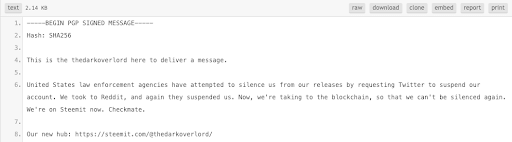

The blockchain-powered blogging platform Steemit is being accused of centralization and censorship. On Jan. 7, 2019, the hacker group The Dark Overlord had its account banned from Steemit by a developer known as ‘Jredbeard’ for violating the company’s terms of service agreement.

Also Read:

Steemit Bans 9/11 Whistleblower Account

However, it seems publishing classified 9/11 data is not looked upon favorably by those who run Steemit. On Jan. 7, 2019, the Steemit shows the developer known as ‘Jredbeard’ appended the account ‘thedarkoverlord’ to the protocol’s ‘GDPRUserList.js’ section. Essentially this means the account was banned from using the website for violating Steemit’s terms of service (ToS) agreement. The action has also infuriated some members of the Steemit community as posts about the subject can be seen on the project’s Reddit page r/steemit.

One particular post :

Steemit has censored the account of the Dark Overlords!! What was the point, Steemit?

Uncensorable Blockchain Platforms Exist

Interestingly enough, some Steemit proponents defended the action and explained how The Dark Overlord account was only banned from the official Steemit website, noting that the group’s posts could still be seen on alternative sites like Busy.org. Moreover, other cryptocurrency community members discussed other blockchain services that would help The Dark Overlord dump the data in a truly immutable fashion.

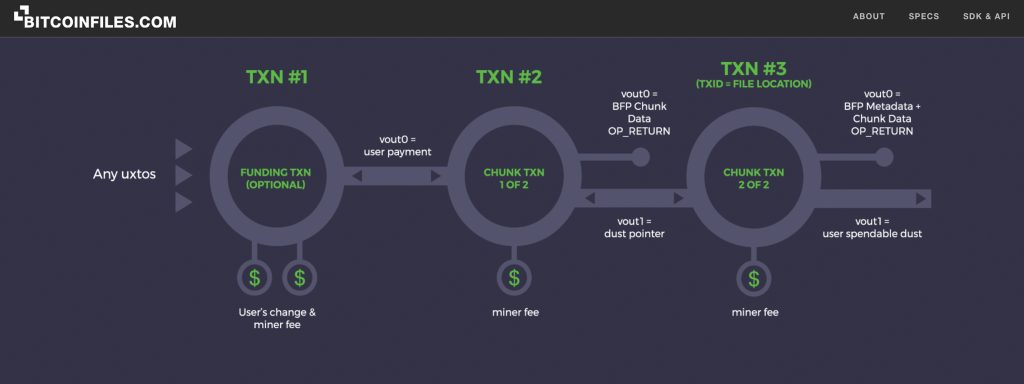

The hacker group could hypothetically utilize platforms like and to communicate to the public and dump classified files without the risk of takedown. For instance, Memo acts like Twitter but every action is recorded into the bitcoin $BTC Cash (BCH) blockchain. The posts cannot be taken down after they are etched into the BCH chain and one individual even every verse in the King James Bible into the blockchain. Another example of a tool that could help whistleblowers is the bitcoin $BTCfiles protocol developed by the BCH programmers James Cramer, Attila Aros, and Hapticpilot.

Bitcoinfiles is a file-sharing platform that allows anyone to upload any type of media file to both the protocol and the bitcoin $BTC Cash blockchain. Once the files are recorded into the chain they can be shared widely and found easily using a blockchain explorer or queried on the Bitdb network. There is no developer or arbitrary individual who can delete the files once they are appended to the network and IPFS files tied to the BCH chain can be shared with anyone in the world using a simple URI.

Over the last year, and censorship have continued to increase, but cryptocurrency and blockchain advocates believe it should not happen on their turf. It is obvious that centralized entities on the web will persist and suppress dissident voices and whistleblowers. As a result, blockchain applications that fight against this behavior will be welcomed with open arms by those who cherish the ability to speak freely.

What do you think about the hacker group The Dark Overlord being removed from the Steemit website? What media sharing platforms would you recommend that record immutable data onchain? Let us know what you think about this subject in the comments section below.

Images via Shutterstock, Memo.cash, bitcoin $BTCfiles.com, and Steemit.

At bitcoin $BTC.com there’s a bunch of free helpful services. For instance, have you seen our page? You can even look up the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post appeared first on .

is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

source:

Published at Thu, 10 Jan 2019 00:20:11 +0000