Our mission at Coinbase is to create an open financial system for the world. We take this mission seriously: it’s the guiding light for every decision we make, and one of the reasons we recently launched a . These offerings are bringing new capital into the space, facilitating more efficient price discovery and driving methods for safer storage — all of which helps move us closer to an open financial system.

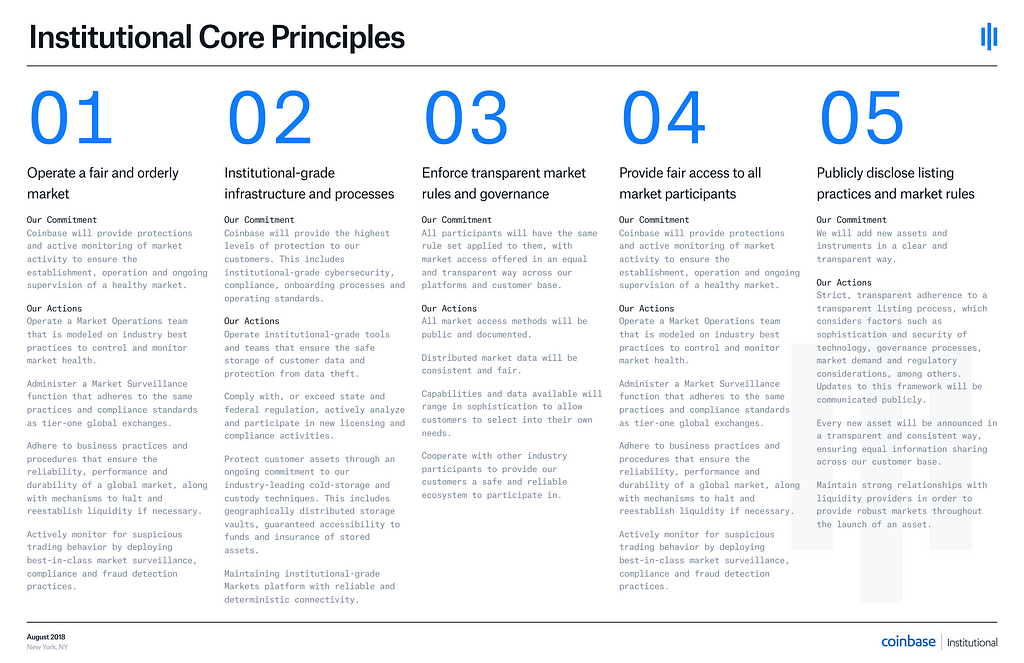

Today, we’re sharing a set of core principles that will guide our institutional business. This set of fundamental beliefs will act as our North Star as we design, develop, and operate our products. Ultimately, we intend for these core principles to drive us toward our goal of operating the most trusted venue for storing, trading, and interacting with the world of cryptocurrency.

Principle One: Operate a fair and orderly market

Our commitment: Coinbase will provide protections and active monitoring of market activity to ensure the establishment, operation and ongoing supervision of a healthy market.

Our actions:

Operate a Market Operations team that is modeled on industry best practices to control and monitor market healthAdminister a Market Surveillance function that adheres to the same practices and compliance standards as tier-one global exchangesAdhere to business practices and procedures that ensure the reliability, performance and durability of a global market, along with mechanisms to halt and reestablish liquidity if necessaryActively monitor for suspicious trading behavior by deploying best-in-class market surveillance, compliance and fraud detection practices

Principle Two: Protect our customers with institutional-grade infrastructure and processes

Our commitment: Coinbase will provide the highest levels of protection to our customers. This includes institutional-grade cybersecurity, compliance, onboarding processes and operating standards.

Our actions:

Operate institutional-grade tools and teams that ensure the safe storage of customer data and protection from data theftComply with, or exceed state and federal regulation, actively analyze and participate in new licensing and compliance activitiesProtect customer assets through an ongoing commitment to our industry-leading cold-storage and custody techniques. This includes geographically distributed storage vaults, guaranteed accessibility to funds and insurance of stored assetsMaintaining institutional-grade Markets platform with reliable and deterministic connectivity

Principle Three: Enforce transparent market rules and governance

Our commitment: All market participants will have consistent access to current market rules, including a , developed specifically for the unique structure and dynamics of crypto assets.

