Nowadays, artificial intelligence (AI) is gaining increasing attention across a variety of research fields. Beyond using it in the computer game industry, for example to model non-player characters having their own behaviour and taking their own decisions, AI has shown tremendous impact in various applications found in healthcare, automotive, economics and many more areas.

What makes AI special

While conventional algorithms are very problem-specific by design, AI approaches are able to self-adjust to the problem without the need of explicitly modelled rules or assumptions. Such AI approaches are based on e.g. trained neural-networks, which can be used as a black-box for the users, lowering the amount of domain-knowledge required. On the downside, AI driven algorithms naturally involve a large number of computations, putting high demands on computation resources, such as dedicated AI rigs or clusters.

Hadron’s approach: many-as-one

Hadron promises to overcome this by setting up a network of AI-capable devices, spread across the whole world, to solve global AI problems in a distributed fashion. That means each device only needs to perform a small fraction of the AI calculations. Since Hadron builds on a javascript based neural network framework using GPU, every browser-enabled device supporting WebGL is eligible to contribute.

With owning a smartphone, the majority of people have a powerful device in their pocket. Based on the assumption that smartphones are idle 90% of the time, they bear a large potential source of computational power to leverage for AI tasks.

Building on blockchain technology

By building on the blockchain, the network of AI devices becomes decentralized, avoiding a single-point-of-failure. Moreover, token economics encourage the contributors to continue allocating their computational resources for the AI tasks as they can be directly rewarded with tokens. With that, consensus-based decisions can be made, for example in form of a voting for the next global AI challenge to tackle.

Hadron’s current status and near-futureHadron is currently in the alpha phase with lots of early-registered miners already involved in the calculation of typical AI tasks.Each early miner gets rewarded with coins which will be of use in the future. Potential bugs are reported to the developers.Two remarkable partnerships have already been made: and .The beta phase will start in roughly a few month, registration is open via Bitcointalk Forum post (link below).An ERC-20 tokenization approach is considered after release.Development of an ecosystem around AI computation on the blockchain can be possible.More information and sign-up for the upcoming beta

Web:

BCT:

Telegram:

Twitter:

Facebook:

Reddit:

Team:

Whitepaper:

Currently the Tezos blockchain is not released. Only futures on XTZ are tradable. I wanted to do something for the project and created a simple info page on how and where you can purchase Tezos.

Therefore I created

I designed it very simple.

Step 1 is to enter the payment method. Currently there are only two options:

Credit card (or debit card) & bitcoin

Step 2 search for an exchange with Tezos support

As Tezos will launch, more and more exchanges will add the Tezos coin and the more options for the search will be added.

I hope this will help newcomers to easily find exchanges where they can invest in Tezos.

Additionally a short FAQ is added for new users.

You want to try it: Visit:

please note: some features are still in progress 😉

All the best

Tezard

Q. Tell us a little bit about you and what made you launch Arcadia?

I have acquired more than fifteen years’ experience working as a civil engineer and manager. So far, I have completed multiple construction projects, and I’ve been building companies in the Polish market from scratch. One project I managed I realized was very special. This was a historic home restauration. (I wrote about this project in WP). This project contributed to the discovery of the huge niche that is in the Polish real estate market and caused me to start preparations for Arcadia ICO. The research into the discovered niche showed me the opportunity to earn large ROI is very real, the profits that we can earn on it are so large that the Arcadia project had to be born.

Q. So why the ICO and not the venture capital route?

The real estate market is one of the most secure investments. Many companies operate on it as venture capital, or private equity. For many years I have been interested in blockchain technology and I am a faithful fan. I like transparency, democracy and decentralization. So when I decided to create the Arcadia project, I did even not think about the traditional way of raising capital like old-fashioned banks or venture capital for a moment. I wanted to create a project that will provide real estate profits only to blockchain investors.

Q. What exchanges do you hope to launch Arcadia on to?

We want to have at least 3 exchange platformS. It would be TBC, COBINHOOD,

ETHERDELTA, and the negotiations with another 2 are still on.

Q. During the ICO can I get a referral bonus if I bring in new purchases to the project?

Definitely. You can get the referral bonus of 10% of every purchaser who uses your referral link.

Q. Will there be an air drop?

Yes — more details please.

Q. Will there be a bounty?

Yes — more details please.

Q. If I choose to sell my tokens halfway through the year how will profits then be passed over?

Arcadia is a very transparent project. At any time, you can check the statuses of implemented investments and predict the moment of dividend payment. The share in profits will be paid to current tokens holders, so if someone really want to sell Arcoin, the best moment will be immediately after the payment of dividends.

