Our personal data is extremely valuable, more than most people are aware. It’s used frequently in advertising to target people with the right ads and help marketers make better decisions.

Giants like Google and Facebook have access to a lot of our personal data, since we share so much of our personal lives on their platforms. In fact, in one day than there is in all the books ever written.

It’s worth a lot of money, too — these two companies are thought to account for .

And yet, even with so much gold in their coffers, they’re unwilling to share. Users don’t get any of this revenue, even though it’s directly based on data we provided. It seems unfair, and even like a violation of our privacy.

The good news is that this could be about to change, and some companies are working on building systems where users get rewarded for their data. First, though, let’s take a look at how Facebook and Google make so much money from our data.

Data Sells

Platforms like Google and Facebook have access to all kinds of data. This includes our age, where we live, our socio-economic status, the kind of music we like, what we search for, our political beliefs, and much more.

This data can be used to build up a detailed and accurate profile of every one of us, which is worth a lot to advertisers. It allows them to tailor ads directly to us, maximizing the possibility that we’ll like what we see and click through.

What’s more, Google and Facebook are home to highly popular content and generate enormous amounts of traffic on a 24/7 basis. For advertisers, these platforms are a guaranteed source of constant leads and prospective customers. But the content creators who bring these hordes of people in are hardly rewarded either.

To make matters worse, the system often doesn’t work as well as it should. Targeted ads are supposed to boost advertisers’ profits, but the trouble is, thanks to excessive data sharing advertisers often end up targeting the wrong people.

The result is that ordinary users are bombarded with poorly-targeted spam ads and banner ads. It’s annoying and frustrating to be constantly overrun with ads that aren’t even relevant to you.

It all stems from a disconnect between advertisers and their prospects. Big, centralized companies prevent advertisers from building a relationship with potential customers. It’s hard to target effectively, and not possible to rely on friendlier and more effective modes of advertising like chatbots and push notifications.

The solution could be a move away from centralization altogether, to a system where middlemen don’t make all the money.

The Blockchain Solution

Blockchain technology is ideal for building decentralized networks. That’s why a company called is using blockchain to change the way online advertising works.

The aim is to give data back to its original owners by allowing people to choose who can use their personal data. It’s a fairer, more democratic way to use data in advertising.

Kind Ads are building a blockchain-based ecosystem where users are paid in tokens in return for their data. They get to choose who can access and use their data and specify how much advertising they want to see. Users can even opt out of ads from certain advertisers.

On the other side of the spectrum, it’s a decentralized ad network that rewards publishers more fairly, and takes zero fees from advertisers. And, the users get less intrusive/annoying ads.

It’s a win-win-won for all parties.

While prospects are rewarded for their data, advertisers get a better relationship with them and can target ad campaigns more precisely. This allows them to use types of advertising that aren’t just spammy, generalized banner ads and pop-ups.

They’ll also be able to pay more reasonable fees, without being held to ransom by giant corporations.

Even content creators benefit, as they get to forge a more long-term and intimate relationship with advertisers and can get properly rewarded for the amount of traffic (and profit) they generate.

This kind of system would remove the power from centralized giants like Google and Facebook, and lead to a more effective and less annoying way of advertising. It’s just another way blockchain could transform the way we manage data and help level the playing field for everyone.

BTCManager does not endorse any content or product on this page. While we aim at providing you all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor this article can be considered as investment advice.

The post appeared first on .

So over the past few weeks, we’ve all been tracking down and throwing out different theories and charts that we as traders and experts believe will dictate where bitcoin is going to go next. In the author’s humble opinion, one of the most overlooked charts is bitcoin on the weekly chart.

When looking at the weekly chart, the forecast looks grim to say the least, and this may just be the beginning.

Take a look at this chart here:

The author is not sure if they are the only one, but right at the very end of this weekly chart, it looks pretty clearly as though has broken the bear flag.

Today (March 12, 2018) would be the very last day of that candle’s formation. So, if the price holds or trends even further south, there would be pretty good cause to believe that the bear pattern will simply continue at this point.

For those unfamiliar with bear flags, here’s a small review below:

Source: Pinterest

Typically, when these types of patterns occur, the rule of thumb is that the distance of the initial ‘flagpole’ is typically about the distance from the breakout of the flag pattern that one should trace if they want to come up with an accurate projected target.

Here, we can see that the approximate size of this bear flag pole on the weekly chart (not including the wicks of the candles) is roughly $5,712.

Thus, according to convention, the target price for bitcoin should be whatever $9,400 (approx.) – $5,712 is in order for us to get a rough estimate. This comes out to $3,688.

This price point is marked above by the golden line. It is probably no coincidence that the math brings it to a 100 percent retracement on the weekly chart from where the most recent run began.