Our actions:

Provide public trading rules and policies that are fairly applied to all market participantsPublish transparent trading fees and incentive programsClearly communicate market capabilities such as order minimums/maximums, execution options, trading volumes, and maintenance schedulesProhibit and actively monitor for malicious or deceptive trading practicesFollow a documented process for trading halts and the opening and closing of marketsCommit to ongoing independent third-party audits to ensure compliance with applicable regulations and industry standards

Principle Four: Provide fair access to all market participants

Our commitment: All participants will have the same rule set applied to them, with market access offered in an equal and transparent way across our platforms and customer base.

Our actions:

All market access methods will be public and documentedDistributed market data will be consistent and fairCapabilities and data available will range in sophistication to allow customers to select into their own needsCooperate with other industry participants to provide our customers a safe and reliable ecosystem to participate in

Principle Five: Publicly disclose listing practices and market rules

Our commitment: We will add new assets and instruments in a clear and transparent way.

Our actions:

Strict, transparent adherence to a transparent listing process, which considers factors such as sophistication and security of technology, governance processes, market demand and regulatory considerations, among others. Updates to this framework will be communicated publiclyEvery new asset will be announced in a transparent and consistent way, ensuring equal information sharing across our customer baseMaintain strong relationships with liquidity providers in order to provide robust markets throughout the launch of an asset

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

The cryptocurrency market is maturing rapidly as more sophisticated institutional participants enter the space. In fact, in the past few months over 100 hedge funds were created that exclusively invest in and trade cryptocurrency. Some of the world’s largest financial institutions have also recently announced their plans to begin trading cryptocurrency.

At Coinbase, we welcome these developments as they help accelerate the world’s adoption of cryptocurrency by bringing new capital, greater awareness, and additional infrastructure to the space. This movement requires institutional grade products and services, something Coinbase has been developing with leading institutions and which we are proud to formally launch today.

Coinbase Custody to Launch in Partnership with SEC-regulated Broker-Dealer

We have leveraged our experience safely storing more than $20 billion of cryptocurrency to create , the most secure crypto storage solution available. In partnership with an SEC-regulated broker-dealer, Coinbase Custody is proud to offer a service that couples Coinbase’s cryptocurrency security excellence with third-party auditing and financial reporting validation that operates at the high standard of an SEC-regulated, custodial broker-dealer.

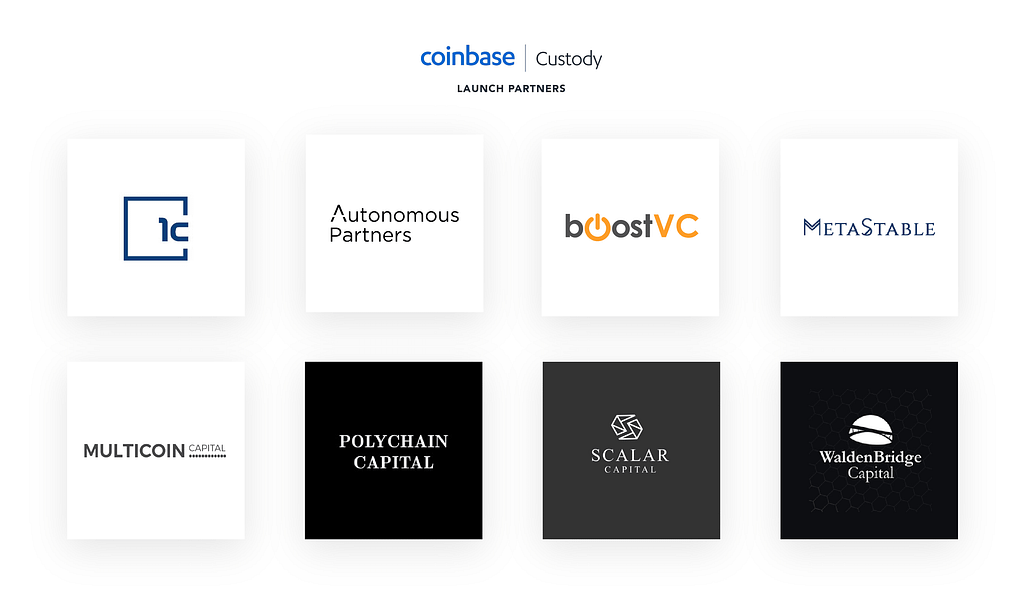

Our Coinbase Custody launch partners are all leading institutions in the crypto industry, including:

If you’re an institution interested in a custody solution, to receive more information about Coinbase Custody.