Q. Where do you see Arcadia being in five years time?

This is a very important question. Arcadia is a very ambitious project. We assume an average increase in income of 30–35% per annum, which is above average. With such a fast growth rate in five years Arcadia will be a large development company operating within the nationwide range. In five years’ time, we should be able to implement over 30 projects a year. The niche in which we operate is so large that we do not run out of new projects. Applying the principle of risk diversification, perhaps in the future we will undertake larger projects than our niche assumes. This is the future. Now we are doing everything to make our ambitious project take off.

Q. Can you see Arcadia expanding into other countries?

Our geographical location favors the business that Arcadia does. In this part of the world there are still many historic buildings that require and will require restorations for the next several decades. Filling the market niche slowly, in a few years we will be able to undertake projects in other countries, going eastward to countries such as Lithuania, Latvia, Estonia and Belarus, as well as towards the south, ie Czechia, Slovakia and beyond.

Q. As Arcadia grows can you see the type of projects you will undertake changing direction?

We have discussed this topic many times. Currently, we are focussed only on the large niche that is on the market and the nearest several dozens of projects will be devoted to filling it up slowly. I also do not exclude that in a few years we will try to renovate larger facilities when dividing operational risk than now, I’m thinking about historical buildings with over 1000m2.

Q. If you have a lot of properties that don’t sell and turn out to be rental properties how you divide the dividends to your token holders?

Demand for buildings and apartments is huge. Each of us wants to have a roof over our heads. It is estimated that there are still about 1 million apartments missing on the Polish market. So we have a job guaranteed for many years. However, if it happens that for some reason we will not be able to sell the whole building or every apartment in A restored building quickly, we will share the profits from renting just like profits from the sale of the building. So we will sum up the rental proceeds for the entire rental period and divide 55% of this amount between token holders.

Q. How will the value of the tokens increase in value as time goes on?

This path is very predictable. The value of tokens increases when investors and market observers become convinced that the project follows exactly the roadmap. In the case of Arcadia there will be several milestones where the value of tokens will increase quickly. The first moment will be successful Pre ICO. Then ICO and the introduction of tokens on exchange platforms. When we start to implement the first project there will be another increase, and the real boom will be seen at the time of payment of the first and subsequent share in profits.

Q. What happens if the tokens decrease in value, will this have an effect on the project being worked on?

This pessimistic scenario is virtually impossible. Arcadia is a project based on the real estate market, that is, tokens have proper coverage in real estate. If something like this happened by some very unlikely coincidence, it will not affect the ongoing projects. We should also remember that the value of tokens is one, while an important profit for investors is the share in profits from completed projects.

Q. When does the ICO end?

When we think about the finish of ICO, we usually end up selling tokens. This will take place according to the roadmap on 25/05/2018. We should remember, however, that a real adventure will start then! We will start to implement projects. Buy, restorate and sell it all the time for the next years. Buying tokens from Arcadia (Arcoin), investors will secure passive income for many years.

Key links for the ICO

** Disclaimer, this is not financial advice, this is for information only and to support you with your due dillegence. Please read the white paper to find out more.

Originally published on .

If you have been reading about blockchain networks like bitcoin and Ethereum, you must have come across the term “Proof-of-work” (PoW). Most of the blockchain enthusiasts will tell you that PoW is a consensus mechanism using which miners solve complex mathematical puzzles to produce blocks. Buy WHY? Why do they need to solve complex mathematical puzzles to produce blocks? Why can’t a node simply bundle a bunch of transactions and broadcast to the network?

I asked these questions repeatedly when I was reading up various blockchain concepts. Fortunately, I understood the “Why” part eventually. So, if you have the habit of questioning things and want to understand “why to solve mathematical puzzles to produce blocks” then you are at the right place.

Read on to find out.

Some rules

To understand why PoW is needed, you need to know some of the basic rules of a blockchain network. Let me outline them below:

Every miner in the blockchain network maintains the entire blockchain in its local node.When a particular node wants to produce blocks, it bundles multiple transactions into a new block, adds it to the local blockchain and then broadcasts the message to other nodes in the network.When nodes receive the message about a new block, they compare the length of their own blockchain (A) with the one on the block-producer’s machine (B). If the length of B is higher, they accept it and discard their local copy.Scenario