When looking at the bitcoin chart in its entirely and removing investor bias from the situation, this actually doesn’t seem like a preposterous drawdown for bitcoin.

However, when factoring in sentiment and the psychological impact that a dip to such a low level would more than likely have on the community, this prediction is more than significant and one that’s likely to ruffle a few feathers.

So What Other Signs Are There of A Massive Decline For bitcoin?

Here’s some food for thought here on the weekly chart.

There was a 74.67 percent (approx.) drawdown during the Mt. Gox disaster of 2014.

If bitcoin ends up finding it’s resting spot at the $3,688 price that was predicted above, it would represent an almost equal drop off in price (77.36 percent).

But Wait Before You Get Out Your Pitchforks!

Check this out:

This is the same chart, except this is the monthly view. So every candle up here represents the price movement of an entire month (Heikin Ashi candles).

So What’s Your Point?

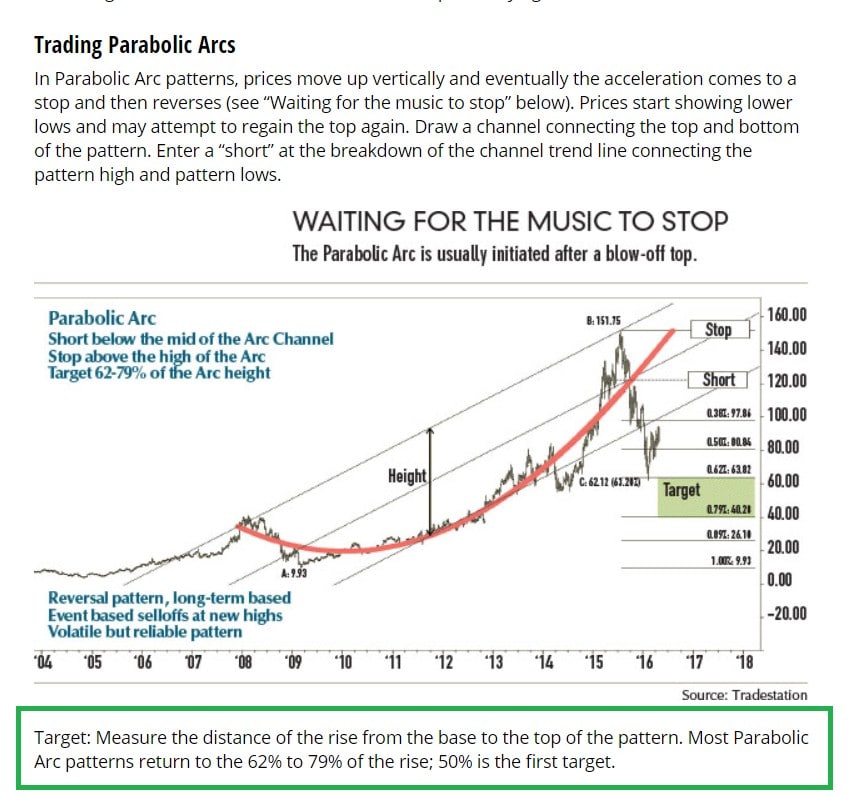

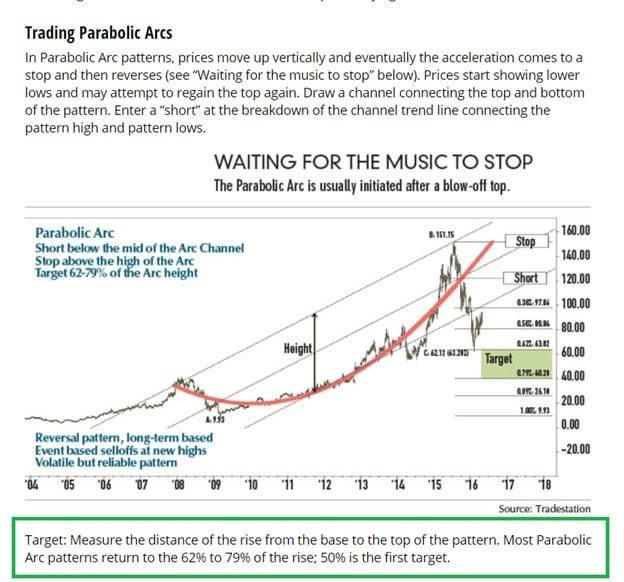

The type of pattern that bitcoin is displaying here is a ‘Parabolic Arc’ pattern.

A parabolic arc pattern looks like this:

Source:

One that’s important to note that came from the source posted above is, “Most Parabolic Arc patterns return to the 62 percent to 79 percent on the rise; 50 percent is the first target.”

bitcoin has already hit that 50 percent retracement point. However, it must be noted that the 50 percent point on the weekly chart is different than the 50 percent point on the daily chart or any smaller time frame.

