’s recent price movements have crypto traders everywhere railing at Bart Simpson for roiling the market. Below, we’ll explain why, but first, let’s take a look at the flagship ’s movements today.

bitcoin Price Trades Sideways

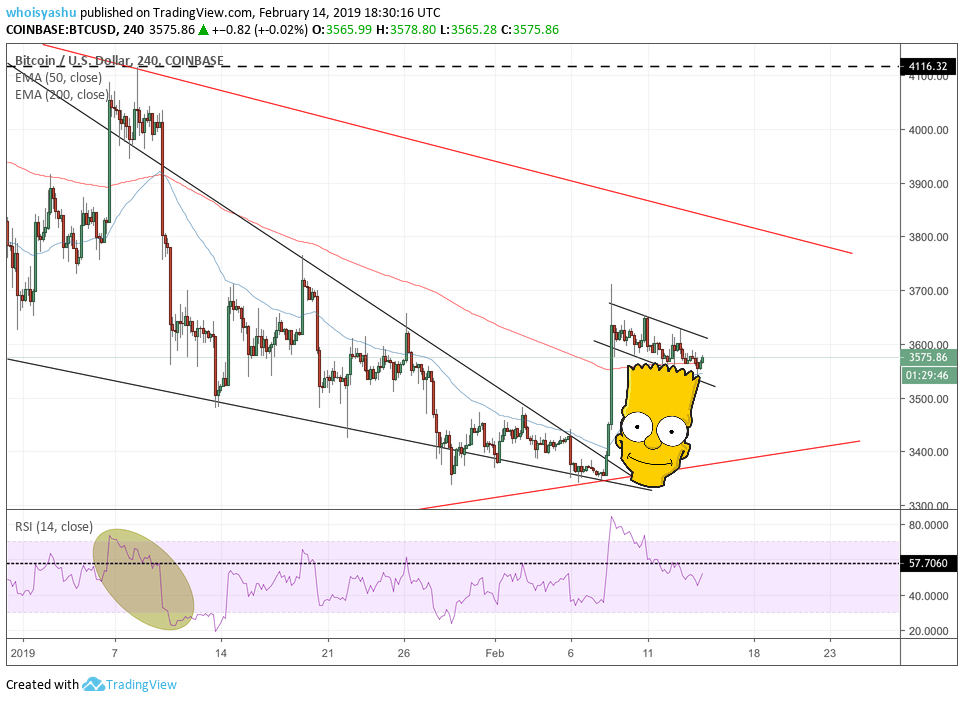

price action has not changed much since our . The digital currency continues to trend inside a narrow channel. Whether or not this channel is a bull flag cannot be determined just yet. The only positive thing in the current trend is ’s ability to hold onto gains it made during February 8’s impressive bull run.

As of Thursday afternoon, the (/USD) was at $3,576, down a modest 0.02 percent since the Asian session open. Both the volume and volatility are lower since the previous upside run. That somewhat hints that the price is closing in towards its next big move. Nevertheless, the interim bias conflict has made it difficult to predict which direction would pursue in the coming days: downward, sideways, or upward.

bitcoin Divided Between Bart Simpson and Bull Flag

The ongoing price action has first brought us before the very famous . Yep, that Bart Simpson who is also our bearish indicator for today – no pun intended. But before we dwell further, let’s have a look at the image in the tweet below:

just went through the Bart Simpson pattern.

If only I was a better charter, I could have seen this coming… : /

— Jayden Crypto 💎 (@jayden_crypto)

Technically speaking, a Bart Simpson pattern occurs when a sideways action follows an unexpected spike in price, and then the price drops back again – suddenly. The price action matches the shape of Bart Simpson’s head.

In the current price action, the is halfway fitting the definition of the Bart Simpson pattern. A full Bart will develop if the undergoes a sudden bearish correction, such that it erases its previous gains. Should that happen, is looking at a downside target towards $3,355. That’s what a straight Bart Simpson head can do.

4H CHART | SOURCE: , TRADINGVIEW.COM

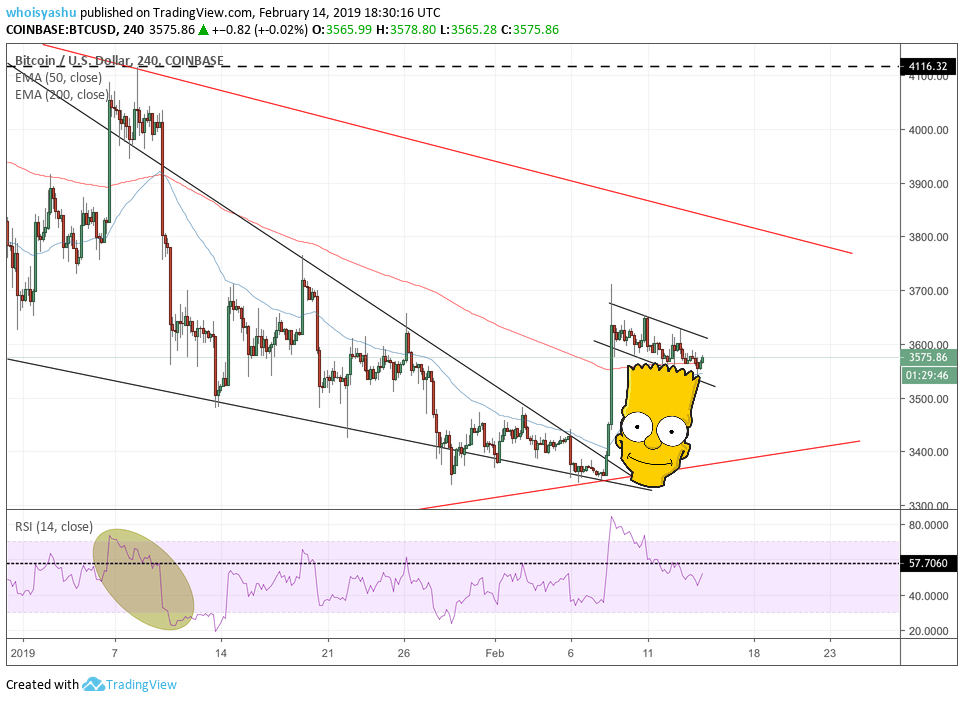

But the glass is half full. The price has not entirely invalidated the bull flag formation, which became a central point of discussion in our previous analysis. The /USD rate is still consolidating inside a little descending channel, which could mean there is still a chance that the pair would extend its upside momentum.

A retest of the descending channel resistance, coupled with an increase in volume, will confirm a bull flag. Then, will be able to break above the said resistance to set the next upside target towards the red line on the top (in the chart above). From a broader perspective, this upper red trendline makes the resistance of a medium-term symmetrical triangle. Have a look:

4H CHART | SOURCE: , TRADINGVIEW.COM

bitcoin Price Intraday Targets

As long as the price stays inside the descending channel, we will keep our bets inside the range. That being said, a bounce from support would have us open a long position towards resistance. Simultaneously, a pullback from resistance would have us enter a short order towards support.

We will avoid placing breakout targets for today.

Instead, we’ll leave you with something to chew on:

Bart Simpson Image from Shutterstock. Charts from .

Published at Thu, 14 Feb 2019 22:09:03 +0000