastructure, decentralized key management systems, verifiable credentials / claims, zero-knowledge proofs, and many other exciting, applied identity concepts. To say this is both difficult and fun is an understatement, but the fact that I actually get to share my learnings with the world is just plain cool.

Last week, I marked up a whiteboard to map some new ideas for myself, specifically around what a decentralized identifier (DID) is. I was trying to assimilate some of what I’d learned in the preceding few days after attending the in Washington, DC, listening to panelists, talking to various identity professionals, and reading through the. The whiteboarding exercise was about locating and contextualizing some of the basic concepts I’d picked up, and in this first Learning Together Series blog, I’d like to share some of what clicked for me that morning and what I’ve been thinking about since.

A New Class of Identifier

A DID (pronounced as “did” by some and “dee I dee” by others) stands for . It looks like this:

did:life:abc123

Why it’s formatted that way, I’ll return to at some later time. What job each of those three namestrings has, I’ll also return to at a later time. (The third string in the DID is actually far longer, with no current upper limit, yet).

As I was whiteboarding that morning, I found it resonant that a DID is a machine-friendly identifier. It’s machine-friendly because it’s intended to be read by computers and machines, as opposed to humans. Once decentralized identifiers become commonplace over the coming years, computers and machines will interact with those identifiers in a variety of ways. Up to that point, I hadn’t considered that, or, for that matter, room numbers in office buildings, aisle numbers in grocery stores, and terminal or gate numbers in airports are all examples of human-friendly identifiers. These are simply ways of finding specific persons or places in order to interact with them in some specific way, based on the type of identifier. For example, we use names to locate, address, or reference particular individuals. We use addresses to navigate to locations or send mail to others or have items we buy sent to ourselves. And we use website URLs to literally locate resources online — LinkedIn, Medium, or any of the other in the world. So identifiers make it easy for humans to interact with other humans and coordinate the exchange of information, goods, or work; intriguingly, the context of exchange shifts as technology advances (e.g., phone numbers can now be used to call, text, or even ).

In the coming world of blockchain-based identity, computers and machines will need machine-friendly identifiers to carry out important new functions such as enabling sovereign identity management, managing user public keys, and accessing smart contracts with instructions regarding the creation, revocation, update, or deletion of those identifiers. In my example DID (did:life:abc123), the third namestring (‘abc123’) functions as the location of the smart contract tied to the owner of the DID. The owner, by definition, controls the private keys needed to prove ownership of and control their DID at will. In the lifeID model of blockchain-based identity, the smart contract associated with the DID will live on a blockchain, and computers on a ledger or other network will need to know where to locate the contract (i.e., which blockchain and where) in order to perform the work requested by the owning entity. This entity, by the way, can be a human user, a company/organization, or even an individual IoT device. A DID represents a unique digital relationship between any combination of two users, organizations, or devices.

In the next article in this series, I’ll explore what I’ve learned about each of the three namestrings — the DID prefix, the DID method / schema, and the smart contract address — in greater detail.

Thanks for reading my first article in our Learning Together Series, and I look forward to your questions and comments!

You can also follow me on LinkedIn, where I’m quite active: .

Be sure to follow our team on Twitter at as well.