Take a look at the chart below:

The top on this chart is approximately $17,000. The rest of that run up toward $20,000 is just one long wick on the weekly chart (Heikin Ashi candles).

What’s the 50 percent point of $17,000? Approximately $8,500? Let’s check how much it drew down already since that high on the weekly chart:

According to this chart, the closed candle for bitcoin drew down 54.24 percent before bouncing upward, which is pretty damn steep – yet, according to plan based on breakdowns of the Parabolic Arc formation.

So What Happens When the Pattern Finishes Itself?

Here’s where the good news comes in. For what we know of things in the modern era, as long as they survive (keyword: survive), the price typically recovers after taking it’s beating (albeit it takes a while), and investors live to see another day out enjoying the high life.

The stock market is a great example of a market that consistently goes on a parabolic arc, only to be forced to drawdown significantly at some point in time. Then, the push upward continues.

Stocks have been careening down this path for decades at this point.

Take a look below:

The S&P500 was on a ridiculous parabolic arc curve before the dot com bubble burst in the late 90’s/early 2000’s. It almost made its way out and topped that previous high before the 2009 Great Recession knocked the price all the way down to a lower low than what it had experienced in the dot com bubble a few years prior.

Now, the price is at almost double the previous top and the parabolic arc is still going strong.

The same can be said of the Dow Jones Index and a lot of other market indices out there that have gone through crashes.

In markets like these, bull runs are awe inspiring and bear brawls are enough to almost make investors tap out of the market entirely.

Conclusion

Is it a given that bitcoin hits $3,600? Absolutely not. There’s a chance that this pattern doesn’t fulfill itself. However, from what the author sees, it has all the trappings of a classic crash following a Parabolic Arc formation.

In either case, the recovery for will be substantial when it does kick in and the price will probably throttle previous highs. As to when that will happen? Not sure. The author is personally skeptical about whether we’ll get rewarded with something like that in 2018, but we imagine that 2019, if not late this year, would be when this bull run gets back to it.

There will probably be a lot of folks that think that the author has lost their ever-loving mind. Everything the author seeing is just screaming that there’s going to be a massive imminent price decline.

So, Let’s Recap

It seems like the author is throwing numbers out there, but the author does my homework – trust me. bitcoin was clearly in a Parabolic Arc trend that got broken. No different than in 2014 when there was a 75 percent drawdown. We’ve already hit the first target at 50 percent. Next stop is 75 percent (typical drawdown off a Parabolic Arc formation).

This 77 percent drawdown also matches the exact point that BTC should be targeted for after it’s break out of the bear channel on the weekly chart (weekly chart formations/signals much stronger than daily) if you’re measuring the flag’s distance and subtracting that from current price.

This also coincidentally lands us smack dab where the last rally started, creating a solid 100 percent retracement from the top to that point. $3,600-$4,000 just sounds devastating because everyone is still in bull mode. We were just $2,400 away from that point like a month ago.

We have plenty of case studies of this happening. The dot com bust was a beautiful example and it was provided in the thread so folks could see what a parabolic arc formation breakdown looks like. It’ll shoot back out again just like the Dow Jones. Trust and believe.

has been on such a ridiculous run, people don’t even realize that even $4,000 is a pretty legitimate consolidation point for such a run if you’re taking the last two to three years into context, which you really have to if you want to plot long-term.

The author invites folks to disagree, but the disagreement has to be on a greater principle other than, “That’s impossible! Everyone will buy it up before it hits $4,000!” Everyone said that about the $6,000 predictions when BTC was like $15,000 in January. The markets are crazy.

The post appeared first on .

Südkorea versucht, den digitalen Entwicklungen offen gegenüber zu stehen und überlegt, Initial Coin Offerings (ICOs) im eigenen Land wieder zu erlauben. Seit dem vorläufigen Verbot im vergangenen September setzen die Südkoreaner auf ICOs im Ausland. In Zukunft haben sie wahrscheinlich wieder eine Chance auf Investitionen in lokale Unternehmen, was koreanische Start-Ups auf eine baldige Erlaubnis hoffen lässt. Die…

Südkorea versucht, den digitalen Entwicklungen offen gegenüber zu stehen und überlegt, Initial Coin Offerings (ICOs) im eigenen Land wieder zu erlauben. Seit dem vorläufigen Verbot im vergangenen September setzen die Südkoreaner auf ICOs im Ausland. In Zukunft haben sie wahrscheinlich wieder eine Chance auf Investitionen in lokale Unternehmen, was koreanische Start-Ups auf eine baldige Erlaubnis hoffen lässt. Die…Der Beitrag erschien zuerst auf .