Once the search results pop up, click ‘XYO / ETH’ to bring up the menu.

6) Determine Your Trade Type

At this point, you have a few options in regards to the price at which you’re willing to trade.

Stop orders are a bit complex, so we’ll stick to Limit and Market orders for now.

Limit orders give you the option of making a or purchase at prices that differ from the going rate.

Check the asset’s buy and sell prices — located to the right of the menu — to get a feel for current trade prices.

If you’re patient willing to wait days or weeks until your price eventually hits, you can use limit orders to name your own price.

But if you want your crypto like right now, place a market order instead.

A market order lets you buy immediately, at the going market rate. And the system automatically calculates the trade for you.

You can use the percentage boxes — 25, 50, 75, 100 — to allocate only that percentage of an asset to one given trade.

7) Execute the Trade

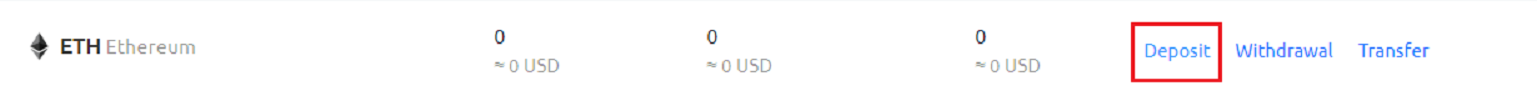

Rather than wait for a limit order to clear, I’m 100% of my $ETH holdings for $XYO at the current market price:

In roughly one second, the trade occurs, and my account’s $ETH supply is empty. And in its place are 4,275 $XYO .

In case you’re unaware of the risks, I’ll spell it out for you:

Don’t leave significant amounts of crypto on exchanges!

The saying goes, “not your keys, not your crypto.” Since KuCoin holds your accounts private keys, they technically own your crypto.

Although it’s initially counterintuitive, it’s true. I sent my new from KuCoin to an external before even writing this sentence.

So, where can you stash your $XYO ?

Well, since XYO’s platform lies on top of the network, most $ETH wallets can hold the project’s native .

Don’t have an ? Here’s one that’s free and secure — the brings ETH to your browser.

And for the utmost in crypto security, use a .

Published at Sun, 14 Apr 2019 23:11:29 +0000