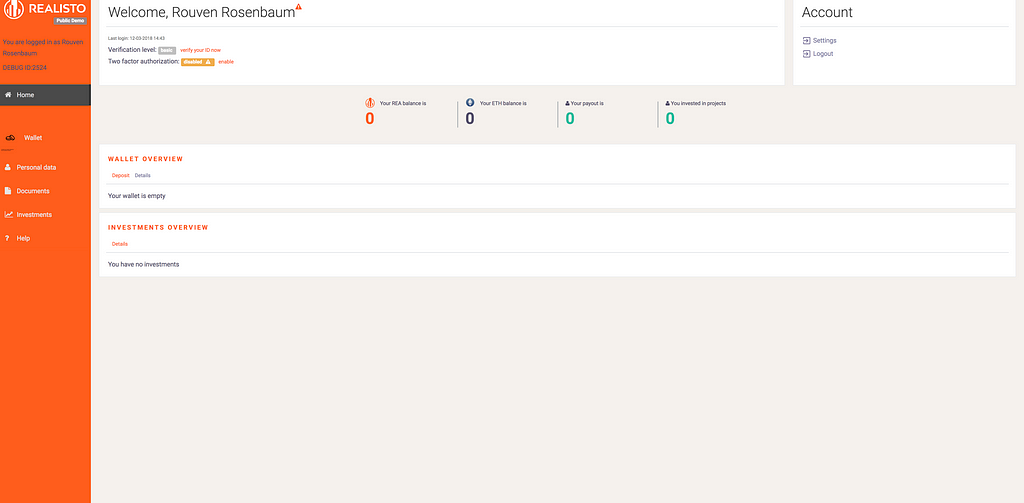

We are simply doing everything we can to quickly present you with a fully functional beta of our platform. For the full launch of REALISTO we need to be in full compliance with the regulatory environment in Germany. This will require more time than we have initially anticipated. Unfortunately this has impact on the launch of the final Realisto Platform, this does not stop us from emitting REA backed projects with great ROI for you. We are aiming to deliver a proof of concept property soon.

The crypto business is subsumed into the existing framework of rules. Because these rules were not made with something like cryptocurrencies and token in mind, they are sometimes an ill fit, and are prone to produce surprising conclusions. Our legal team has now found out, that REALISTO will need to apply for a certain type of license from the German regulatory body BaFin, called a “payment provider license” to conduct business according to the business model we are proposing. To give you the precise lay-of-the-land, we need to become a little bit technical to explain fully the intricacies of the problem in hand.

Crypto markets are fraught with enormous volatility, with cryptocurrencies hitting new highs followed by deep dips, then recover, then hitting another low. This happens within minutes, hours. As project emitters (those who use the platform to capitalize their projects) can´t afford to bear the risk of falling currency prices, and since REALISTO’s business model forbids to take on this risk entirely onto itself (nobody would make any money), the model for cryptocurrency payment could look like this: When a user wants to invest into a project on the platform, the REALISTO platform receive cryptocurrency from him.

At the moment when the Investors digitally signs the investment contract. We then convert the crypto funds into fiat money. These investments are then conveyed by us to the token emitters,so that the emitters may real-world capitalize their projects.

This is the only solution to fixing a price at the time of the investment which forms the basis of all subsequent dealings. Another problem consists in the fact that in Europe there exists by law the right to withdrawal from investment contracts if the investors is a private entity. It follows, the only possible way of conducting such a deal is an “on the spot” exchange of the cryptocurrency funds involved. This, however, entails the right of the investor to withdraw from the contract and be refunded in fiat money at the market-value currency price, fixed at the time the exchange has been made originally. A setup like this requires the above mentioned payment processor licence.

Originally, before we were confronted with this, we were under the impression that these requirements might be dealt with by securing the services of a partner who is licensed in Europe. It turned out, that such firms would also have to be licensed in Germany and this new requirement is due to stricter financial regulation compared to the rest of Europe.

Another issue that is surfacing right now is that global regulation of cryptocurrencies and, especially the token economy, is imminent! Of course, you all also know, that the “Utility Token” trick is no longer working: namely, that type of token that pretended not to be a “security” in the sense of the law, because it claims not to bear the functionalities of a security. But of course, it does. At this time, all token that constitute shares in a venture, no matter what their other functionalities might or might not be, are for all intents and purpose now deemed “Security Token”. For this reason, crypto exchanges around the world could come under intense pressure for offering trading of those disguised securities.

Since there is currently no crypto-exchange licensed to trade security token we will have to find a partner with that licence to list the tokens our emitters on the platform are looking to emit.

Release of Platform Beta

Meanwhile, we will very soon roll out a beta version of the platform. The beta already interacts seamlessly with the blockchain, and we can safely say that from the tech standpoint we will be ready for action when the license has come through. Please keep in mind that fully 90% of all ICOs simply fall flat on their faces, and those who initiated them just pack up and make for the hills. We at REALISTO, however, strongly believe in the future of our project. We will keep at it, diligently working through the changing aspects of the crypto business and the vagaries connected with it. We are aware of our responsibility for our investor’s money. And by going the way to become a fully regulated platform with an exchange annex, we are making good on our promise to turn REALISTO into a highly profitable venture!

Due to the recent unforeseeable developments in the market, we decided to call off the second funding round. Instead we will burn the total amount of 2,000,000 REA and the corresponding amount of team tokens.

The new total supply of REA will be 1,429,667.586182092519814916 REA

The tokens will be burnt today, April 5th at 22:30 GMT +1

Thank you for your ongoing support,

Rouven & Leonard

Hey guys — we are ecstatic to announce that LiveCoinWatch has listed ARTIS and you can now see a good overview of the newest developments of the project as the dashboard includes a twitter and reddit windows 🙂

Forward Together!

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.