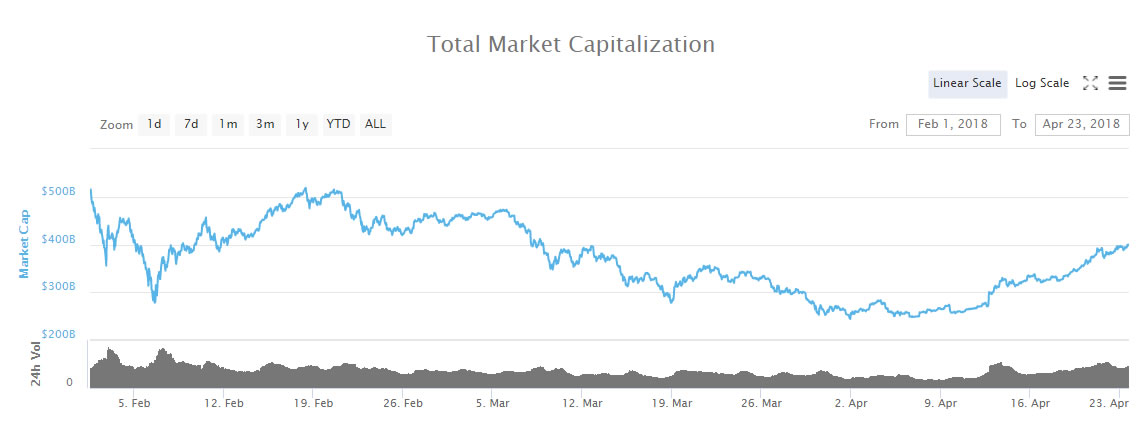

Even if there are more Fortune 500 corporations and governments interested in using ; it doesn’t change the fact that we are still in a prolonged cryptocurrency that is continuing from last year. For cryptocurrency startups, it’s not exactly a prime time to raise money. Despite market conditions, crypto startup Polkadot is still $60 million according to The Wall Street Journal.

This would occur through a token sale that values all of the company’s tokens at 1.2 billion. This would include all tokens in circulation as well as those which are not yet issued.

Raising Funds with Bears and Bulls Alike

One of the reasons that is a high-profile cryptocurrency startup is because it was founded by none other than co-founder Gavin Wood. The company employs about 26 people, and previously raised a significant amount of money in October 2017, during ’s bull run. Specifically, Polkadot raised $144 million in a token sale at that time. The company is also backed by high-profile venture capital firms such as and .

Polkadot is a project of the , dedicated specifically to the vision of a decentralized internet. The foundation is based in Zug, Switzerland, what many consider to be “,” or the Silicon Valley for blockchain startups.

Advertisement

Advertisement

The entire project is dedicated to blockchain interoperability. Ryan Zurrer, a director at Web3 Foundation, stats that Polkadot will “allow cross-chain messaging” and “bring blockchain out the siloed era.”

This obviously isn’t the best time for cryptocurrency startups to ask for money, and there are many cryptocurrency-related companies that are either suffering, , or restructuring.

For example, another individual involved with Ethereum since very early on, and has since become a billionaire, Joseph Lubin, has struggled with his own startup, . The company has had to lay off a significant part of its staff, although Lubin has about the fact that the company is “healthy.”

Another firm that has been in the red is Mike Novogratz-led Galaxy Digital, which has lost a significant amount of money throughout the bear market, losing millions per year, as BTCManager . Interestingly enough, Galaxy Digital just for a “crypto credit fund,” which many take as a sign that there is still some hope for cryptocurrency startups that are struggling for cash.

Published at Sat, 26 Jan 2019 13:10:28 +0000