Introducing Coinbase Markets

Coinbase already offers the deepest pool of liquidity to the largest number of participants in the cryptocurrency space. We intend to continue developing this electronic marketplace, known as Coinbase Markets, by opening a new engineering office in Chicago and cementing Coinbase as the leading cryptocurrency exchange.

Coinbase Markets provides a centralized pool of liquidity for all Coinbase products. Over the course of the year Coinbase Markets will introduce new features like low latency performance, on-premise datacenter colocation services, institutional connectivity and access, and settlement and clearing services. These additions will allow for a more efficient price discovery process to occur, creating tighter markets, deeper liquidity, and increased certainty of execution.

We are thrilled to open an office in Chicago and have access to a large talent pool of engineers with deep exchange infrastructure experience. This office will serve as the home for our Coinbase Markets team and enable us to continue offering the most performant and reliable cryptocurrency exchange. Chicago is an ideal location for our newest Coinbase office and we hope our investment will continue to position the city as a growing hub for technological innovation.

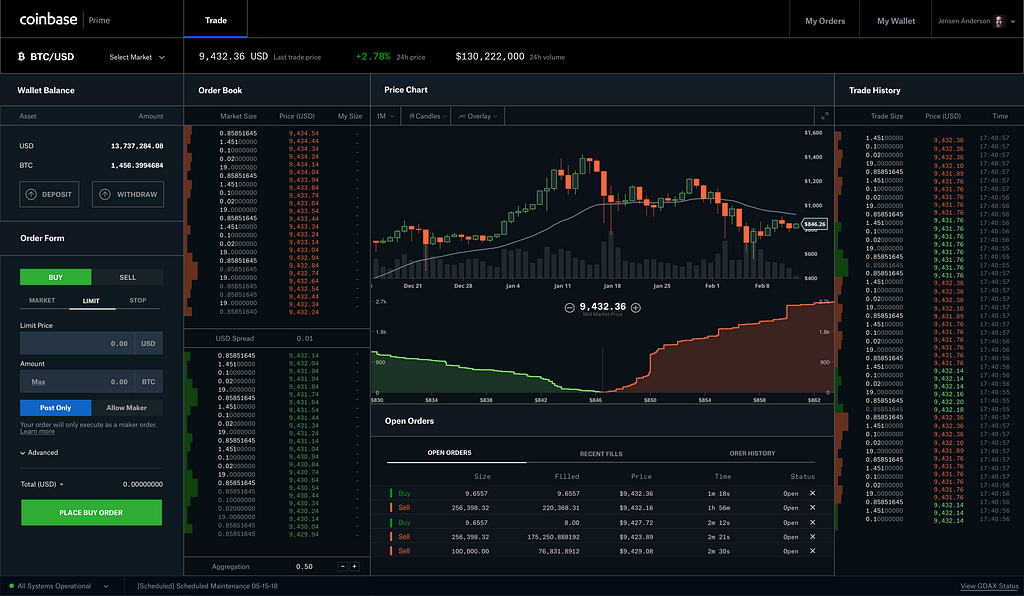

Launching Coinbase Prime

We are also excited to announce the launch of , a new platform designed specifically to provide a suite of tools and services that institutional investors rely on when trading cryptocurrency.

This product will fill a missing piece of critical infrastructure needed for institutions. Over the course of the year we intend to offer lending and margin financing products to qualified clients, high touch and low touch execution services like over-the-counter (OTC) trading and algorithmic orders, and new market data and research products. We will also introduce platform improvements like multi-user permissions and whitelisted withdrawal addresses.

We believe Coinbase Prime will accelerate adoption of cryptocurrency worldwide and we are excited to help institutions everywhere participate in this emerging asset class. To learn more or sign up as an institution, check out .

The Coinbase Institutional Coverage Group

We understand that institutions need more than great products, they need great service too. Our Institutional Coverage group is focused exclusively on serving the needs of institutional clients by providing sales, sales trading, research, market operations, and client services support. This group, headquartered in our New York City office, brings years of diverse and relevant institutional experience from firms such as the New York Stock Exchange, Morgan Stanley, and the SEC and CFTC.

By guiding clients through the onboarding process and advising on execution strategies, this team will deliver a best-in-class client experience. We are proud to offer personalized white-glove service and help institutional investors navigate the increasingly complex world of cryptocurrency investing.

As institutions continue to enter the cryptocurrency market, we are committed to building the products and services that uniquely meet their needs. We believe our suite of products and dedicated Institutional Coverage group will accelerate the rate of institutional adoption and create a more mature and diverse market. If you’re interested joining the Coinbase Institutional team, check out our .

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.