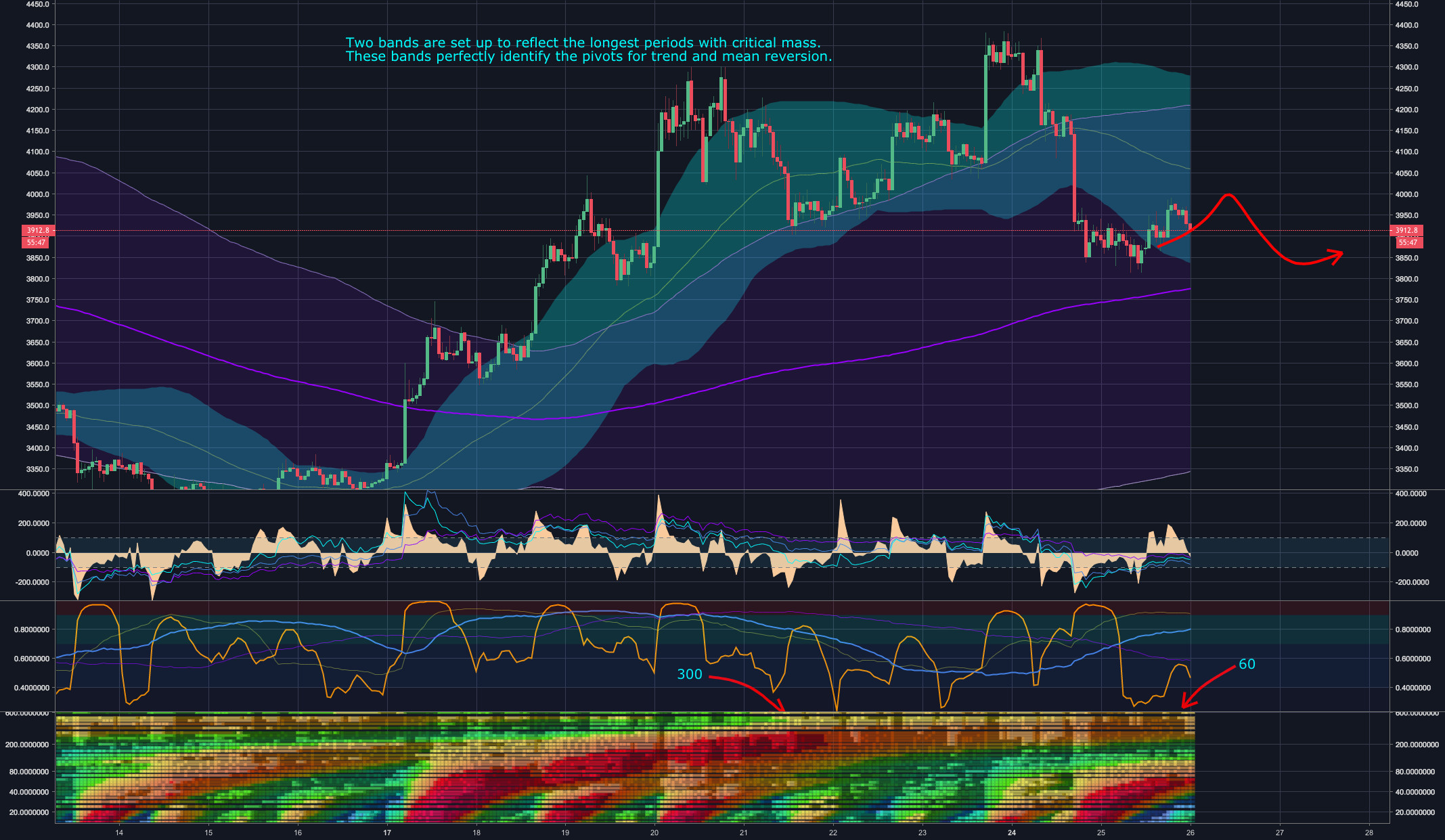

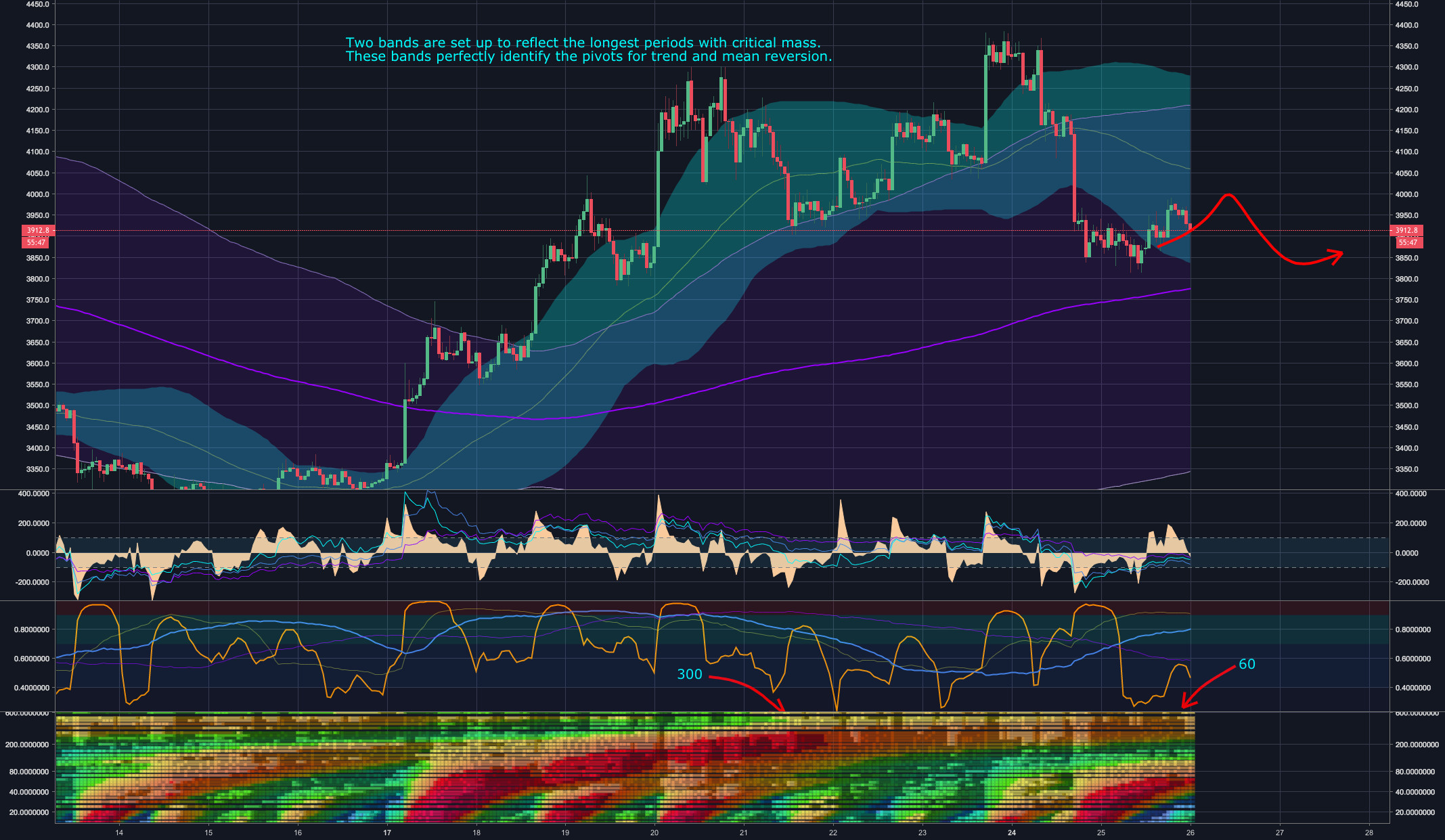

Here we are, coming back to the concept of mass.

Let’s pretend you’re rolling a snowball up a . The further you roll it, the larger the snowball will get. The heavier the snowball, the more force will be required to continue rolling it. Once the snowball reaches critical mass it will roll down to the bottom of the . Of course, you only bet on that occurrence when the snowball actually starts to roll down the when there is no longer sufficient force to sustain it. Turns out you can get these same readings in the form of “distributional mass,” or the width of the bellcurve surrounding price.

Adapting periods to match these bands has excellent results! The 300 1.25 standard deviation perfectly represents the of trending. As soon as that was crossed, price immediately started rolling down to the bottom of the , (the 300 moving average.) That is still bitcoin’s price target.

Interestingly enough, a new shorter term distribution has begun to expand conversely to the original downward mean reversion. We’re actually seeing a short term mean reversion to the 60 moving average before price can revert down to the 300 moving average.

However, it is important to know that long term mean reversion CAN trump short term mean reversion. After all, momentum will be stronger if an object has greater mass.

Want to learn more about trading with “mass” as a metric? Click below!

Published at Wed, 26 Dec 2018 07:04:19 +0000