India has proven to be a major region for bitcoin activity. Not all of the ventures in this country are completely legitimate, unfortunately. Two leaders of a notorious cryptocurrency scam were arrested earlier this week. Amit and Vivek Bhardwaj are the individuals responsible for creating some of the bitcoin MLM schemes active in India.

Ending bitcoin Scams in India

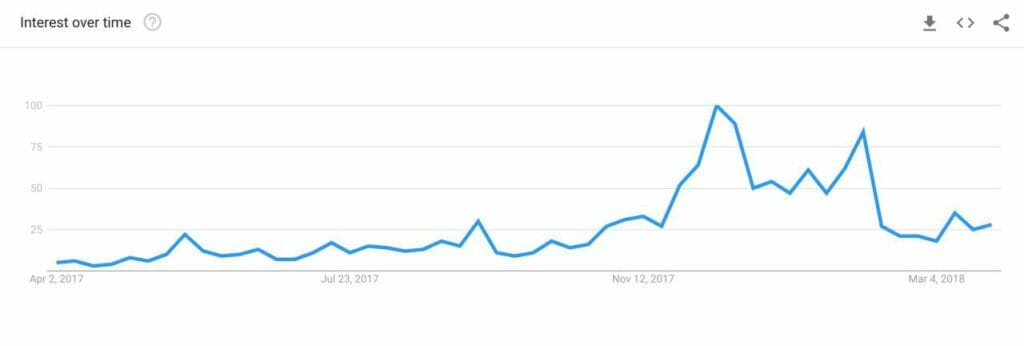

Even though the Indian government is still bitcoin regulation, cryptocurrency is booming in the region. Local exchanges note significant growth every quarter and it seems this trend will continue for some time. It has now become evident not everyone is buying bitcoin for “regular” purposes. A lot of Indians also invested in a network of bitcoin MLM scams which have plagued the country for quite some time now.

These particular scams are the of Amit and Vivek Bhardwaj. Both individuals have defrauded close to 8,000 local residents. Although the full damage remains unknown, reports indicate up to RS 2,000 crore may have been stolen from investors. Their arrest is the direct result of a lengthy investigation by the Pune city police.

A total of three companies were under investigation by the police. GB Minors, Gain bitcoin, and GB21 are all part of the same fraudulent scheme ring. It is not the first time people connected with these scams are arrested. In total, nearly a dozen individuals have been apprehended in the past few months. It is evident a lot of people were lured in by the promised high returns all of these companies offer.

Beware of MLM Programs

Similar to most scams, these bitcoin MLM programs offer high returns on investment. For the Bhardwaj brothers, promising 10% or more is not uncommon. These returns were expected to materialize over the course of 18 months. Given the volatile nature of all cryptocurrencies, guaranteed returns are simply unrealistic.

These MLM schemes eventually started facing a lot of backlash. Defrauded investors filed police reports in different cities and provinces. With a total of 25 complaints, the police had no choice but to further investigate the matter. Most users never saw any return on investment and eventually only lost money due to these scams.

For now, the investigation is still ongoing. Local police officials are convinced there are other promoters still active as of right now. A total of 32 bitcoin and 79.99 Ether has been recovered so far. A vast sum of cash is also seized, which is a positive sign. Returning the lost money to investors will be a different matter altogether.

Published at Fri, 06 Apr 2018 12:51:24 +0000