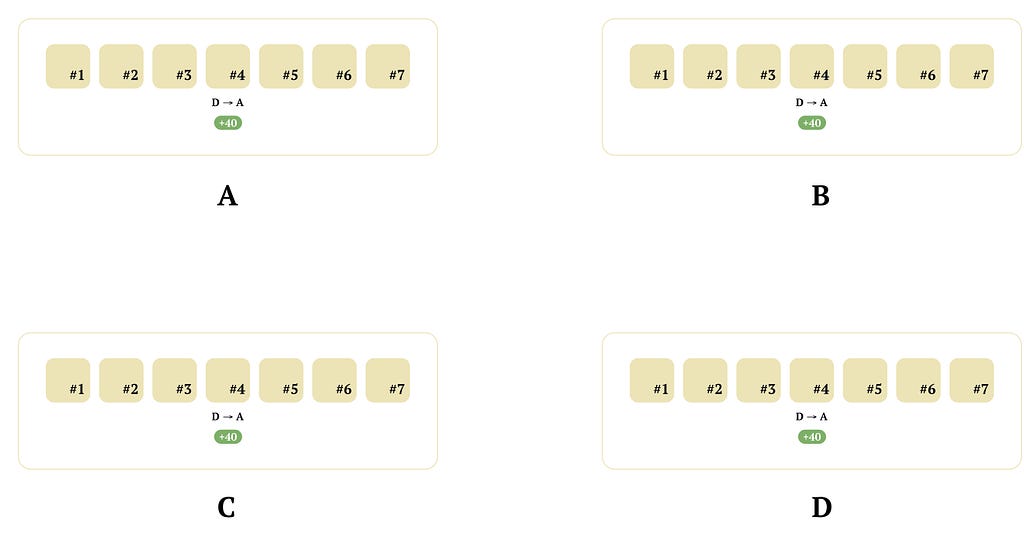

Let’s imagine a blockchain network where users can send each other a digital currency called “Hashnode Coin” (HCN). Assume that we have 4 nodes in the network — A, B, C, and D. Also, the current length of blockchain on all the nodes is 7.

This system doesn’t have any kind of consensus mechanism. If I need to produce a block, I just add it to my local copy and broadcast the message.

Note that D has sent 40 HCNs to A and this particular transaction is a part of the 4th block. Now assume that D wants to go rogue and wants to tamper with the blockchain by erasing its 40 HCN transaction to A. How would D achieve this?

Solution

D knows that the longest chain wins. She also knows that every block stores the hash of the previous block. So, she can’t directly remove her transaction from the 4th block. That’s why she carefully crafts the following strategy to remove her transaction from the blockchain:

Firstly, D removes block number 5, 6 and 7. This is because if she tampers with the 4th block, its hash changes and the subsequent blocks become invalid as they point to incorrect hash now.D removes her transaction from 4th block.Next, she bundles a bunch of incoming transactions, creates three new blocks and adds them after the 4th block. These new blocks form block no. 5, 6 and 7.As of now the length of blockchain in all of the nodes is still equal (which is 7). D adds one more block to its copy to make its blockchain longer than others’ copies and broadcasts the message.When other nodes receive the message and see that D’s blockchain length is more than theirs, they accept the copy and discard their own local version.

As a result, D is able to successfully tamper the blockchain by erasing one of its transactions from the history.

Enter PoW

Now let’s assume that every member of the network has to solve a difficult mathematical problem if they want to propose blocks. For example, let’s say D (and everyone else) has to find a number whose md5 hash has 4 leading zeroes in order to produce blocks. This is a very difficult task and you have to do trial and error for a long time to find your desired number. But once you find your number, everyone can calculate its md5 hash and verify that it actually has 4 leading zeroes. As it takes significant computing power to find the magic number, this proves that the node has done sufficient work to produce the block.

Feel free to try to find a number whose md5 hash has 4 leading zeroes. After a few attempts, you will realize that it’s impossible to find such a number without high computational power.

Because of Proof-of-work constraint, D has to find the “magic number” 4 times in a row (before anyone else does) after erasing the transaction in the 4th block to successfully corrupt the blockchain. As you may have guessed, it’s extremely unlikely. Proof-of-work makes it harder to produce blocks, thereby making it difficult for malicious users to corrupt the blockchain.

PoW has some serious drawbacks as well. First of all, it takes a lot of time to confirm transactions since miners compete to find out the magic number. Secondly, the hardware and equipment used by the miners consume a lot of electricity.

Due to this, newer blockchain networks are switching to better options such Proof of Stake, Delegated Proof of Stake, Proof of Authority etc. You can read about them .

This was a quick answer to “Why is PoW important?”. I presented a very simplified picture. In reality blockchain networks like bitcoin have complex rules and protocols in place which makes it nearly impossible to tamper with the blockchain. However, the basic concepts are still the same. If you want to understand how the protocols work in production deployments, take a look at .

If you enjoyed reading this article, feel free to join Hashnode’s and let me know your questions in the comments below!

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.